Sourcery ✨ Satya Nadella

(3/18-3/22) Inflection AI, Wonder, Hippocratic AI, Foundry, Radia, Carlsmed, Loyal, Coast, Morph, BigID; Databricks/Lilac AI, Cisco/Splunk

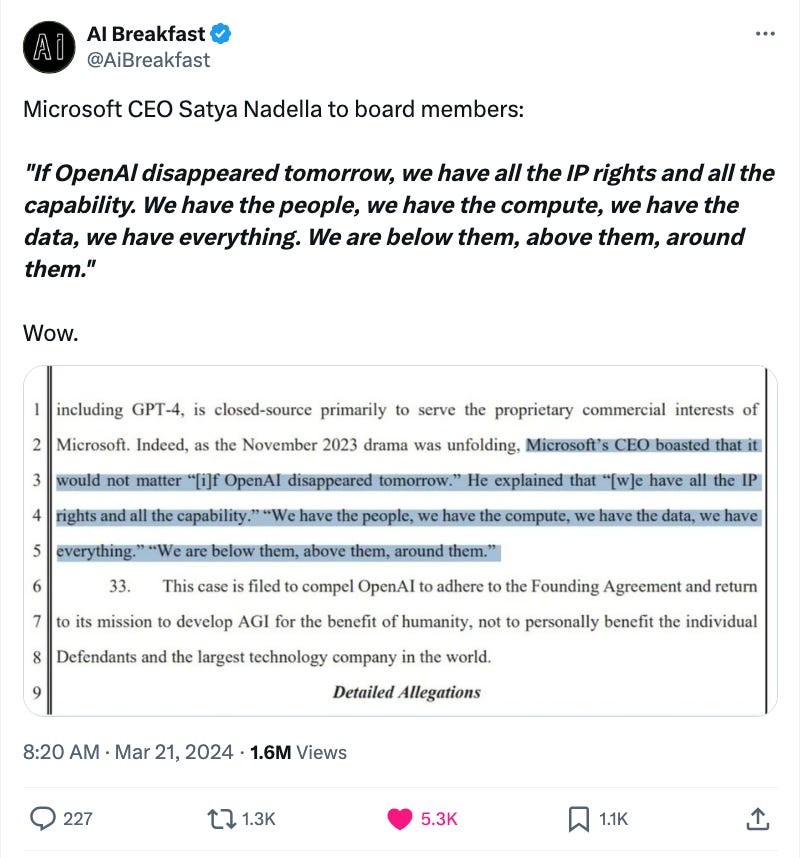

Microsoft’s Satya Nadella is not messing around.

Musings

AI

Microsoft Agreed to Pay Inflection $650 Million While Hiring Its Staff [The Information]

Microsoft isn’t slowing down, and they’re also getting a bit creative.. This deal, mostly in the form of licensing Inflection's AI models, allows the startup to provide a positive return to its investors despite most of its staff joining Microsoft. The unusual arrangement has raised questions about whether it's structured to avoid regulatory scrutiny over potential acquisitions in the AI space.

AI SaaS Companies Will Be More Profitable [Tomasz Tunguz]

Tepid Revenue at Cohere Shows OpenAI Competitors Face Uphill Battle [The Information]

HardTech

We have an exciting podcast coming out this Friday with one of LA’s fastest growing hardtech companies. Stay tuned!

Spice up your pantry OCD, meet Cliik

Our good friend Ally Dayon, also behind the famous slipper brand Brunch, recently launched Cliik. Cliik is a customizable storage solution company starting with pantry staples. Sleek, vibrant, fun, colorful designs, and satisfying magnetic "clicks," Cliik invites you to rediscover the joy of childhood while embracing modern elegance.

. . .

Last Week (3/18-3/22):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into five categories, FinTech, Care, Enterprise & Consumer, HardTech, and Sustainability, and ordered from later-stage rounds to early-stage rounds.

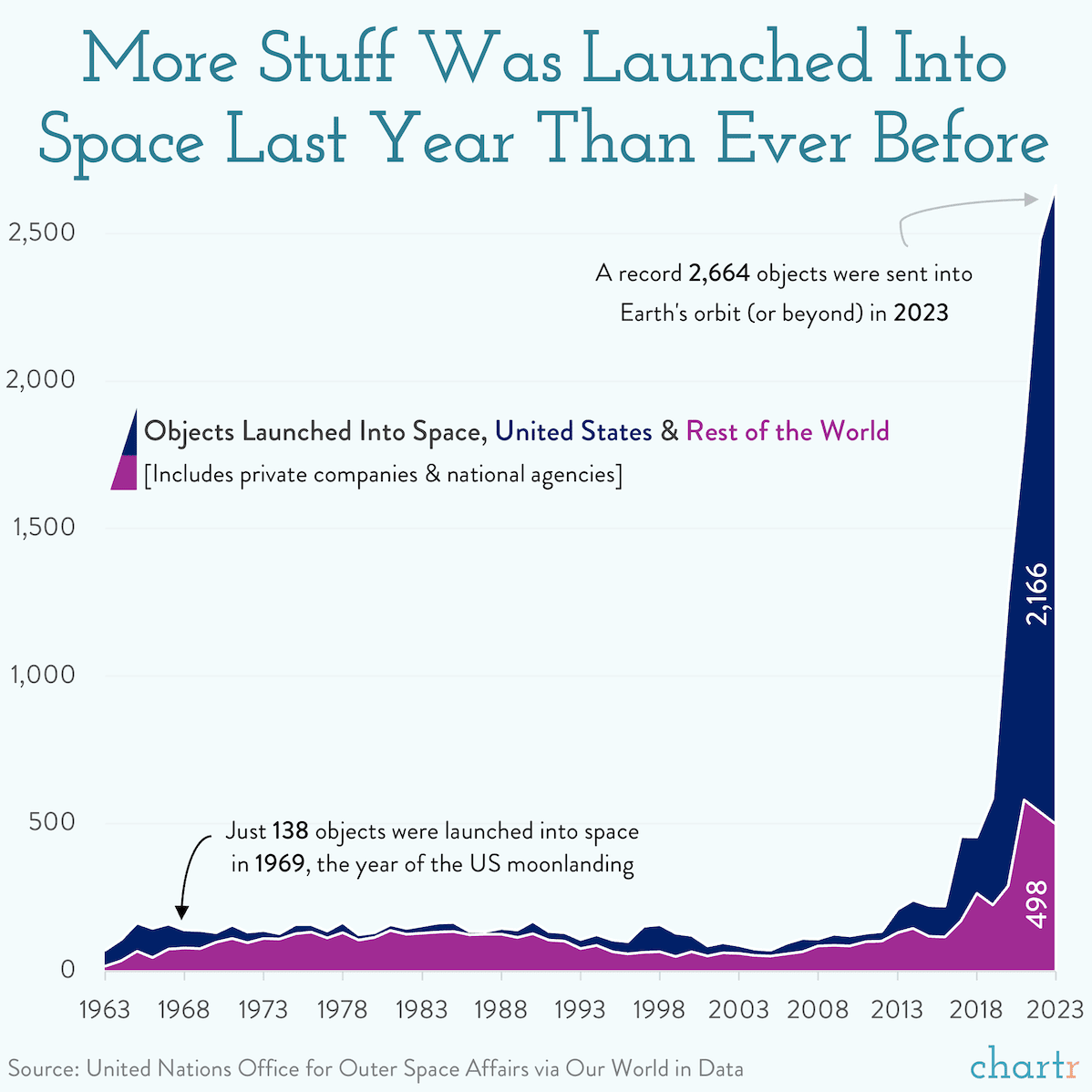

Final numbers on Space Launches Soar in 2023 at the bottom.

Deals

Fintech:

- Coast, New York, NY provider of expense cards designed for use by business fleets, raised $25M in funding from BoxGroup, Avid Ventures, Accel, Insight Partners, Better Tomorrow Ventures, and Vesey Ventures.

- NX Technologies, Cologne, Germany developer of the bezahl.de platform for automotive payment management, raised €22M ($23.8M) in Series B funding led by PayPal Ventures with participation from Seaya Ventures, Walter Ventures, and existing investor Motive Ventures.

- Morph, Singapore-based developer of an ethereum layer 2 network, raised $19M in seed funding led by DragonFly Capital with participation from Pantera Capital, Foresight Ventures, The Spartan Group, MEXC Ventures, Symbolic Capital, and others.

- Marco Financial, Miami, FL trade finance platform for the U.S. and Latin America, raised $12M in Series A funding led by IDC Ventures with participation from IDB Lab, Barn Invest, SquareOne Capital, Arcadia Funds, Florida Funders, and others.

- Keyring Network, London, U.K provider of compliance tools for on chain transactions, raised $6M in seed funding led by gumi Cryptos Capital and Greenfield Capital with participation from Motier Ventures, Kima Ventures, UDHC Finance, Eberg Capital, and others.

- Umoja, Atlanta, GA smart money protocol, raised $2M in a seed extension from Coinbase, 500 Global, and Quantstamp.

. . .

Care:

- Hippocratic AI, Palo Alto, CA developer of generative AI nurses and other health care applications, raised $53 million in Series A funding led by Premji Invest and General Catalyst with participation from SV Angel, Memorial Hermann Health System, and existing investors.

- Carlsmed, Carlsbad, CA provider of personalized surgery technology, raised $52.5M in Series C funding led by B Capital and U.S. Venture Partners with participation fromThe Vertical Group.

- Loyal, San Francisco, CA developer of longevity drugs for dogs, raised $45M in Series B funding led by Bain Capital Ventures with participation from Khosla Ventures, First Round Capital, Box Group, Collaborative Fund, Quiet Capital, and Todd & Rahul's Angel Fund.

- PocketHealth, Toronto, Ontario medical image exchange platform for patients and health care providers, raised $33M in Series B funding from Round13 Capital, Deloitte Ventures, Samsung Next, Questa Capital, and Radical Ventures.

- Keep Company, Bethesda, MD platform that provides support to employees with caregiving responsibilities, raised $1.2M in funding from Techstars, Idea Fund Partners, VEST Her Ventures, Pixel Perfect Ventures, TEDCO, and Inspire Access.

. . .

Enterprise & Consumer:

- Wonder, a "cloud kitchen on wheels" company led by Marc Lore, raised $700M from NEA, GV, Accel, Bain Capital Ventures, Forerunner, Alpine and Harmony, and Watar Partners. The deal also includes $100m from Lore himself.

- Pocket FM, Los Angeles, CA audio entertainment platform and developer of audio series, raised $103M in Series D funding led by Lightspeed with participation from Stepstone Group.

- Foundry, an AI compute startup, raised $80M in seed and Series A funding co-led by Lightspeed and Sequoia Capital.

- BigID, New York, NY data security and compliance company, raised $60M in funding led by Riverwood Capital with participation from Silver Lake Waterman and Advent.

- Pandion, Seattle, WA network for the delivery of e-commerce parcels to residential destinations, raised $41.5 million in Series B funding led by Revolution Growth with participation from Playground Global, Prologis Ventures, Bow Capital, Telstra Ventures, AME Cloud Ventures, and others.

- Borderless AI, Toronto, Canada developer of an AI HR agent, raised $27M in seed funding led by Susquehanna and Aglaé Ventures.

- CyberSaint, Boston, MA cyber risk management platform, raised $21M in Series A funding led by Riverside Acceleration Capita with participation from Sage Hill Investors, Audeo Capital, and BlueIO.

- BlueFlag Security, Sunnyvale, CA security platform for software development lifecycles, raised $11.5M in seed funding led by Maverick Ventures and Ten Eleven Ventures with participation from Pier 88 Investment Partners.

- Carbonated, Los Angeles, CA video game studio developing a globally interactive mobile game, raised $11M in Series A funding led by Com2uS with participation from a16z, BITKRAFT Ventures, Cypher Capital, Blocore, Goal Ventures, and WAGMI.

- Superlinked, San Francisco, CA platform that turns data into vector embeddings that are compatible with machine learning, raised $9.5M in seed funding led by Index Ventures with participation from Theory Ventures, 20Sales, Firestreak, and others.

- Mermaid Chart, San Francisco, CA platform designed for employees to build and collaborate on text-based diagrams, raised $7.5 million in seed funding from M12, Sequoia Capital, Open Core Ventures, Streamlined Ventures, Good Friends Capital, V1 VC, and others.

- Euno, Sunnyvale, CA data governance platform, raised $6.3M in seed funding led by 10D with participation from INT3 and angel investors.

- Winible, Austin, TX ecommerce platform for the sports betting industry, raised $6M in seed funding led by Inspired Capital.

- Mallard Bay, Baton Rouge, LA online marketplace for booking guided hunting and fishing trips, raised $4.6M in Series A funding led by Soul Venture Partners with participation from Acadian Capital Ventures.

- Cleric, San Francisco, CA developer of an autonomous AI engineer for site reliability and infrastructure management, raised $4.3M in seed funding led by Zetta Venture Partners.

- Basketball Forever, New York, NY basketball media brand, raised $4M in Series A funding led by Yolo Investments with participation from Astralis Capital Management, and Andover Ventures.

- Stanhope AI, London, UK developer of AI models designed to make decisions without previous training by providing them with neuroscience data, raised £2.3M ($2.9M) in seed funding led by UCL Technology Fund with participation from Creator Fund, MMC Ventures, Moonfire Ventures, Rockmount Capital, and angel investors.

- Mobly, Lehi, UT developer of a mobile sales tool designed for in-person networking, raised $2.5M in seed fundin led by Peterson Ventures with participation from VITALIZE Venture Capital, Peak Ventures, Tenzing Capital, Upstream Ventures, Service Provider Capital, and angel investors.

- Quilt, San Francisco, CA developer of AI models for presales and solution teams (like consultants and sales engineers), raised $2.5M in seed funding led by Sequoia.

. . .

HardTech:

- Radia, Boulder, CO developer of planes large enough to carry wind turbine blades, is raising up to $300M in Series C funding.

- NeuReality, Caesarea, Isreal developer of AI inference chips that help AI systems generate content from the data they were trained on, raised $20M in funding from the European innovation Council Fund, Varana Capital, Cleveland Avenue, XT Hi-Tech, and OurCrowd.

- Fuel Me, Burr Ridge, IL fuel procurement and management platform, raised $18M in Series A funding led by Pritzker Group Venture Capital and Tribeca Venture Partners with participation from Bessemer Venture Partners, Interplay Venture Capital, and FJ Labs.

- Firestorm Labs, San Diego, CA manufacturer of unmanned aerial systems for war, raised $12.5M in seed funding led by Lockheed Martin Ventures.

- Ediphi, Boston, MA developer of estimating software for contractors, raised $12M in Series A funding from Norwest Venture Partners.

- Stress-Free Auto Care, a network of tech-enabled automotive service shops in California and Texas, raised $11M in Series A funding led by Forerunner Ventures.

- Buzz Solutions, Palo Alto, CA provider of AI technology designed for visual infrastructure inspections and predictive maintenance, raised $5M in funding led by GoPoint Ventures with participation from Blackhorn Ventures and MaC Venture Capital.

- Monaire, Boston, MA platform that uses AI to predict maintenance needs and provide energy management to HVAC and refrigeration systems in small buildings, raised $3.5M in seed funding led by Construct Capital with participation from Workshop Ventures.

. . .

Sustainability:

- AirMyne, Berkeley, CA developer of direct air carbon capture processes, raised $6.9M in seed funding from Y Combinator, Alumni Ventures, Liquid 2 Ventures, EMLES, Impact Science Ventures, and others.

Acquisitions & PE:

- Microsoft has hired the co-founders and many other employees of Inflection AI, a Silicon Valley startup that last summer raised $1.3B at a $4B valuation.

- Databricks, backed by Vantage Legacy Capital, acquired Lilac AI, a Boston, Mass.-based AI tool for searching, quantifying, and editing data. Financial terms were not disclosed.

- JumpCloud, backed by Ventioneers and H.I.G. Capital, acquired Resmo, an Ankara, Turkey-based IT, SaaS, and cloud asset management platform. Financial terms were not disclosed.

- Francisco Partners agreed to acquire Jama Software, a Portland, Ore. and Amsterdam, The Netherlands-based platform for managing and tracing the requirements during product development, from shareholders including Insight Partners and Madrona Ventures for $1.2B.

- nCino (NASDAQ: NCNO) agreed to acquire DocFox, a Miami, Fla.-based provider of automated onboarding and account opening processes for commercial and business banking, for $75M.

- Cisco (Nasdaq: CSCO) completed its $28B acquisition of cybersecurity and observability company Splunk.

- HashiCorp (NYSE: HCP), an SF-based multi-cloud automation software provider with a $5.3B market cap, is exploring a possible sale, per Bloomberg.

- Francisco Partners agreed to buy Jama Software, a Portland, Ore.-based enterprise product development platform, for $1.2B from backers like Insight Partners and Madrona Venture Group.

. . .

IPOs:

- Astera Labs, a Santa Clara, Calif.-based developer of semiconductor-based solutions for cloud and AI infrastructure, raised $713M in an offering of 19.8M shares priced at $36 on the Nasdaq. The company posted $116M in revenue for the year ending December 31, 2023.

Funds:

- IVP raised $1.6B for its 18th flagship VC fund.

- B Capital, Los Angeles-based venture capital firm, raised $750M for its second opportunities fund focused on technology, health care, and climate tech companies.

- Bedrock raised $400M for its fourth VC fund, and added Rachel Haot as chief of staff. She previously was chief digital officer for both New York state and New York City.

- Frontline Ventures, Dublin, Ireland-based venture capital firm, raised $200M across one growth stage and one seed stage fund focused on U.S.-based business-to-business software companies looking to expand into Europe.

- Autism Impact Fund, New York City-based venture capital fund, raised $60M for its first fund focused on companies that improve diagnoses, treatment, and support for people with Autism Spectrum Disorder.

- Zero Prime Ventures, San Francisco-based venture capital firm, raised $48M for its second fund focused on early-stage data infrastructure, generative AI tooling, and machine learning companies.

Final Numbers

Hard launch

We are launching more stuff into space than ever before. Indeed, us Earth-dwellers launched a record-breaking 2,664 objects into space last year… with the US — be that American companies or government agencies — responsible for 81% of them.

That’s per recent numbers from the United Nations Office for Outer Space Affairs (UNOOSA), via Our World in Data, which revealed that the number of objects launched into space (everything from satellites to crewed spacecrafts) rose by almost 200 in 2023.