Sourcery → Red Flags

(4/22-4/26) CT, 7K!! 🌸 Cognition, Augment, Rippling, ThreatLocker, Parloa, Nominal, Movement Labs, Tines, Nagomi Security, Nooks, Pomelo, Nominal, Dropzone AI, Anon, Skyports, Exowatt, Chemix

Hello from CT

Where I am visiting family for my nephew’s 1st birthday, which apparently is a major red flag to Mike Solana 😂. HBD Rory!

Amid the forceful requests to dress up as the actual successful YouTuber Ms. Rachel for the Moana themed party in our backyard.. filled with gorgeous cherry blossoms & blooming trees, I am clinging to consciousness due to seasonal allergies. Truly forgot how bad these get. And yet, I still spend most of the day outside. I will never learn. Too nice out.

In other news.. we hit 7K subscribers! Thank you all for the continuous support & sharing! Things seem to be working! 🥳

This was a fun week of funding announcements with plenty of large exciting deals from Cognition, Rippling, Augment, ThreatLocker & Parloa. As well as interesting Musings from Reid Hoffman’s AI clone, Cognition’s viral videos, to the state of CA running on renewables for 9hrs, & the continuous debate on open vs closed source LLMs.

🎧 Stay tuned for our interview with Minn Kim of Lighthouse this Friday on the US skilled immigration opportunity for the AI & HardTech boom.

. . .

Musings

AI

Six-Month-Old AI Coding Startup Valued at $2 Billion by Founders Fund [The Information]

This childhood video of Scott’s math competition went viral on X with 3.9M views not too long ago and actually breathed hope and life back into the tech world.. reminding us why VCs invest in the first place. Taking a bet on the future into super geniuses.

And with 30M X views, here’s the video of their viral Devin product demo

Arthur Mensch: Open vs Closed - Who Wins and Mistral's Position [20VC]

Highly recommend watching the YouTube video.

Reid Hoffman’s AI Deepfake Bot: Reid AI

Ep8. AI Models, Data Scaling, Enterprise & Personal AI [BG2 with Bill Gurley & Brad Gerstner]

#412: Microsoft’s New Phi-3 Small Language Models Pack A Mighty Punch, Tesla Robotaxis, & more [Ark Invest]

HardTech

War for Our World, China will be ready to invade Taiwan in 2027. Are we prepared to do anything about it? [A Cruising Voyage Ryan McEntush ]

California has recently achieved running entirely on renewable energy for over nine hours [Fast Company]

Showcasing the state's increasing reliance on clean power sources like solar and wind, amid efforts to enhance grid storage and management capabilities.

In 2025, Japan plans to launch a satellite demonstration that will beam about 1 kilowatt of solar power from space to Earth [Space]

Marking a step towards potential space-based solar power stations that could contribute to reducing fossil fuel reliance

After five months of silence, NASA's interstellar explorer Voyager 1 spacecraft resumed communication, updating its health status but still unable to send valid scientific data. [Space]

More

TikTok Bill Passed, Tent City At Columbia, NPR CEO Is In The CIA, and Mission Driven Tech [Pirate Wires]

Jared Hecht of USV, 2x Exited Founder of Fundera (Nerdwallet) & GroupMe (Skype/Microsoft) [Sourcery]

If you need a new show and haven’t watched Under the Bridge yet, highly recommend

→ Want to sponsor this newsletter? Email us!

Last Week (4/22-4/26):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into eight categories, Fintech, Care, Enterprise / Consumer, HardTech, Sustainability, Acquisition/PE, IPOs, and Fund Announcements and ordered from later-stage rounds to early-stage rounds.

Highlighted VC Deals

Movement Labs, Augment, Rippling, Cognition, ThreatLocker, Parlor, Tines, Nagomi Security, Nooks, Pomelo, Nominal, Dropzone AI, Anon, Skyports, Magnus Metal, Exowatt, Chemix, Lumeris, Midi Health, Summer Health, Alaffia,

Acquisitions & PE

Betterment, Public/TradeApp, Nvidia/Run:ai

Final numbers

Japanese Yen Plummets, Tesla’s record drop in first-quarter revenue, funding drought in the agtech industry, Snap’s global growth, and the lab grown diamond delta

Research

Wikipedia-like LLMs, Quantitative Tightening Around the Globe, AI Predict Brain Age from EEG Data

VC Deals

This roundup was customized & powered by Wonder. Start your free trial here.

Fintech:

- Movement Labs, a San Francisco, CA-based blockchain development company incorporating modular elements to create a more secure & performant Ethereum ecosystem, completed a $38M Series A financing, led by Polychain Capital, with participation from Hack VC, Placeholder, Archetype, Maven 11, Robot Ventures, Figment Capital, Nomad Capital, Bankless Ventures, OKX Ventures, dao5, and Aptos Labs.

- Pomelo, a San Francisco, CA-based international consumer credit card company, secured a $35M Series A funding and a $75M expansion of its warehouse facility, led by Vy Capital, Founders Fund, and A* Capital.

- Homium, a Los Angeles, CA-based home equity mortgage lender and securitization platform, received a $10M Series A funding, led by Sorenson Impact Group and Blizzard, the Avalanche Ecosystem Fund.

- Bump, a Los Angeles, CA-based wealthtech and financing platform, closed a $3M Seed funding, supported by Impact X Capital, Capitalize VC, Serac Ventures, Tristan Walker’s Heirloom Ventures, Plug and Play, Symphonic Capital, Gaingels, Mana Ventures and existing investors Snap Inc, H/L Ventures, Connetic Ventures, and Sixty8 Capital.

- Moso, a Los Angeles, CA-based shop-to-earn platform that merges online shopping with cryptocurrency, raised $2M in seed funding from Symbolic Capital, Dao5, Coinlist, Polygon Ventures, and other angel investors.

- Twill Payments, a Camden, DE-based payment integration solution company, completed its Pre-seed funding round but the deal size and investors are undisclosed.

Care:

- Lumeris, a St. Louis, MO-based value-based care managed services company for health systems and providers, received a $100M equity growth financing, led by Deerfield Management and Endeavor Health, with support from Kleiner Perkins, Sandbox Industries, BlueCross BlueShield Venture Partners and JDLinx.

- Midi Health, a Los Altos, CA-based virtual care clinic for women navigating perimenopause and menopause, received an additional $60M in Series B funding, led by Emerson Collective, with support from GV (Google Ventures), Memorial Hermann, SemperVirens, Felicis, Icon Ventures, Black Angel Group, Gingerbread Capital, Able Partners, G9, and Operator Collective.

- Summer Health, a NYC-based digital health company focused on pediatric support, received $11.65M in Series A funding, co-led by 7wire Ventures and Lux Capital, with support from Sequoia Capital, Metrodora Ventures, Box Group, Shrug Capital, Pivotal Ventures, and Leaps by Bayer.

- Alaffia Health, an NYC-based company focused on the use of generative AI for health plan claim operations, closed a $10M funding, led by FirstMark Capital, with participation from GingerBread Capital, Anthemis, Aperture Venture Capital, 1984 Ventures, Remarkable Ventures, and Tau Ventures.

- Clarity Pediatrics, a San Francisco, CA-based digital health company, secured a $10M funding, led by Rethink Impact, with support from Homebrew, Maverick Ventures, January Ventures, Vamos Ventures, Alumni Ventures, and Citylight VC.

- Auxa Health, a NYC-based AI-powered benefit navigation technology startup, secured a $5.2M Seed funding, led by Zeal Capital Partners, with support from AlleyCorp, K50 Ventures, Laconia Capital Group, and Chaac Ventures.

- PinkDx, Inc., a Daly City, CA-based company operating in the women's healthcare space, closed a $4M Series A funding round, co-led by Catalio Capital Management, LP, and The Production Board, with other participating investors including Mountain Group Partners, Byers Capital, and Mayo Clinic.

- Handl Health, a Los Angeles, CA-based AI benefit design platform for benefits consultants, completed a $2.5M Seed funding round, led by Mucker Capital and Everywhere VC, with participation from Tau Ventures, Riverfront Ventures, DHVP (Digital Health Venture Partners), Boutique Venture Partners, Plug and Play Ventures, and Techstars.

- Pelvital USA, Inc., an Eagan, MN-based women’s health company, secured an additional $2.32M in its seed-plus funding round, led by Boomerang Ventures, with support from Pier 70 Ventures, Life Science Angels, Tech Coast Angels Orange County, and Blue Pacific Fund.

- Medical Informatics Engineering, a Fort Wayne, IN-, Austin, TX- and San Francisco, CA-based health IT software and systems provider for the occupational health market, completed an undisclosed investment amount from Serent Capital.

Enterprise/Consumer:

- Augment, a Palo Alto, CA-based AI coding assistance startup, completed a $227M Series B funding round from Sutter Hill Ventures, Index Ventures, Innovation Endeavors, Lightspeed Venture Partners, and Meritech Capital.

- Rippling, a San Francisco, CA-based workforce management startup, secured $200M in new financing, led by Coatue, with support from Founders Fund, Greenoaks, and other existing investors.

- Cognition, a six-month-old San Francisco startup that has developed Devin, a chatbot that can write and fix code, raised $175M at a $2B valuation led by Founders Fund, which just one month earlier led the company's Series A round at a $350M valuation. Other investors in the round include Khosla, 8VC,

- ThreatLocker, an Orlando, FL-based global cybersecurity company focused on Zero Trust endpoint security solutions, closed a $115M Series D funding, led by General Atlantic, with participation from StepStone Group and the D. E. Shaw Group.

- Parloa, a Berlin, Germany-based AI-powered customer service automation company, closed a $66M Series B funding, led by Altimeter Capital, as well as other investors including EQT Ventures, Newion, Senovo, Mosaic Ventures, and La Famiglia Growth.

- Tines, a Boston, MA-based smart and secure workflows company, received $50M in an extended Series B funding, led by Accel and Felicis with support from Addition, CrowdStrike Falcon Fund, SVCI, and pre-existing investors in Tines.

- Nagomi Security, a New York City-based proactive security platform for cybersecurity teams, raised $30M in funding, led by TCV, with support from CrowdStrike Falcon Fund, Okta Ventures, and others.

- Nooks, a San Francisco, CA-based AI dialing & prospecting platform, closed a $22M Series A funding, led by Lachy Groom, as well as other participating investors including Tola Capital and Stifel Venture Banking.

- BettrData, a Lakewood, CO-based data operations and workflow management platform, secured a $22M seed funding, led by Range Ventures, with other participants from SaaS Ventures and Greater Colorado Venture Fund.

- WILDE Brands, a Nashville, TN-based innovative snack brand, secured a $20M funding, led by Karp Reilly, with support from Jack Harlow, Machine Gun Kelly, The Family Fund, Grey Space Group, and others.

- Sublime Security, a Washington, DC-based AI-powered, programmable email security platform, completed a $20M Series A funding, led by Index Ventures, with participation from Decibel Partners and Slow Ventures.

- Nominal, a Los Angeles, CA-based end-to-end data analysis solutions company for industrial engineering teams, secured a $7.5M Seed and $20M Series A funding rounds, co-led by Lux Capital and General Catalyst, with support from Founders Fund, Haystack VC, XYZ Ventures, Human Capital, Box Group, and Overmatch.

- Dropzone AI, a Seattle, WA-based AI security analysts platform for security operations teams, closed a $16.85M Series A funding, led by Theory Ventures, Decibel Partners, Pioneer Square Ventures, and In-Q-Tel (IQT), with participation from Carta CISO Garrett Held and Anshu Gupta.

- Outpost, an Austin, TX-based provider of a network of managed semi-truck parking facilities, closed a $12.5M Series A funding, led by GreenPoint Partners, with participation from Speedwagon Capital Partners.

- 401GO, a Sandy, UT-based B2B retirement plan provider, received $12M in Series A funding from Next Frontier Capital, Rally Ventures, Impression Ventures, and Stout Street Capital.

- HighByte, a Portland, ME-based industrial software company, completed a $12M Series A funding, led by Standard Investments, with other participating investors, including Exposition Ventures, Maine Venture Fund, and others.

- Dripos, a NYC-based comprehensive software platform for coffee shops, closed an $11M Series A funding, led by Base10 with participation from Michael Siebel of Y Combinator, Shyam Rao, and Ian Crosby, among others.

- Prophet Security, a Palo Alto, CA-based security automating company, completed a $11M Seed funding, led by Bain Capital Ventures (BCV), with support from various security leaders and angel investors.

- Carv, a Santa Clara, CA-based modular data layer for gaming and AI, completed a $10M Series A funding, led by Tribe Capital and IOSG Ventures, with participation from Consensys, OKX Ventures, Fenbushi Capital, No Limit Holdings, Draper Dragon, Arweave, LiquidX, and MARBLEX, among others.

- Edia Learning, a US-based AI math learning platform for students, raised $9.4M in funding, led by Felicis.

- RWX, a Columbus, OH-based provider of continuous integration and continuous delivery (CI/CD) platform, completed a $7M Seed funding round from Quiet Capital.

- Anon, a San Francisco, CA-based developer platform for secure AI access and control to online user accounts, closed a $6.5M funding, led by Union Square Ventures and Abstract Ventures, with participation from Impatient Ventures and Ryan Hoover, Gokul Rajaram, Scott Belsky, and Amjad Masad, among other investors.

- Prime Intellect, a San Francisco, CA-based open and decentralized AI platform, received $5.5M in Seed funding, led by Distributed Global and CoinFund, with support from Compound, Collab+Currency, and Juan Benet, and Clem Delangue.

- Amplifier Security, an Atlanta, GA-based automation and security copilot company, received $3.3M in funding, led by Cota Capital with support from WestWave Capital, Shift Left Ventures, and other angel investors.

- Diddo, a Santa Monica, CA-based interactive ads API company, closed a $2.8M seed funding round, led by Link Ventures, with participation from Neo, Lamar advertising’s family office, Scott Forrstal, and other angel investors.

- Trace, a Columbus, OH-based platform for building location-based AR spaces, closed a $2M Pre-Seed funding round, led by Rev1 Ventures and Impellent Ventures, with participation from Everywhere Ventures, Ohio Innovation Fund, Portland Seed Fund, Allied Venture Partners, Service Provider Capital, Astir Ventures, Move VC, Phoenix Venture Fund, and other private investors in the XR space and scout funds.

- Sustain Exchange, LLC, a NYC-based startup focused on creating positive change in transactions in line with the 17 UN Sustainable Development Goals, raised $2M in seed funding from Jeff Hallstead.

- Continuum, a Chicago, IL-based digital networks company for B2B distributors and manufacturers, completed a $1.7M Pre-Seed funding, led by M25, with participation from Rex Salisbury’s Cambrian and Clocktower Ventures.

- Churnkey, a Charleston, SC-based retention automation software, closed a $1.5M funding, led by CreativeCo.

- Casa Shares, a Rexburg, ID-based SEC-qualified real estate investing platform, completed a $1.5M Pre-Seed funding from a group of private investors.

- Wheelhouse, a NYC-based independent content and talent platform, received an undisclosed amount of investment from Alignment Growth.

- Cognitus, a Dallas, TX-based SAP software solutions provider, closed an undisclosed growth investment amount, led by Siguler Guff & Company and Haven Capital Partners.

- FirstHive, a San Jose, CA-based provider of customer data platform (CDP) solutions, raised an undisclosed amount in funding, led by Saama, with participation from Benhamou Global Ventures (BGV), Amit Singhal, Twin Ventures, Mela Ventures, and Amit Midha.

HardTech:

- Skyports, a London, UK-based vertiport infrastructure and electric drones company, closed its £88.6M Series C funding, led by ACS and Groupe ADP.

- Magnus Metal, a Tel Aviv, Israel-based digital casting system developer for metal alloys, secured a $74M Series B funding, led by Entrée Capital and Target Global, with support from Caterpillar Ventures, Tal Ventures, Deep Insight Ventures, Awz Ventures, Lumir Ventures, and others.

- Curio Legacy Ventures, a Washington, DC-based tech development company advancing closed fuel cycles, received a $14M Seed funding from Synergos Holdings and the Department of Energy (DOE).

- Radical, a Seattle, WA-based high-altitude solar-powered aircraft manufacturer, closed a $4.5M Seed funding round, led by Scout Ventures, alongside other participating investors: Inflection Mercury Fund and Y Combinator.

- Aropha, a Bedford, OH-based laboratory focused on advancing biodegradable material discovery and testing through lab automation, robotics, and AI predictive modeling, received a $1M Seed funding, led by Comeback Capital, with support from Lightbank and Right Side Capital Management (RSCM).

- Pure Lithium, a Boston, MA-based lithium metal battery technology company, extended its Series A funding round, by an undisclosed amount, backed by Ivanhoe Capital and WS Investment Company.

Sustainability:

- Agilitas Energy, a Wakefield MA-based integrated developer, builder, owner, and operator of distributed energy storage and solar photovoltaic (PV) systems, completed a $100M Debt funding round, led by Nomura Securities International, Inc.

- On.Energy, a Miami, FL-based electric power asset owner and end-to-end integrator of battery energy storage systems, closed a $25M working capital facility, led by Lombard Odier Investment Managers.

- Exowatt, a Miami, FL-based renewable energy company, secured a $20M seed funding from a16z, Atomic, and Sam Altman.

- Chemix, a Sunnyvale, CA-based EV-battery developer, closed a $20M Series A funding, led by Ibex Investors, with participation from Mayfield Fund, Berkeley SkyDeck, Urban Innovation Fund, BNP Paribas Solar Impulse Venture Fund (SIVF), Global Brain’s KDDI Open Innovation Fund III (KDDI CVC), and Porsche Ventures.

Acquisitions & PE:

- GTCR agreed to acquire AssetMark, a Concord, CA-based wealth management technology platform for financial advisors, in a $2.7B take-private deal.

- Quanex is set to acquire Tyman, a London, UK-based supplier of engineered fenestration components and access solutions to the construction industry, for approximately $1.1B.

- JD Sports agreed to acquire Hibbett (NASDAQ: HIBB), a Birmingham, AL-based sports fashion retailer, for about $1.1B.

- Knorr-Bremse is set to acquire Saint-Ouen-sur-Seine, the North American conventional rail signaling business of Alstom, a France-based developer of railway transport equipment and services, for about €630 million ($671 million).

- Givebutter, an Austin, TX-based nonprofit fundraising platform, secured a $50M investment funding, led by Bessemer Venture Partners’ BVP Forge, with support from Ardent Venture Partners.

- Proemion has agreed to acquire Trendminer, a Hasselt, Belgium-based industrial analytics company, for €47 million ($50 million), led by Battery Ventures.

- FinQuery, an Atlanta, GA-based AI-powered corporate expenditure management solution, raised a $25M minority investment from Periphas Capital, with participation from Lavelle Capital.

- Paystand, a Scotts Valley, CA-based blockchain-enabled B2B payments company, acquired Teampay, a NYC-based provider of spend management software for an undisclosed amount.

- AMBOSS acquired NEJM Knowledge+, a Boston, MA-based learning and assessment tool for clinicians, for an undisclosed amount, led by Partech.

- Granite Creek Capital Partners acquired a minority stake in The District Communications Group, a Washington, DC-based communications firm, for an undisclosed amount.

- Finsight, a NYC-based financial technology company, acquired T-REX, a provider of a cloud-native platform engineered to model and manage investments across private credit, for an undisclosed amount.

- KnowBe4, a Tampa Bay, FL-based security awareness training and simulated phishing platform, moved to acquire Egress Software Technologies, a London, UK-based adaptive and integrated cloud email security company, for an undisclosed amount.

- Gamut Capital Management agreed to acquire DEX Imaging, a Tampa, FL-based provider of printers, copiers, and other office technology, from Staples, for an undisclosed amount, led by Essling Capital, HarbourVest Partners, and Sycamore Partners Management.

- Planoly, an Austin, TX-based social media management platform, acquired Snipfeed, a social media monetization tool, for an undisclosed amount.

- Betterment, an NYC-based independent digital investment advisor, has agreed to acquire Marcus Invest’s digital investing accounts, for an undisclosed amount.

- Infosys (NSE: INFY) (BSE: INFY) (NYSE: INFY) a Bengaluru, India-based digital services and consulting company, has agreed to acquire in-tech, a Munich, Germany-based automotive engineering R&D services company, for an undisclosed amount.

- Celebrity Coaches acquired Moonstruck Leasing, a Nashville, TN-based entertainment coach leasing company, for an undisclosed amount, led by Allied Industrial Partners.

- Blackstone agreed to acquire Tropical Smoothie Cafe, an Atlanta, GA-based franchisor of fast casual restaurants from Levine Leichtman Capital Partners, for an undisclosed amount.

- Public, an NYC-based digital investing platform, acquired the TradeApp investment accounts from Stocktwits, for an undisclosed amount.

- Sigma Defense Systems, a portfolio company of Sagewind Capital, acquired EWA, a Herndon, VA-based electronic warfare technologies manufacturer, for an undisclosed amount.

- Nvidia (NASDAQ: NVDA) agreed to acquire Run:ai, a Tel Aviv, Israel-based developer of GPU orchestration software for an undisclosed amount.

- Lightyear Capital transferred ownership of its portfolio company, ampliFI Loyalty Solutions, to a single-asset continuation fund, while retaining management of the company, led by Neuberger Berman.

IPOs:

- Loar Holdings, a White Plain, NY-based manufacturer of niche parts for aircraft and aerospace and defense systems, closed $308M in an offering of 11 million shares priced at $28 on the NYSE.

- Marex Group, a London, UK-based financial services provider, closed $292M in an offering of 15.4 million shares priced at $19 on the Nasdaq.

Fund Announcements:

This roundup was customized & powered by Wonder. Start your free trial here.

- Vestar Capital Partners, a New York City-based private equity firm, closed a $1.2B continuation fund vehicle for its stake in Circana, a Chicago, IL-based market research firm.

- Crosslink Capital, Inc., a Menlo Park, CA-based early-stage VC firm, closed its tenth flagship venture capital fund, Crosslink Ventures X, at $350M.

- GEF Capital Partners, a Washington, DC-based private equity fund, closed its second fund at $325M for companies focused on climate change and pollution remediation solutions.

- Endicott Capital, a New York City-based private equity investment firm, closed its second fund worth $250M, focused on making investments in information services companies.

Final Numbers

Yen descend

The currency of the world’s fourth largest economy is plummeting, with ¥100 buying just $0.63 on Friday — its lowest rate in over 34 years, just as Japan's Golden Week holiday period kicks off.

The weaker yen is a boon for Japanese exporters and foreign visitors, who have been increasingly flocking to the country in recent times. Indeed, last month a record 3.08M foreign travelers visited the island nation, which was slower than others to re-open borders after the pandemic, only relaxing restrictions in October 2022.

Pacific exchange

The yen's depreciation is a perfect case study for economics teachers around the world. While most major central banks have aggressively hiked rates to combat inflation, Japan's rates remain near zero — fueling a classic “carry trade”, where investors borrow the currency cheaply and sell it to invest in higher-yielding currencies or assets (i.e. not in Japan), driving down the buying power of yen.

The US, meanwhile, is at a different stage in its cycle, attracting buyers for its currency as the Federal Reserve signals it might need to maintain higher interest rates for longer amidst lingering inflation.

A weaker yen could reshape the Japanese economy, making the country’s exports more competitive and foreign imports more expensive. In the short term, Japanese authorities have appeared publicly sanguine about the devaluation, although a sharp jump in yen this morning has been met with strong suspicions that the government may have moved to support the currency.

Data: Company Reports; Chart: CNBC

The chart illustrates a consistent upward trend in Tesla’s revenues from Q1 2019 to Q1 2024, with total automotive revenues being the largest and most rapidly growing segment, followed by services and other, and energy generation and storage.

Despite the upward trend, Tesla experienced its largest revenue decline since 2012, dropping 9% to $23.33 billion in Q1 2024, missing analysts' estimates, with automotive revenue falling 13% to $17.38 billion, amid ongoing price cuts and a steeper drop than the 2020 decline due to the COVID-19 production disruptions.

Data: Pitchbook; Chart: McKinsey

The chart shows a sharp decline in Agtech venture capital investment and all venture capital, which picked up in 2021 to a steep decline by mid-2023, defining the “Capital drought period.”

The agtech industry has faced a significant funding reduction, with venture capital investments dropping 60% since 2021 and 30% in 2023, severely impacting start-ups, as $6 billion was lost across 30 key companies due to distress and turnaround situations.

Oh, Snap

Sometimes, it helps to see the bigger picture. Shares of Snap Inc., the company behind Snapchat, surged nearly 30% last week after posting better-than-expected results for the most recent quarter — in no small part due to astounding growth outside of North America. Revenue jumped some 21% on the year prior, but Snap also posted a 39M annual increase in global daily active users, over 90% of which came from outside of the US and Canada.

Snap’s position in the competitive social media arena has always been somewhat precarious — epitomized by one infamous tweet wiping $1B+ off its value. Lacking the sheer scale of Meta or the virality offered by the endless scrolling TikTok feed, Snap has struggled to become a profit machine, losing money nearly every quarter since going public.

A typical North American user was worth $7.44 to Snap in its most recent quarter, way more than the $1.13 that it raked in from its “Rest of World” Snappers, but nowhere near the ~$68 per user average that Facebook made from its US & Canadian active users in the final quarter of 2023. However, Snap has been improving its advertising targeting capabilities, with the number of small and medium advertisers on the app rising 85% in the last year.

Filtering through

Although its appeal may have peaked in the US — where users haven’t really grown for years — Snap has found success overseas. Early last year, the app reached 200M monthly active users in India, home to an estimated 20% global share of Gen Z, Snapchat’s primary user base. And, with TikTok caught in Congress’s crosshairs, Snap could find itself perfectly placed to win a larger share of eyeballs in its most lucrative market.

Under pressure

There’s not that much you can get done in 2 and a half hours nowadays — you could only make it ~80% of the way into this year’s best picture winner, for example, or about midway through the average American teen’s daily social media screen time. Scientists, however, can now reportedly produce diamonds in a tight 150-minute time frame... while natural diamonds take anywhere from 1-3 billion years to form.

The new method rapidly heats and cools a mix of liquid metals at atmospheric pressure — a fraction of the pressure typically required to make the gems — marking the latest innovation in the world of lab-grown diamonds, which continues to threaten the entrenched diamond industry.

Instagems

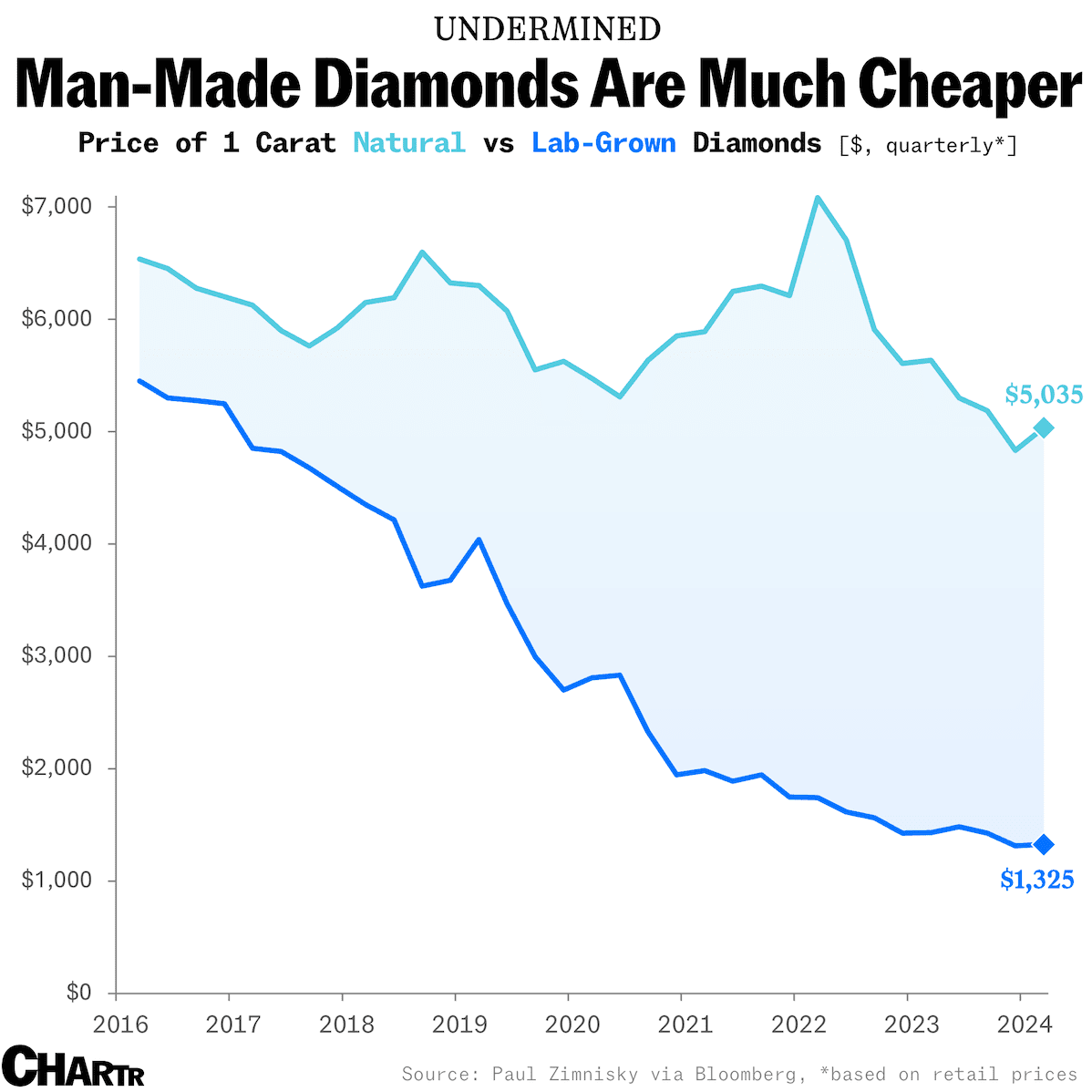

The burgeoning business of growing synthetic stones is poised to upend a centuries-old industry, as the low cost of making rather than mining continues to drive prices down. Indeed, while natural diamond prices surged during the pandemic, the cost of both natural and man-made diamonds have plummeted in recent years, according to data from industry expert Paul Zimnisky via reporting from Bloomberg.

That’s bad news for jewel giants like De Beers, which is apparently being lined up to be offloaded by Anglo American, its parent company that recently received a $39B takeover bid from rival BHP Group. De Beers has been at the heart of diamond-mining controversy for decades, from reports on its environmental impacts to accusations of unethical production practices. For many, the cheaper, less damaging lab-grown alternatives offer a shinier prospect when picking out that special something.

New Research

Assisting in Writing Wikipedia-like Articles From Scratch with Large Language Models

This study explores using large language models to create well-grounded and structured long-form articles akin to Wikipedia entries, introducing the STORM system which enhances pre-writing through diverse research perspectives and simulated expert dialogues to form organized outlines. [arXiv]