Sourcery → Padel

(5/27-5/31) Is software dead? (again..?) 🎾 X.ai, CoreWeave, Babylon, Authentic, Natural Cycles, Gameto, Plenful, Rhea, Maven AGI, Sagetap, (Re)vive

Hello from the Padel Court 🎾

One month in Miami, and I can confirm, Padel (“pahh-del’) is the best sport ever.

Dramatic? No.

If anyone can put 20 courts in Venice or Malibu, give Sourcery priority booking, some merch, & a parking spot, please let me know. Thanks!

Curious about the history of padel?

Padel was invented in 1969 by Enrique Corcuera in Acapulco, Mexico. Corcuera adapted his home squash court, adding walls and a net, to create the first Padel court. The sport quickly gained popularity in Spain and Argentina, becoming deeply ingrained in their sporting cultures. In the 1990s, the International Padel Federation (FIP) was established, further promoting the sport's growth and standardizing rules.

Padel's popularity has surged globally in recent years, with rapid expansions in Europe, the Middle East, and North America, driven by its accessibility, social nature, and the construction of new facilities. The bougier, the better. As of September 2023, Padel had an estimated TAM of $2B, with only about 300 courts in the US. The USPA predicts that by 2030 that will grow to 30k courts. It’s going to take off. By comparison, as of 2024, Padel has reached over 25M players in 90+ countries, most popular in Spain with 6M players and 20,000+ courts, while Italy has over 5,000 courts. Over 900K Padel rackets were sold last year. [Padelathletes]

In the US, Padel is predominantly located in Miami, you can find a Padel club in every neighborhood, with one of the largest, Ultra, in the Magic City Innovation District, and some of the boujier ones like Reserve on the water & in the design district. The next highest concentrations are in Texas, and then a couple of clubs in NYC, San Diego, and some in SF (you can find some in your state here). It’s a bit more competitive and faster paced than tennis, certainly fun to hit off the glass, and well.. just much more sophisticated than pickleball.

Learn more about the biz → Padel: Causing a Racket [Business Breakdowns]

PS Shoutout to Michael Morgenstern from Brex for throwing a wonderful local tech dinner last week, even in the ‘off-season,’ Miami is still kicking. Plus, the weather is perfect.

Musings

Software

Is the Software Market in Trouble? [Tunguz]

The end of software [Chris Paik]

Chris Paik writes a thought provoking piece on “Software is dead” after Salesforce’s earnings triggered a broader public debate on the long term defensibility of software and the heavy cost of AI integrations + R&D spend.. sound familiar? Well, we kinda went through this doom cycle all last year, now the public markets are catching up as the data collects a clearer narrative.

Meanwhile folks like Chamath have been preparing for this moment by starting their own competitive solutions (8090 Incubations) at a steep discount due to the commoditization of SaaS and lower development costs.

Downfall of SaaS & Uprising of Vertically Integrated Monopolies [Xander Oltmann, Commodity Capital]

Palantir Technologies has been awarded a $480 million contract by the Pentagon to expand the Maven Smart System, a data analysis and decision-making tool, to more military users worldwide. [C4ISRNet]

This five-year contract will enable the Defense Department to extend the system’s use to thousands of users at five combatant commands.

AI

Is Moore’s Law Really Dead, Given The Boom In AI Compute? [Ark Invest]

Energy

Global gas market to grow 50% amid energy transformation [Goldman Sachs]

Other

The Millennial Mid-Life Crisis and Prevalence of "Selling Out" [The CQ by Forerunner]

Microplastics: What They Are, Why They are Dangerous, and How to Protect Yourself [Doctor’s Farmacy]

Last Week (5/27-5/31):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into eight categories, Fintech, Care, Enterprise / Consumer, HardTech, Sustainability, Acquisition/PE, and Fund Announcements, and ordered from later-stage rounds to early-stage rounds.

Highlighted VC deals include

X.ai, CoreWeave, Babylon, Authentic, Natural Cycles, Gameto, Plenful, Rhea, Maven AGI, Sagetap, (Re)vive

Acquisitions & PE

T-Mobile, Raptor Labs

Funds

Energy Capital Partners

Final Numbers

FBI Internet Crime Report, The Economy in 4 Charts (USA #1)

VC Deals

This roundup was customized & powered by Wonder. Start your free trial here.

Fintech:

- Babylon, a Palo Alto, CA-based company building a Bitcoin-secured decentralized economy, completed a $70M funding round, led by Paradigm, alongside Bullish Capital, Polychain Capital, and other investors.

- FintechOS, a London, UK-based end-to-end financial product management platform, secured a $60M Series B funding round, led by Molten Ventures, and joined by Cipio Partners, BlackRock, EarlyBird VC, OTB VC, and Gapminder VC.

- Supervizor, an NYC-based quality assurance platform for finance teams, secured a $22M funding, led by Orange Ventures, and joined by Wille Finance, La Maison Partners, New Alpha Asset Management, Adelie Capital, and ISAI.

- Authentic, a NYC-based insurtech startup offering affordable captive insurance policies to SMB customers, received $11M in Series A funding, led by FirstMark Capital, along with Slow Ventures, Altai Ventures, MGV, Upper90, and Commerce Ventures.

- Fortunafi, a Miami, FL-based on-chain financial company, secured $9.5M in total funding from Shima Capital, Manifold, Cobie, Evanss6, Scott Lewis, Ari Litan, Austin Green, and other investors.

- Switchboard, a Miami, FL-based permissionless oracle network protocol enabling on-chain connections, closed $7.5M in Series A funding, led by Tribe Capital and RockawayX, and joined by Solana Foundation, Aptos Labs, Mysten Labs (Sui), Subzero Ventures, Starkware, Arche Capital, Breed VC, Ascensive Assets, and others.

- Kintsugi AI, a Francisco, CA-based sales tax automation platform, received $6M in Series A funding at a $40M valuation, led by Link Ventures, Venture Highway, KyberKnight, Plug and Play, DeVC, and angels investors.

- Braavo Capital, a NYC-based provider of non-dilutive financing for consumer subscription apps, received $5M in Series B funding, backed by Headline, along with a new $30M debt fund from Upper90.

- NodeOps, a NYC-based Blockchain node orchestration platform, secured a $5M Seed funding round, led by L1D, alongside Blockchain Founders Fund, Finality Capital, Oakgrave Ventures, Double Peak Group, Momentum6, Bitscale Capital, Richard Ma (Quantsamp), JD Kanani (Former Polygon Co-Founder), Rushi (Movement Labs), and Dorothy (AltLayer).

- Coinflow Labs, a Chicago, IL-based instant settlement payment provider, raised $2.25M in a Seed funding round, led by CMT Digital, with support from Reciprocal Ventures, Jump Crypto, Draper Dragon, Digital Currency Group, and various angel investors.

- Aperture Finance, a Mountain View, CA-based decentralized finance (DeFi) platform, secured an undisclosed amount in Series A funding at a $250M valuation, bringing the total amount to $12M, led by Skyland Ventures, Blockchain Founders Fund, and Krypital Group, and joined by Alchemy, SNZ, Stratified Capital, Tide, Cipholio, ViaBTC, CatcherVC, and Double Peak.

Care:

- Natural Cycles, a Stockholm, Sweden-based women’s health and birth control app company, secured $55M in Series C funding, led by Lauxera Capital Partners, with support from Point72 Private Investments, EQT Ventures, Samsung Ventures, Heartcore Capital, Headline, and Bonnier Ventures.

- Gameto, an NYC-based women’s reproductive health and fertility company, closed $33M in Series B funding, led by Two Sigma Ventures and RA Capital, alongside Insight Partners, Future Ventures, BOLD Capital Partners, and others.

- Valar Labs, a Palo Alto, CA-based developer of computational histology AI (CHAI) tests for cancer diagnosis and therapies, raised $22M in Series A funding, led by DCVC and Andreessen Horowitz (a16z) Bio + Health, with support from Pear VC.

- Plenful, a San Francisco, CA-based AI workflow automation platform for pharmacy and healthcare operations, completed a $17M Series A funding round, bringing the total amount to $25M, led by TQ Ventures, and joined by Bessemer Venture Partners, Mitchell Rales (Co-founder and Chairman of Danaher), Susa Ventures, and other existing investors.

- Weave Bio, a New Haven, CT-based AI-native life sciences platform, closed a $10M funding round, led by Innovation Endeavors and Magnetic Ventures.

- Rhea, a Singapore and New York City-based network of reproductive health clinics, received $10M in funding, led by Thiel Capital and joined by LifeX Ventures, Blue Lion Global, and FJ Labs.

Enterprise/Consumer:

- xAI, a Bay Area, CA-based AI development company accelerating human scientific discovery, secured $6B in Series B funding, backed by Valor Equity Partners, Vy Capital, Andreessen Horowitz, Sequoia Capital, Fidelity, Prince Alwaleed Bin Talal, and Kingdom Holding.

- Mavenir, a Richardson, TX-based cloud-native network infrastructure company, secured $75M in investment from an undisclosed existing investor.

- Transcend, a San Francisco, CA-based data privacy platform provider, completed a $40M Series B funding round, bringing the total amount raised to about $90M, led by StepStone Group, and joined by HighlandX, Accel, Index Ventures, 01 Advisors (01A), Script Capital, and South Park Commons.

- Maven AGI, a Boston, MA-based AI customer support startup, received $20M in Series A funding, led by M13, alongside other participating investors, including Lux Capital, E14 Fund (part of MIT), and executives from OpenAI, Google, HubSpot, and Stripe.

- Novel, an Overland Park, KS-based capital intelligence platform, secured a $15M Pre-Series A funding, led by MatterScale, Gaingels, and previous investors.

- Remark, a New York-based product guidance startup for online stores, closed a $10.3M funding round, backed by Spero Ventures, Stripe, Shine Capital, Neo, Sugar Capital, and Visible Ventures.

- GaiaNet, a San Francisco, CA-based AI company decentralizing current AI agent software, closed a $10M Seed funding, backed by Generative Ventures’s Lex Sokolin, Republic Capital’s Brian Johnson, 7RIDGE’s Shawn Ng, Kishore Bhatia, EVM Capital, Mirana Ventures, Mantle EcoFund, and ByteTrade Lab.

- Odyssey, a NYC-based platform that partners with states to administer school choice programs for parents, secured a $10M Series A funding, led by Bradley Tusk of Tusk Venture Partners and joined by Andreessen Horowitz, Cubit Capital, and Bling Capital.

- Everfence, a Newport Beach, CA-based platform connecting homeowners and contractors for fencing projects, closed $7M in Series A funding, led by HIPstr, the investment arm of HighPost Capital.

- Sagetap, a San Francisco, CA-based AI-driven marketplace matching SaaS buyers and sellers, closed a $6.8M funding round, backed by NFX, Uncorrelated Ventures, Emergent Ventures, and 15 active customers.

- SmartPM Technologies, Inc., an Atlanta, GA-based automated project controls platform for construction, completed a $5.5M Series A funding round, led by Building Ventures, with support from GS Futures and The Nemetschek Group.

- (Re)vive, an NYC-based provider of a solution addressing unstockable and returned inventory for brands, closed $3.5M in Seed funding, led by Equal Ventures and Hustle Fund, along with other investors, including Banter Capital, Coalition Operators, Mute VC, Veronica Chou, Charge VC, Everywhere VC, and Hyphen Capital.

- Ducky, a Nashville, TN-based AI-powered support platform, received $2.7M in Pre-Seed funding, led by Penny Jar Capital, with support from Bread & Butter Ventures, NOMO Ventures, Wilson Sonsini, angel investors, and others.

- Zendata, a San Francisco, CA-based AI governance and data privacy solutions company, secured a $2M Seed funding round, led by PayPal Ventures, First-hand Alliance (operated by Salesforce Alumni), Geek Ventures, and Altari Ventures.

- Kalogon, a Melbourne, FL-based smart seating solutions company, received $1.2M in funding from Sawmill Angels, M7, SeedFundersOrlando, and AARP.

- Old Well Labs (OWL), a Charlotte, NC-based provider of a software platform for finding and monitoring investment managers and allocators, secured an undisclosed amount in Series A funding, led by Nellore Capital, alongside Ted Seides, Mike and Tom Elnick, Shubham Goel, Brian Bares, fund managers, and endowment CIOs.

- RealReviews.io, an NYC-based provider of an AI-powered review platform, secured an undisclosed amount in funding from undisclosed investors.

HardTech:

- CoreWeave, a Roseland, NJ-based AI hyperscaler powering complex AI workloads with customized solutions at scale, completed a $1.1B Series C funding round, led by Coatue, and joined by Magnetar, Altimeter Capital, Fidelity Management & Research Company, Lykos Global Management, Blackstone, Eric Schmidt, and Jane Street Group.

- Axus Technology, a Chandler, AZ-based chemical mechanical planarization (CMP) equipment company for manufacturing semiconductors, secured a $12.5M funding round, led by IntrinSiC Investment.

- Rain AI, a San Francisco, CA-based AI chip company, closed an $8.1M Series A Extension funding round, led by Epic Venture Partners.

- Basalt Technologies Corp., a San Francisco, CA-based spacecraft OS company, completed a $3.5M Seed funding round, led by Initialized Capital.

- Wavelogix, a West Lafayette, IN-based proprietary IoT sensing and data analytics company, secured a $3M funding, led by Rhapsody Venture Partners.

Sustainability:

- Syre, a Stockholm, Sweden-based textile impact company, closed $100M in Series A funding, led by TPG Rise Climate, and joined by H&M Group, Giant Ventures, IMAS Foundation, Norrsken VC, and Volvo Cars.

- One Energy, a Findlay, OH-based industrial power company, including wind energy, secured over $35M in Series A funding from undisclosed investors.

- Claros Technologies, Inc., a Minneapolis, MN-based provider of PFAS analytical and destruction technologies, closed a $22M funding round, co-led by Ecosystem Integrity Fund and American Century Investments, and joined by Capita3, Children’s Minnesota, Kureha America Inc., Open Door Foundation, F. R. Bigelow Foundation, Groundswell Ventures, the University of Minnesota, and other investors.

- Plural Energy, a San Francisco, CA-based on-chain investing platform leading the global transition to clean energy, secured a $2.33M Pre-Seed funding round, led by Necessary Ventures and Compound, and joined by Volt Capital and Maven11.

- Chloris Geospatial, a Boston, MA-based technology company measuring forest carbon from space, secured an undisclosed investment, led by Cisco Foundation and NextSTEP, with participation from AXA IM Alts, Orbia Ventures, At One Ventures, and Counteract.

Acquisitions & PE:

- T-Mobile is set to acquire the wireless operations and other assets from U.S. Cellular, a Chicago, IL-based mobile network operator, for $4.4B.

- Hg Capital is set to complete the acquisition of AuditBoard, a Los Angeles, CA-based risk management platform for audit, risk, compliance, and ESG management, for more than $3B from Battery Ventures.

- TransDigm Group Incorporated (NYSE: TDG), a Cleveland, OH-based designer, producer, and supplier of highly engineered aircraft components, acquired Raptor Labs Holdco, a manufacturer of complex test and measurement solutions, for about $655M in cash.

- Portside, a Cary, NC-based modern software solutions platform for the business aviation industry, secured an undisclosed strategic growth investment from Vista Equity Partners and Insight Partners.

- Tinicum acquired KGM, a Tulsa, OK-based natural gas product provider, from Compass Group Equity Partners, for an undisclosed amount.

- Thyme Care, a Nashville, TN-based value-based cancer care facilitator, secured an undisclosed investment from Echo Health Ventures and CVS Health Ventures.

- Realtime Robotics, a Boston, MA-based collision-free autonomous motion planning company for industrial robots, secured an undisclosed investment from Mitsubishi Electric Corporation.

- FileCloud, an Austin, TX-based content governance and collaboration platform for unstructured data, acquired Signority, a Kanata, ON, Canada-based e-signature and document workflow platform, for an undisclosed amount.

- LeadsOnline, a Plano, TX-based data, technology, and intelligence platform for law enforcement agencies, acquired Nighthawk.Cloud, an Englewood, CO-based investigative data visualization and analysis company, for an undisclosed amount.

Fund Announcements:

- Energy Capital Partners, a Summit, NJ-based private equity firm, closed its fifth fund at $4.4B, focused on companies in power generation, renewable, and storage, as well as sustainability and decarbonization.

Final Numbers

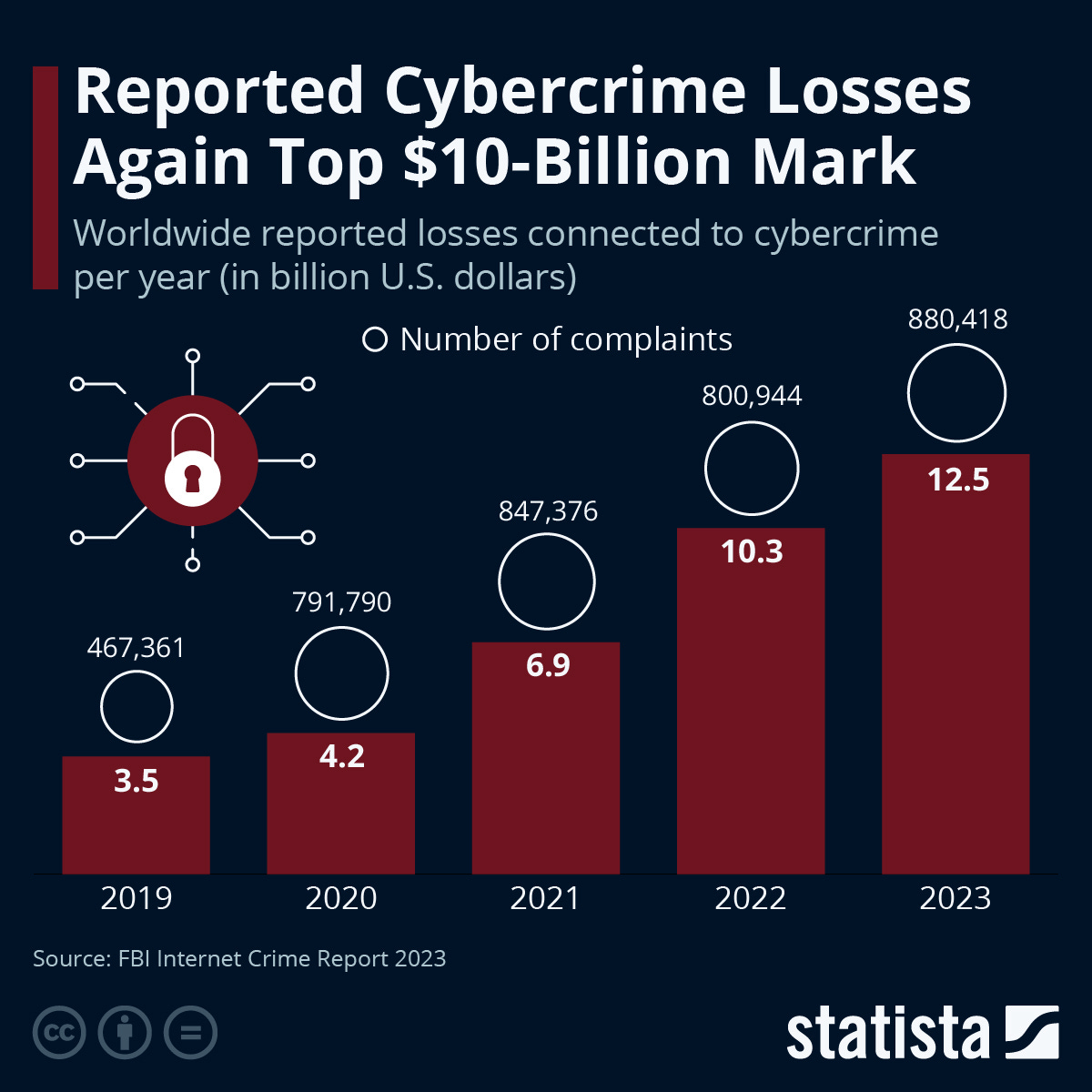

Data: FBI Internet Crime Report 2023; Chart: Statista

The FBI's annual Internet Crime Report revealed that cybercrime losses reached $12.5 billion in 2023, up $2 billion from the previous year and more than triple the amount in 2019, despite the number of complaints not doubling. [Statista]

Most losses were due to investment fraud and hacked business emails, with the U.S. seeing the highest number of complaints and losses, particularly from California, Texas, and Florida. [Statista]

The Economy In 4 Charts

A recent Harris X Guardian poll made for some striking reading for those of us who spend our days buried in data. According to the survey, the majority of Americans believe the nation is currently in a recession (it’s not), 49% think the S&P 500 is down for the year (it’s up 11%), and the same percentage believe unemployment is at a 50-year high (again, it’s not).

It would be easy to dismiss the survey, but if a significant number of Americans feel the economy isn’t working for them, we have to ask: what’s going on?

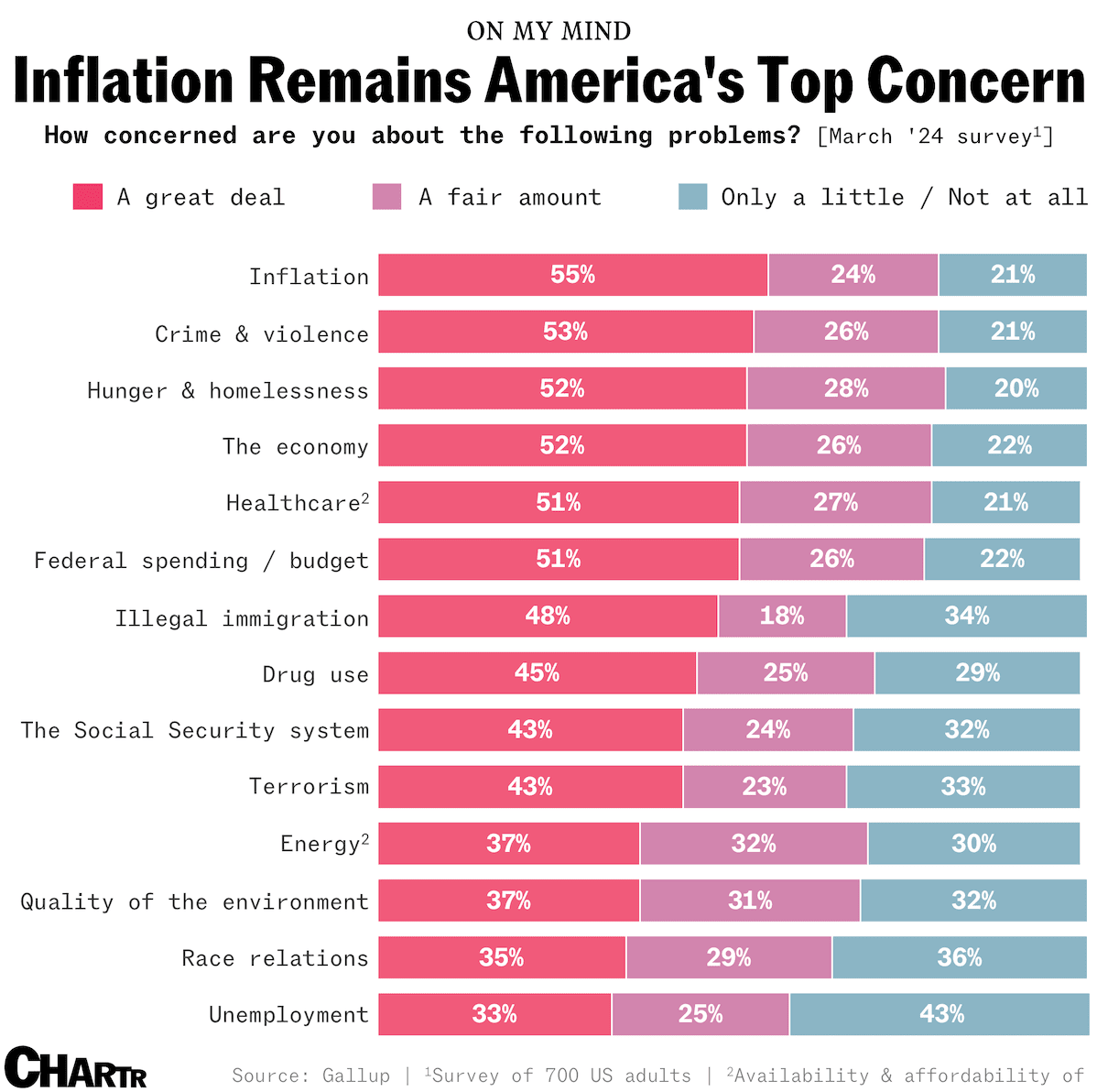

The simplest explanation is that most of us are bad at gauging how a $30 trillion economic machine is faring. So, we focus on our own financial situation — and on a personal level, many people are feeling the strain because of the one elephant in the room that just won’t go away: inflation. Indeed, a Gallup poll from March found that inflation continued to outrank crime, healthcare, terrorism, energy, the environment, drug use, and many other topics as America’s top concern.

Sticky downwards

Arguably the biggest problem is that economists tend to focus on the bleeding edge of the economic data, often looking not just at the level of inflation, but estimates of its trajectory — is it accelerating, decelerating, etc. But, as one astute investor posted on X (formerly known as Twitter)… that’s not what normal people care about.

If inflation is 10% annually for 2 years, and then drops to 5% in the third year, economists and investors may rejoice at the progress, but almost no-one else will blink. That’s because the cumulative effect of that sequence of events is a 27% increase in prices over 3 years… which people notice when they buy butter, insurance, hot dogs, or gas. That example is not a million miles away from what has actually happened.

Many prices are now 20-30% higher than they were in 2020 — and, while inflation has cooled substantially, to just 3.4% as of the latest CPI report, that still means costs are rising. McDonald’s went so far as to comment directly on its own price rises, after videos of expensive Big Mac meals, including one for $18, went viral. McDonald’s says its prices are up 40% in the last 5 years, reflecting a broader rise in the cost of labor, paper, and food.

USA #1

Another reason economists might have a rosier view of the American economy than the general public? A global perspective. Indeed, the US has seen real GDP grow by nearly 9% since the pandemic began, by far the strongest of any of its G7 peers, which have averaged only 2.7%. Canada’s economy has been the next best in the group of seven, growing 5%.

The hiccup in the US recovery was a brief two-quarter GDP dip at the start of 2022 — fitting the classic recession definition. But, the National Bureau of Economic Research, which makes the final decision, decided not to classify it as one. Furthermore, despite all the talk of mass layoffs and automation, US unemployment has remained below 4% since the beginning of 2022, near historically-low levels.

In contrast, the UK economy has been much weaker than America’s. Indeed, British GDP is barely larger, in real terms, than it was at the end of 2019… just as the electorate gears up for a July 4th election.

The great American consumer

Despite sky-high interest rates and inflation, good old-fashioned consumer spending – the biggest slice of the US economic pie – has been nearly unstoppable for more than 3 years, with people continuing to splurge. However, very recently, there have been signs that some consumers might be starting to crack. Retail sales growth halted abruptly in April, and recent earnings from Target and Walmart suggest that lower-income consumers are starting to struggle, with Fortune reporting “a shift from spending on wants to needs”, with similar sentiments shared by executives at other consumer companies.

In recent years, when consumers felt the pinch, many had pandemic-era savings to dip into thanks to stimulus checks, enhanced unemployment benefits, tax credits, and the fact that there wasn’t much to spend your money on during lockdown. This influx of cash bolstered our bank accounts significantly: one economic model estimates that America banked excess savings worth a staggering ~9% of nominal GDP during 2021.

But, that buffer is now disappearing, with excess pandemic-era savings now sitting at just above 2% of nominal GDP and falling according to estimates from the Fed at the end of last year. More recent analysis from third-parties suggests that those excess savings are now all gone, leaving consumers more vulnerable.

Average Joes vs. CEOs

Interestingly, while consumers are beginning to show signs of strain, CEO confidence tells a different story. Indeed, executives remain positive about the economy, with pandemic-era supply constraints now a thing of the past and earnings continuously exceeding expectations. The positive in all this for the Average Joe, as Luke Kawa explains, is that if this corporate optimism continues to translate into more business investment, new employment opportunities are usually close behind. But, employment opportunities tomorrow, while prices rise today, is a hard slogan to sell. At least the stock market keeps going up.

New Research

Lifespan regulation by targeting heme signaling in yeast

The study demonstrates that maintaining heme balance is crucial for aging, as heme supplementation significantly extends the replicative lifespan of yeast, independent of the genetic factor regulating glucose fermentation. However, heme-supplemented cells showed impaired mitochondrial respiration, indicating potential complexities in targeting heme levels. [Spinger]

These findings suggest that manipulating heme levels could be a promising therapeutic strategy for promoting healthy aging and longevity. [Spinger]