Sourcery → Rippling, Ramp, A16Z

(4/15-4/19) NYC Visit ☀️ Anrok, Two Chairs, Avive Solutions, Kontakt.io, Evergreen Theragnostics, Ilant Health, Rivos, Upstage, Cape, GovDash, HumanX, Rivet Work, NightVision, Iceye, G

Hello from NYC

As someone who lived here for 7 years then went west for the past 3, nothing is better than a weather-friendly NYC visit. The air is different. People dress better. Suddenly most are happy. ..and it’s definitely the sunshine.

In the last 3 years NYC has really come a long way, cultivating a strong and vibrant ecosystem for technology, AI, and yes, VC. It’s certainly always exciting to make the quarterly trip to reconnect with friends, meet new people, and always be reminded to walk faster & step up the fashion game.

Musings

Macro

The Great IPO Debate, Tesla Robotaxi v Uber, Tech Check [BG2 with Bill Gurley & Brad Gerstner]

Redpoint Ventures & Stepstone Group on VC Deployment, M&A, and Google's AI Strategy [TWIS]

New funds, new era? Andreessen Horowitz bucks tech trend with $7.2B fund [CTech]

“According to the company's reports, it manages assets amounting to $42B across 28 funds. The largest fundraising to date was for the crypto fund it raised in May 2022, totaling $4.5B, which completed the capital raised for investing in the crypto market and its derivatives to $7.9B across four different funds. Not all of this capital was invested due to the significant decline in the crypto market in the last two years.”

Breakdown of the new $7.2B fund

$3.75B for Growth

$1.25B for AI infrastructure

$600M for American Dynamism

$600 for Gaming

AI

AI optimists crowd out doubters at TED [Axios]

With 1.4M views, this $100B budget Microsoft keynote really sent X for a spin

Cerebral Valley New York Speakers: Snowflake CEO, Ramp CEO, Runway CTO, Databricks VP, Sequoia Partner & More Soon [Newcomer]

Can confirm this is an excellent event, incredible speakers & conversations each time

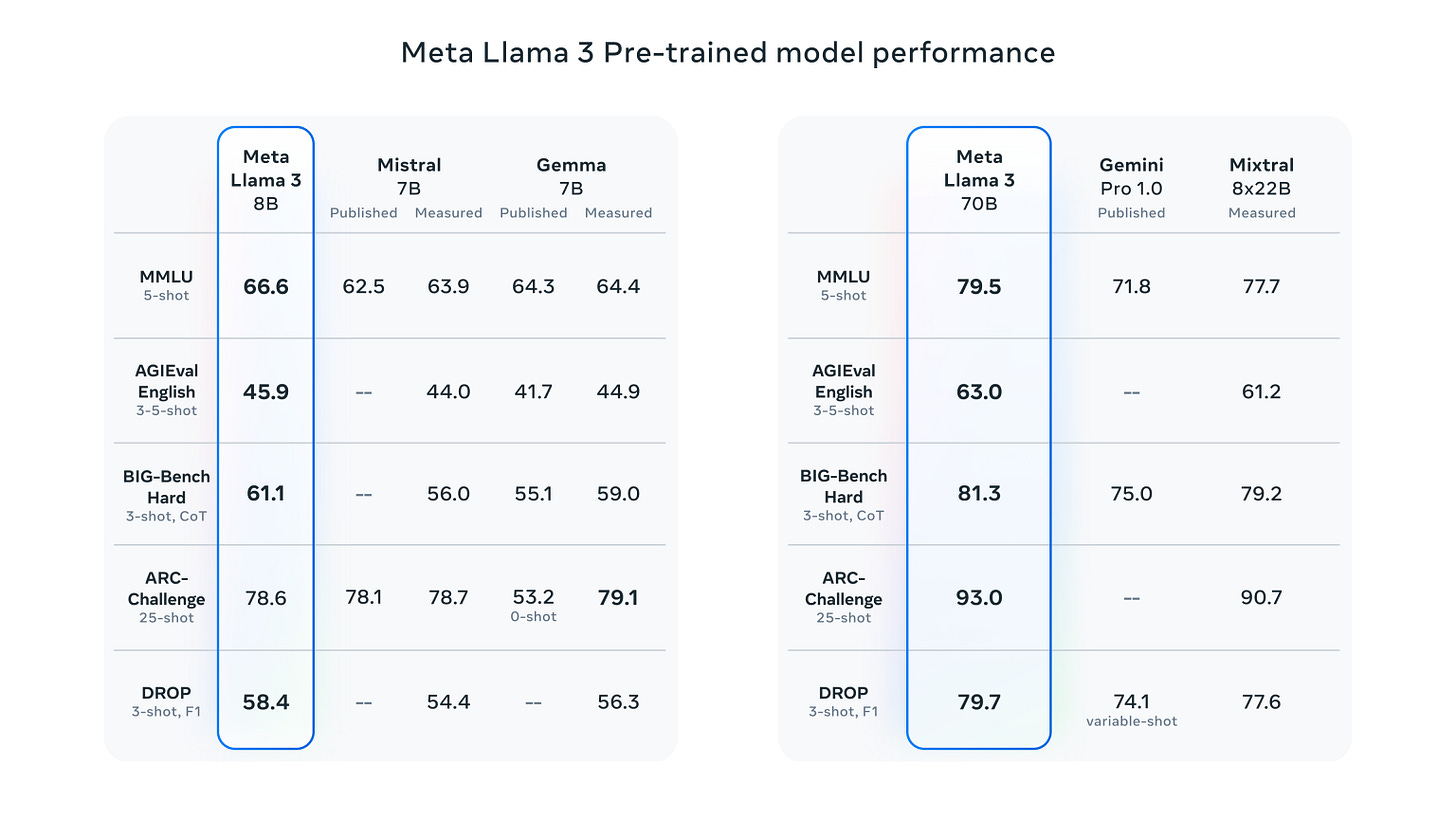

Meta Has Released Its Long-Awaited Llama 3 [Ark Invest] [AI News]

Data

The Cloud Storage Triad: Latency, Cost, Durability; A theorem for primary persistence on object stores [Materialized View]

HardTech

Startup Nominal Raises $27 Million to Aid Defense Tech Boom [Yahoo]

Launched out of stealth with funding from Lux Capital, General Catalyst and Founders Fund

More

Oh Say, What is Truth? The Need For A Renaissance of Truth Seekers [Kyle Harrison]

Success & The Psychology of Self-Control [Ultra Successful]

. . .

Last Week (4/15-4/19):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into five categories, FinTech, Care, Enterprise & Consumer, HardTech, and Sustainability, and ordered from later-stage rounds to early-stage rounds.

Highlighted VC deals include Rippling, Ramp, Anrok, Two Chairs, Avive Solutions, Kontakt.io, Evergreen Theragnostics, Ilant Health, Rivos, Upstage, Cape, GovDash, HumanX, Rivet Work, NightVision, Iceye, GridBeyond, Magnus Metal, Quilt, Verne, GA Drilling, Found Energy, Breaking, and Captura.

Final numbers on the top US states for EV adoption and a byte out of cyber crime at the bottom.

Deals

This roundup was customized & powered by Wonder. Start your free trial here.

Fintech:

- Rippling, an S.F.-based employee onboarding tech startup, is raising $200M in new funding led by Coatue, with $670M in a secondary sale, with Founders Fund and Greenoaks also participating, per TechCrunch.

- Ramp, a New York City-based financial automation platform, closed a $150M Series D-2 funding round, led by co-led by Khosla Ventures and Founders Fund, with participation from Sequoia Capital, Greylock, and 8VC, and existing investors Thrive Capital, General Catalyst, Sands Capital, D1 Capital Partners, Lux Capital, Iconiq Capital, Definition Capital, Contrary Capital, and more.

- Sétanta Development Capital, a Charlotte, North Carolina-based residential real estate financing company, completed a $100M credit facility, led by Victory Park Capital.

- Berachain, a Toronto, California-based provider of an EVM-compatible layer 1 blockchain, closed a $100M Series B funding, led by Brevan Howard Digital and Framework Ventures, alongside other participants including Polychain Capital, Hypersphere Ventures, Nomad Capital, Arrington Capital, Samsung Next, Amber Group, Cypher Capital, Hack VC, Tribe Capital, Laser Digital by Nomura Group, Hashkey Capital, Rubik VC, and other angel investors.

- Anrok, a San Francisco-based global sales tax solution, closed a $30M Series B funding, led by Khosla Ventures, with Index Ventures, Sequoia Capital, and others participating in the round.

- Xfactor.io, a San Francisco, CA-based provider of a comprehensive AI-powered revenue platform, completed a $16M Series A funding, led by Accel and Mike Carpenter, with Lightspeed and others also participating in the funding round.

- Centrifuge, a San Francisco, California-based onchain finance startup, closed a $15M Series A funding, co-led by ParaFi Capital and Greenfield, with other participants, including Gnosis, IOSG Ventures, Modular Capital, Circle Ventures, Edessa Capital, ProtoCap, Re7 Capital, Scytale Digital, Skynet Trading, TRGC, Arrington Capital, Bloccelerate, Borderless Capital, Wintermute Ventures, Stake Capital, and The Spartan Group.

- Zeus Network, a developer of a permissionless communication layer on Solana for Bitcoin, completed over $8M in funding from Mechanism Capital, OKX Ventures, and Solana co-founder Anatoly Yakovenko, among others.

- ClaimScore, a Pompton Lakes, New Jersey-based AI-based, real-time claim validation software platform, completed a $3.15M Seed funding, led by ROC Venture Group.

- Zeko Labs, a San Francisco, California-based decentralized finance and software solutions company, closed a $3M in funding, led by UOB Venture Management, Signum Capital, and YBB Capital, with participation from Autonomy Capital, Cogitent Ventures, GBV, Tenzor Capital, 3Commas Capital, ArkGrow, AVID3, Cryptonauts, Nox Holdings, NxGen.xyz, SkyVision Capital (SVC), and Presto Labs.

Care:

- Two Chairs, a San Francisco, California-based behavioral health company, raised $72M in Series C equity and debt financing, led by Amplo with Fifth Down Capital, Bridge Bank, and other participating investors.

- Avive Solutions, a San Francisco, CA-based developer of a connected automated external defibrillator (AED) – the Avive Connect AED, closed a $56.5M Growth Equity funding, led by Questa Capital, Laerdal Million Lives Fund (LMLF), and Catalyst Health Ventures, including RC Capital and Eckuity Capital, as participants.

- Kontakt.io, a New York City-based inpatient journey analytics platform, closed a $47.5M funding, led by Goldman Sachs Asset Management.

- Evergreen Theragnostics, a Springfield, New Jersey-based clinical-stage radiopharmaceutical company, completed a $26M funding round from Petrichor and LIFTT.

- RFX Solutions, an Oklahoma City-based SaaS compliance software for healthcare facilities, closed a $9M Series A funding, led by Arthur Ventures.

- LunaJoy Health, a St. Petersburg, Florida-based women’s mental health company, raised $4.2M in funding from Y Combinator, FoundersX Fund, Goodwater Capital, Magic Fund, VentureSouq, Nurture Ventures, and NorthSouth Ventures.

- Ilant Health, a New York City-based obesity management and cardiometabolic health solutions company, closed an additional $3M in funding, from LifeX Ventures, Celtic House Asia Partners, and Cornucopian Capital, other existing investors.

- Nava Health, a Columbia, MD-based group of holistic health and treatment centers focused on integrative medicine, raised an undisclosed revenue-based funding, led by Decathlon Capital.

Enterprise/Consumer:

- Rivos, a Santa Clara, California-based RISC-V accelerated platform company for analytics and Generative AI, closed over $250M in Series A-3 funding, led by Matrix Capital Management, with participation from Intel Capital, MediaTek, Cambium Capital, CIDC, Capital TEN, Hotung Venture Group, Walden Catalyst, Dell Technologies Capital, Koch Disruptive Technologies, and VentureTech Alliance.

- Upstage, a San Jose, California-based AI and large language models (LLMs) company, completed a $72M Series B funding from SK Networks, KT, Korea Development Bank, Shinhan Venture Investment, Hana Ventures, Mirae Asset Venture InvesAtment, Industrial Bank of Korea, SBVA, Primer Sazze Partners, Company K Partners, and Premier Partners.

- Cape, an Arlington, VA-based privacy-first mobile carrier, closed a $61M funding, led by A* and Andreessen Horowitz, with participation from XYZ Ventures, ex/ante, Costanoa Ventures, Point72 Ventures, Forward Deployed VC, and Karman Ventures.

- UniUni, a Richmond, BC, Canada-based company that operates in the e-commerce last-mile logistics space, closed a $50M Series C funding, led by DCM.

- Anvilogic, a Palo Alto, California-based provider of a multi-data platform SIEM, closed a $45M Series C funding, led by Evolution Equity Partners, with participation from Foundation Capital, Cervin Ventures, Myriad Ventures, Point72 Ventures, Outpost Ventures, Stepstone Group, and G Squared.

- CarNow, an Atlanta, Georgia-based live-data automotive technology platform, completed a $40M loan facility from Runway Growth Capital.

- Ecotrak, an Irvine, California-based provider of intelligent facility management solutions, completed a $30M funding, led by Respida Capital, with Carver Road Capital and Gala Capital Partners joining as participants.

- Snappy, a New York-based provider of a gifting platform, closed a $25M Series D funding, led by Qumra Capital alongside other participants, including 83North, Saban Ventures, Notable Capital, and Hearst Ventures.

- Loft Labs, a San Francisco, California-based provider of platform engineering building blocks, closed a $24M Series A funding, led by Khosla Ventures and other participants, including Fusion Fund, Surface Ventures, Emergent Ventures, Berkeley SkyDeck Fund, and Kit Merker.

- NeuBird, a San Francisco, California-based cloud-based generative operations platform for enterprises, closed a $22M Seed funding, led by Mayfield.

- Dot Compliance, a Phoenix, Arizona-based AI-enabled quality management system (QMS) solution provider, completed a $17.5M Series B funding, led by IGP Capital and Vertex Ventures, while TPY Capital participated.

- Vorlon, a Mountain View, California-based 3P API security platform, completed a $15.7M Series A funding round, led by Accel and joined by Shield Capital and others.

- AI Squared, a Washington, DC-based AI, data, and business analytics company, closed a $13.8M Series A funding, led by Ansa Capital, including other participants from NEA, Ridgeline, and Roger W. Ferguson Jr.

- dataplor, a Manhattan Beach, California-based global location intelligence solutions provider, completed a $10.6M Series A funding, led by Spark Capital and other participants, including Quest Venture Partners, Acronym Venture Capital, Circadian Ventures, Two Lanterns Venture Partners, and APA Venture Partners.

- Calzar, a San Francisco, California-based cloud marketplace services provider, raised $10M in Series A funding, led by Ridge Ventures and Ensemble VC, alongside other participants, including Saurabh Gupta, The General Partnership, and Twin Ventures.

- Avalon, an Orlando, Florida-based independent game studio, completed a $10M funding, led by Bitkraft Ventures and Hashed, with participation from Coinbase Ventures, Spartan Capital, Foresight Ventures, LiquidX, and Momentum6.

- Uniqus Consultech, a San Jose, California-based tech-enabled global platform that provides ESG, accounting, and reporting consulting services, closed a $10M Series B funding, led by Nexus Ventures with participation from Sorin Investments.

- GovDash, a New York City-based AI-powered platform for assisting with government contracts, closed a $10M Series A funding, led by Northzone with Y Combinator participating in the funding round.

- VulnCheck, a Lexington, Massachusetts-based exploit intelligence company, completed a $7.95M seed funding round, led by Sorenson Capital.

- BreachRx, a San Francisco, California-based incident response platform for enterprises, raised $6.5M in seed funding, led by SYN Ventures with participation from Overline.

- HumanX, a New York City-based AI strategy company, closed a $6M funding, led by Primary Venture Partners, with participants, including Foundation Capital, FPV Ventures, and Andreessen Horowitz.

- Rivet Work, a Detroit, Michigan-based electrical construction workforce management platform, completed a $6M funding round, led by Brick & Mortar Ventures alongside other funding participants, including defy.vc, Augment Ventures, Detroit Venture Partners, Michigan Rise, and other angel investors.

- NightVision, a Bradenton, Florida-based application security provider, completed a $5.4M Seed funding round from undisclosed investors.

- Diagon, a San Francisco, California-based sourcing platform for the manufacturing equipment industry, closed a $5.1 million seed funding, led by the Westly Group, with Valia Ventures, Techstars, Foster Ventures, Foxe Capital, Anthemis Group, and others participating.

- NEBRA, a New York City-based zero-knowledge proof research and development organization, closed a $4.5M combined pre-seed and seed round, led by Nascent Ventures and Bankless Ventures, with participation from a16z Crypto Startup Accelerator and angel investors.

- Condoit, a Birmingham, AL-based provider of a platform for digitizing the electrical industry, closed a $4.5M Seed funding, led by The Westly Group and other participants, including Fontinalis Partners, Navitas Capital, C2 Ventures, Studio Management, Overline, and Southwire.

- Patlytics, a San Francisco-based AI-powered patent platform, closed a $4.5M seed funding round, led by Gradient alongside 8VC, Liquid 2 Ventures, Tribe Capital, Vermilion Ventures, Gaingels, Alumni Ventures, Position Ventures, and other angel investors.

- Draftboard, a New York City-based talent recruitment platform, completed a $4.1M pre-seed funding, led by Twelve Below and joined by Founder Collective, Ground Up, and Amino.

- Paraform, a San Francisco-based recruiting marketplace, completed a $3.6M seed funding round, led by A*, with Primer Sazze Partners and others participating.

- Hatch, a NYC-based provider of AI-powered donor engagement solutions for nonprofits, closed a $3M Seed funding, led by Differential Ventures, including participants from Character, Howard Morgan, and other angel investors.

- Renterra, a Chicago, Illinois-based software platform for the equipment rental industry, completed a $3M funding round, led by Bienville Capital, alongside other participating investors from Iron Prairie Ventures, Alaris Capital, and others.

- Take2 AI, a New York-based AI-powered job simulation and sales recruiting platform, closed a $3M Seed funding round, led by Reach Capital & SemperVirens, with participation from multiple Techstars and HR leaders.

- AgentSmyth, a New York City-based agent technology startup, raised $2.5M in Seed funding from Michael Rafferty and Craig Milias.

- Volo Sports, a Baltimore, MD-based provider of community-focused, tech-enabled adult social sports and curated events, raised an undisclosed amount of strategic growth investment, led by Manhattan West.

- SilverSky, a Morrisville, NC-based cybersecurity provider, closed an undisclosed amount in funding, led by SQN Venture Partners and other funding participants.

HardTech:

- Iceye, a Helsinki, Finland-based company that focuses on synthetic aperture radar (SAR) satellite operations for earth observation, persistent monitoring, and natural catastrophe solutions, closed a $93M Growth funding round, led by Solidium Oy, with participation from Move Capital Fund I, Blackwells Capital, Christo Georgiev, and other existing investors.

- GridBeyond, a Dublin, Ireland-based intelligent energy and smart grid platform company, closed a €52M Series C funding, led by Alantra’s Energy Transition Fund - Klima, with participation from Energy Impact Partners, Mirova, ABB, Constellation and Yokogawa Electric Corporation, and Act Venture Capital.

- Magnus Metal, a Tel Aviv, Israel-based technology company that specializes in industrial, high-volume digital casting for metal alloys, closed a $74M Series B funding, led by Entrée Capital and Target Global, including participants from Caterpillar Ventures, Tal Ventures, Deep Insight Ventures, Awz Ventures, Lumir Ventures, Discount Capital, Lip Ventures, Cresson Management, Next Gear Fund and Essentia Venture Capital.

- Kode Labs, a Detroit, Michigan-based autonomous smart building startup, completed a $30M Series B funding, led by Maverix Private Equity, alongside other participants from TELUS Ventures and I Squared Capital.

- CleanFiber, a New York City-based materials science company, closed a $28M Series B funding, led by Spring Lane Capital, with other participants, including Climate Innovation Capital, AXA IM Alts, Tokyu Construction/Global Brain, Ahlström Invest, and other family offices.

- Allen Control Systems, an Austin, TX-based defense technology company, completed a $12M Seed funding, led by Craft Ventures alongside other participants, including Forum Ventures and Rally Ventures.

- LQDX, a Santa Clara, California-based developer of materials for advanced semiconductor manufacturing, raised $10M in Equity and Government funding from undisclosed investors.

- Trident IoT, a Carlsbad, California-based technology and engineering company focused on accelerating the manufacture of connected devices, closed a $10M funding round, led by Todd Pedersen and others.

Sustainability:

- Quilt, a Redwood City, California-based smart home climate solution company, closed a $33M Series A funding round, led by Energy Impact Partners and Galvanize Climate Solutions, with participation from Lowercarbon Capital, Gradient Ventures, MCJ Collective, Garage Capital, Incite Ventures, and Drew Scott.

- Verne, a San Francisco, California-based developer of high-density hydrogen storage systems, closed an undisclosed amount of funding which brought the total to $15.5M, led by Trucks Venture Capital, with participation from Collaborative Fund, Amazon’s Climate Pledge Fund, United Airlines Ventures Sustainable Flight Fund and Newlab.

- GA Drilling, a Houston, Texas-based company focusing on deep geothermal energy, closed a $15M funding, backed by Nabors, Christian Oldendorff’s new Family Office, alfa8, Thomas von Koch, Underground Ventures, and Neulogy Ventures.

- Found Energy, a Boston, Massachusetts-based cleantech startup, raised $12M in Seed funding from KOMPAS VC, Munich Re Ventures, Good Growth Capital, the Autodesk Foundation, J-Impact, GiTV, Massachusetts Clean Energy Center (MassCEC), and Glenfield Partners LTD.

- Breaking, a Boston, Massachusetts-based plastic degradation and synthetic biology company, raised $10.5M in Seed funding from undisclosed investors.

- Captura, a Pasadena, California-based developer of technology for removing carbon dioxide from the ocean, completed a $10M Series A funding extension, backed by National Grid Partners and Japan Airlines Innovation Fund/Translink Capital.

Acquisitions & PE:

- Resideo Technologies (NYSE: REZI) set to acquire Snap One Holdings (NASDAQ: SNPO), a Charlotte, North Carolina-based smart-living products, services, and software provider, for about $1.4B.

- Armis, a San Francisco, California-based asset intelligence cybersecurity company, acquired Silk Security, a Santa Clara, California-based cyber risk company, for $150M.

- ceτi AI, a decentralized artificial intelligence infrastructure company, announced its acquisition of Big Energy Investments Inc., a Canadian company focusing on strategic investment in high-performance computing infrastructure, for an undisclosed amount.

- Battery Ventures, a Boston, MA-based global, technology-focused investment firm, acquired Labguru (BioData Inc.), a Cambridge, MA-based life-science laboratory-data platform, for an undisclosed amount.

- Meet The People acquired True Independent Holdings, a Columbia, Missouri-based media marketing group, for an undisclosed amount, backed by Innovatus Capital Partners.

- Precision Pipeline acquired SabCon Underground, a Winter Haven, Florida-based natural gas repair, installation, and maintenance services company, for an undisclosed amount, backed by MPE Partners.

- Beefree, a San Francisco, California-based no-code email creation company, acquired Really Good Emails, an email design resource and platform, for an undisclosed amount.

- Commvault (NASDAQ: CVLT), a Tinton Falls, New Jersey-based cyber resilience and data protection solutions company, acquired Appranix, a cloud cyber resilience company, for an undisclosed amount.

- Thoughtworks (NASDAQ: TWKS), a global technology company, acquired individuals and technology assets from Watchful, a San Francisco, CA-based AI model deployment company, for an undisclosed amount.

- BMC, a Houston, Texas-based autonomous digital enterprise software solutions company, acquired Netreo, an Irvine, California-based IT network and application observability solutions, for an undisclosed amount.

- BeyondTrust, an Atlanta, Georgia-based identity and access security company, acquired Entitle, a Tel Aviv, Israel-based privilege management solution company, for an undisclosed amount.

- Accenture Federal Services, a wholly owned subsidiary of Accenture (NYSE: ACN), has moved to acquire Cognosante, a Falls Church, Virginia-based mission-driven provider of digital transformation and cloud modernization solutions, for an undisclosed amount.

- Karma Wallet, a Raleigh, North Carolina-based sustainable consumer spending company, acquired DoneGood, a marketplace for sustainable shopping, for an undisclosed amount.

- Godspeed Capital Partners acquired Special Aerospace Services, a Boulder, Colorado-based engineering and manufacturing services provider to the aerospace, aviation, defense, and energy industries, for an undisclosed amount.

- One Equity Partners acquired Ballymore Safety Products, a Coatesville, Pennsylvania-based designer and manufacturer of engineered lifting, material handling, and safety-related products, for an undisclosed amount.

- Bernhard Capital Partners’ Department of Energy Services platform acquired Strategic Management Solutions, an Albuquerque, New Mexico-based management and technical consulting services company for nuclear programs and projects, for an undisclosed deal.

- Cumming Group acquired The Ridgway Group, a Los Angeles, California-based project and cost management professional services company, for an undisclosed amount.

- Firmament acquired a majority stake in Sparkle Express Car Wash Group, a Chicago, Illinois-based membership-based express car wash brand, for an undisclosed amount.

- PestCo acquired Sasquatch Pest Control, a Portland, Oregon-based pest control services company, for an undisclosed amount.

IPO:

- Centuri Holdings, a Phoenix, Arizona-based infrastructure services company for the energy and utility industry, raised $260M in an offering of 12.4 million shares priced at $21 on the NYSE.

- UL Solutions, a Northbrook, Illinois-based product testing and safety certification services company, raised $946M in an offering of 33.8 million shares priced at $28 on the NYSE.

Fund Announcements:

- Evolution Equity Partners, a New York City-based investment firm, completed the $1.1 billion Evolution Technology Fund III, backed by a diverse mix of institutions, sovereign investors, insurance companies, endowments, foundations, fund of funds, family offices, and high-net-worth individuals.

- Wellington Management, a Boston, Massachusetts-based asset manager, closed its first fund worth $385M for tech-enabled solutions addressing climate change.

- SOSV, a Princeton, New Jersey-based multi-stage deep tech venture investor, announced the close of its $306M SOSV V fund, backed by corporates, sovereign wealth funds, institutional investors, and private family offices globally.

- AlleyCorp, a New York City-based tech VC firm, closed a $250M fund from a small group of limited partners.

- Magnesium Capital, a London, UK-based energy transition buyout firm, completed its inaugural fund at €135M, backed by blue-clip institutional investors from the US, Europe, and the UK.

- SpringTide Ventures, a Boston, Massachusetts-based VC firm, closed its second fund worth $65 million for the healthtech industry.

- Maven Ventures, a Palo Alto, California-based VC firm, closed its fourth fund at $60M, focused on seed stage investments for addressing consumer tech trends.

Final Numbers

P.P.S. Wonder saved me 5 hours of work by tapping the best of AI and human researchers to deliver this customized roundup of recent deal activity straight to my inbox. Their on-demand desk research platform turns around robust research reports and accurate answers to important strategy questions in hours. Kick off your free trial today to see where it can save your team time too!

Data: JD Power; Chart: CNBC

The chart illustrates the Top U.S. states for electric vehicle adoption based on J.D. Power’s index and EV market share between January – February 2024, underscoring the varying levels of EV adoption across states, with California significantly ahead.