Sourcery → woah.

(6/10-6/14) BeReal, Bilt, Kirsten Green ☀️ Apex, GPTZero, Zeta Labs, EnFi, InScope, Anterior, Grayce, Cyberhaven, Relay, Whoosh

Apologies in advance. A lot has happened in the last week, musings are heavy.

Quick Poll

Musings

Macro

Pre-IPO Market, AI Hype Cycle, Is Software Dead? [BG2 Pod]

Remix: How private equity took over everything [Decoder with Nilay Patel]

Raising a First-Time Venture Fund in 2024-2025: Sky-High Barriers, Expected New Spinouts, and a Thawing Capital Drought? [Samir Kaji]

SaaS Spend as a Percent of Revenue in 2023 [Sammy Abdullah, Blossom Street]

Is Seat Based Pricing Dead? [Jamin Ball, Altimeter]

Challenging Traditional Fund Models: Hunter Walk, Homebrew & Screendoor [Sourcery]

Founding fund of funds Screendoor, advice for Emerging Managers, debunking misconceptions on becoming a self-funded VC fund (no LPs)

AI

Roadmap: AI Infrastructure [Bessemer]

A new infrastructure paradigm, purpose-built for AI, is emerging to supercharge the next wave of enterprise data software in the age of AI.

OpenAI is on a recruiting hot streak: Sarah Friar (CFO) and Kevin Weil (CPO) join the C-suite [OpenAI]

Alexandr Wang CEO, Scale.ai: Why Data Not Compute is the Bottleneck to Foundation Model Performance [20VC]

AI Model Startups vs Big Tech...SaaS Hit From Two Directions [Newcomer]

The EU's new AI Act, which mandates greater transparency in AI training data, has sparked controversy among tech companies. [AI News]

The war for AI talent is heating up - Big tech firms scramble to fill gaps as brain drain sets in [Economist]

HardTech

LA HardTech Market Map [Erik Stiebel]

Inside look into Radiant’s El Segundo Factory [Jason Carman S3]

Towards Type One, Investing in an Interplanetary Future [Matthew Harris, Agora]

Researchers have developed a new technique using a femtosecond laser to create and control optical qubits in silicon, potentially enabling scalable quantum computers and networks. [Science Daily]

Elon Musk celebrated the approval of his $44.9 billion pay package at a Tesla event in Austin, despite a Delaware judge previously ruling against it due to shareholder deception. [Fortune]

The approval secures Musk's position at Tesla, with plans to expand into AI and robotics

Consumer

Rising Above the Noise in Consumer VC with Kirsten Green of Forerunner [TWIS w/ Mark Suster]

Forerunner Research: Consumer Vs Enterprise [Forerunner]

Research Rundown: BeReal’s $600M exit & the market data behind it [Contrary Research]

The Consumer Renaissance (Part II) [Rex Woodbury]

FinTech

Wells Fargo is subsidizing Bilt to the tune of ~$120 million a year based on some false assumptions in their contract (expires in 2029) [Rex Salisbury, Cambrian]

A Fintech Retrospective [F-Prime]

More

Regret Porn "You can either run from it, or... learn from it!" [Kyle Harrison]

Mark Suster: The face of L.A. venture capital [LA Times]

Former Chairman and CEO of Home Depot, Frank Blake - Leading By Example [Invest Like the Best]

Google Cloud's Mandiant revealed that approximately 165 organizations may have had their data exposed in a significant cyber incident involving Snowflake [Axios]

Despite odd initial decline, Apple's stock surged by $312 billion over the two days following WWDC. [Axios]

The WWDC stock drop was one of the weirdest things from last week, don’t know if the drop on the day was due to hedge fund arbitrage or what, but their rally back up emphasized Apple’s superpower: lock-in & upgrades - Apple introduced new device & silicon dependency to stay up to date with their AI models upon release (new cameras aren’t going to cut it anymore) + satellite cell service in the new iOS (this is huge).

Apple’s WWDC 2024: Reactions, Highlights & Breakdowns with Jason and Alex [TWIS]

Are you a top AI founder or investor & want to connect with peers building the future of AI?

Apply here to attend Cerebral Valley New York—an invite-only event featuring speakers like Sridhar Ramaswamy CEO of Snowflake and Eric Glyman CEO of Ramp.

See ya there! 👋

Last Week (6/10-6/14):

Relevant deals include the 85+ deals across stages below.

I've categorized the deals below into eight categories, Fintech, Care, Enterprise / Consumer, HardTech, Sustainability, Acquisition/PE, and Fund Announcements, and ordered from later-stage rounds to early-stage rounds.

Highlighted VC Deals include:

Apex, GPTZero, Zeta Labs, EnFi, InScope, Anterior, Grayce, Cyberhaven, Relay, Whoosh

Acquisitions & PE

Tegus/AlphaSense, Vantage Data Centers, PowerSchool

Funds

Foresight Capital, JP Morgan Private Capital, High Alpha

Final numbers

Have wages have kept up with inflation? and lingering high food prices despite declining inflation

VC Deals

This roundup was customized & powered by Wonder. Start your free trial here.

Fintech:

- Fibe, a Mumbai, India-based consumer lending platform, raised $90M in Series E funding, led by TR Capital, Trifecta Capital, and Amara Partners, alongside TPG Rise Fund, Norwest Venture Partners, Eight Roads Ventures, and Chiratae Ventures.

- AccountsIQ, a Dublin, Ireland-based cloud-based fintech accounting platform, closed €60M in Series C funding, led by Axiom Equity.

- Mad Mobile, a Tampa, FL-based restaurant and retail SaaS and payment solutions provider, received $50M in funding from Morgan Stanley Expansion Capital and Bridge Bank.

- Posh AI, a Boston, MA-based company providing a platform democratizing access to banking, secured strategic funding, bringing the total amount raised to $45M, led by Curql, with participation from TruStage Ventures and Canapé Ventures.

- Nexus, a San Francisco, CA-based zero-knowledge cryptography company, secured $25M in Series A funding, co-led by Lightspeed Venture Partners and Pantera Capital, alongside Dragonfly Capital, Faction Ventures, and Blockchain Builders Fund.

- Aidentified, Inc., a Boston, MA-based AI-powered prospecting and relationship intelligence platform for financial services professionals, secured $12.5M in Series B funding from FactSet.

- EnFi, a Boston, MA-based AI fintech startup, closed $7.5M in Seed funding, led by Unusual Ventures and joined by Boston Seed, Argon Ventures, and Impellent Ventures.

- Brightwave, an NYC- and Boulder, CO-based AI-powered research assistant for financial analysis, closed $6M in Seed funding, led by Decibel Partners, alongside Point72 Ventures, Moonfire Ventures, and angel investors including executives from OpenAI, Databricks, Uber, and LinkedIn.

- InScope, a San Francisco, CA-based AI-powered fintech startup, secured a $4.3M seed funding round, led by Lightspeed Venture Partners, supported by Vipul Ved Prakash, Jake Heller, Debbie Clifford, Justin Coulombe, and Nadia Asoyan.

- Nada, a Dallas, TX-based investment tech platform for homeowners and investors, raised undisclosed seed extension funding from LiveOak Ventures and 7BC Venture Capital.

Care:

- Anterior, an NYC-based AI-powered healthcare administration platform, closed $20M in Series A funding, led by New Enterprise Associates, with support from Sequoia Capital, Blue Lion Global, and Neo.

- Better Health, a San Francisco, CA-based medical supply and support provider, secured $14M in funding from Healthworx, UHealth – University of Miami Health System, and Mosaic General Partnership.

- Grayce, a San Francisco, CA-based social care platform for families, closed $10.4M in Series A funding, led by Maveron alongside BBG Ventures, Correlation Ventures, GingerBread Capital, Alumni Ventures, Visible Ventures, Gaingels, and What If Ventures.

- Auxilius, an NYC-based clinical trial financial management (CTFM) platform, raised $10M in funding from SignalFire.

- Arya, an NYC-based holistic sexual wellness platform, secured a $7.5M Seed funding round, led by Patron and Play Ventures, with support from At.inc/, Heracles Capital, Neil Parick, Harpreet Rai, Yasmin Lukatz, and Naama Breckler.

- Koda Health, a Houston, TX-based digital advance care planning provider, completed an undisclosed seed funding amount, led by Ecliptic Capital, alongside Memorial Hermann Health System, AARP, and the Texas Medical Center (TMC) Venture Fund.

- Apricot Technologies, an Oklahoma City, OK-based startup that leverages generative AI to reduce health care documentation, received an undisclosed amount in funding from Cortado Ventures.

Enterprise/Consumer:

- Cognigy, a Düsseldorf, Germany-based AI-first customer service automation company, secured $100M in Series C funding, led by Eurazeo Growth and joined by Insight Partners, DTCP, DN Capital, and others.

- Cyberhaven, a San Jose, CA-based data detection and response (DDR) company, closed $88M in Series C funding, led by Adams Street Partners and Khosla Ventures, alongside Redpoint Ventures, Costanoa Ventures, Vertex Ventures, Crane Venture Partners, Wing Venture Capital, Amol Kulkarni, Gerhard Eschelbeck, Ash Devata, and others.

- Canary Technologies, a San Francisco, CA-based hotel guest management technology platform, completed a $50M Series C funding round, led by Insight Partners and joined by F-Prime Capital, Thayer Ventures, Y-Combinator, and Commerce Ventures.

- Relay, a Raleigh, NC-based cloud-based communications platform for frontline teams, closed $35M in Series B funding, led by G2 Venture Partners, with support from Wind River Ventures and Sovereign’s Capital.

- Learn to Win, a Redwood City, CA-based enterprise training software platform, secured $30M in Series A funding, led by the Westly Group, alongside Norwest Venture Partners and Pear VC.

- Findigs, an NYC-based smart rental screening and leasing decision company for the property industry, closed a $27M Series B funding round, led by Nyca Partners and supported by RPM Ventures, Streamlined Ventures, Expa Ventures, Activant Capital, Colle Capital, and Frontier Venture Capital.

- Astrocade AI, a San Francisco, CA-based AI-powered social gaming platform, closed a $12M Seed funding round, backed by AME Cloud Ventures, NVIDIA Ventures, Venture Reality Fund, Eric Schmidt, Niccolo De Masi, John Riccitiello, David Baszucki, Jerry Yang, Mike Abbott, and more.

- Daisy, a Costa Mesa, CA-based home and small business technology installation and services company, received $11M in Series A funding, led by Goldcrest and Bungalow, alongside Bullish, Burst Capital, and other angel investors.

- YourSix, a St. Paul, MN-based cloud physical security solutions company, received $10.5M in Series A funding, led by Vocap Partners alongside Eastside Partners.

- Whoosh, a Mill Valley, CA-based club operations software solution, completed a $10.3M Series A funding round, led by AlleyCorp and joined by 8VC, Alaris Capital, Bienville, Craft Ventures, Eberg Capital, Operator Partners, Raptor Group, Larry Fitzgerald Jr., Alison Lee, Howard Lindzon, Kurt Kitayama, Andy Roddick, and Mike Walrath.

- GPTZero, a NYC-based AI-generated content detection platform, completed a $10M Series A funding round, led by Footwork VC and supported by Reach Capital, Uncork, Neo, Alt Capital, and the former CEOs of Reuters and the NYT.

- Stanly, a Los Angeles, CA-based all-access digital fan club platform, raised $8M in Pre-Series A funding, led by Adrian Cheng’s C Capital and joined by AppWorks, Goodwater, Palm Drive Capital, and others.

- FirmPilot, a Miami, FL-based AI marketing engine for law firms, secured $7M in Series A funding, led by Blumberg Capital and DoubleVerify, with support from Valor Ventures, SaaS Ventures, FJ Labs, and Connexa Capital.

- Roamless, a San Francisco, CA-based travel connectivity startup, secured a $5M seed funding round, led by Shorooq Partners, alongside Revo Capital, Paribu Ventures, Finberg, and Deba Ventures.

- PPC.io, a San Francisco, CA-based pay-per-click (PPC) marketing company, completed a $5M Seed funding round, led by angel investors in the marketing space.

- Wild Common, a Jackson Hole, Wyoming-based agave spirits company, completed a $5M Series A funding round, led by HIPstr.

- BlinqIO, a Delaware-based generative-AI software testing platform, closed $5M in funding, led by Flint Capital alongside Inovia Capital Precede Fund I, TAL ventures, and SeedIL.

- Pyte, a Los Angeles, CA-based AI-powered enterprise computation platform, closed $5M in funding, led by Myriad Venture Partners and joined by Innovation Endeavors, Liberty Mutual Strategic Ventures, and Pillar VC, among others.

- Jump, a Salt Lake City, UT-based AI software for financial advisors, secured $4.6M in funding, led by Sorenson Capital and joined by Pelion Venture Partners and other angel investors.

- Zeta Labs, a San Francisco, CA-based AI research and product company, closed $2.9M in Pre-Seed funding, led by Daniel Gross and Nat Friedman, alongside Earlybird VC, Kaya VC, AI Grant, Shawn Wang (swyx), Bartek Pucek and Mati Staniszewski.

- Tomato.ai, a Danville, CA-based speech AI company, raised over $2.1M in extension seed funding from Cardumen Capital, Recursive Ventures, and Gaingels.

- Connexus, a Washington, DC-based procurement and request for proposal (RFP) platform provider, received $800K in Seed funding, led by Middleburg Communities and joined by Demetrios Barnes (SmartRent and Umbrello) and Todd Butler (Sentral and Migo).

- LawPro.ai, a Los Angeles, CA-based provider of AI-driven solutions for the legal industry, closed an undisclosed seed funding round, led by The Legal Tech Fund and Scopus Ventures, with support from other unnamed angels.

HardTech:

- Apex, a Los Angeles, CA-based spacecraft manufacturing company, closed $95M in Series B funding, co-led by XYZ Venture Capital and CRV, with support from Upfront, 8VC, Toyota Ventures, Point72 Ventures, Mirae Asset Capital, Outsiders Fund, GSBackers, Andreessen Horowitz, Shield Capital, J2 Ventures, Ravelin, Baiju Bhatt, and Ted Waitt.

- Xona, an Annapolis, MD-based zero-trust user access platform for industrial operations, completed a $18M strategic funding round, led by Energy Impact Partners (EIP).

- Fuze Technology, a Los Angeles, CA-based IoT-enabled innovation company, secured $11.5M in Series A funding, led by Beverly Pacific and supported by Palm Tree Crew, Bain Capital Ventures Scout Fund, Dream Ventures, Live Nation Entertainment, ASM Global, SCIENCE Ventures, Haslem Sports Group, Simon Ventures, Michael Gordon, Sunday Ventures, SeaHorse Express, Locker One Ventures, Geoff Lewis, TR Ventures, LK Group, Cameron Azoff, and Nicolai Marciano.

- OnStation, a Cleveland, OH-based digital stationing solution for the heavy highway industry, closed $8.5M in Series A funding, led by JumpStart Ventures (NEXT II Fund) with support from VisionTech Partners, Frontier Angels, Up2 Opportunity Fund, JobsOhio Growth Capital Fund, Next Chapter Ventures, North Coast Ventures, New Dominion Angels, and other angel investors.

- CargoSense, a Reston, VA-based provider of a ‘Visibility OS’ platform for supply chain automation, received $8M in Series A funding, led by Lanza techVentures, with support from Merck Global Health Innovation Fund (MGHIF), SmoothBrain, The Pallet Alliance, and other private investors.

- Ship Angel, an NYC-based provider of an AI-native platform for international shippers, secured $5M in funding, led by Glasswing Ventures and Newark Venture Partners (nvp), with support from Bienville Capital, Socii Capital, and Plug and Play.

Sustainability:

- Flo, a Quebec City, Canada-based electric vehicle (EV) smart charging solutions provider, secured $136M in funding, led by Export Development Canada (EDC) and supported by the Caisse de dépôt et placement du Québec (CDPQ), Investissement Québec (IQ), Business Development Bank of Canada (BDC), Energy Impact Partners (EIP) and MacKinnon, Bennett & Company Inc. (MKB).

- Swift Solar, a San Carlos, CA-based solar technology company, secured $27M in Series A funding, led by Eni Next and Fontinalis Partners, with participation from Stanford University, Good Growth Capital, BlueScopeX, HL Ventures, Toba Capital, Sid Sijbrandij, James Fickel, Adam Winkel, Fred Ehrsam, Jonathan Lin, and Climate Capital.

- ElectronX, a Chicago, IL-based new energy exchange company for the grid transition to renewable sources, closed a $15M seed funding round, led by Innovation Endeavors alongside DCVC, Amplo, BoxGroup, and Lightning Capital.

- Unigrid Battery, a San Diego, CA-based startup developing advanced sodium-ion batteries, completed a $12M Series A funding round, led by Transition VC and Ritz Venture Capital, with support from Union Square Ventures and Foothill Ventures.

- Aepnus Technology, an Oakland, CA-based electrochemical platform provider for enhancing circularity and lowering emissions in the battery supply chain, secured $8M in Seed funding, led by Clean Energy Ventures and supported by Voyager Ventures, Lowercarbon Capital, Impact Science Ventures, Muus Climate Partners, and Gravity Climate Fund.

Acquisitions & PE:

- Vantage Data Centers, a Denver, CO-based global provider of hyperscale data center campuses, received a $9.2B equity investment led by DigitalBridge Group, Inc. (NYSE: DBRG) and Silver Lake, with support from other global investors.

- Bain Capital acquired PowerSchool (NYSE: PWSC), a Folsom, CA-based cloud-based software provider for K-12 education, in a deal worth $5.6B.

- Blackstone agreed to acquire a 40% stake in Copeland, a St. Louis, MO-based provider of climate software and solutions for heating, refrigeration, and other applications, from Emerson Climate Technologies for $3.5B.

- Cognizant (NASDAQ: CTSH) is set to acquire Belcan, a Cincinnati, OH-based global supplier of Engineering Research & Development (ER&D) services, for about $1.3B in cash and stock.

- AlphaSense, an NYC-based market intelligence and search platform, acquired Tegus, a Chicago, IL-based provider of expert research, private company content, and financial data and workflow tools, for $930M.

- Yext (NYSE: YEXT), a NYC-based digital presence platform provider, announced the acquisition of Hearsay Systems, a San Francisco, CA-based digital client engagement platform for the financial services sector, for about $125M, which could potentially include an additional $95M.

- Stake, an NYC-based loyalty fintech company for the rental economy, acquired Circa, a NYC-based rent payments company, for $9.5M in cash and stock.

- Merlin, a Boston, MA-based autonomous flight technology company, is set to acquire EpiSys Science, a Poway, CA-based software AI and autonomy company, for an undisclosed amount.

- Clearhaven Partners, a Boston, MA-based software private equity firm, acquired Zixi, a Waltham, MA-based software-defined video platform (SDVP®) provider, for an undisclosed amount.

- Radiant Logistics, Inc. (NYSE American: RLGT), a Renton, WA-based technology-enabled global logistics solutions company, announced the acquisition of the operations of DVA Associates, Inc., a Portland, OR-based full-range domestic and international transportation and logistics services company in North America, for an undisclosed amount.

- Omega Systems, a Reading, PA-based managed service provider (MSP) and managed security service provider (MSSP), acquired Stamford, CT-based Amnet Technology Solutions and Cloudpath company, for an undisclosed amount.

- Cvent, a Tyson, VA-based meetings, events, and hospitality technology provider, acquired Reposite, an NYC-based AI-powered online vendor and supplier sourcing platform, for an undisclosed amount.

- Netsurit, an NYC-based managed service provider (MSP) industry leader, acquired Avaunt Technologies, Inc., a Tacoma, WA-based MSP company offering technical services, for an undisclosed amount.

- Health Catalyst, Inc. (Nasdaq: HCAT), a Salt Lake City, UT-based data and analytics technology and services company in the healthcare space, acquired Carevive Systems, a Boston, MA-based oncology-focused health technology company, for an undisclosed amount.

- Tripleseat, a Boston, MA-based sales and event management platform, acquired Merri, a 3D floorplan and event design application, for an undisclosed amount.

- Greater Sum Ventures (GSV), a Knoxville, TN-based entrepreneurial family office and growth equity firm, acquired Kologik, a Baton Rouge, LA-based law enforcement software provider for an undisclosed amount.

- Formstack, a Los Angeles, CA-based form, document, and eSignature software provider, acquired Open Raven, a Los Angeles, CA-based data management and security company, for an undisclosed amount.

- Pente Networks, a Hackensack, NJ-based enterprise Infrastructure-as-a-Service (IaaS) private LTE/5G network company, secured an undisclosed investment from Mitsubishi Electric Corporation (TOKYO: 6503)’s ME Innovation Fund.

- NetSPI, a Minneapolis, MN-based security solutions provider, announced the acquisition of Hubble Technology Inc., a Northern Virginia-based cyber asset attack surface management (CAASM) and cybersecurity company, for an undisclosed amount.

- HarperDB, a Denver, CO-based integrated distributed systems platform that combines database, caching, application, and streaming functions into a single technology, secured an undisclosed growth investment from Siren Capital.

- NeuroFlow, a Philadelphia, PA-based behavioral health technology infrastructure provider, announced the acquisition of Owl, a Portland, OR-based measurement-based care technology company, for an undisclosed amount.

- Epam Systems, Inc. (NYSE: EPAM), a Newtown, PA-based digital transformation services and product engineering company, acquired Odysseus Data Services, Inc., a Cambridge, MA-based health data analytics company, for an undisclosed amount.

- Epicor, an Austin, TX-based provider of industry-specific enterprise software and Advanced ERP software, announced the acquisition of KYKLO, a Buffalo, New York-based Product Information Management (PIM) solutions provider, for an undisclosed amount.

Fund Announcements:

This roundup was customized & powered by Wonder. Start your free trial here.

- Foresite Capital, a Los Angeles, CA; New York City; and San Francisco, CA-based venture capital firm, raised $900M for its sixth fund focused on life sciences and health care companies.

- J.P. Morgan Private Capital, a team within J.P. Morgan Asset Management, raised $500M for its first fund focused on life sciences companies.

- High Alpha, an Indianapolis, IN-based venture capital firm, raised $125M for its fourth fund focused on enterprise SaaS companies.

Final Numbers

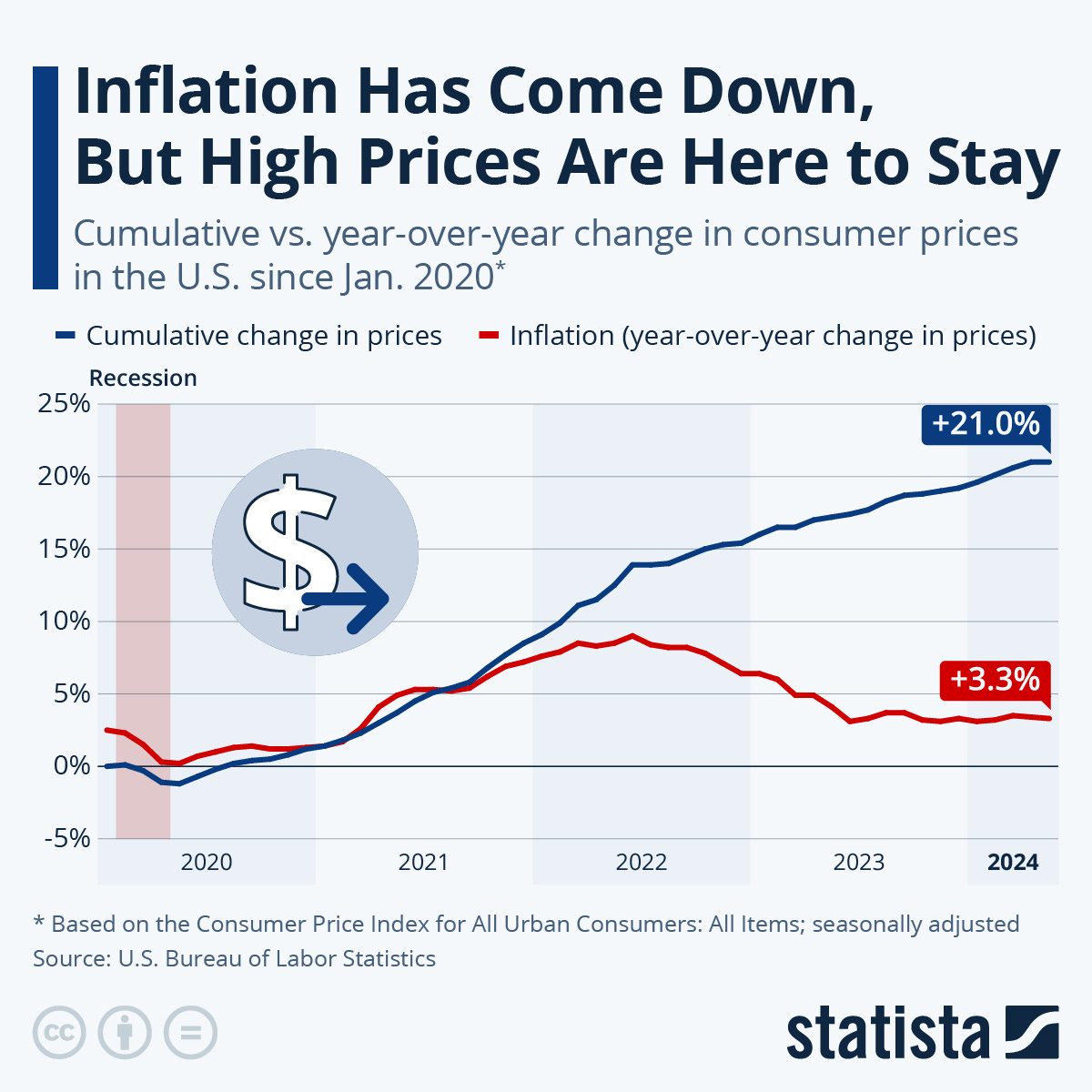

Data: US Bureau of Statistics; Chart: Statista

From April 2021 to April 2023, real hourly earnings declined for 25 consecutive months due to inflation outpacing nominal wage growth. In May 2023, real wages began rising again as nominal wage growth exceeded inflation. [Statista]

Data: US Bureau of Statistics; Chart: Statista

Inflation has decreased significantly since its peak of 9.0% in June 2022, yet consumer prices are still 21% higher than in January 2020. [Statista]

New Research

Mid-life plasma proteins associated with late-life prefrailty and frailty: a proteomic analysis

This study examined 4,955 plasma proteins in 4,189 middle-aged individuals to identify biological markers associated with frailty later in life. It found that 221 proteins were linked to frailty and suggested that midlife dysregulation in inflammation, metabolism, and other pathways could indicate future frailty. [PubMed]

The results highlight the potential for early identification and prevention of frailty by targeting these biological markers. [PubMed]

Photobiomodulation in the aging brain: a systematic review from animal models to humans

Aging can lead to cognitive decline, and photobiomodulation (PBM) therapy, which involves the use of light to stimulate cellular function and promote healing, shows promise in mitigating this decline. This review of 37 studies found that PBM, using specific wavelengths, improved various memory functions in animals and working memory, cognitive inhibition, and language access in humans. [Springer]