SpaceX, Stripe, X, Ramp, Anduril: Navigating Liquidity in Private Markets

Buckle up. Christian Garrett, 137 Ventures

State of Liquidity Markets, SpaceX’s Funding History, Hill & Valley Forum, DC & VC, Europe’s Techno-Rise, Hot Takes

Christian Garrett, Partner at $5B+ AUM fund 137 Ventures, joins us for a wide-ranging conversation on the shifting dynamics of private markets. He breaks down the mechanics behind high-profile secondaries, the tightening liquidity environment for VCs, and how 137 Ventures has navigated it all — including their early involvement in SpaceX and the company’s unique approach to running tender offers every six months.

→ Listen on X, Spotify, YouTube, Apple

We also explore whether the IPO window is really reopening, the emergence of generational talent from companies like SpaceX, Palantir, and Anduril, and why Christian believes defense tech may be overhyped for now. He offers insight into the growing interplay between Silicon Valley and Washington, D.C., including government programs like FedRAMP and the Replicator Initiative, as well as the founding story behind the Hill & Valley Forum.

On the personal side, Christian reflects on his fast path to becoming a Partner, the influence of mentor Trae Stephens, and the firm’s founder-first philosophy. He doesn’t shy away from bold opinions — weighing in on return-to-office culture, the future of San Francisco, and why he’s surprisingly bullish on Europe.

Buckle Up.

This is a thorough one. We report on comprehensive data on the state of private markets and Christian’s exposure to it.

137 Ventures

Founded in 2011, 137 Ventures now sits at over $5B+ AUM. Originally spun out of Founders Fund with Justin Fishner-Wolfson and S. Alexander Jacobson, 137 is a multi-strategy, multi-stage venture capital firm investing in generational high-growth technology businesses. The firm's goal is to drive outsized returns by building concentrated positions through informational and access asymmetries allowed by their differentiated strategies. 137 invests and partners with these companies through different strategies including liquidity and primary capital. Early investors in category winning tech disruptors such as Aerospace (SpaceX, Varda), Defense (Anduril, Hadrian), and Enterprise SaaS (Palantir, Gusto, Figma).

137's portfolio includes: SpaceX, Palantir, Uber, AirBnB, Coupang, Figma, Anduril, Gusto, SolarCity, Ramp, Intercom, Lattice, Flexport, Brex, Spotify, Armada, Teleport, Chainguard, Wonolo, Thirty Madison, TogetherAI, Hex, Varda, Impulse, Kong, Hadrian, Wish, Imprint, Workrise, and more.

SpaceX's Financing History and 137 Ventures' Involvement

SpaceX serves as a prominent example of a private company that has successfully balanced staying private with providing liquidity to its employees and shareholders. Over its 23-year history, SpaceX has raised approximately $10 billion, a relatively modest amount given its scale and valuation, which now exceeds $350 billion. This reflects the company’s capital efficiency and financial discipline. As Garrett notes, "Most of the company's lifecycle has been cashflow positive," allowing it to fund operations and growth without relying heavily on external capital.

137 Ventures became involved with SpaceX early in its journey, leveraging the company’s tender offers as a means of investment. Garrett explains that SpaceX’s financial independence meant it rarely needed to raise primary capital, making tenders the primary avenue for external investors to gain exposure to the company. These tenders also served as a strategic tool for SpaceX to remain competitive in the aerospace industry. By offering liquidity through tenders, SpaceX could attract and retain top talent, competing with established aerospace giants like Boeing, which could offer more liquid compensation packages. This approach has allowed SpaceX to maintain its private status while continuing to innovate and expand its operations.

Dominating the industry, SpaceX is responsible for ~65% of the total licensed commercial launches in the US since its founding. Blue Origin’s total launch count since its inception is only 16% of what SpaceX managed in 2024 alone.

The Current State of Private Markets

Private markets have undergone significant structural changes in recent years, with companies remaining private longer than ever before. This shift reflects a combination of regulatory adjustments, innovations in equity structuring, and the availability of substantial growth capital. Historically, companies would pursue public market listings within 3–4 years of founding, but as of today, the average timeframe has extended to over 12 years (or infinity). Several key factors have contributed to this transformation:

Regulatory Changes: The JOBS Act, passed in 2012, increased the shareholder threshold for private companies from 500 to 2,000, effectively allowing firms to delay going public without regulatory pressure.

Equity Structuring Innovations: The introduction of double-trigger restricted stock units (RSUs), popularized by companies like Facebook, has deferred liquidity events for employees, reducing the need for early IPOs.

Capital Abundance: The private equity and venture capital industries have seen unprecedented growth in available funds. As of recent estimates, the private equity sector holds trillions of dollars in "dry powder" (capital committed but not yet deployed), complemented by hundreds of billions in venture funding.

These factors have enabled private companies to remain private longer, avoiding the scrutiny of public markets and quarterly earnings pressures. By operating in the private domain, companies can focus on long-term strategies, invest heavily in research and development, and compound value without the volatility of public market dynamics. As a result, private markets are increasingly locking up a significant portion of value creation traditionally realized post-IPO.

Macro Trends in Late-Stage Private Markets (2021–2024)

Between 2021 and 2024, late-stage private markets experienced a dramatic cycle of growth, decline, and partial recovery, driven by macroeconomic shifts and changing investor dynamics. The peak in 2021 was marked by record-high valuations and abundant liquidity, but a sharp decline followed in 2022 and 2023 due to rising global interest rates, persistent inflation, and cautious lending environments. Late-stage deal activity slowed significantly, with median Series D and E+ round sizes falling by over 70%, and valuations adjusted to reflect the new economic realities.

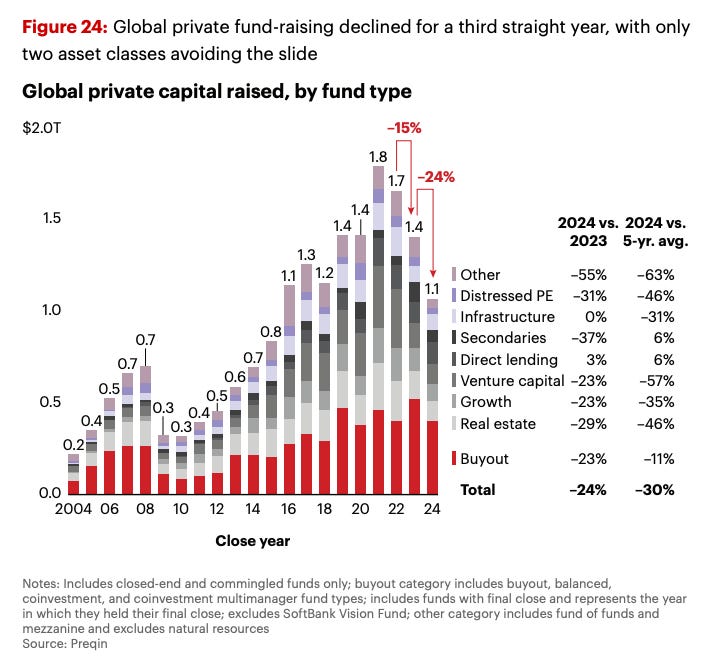

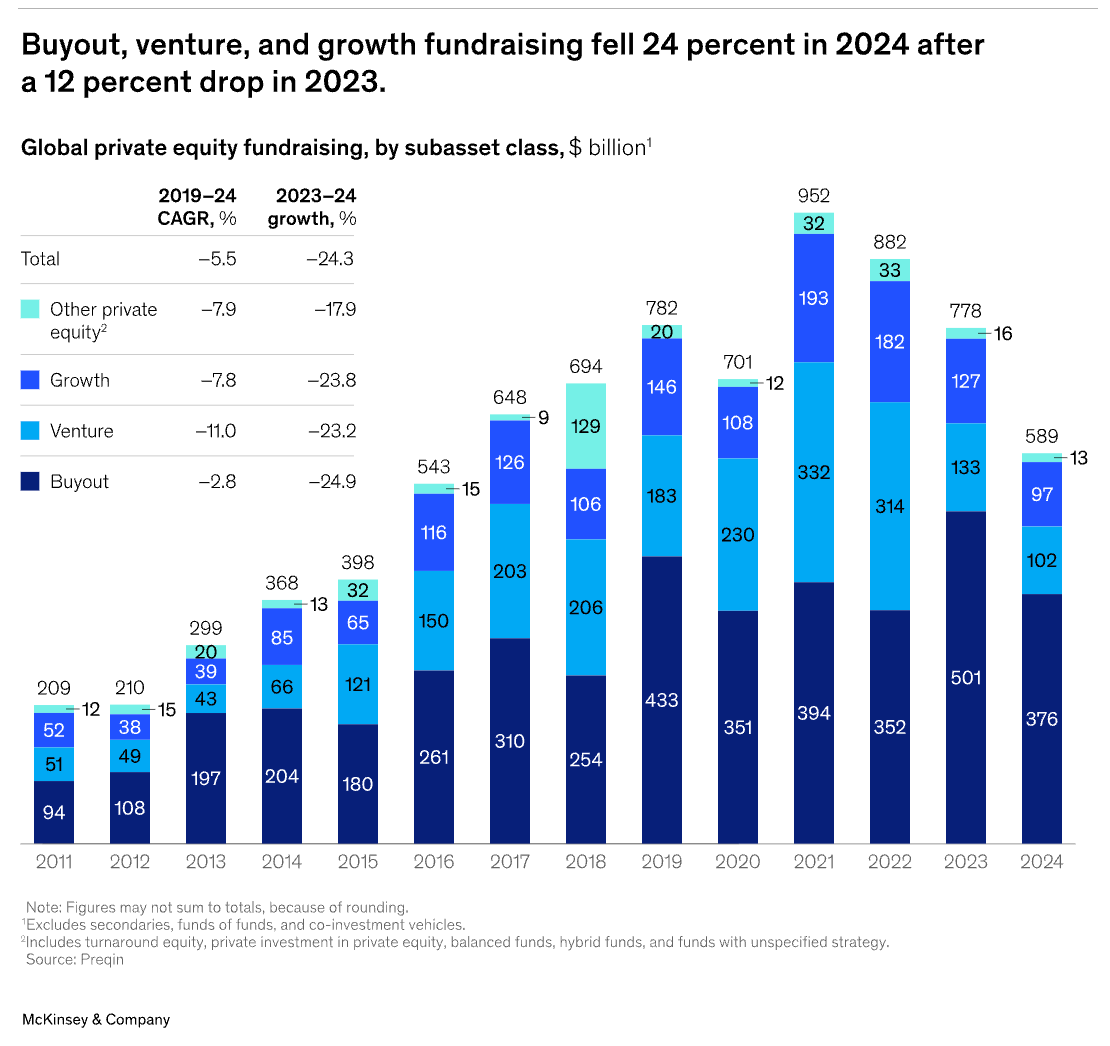

However, 2024 saw a rebound in dealmaking, with private equity deal value increasing by 14% to $2 trillion, supported by improving financing conditions and renewed confidence among sponsors. Despite these gains, challenges such as an exit backlog, longer holding periods, and a steep decline in IPO activity persisted, while public-to-private transactions and sponsor-to-sponsor exits rose as alternative exit strategies. Structural shifts also emerged, with general partners leveraging alternative capital sources, such as continuation vehicles and high-net-worth investors, and focusing on operational improvements to drive returns. Venture capital, however, continued to lag, with late-stage dealmaking declining for the third consecutive year. This period reflects the resilience and adaptability of the private markets sector in navigating economic headwinds.

Source: Bain & Company

Late-stage private markets experienced significant fluctuations in locked-up capital and dry powder reserves, reflecting the broader trends in private equity. Global private equity dry powder, representing committed but undeployed capital, peaked at $3.7 trillion during the early part of the period and declined by more than 50% to $2.1 trillion in 2024, as general partners actively deployed capital amidst improving dealmaking conditions. The dry powder inventory, or the amount of capital available relative to annual deployment, also fell to 1.89 years in 2024 from 2.02 years in 2023, marking a return to historical levels.

However, locked-up capital continued to be a pressing issue, with the exit backlog of sponsor-owned companies reaching its highest level since 2005. By 2024, 61% of buyout-backed assets had been held for more than four years, compared to 55% in 2023 and the ten-year average of 53%. This trend highlights the challenges in monetizing assets acquired during the exuberant dealmaking years of 2021 and 2022, as elevated entry multiples and tougher refinancing conditions persist. Together, these figures underscore a period of recalibration for late-stage private markets, with active deployment balanced against lingering liquidity and exit challenges.

Impact to Venture Capital Markets

Venture capital (VC) activity faced significant headwinds, making it the most challenged sub-asset class within private equity during this period. After a record year in 2021, VC dealmaking began to slow sharply in 2022 due to macroeconomic pressures, including rising interest rates, persistent inflation, and geopolitical uncertainty. This trend continued through 2024, with the deal count for late-stage VC declining by 16.9% year-over-year, marking the third consecutive annual drop in dealmaking velocity. Fundraising for venture capital also slowed, falling 23% in 2024 after a similar decline in the prior year.

The slowdown in venture capital reflected broader shifts in investor behavior. With heightened caution in an uncertain global market, investors increasingly prioritized buyouts and growth equity for their perceived stability and predictable returns over the speculative nature of VC investments. Despite these challenges, venture capital remains an important part of the private equity ecosystem. However, the sector continues to struggle to regain its prior momentum as market conditions remain challenging, with limited distributions and muted returns impacting fundraising and deployment activities.

Late-stage venture capital funding is experiencing a significant decline, driven by a combination of macroeconomic challenges, aging "dry powder," and growing pressure on investors to generate liquidity. In 2024, global fundraising for venture capital fell to $160.6 billion, representing a 39.8% drop from its 2021 peak. The number of venture funds closed also declined sharply, reflecting heightened difficulties in raising capital. Adding to the challenge, a substantial portion of uninvested capital (53% of the $677 billion in global VC "dry powder") is tied to older fund vintages, which now face the pressure of deploying capital effectively in a slower exit environment.

The liquidity crunch is exacerbated by a slowdown in exits, which are essential for returning capital to limited partners (LPs). In the U.S., venture-backed exit activity in 2024 was down 82.2% from 2021, with only $149.2 billion in exits recorded—lower than the three years preceding the peak. This has caused a significant buildup of unrealized investments, leaving investors waiting longer for returns. Distributions to LPs as a percentage of net asset value (NAV) fell to a record low of 11% in 2024, compared to an average of 29% between 2014 and 2017. This lack of liquidity has made LPs more cautious, hindering their ability to commit new capital to funds.

To address these liquidity pressures, general partners (GPs) are increasingly turning to alternative mechanisms such as secondaries, continuation funds, and NAV loans. In 2024, $360 billion was raised through these routes, and while they provide temporary relief, they are not a substitute for traditional exit pathways. The rise in these tools highlights the growing pressure on fund managers to provide liquidity for investors in a tough market.

The fundraising environment has also shifted in favor of established managers, with 68% of new commitments in 2024 going to experienced firms. This concentration of capital in larger, proven funds further disadvantages smaller and emerging managers, many of whom are struggling to close funds. The median time to close a venture capital fund has also increased significantly, reflecting LPs' hesitancy and heightened selectivity.

Overall, the late-stage venture capital landscape is characterized by declining fundraising activity, aging dry powder, and limited liquidity, creating significant headwinds for investors and fund managers alike. While some improvement is expected if exit activity recovers, the backlog of unrealized investments and the broader macroeconomic environment continue to weigh heavily on the industry.

Liquidity Resources: The Role of Secondaries in the Private Market Landscape

As companies remain private longer, secondary transactions have emerged as an important liquidity mechanism for both employees and shareholders. Secondary deals, particularly company-managed tenders, allow stakeholders to sell their equity without the company raising new capital. These transactions serve multiple strategic purposes:

Employee Retention and Morale: Providing employees with liquidity options can help maintain motivation and retention, particularly in the absence of an IPO or other liquidity events.

Valuation Benchmarking: Tender offers allow companies to establish updated valuations in the private market, helping to reprice equity without raising primary capital under unfavorable terms.

Several notable companies have leveraged secondary transactions to facilitate liquidity. Examples include SpaceX, Stripe, OpenAI, Canva, ScaleAI, Revolut, Anduril, Figma, Ramp, Applied Intuition, Plaid, and Databricks. SpaceX, in particular, conducts tenders approximately every six months. This frequency is partly due to the company’s use of single-trigger RSUs, which create ongoing tax obligations for employees. Regular tenders help employees generate liquidity to meet these tax requirements while maintaining operational and strategic flexibility for the company.

→ Important Secondary Terms Explained At The Bottom

Recent Exits via M&A & IPO

The broader technology market has shown signs of recovery in terms of liquidity events, with notable mergers and acquisitions (M&A) and IPOs occurring. Recent activity includes:

Wiz ($32b): Alphabet acquired Israeli cloud security startup Wiz for $32 billion in cash on March 18, 2025, to enhance Google Cloud’s security offerings.

Ampere Computing ($6.5b): SoftBank bought semiconductor firm Ampere Computing for $6.5 billion on March 19, 2025, targeting AI and cloud chip innovation.

Moveworks ($3b): ServiceNow purchased AI employee support startup Moveworks for $2.85 billion (rounded to $3 billion) on March 10, 2025, boosting its enterprise AI capabilities.

Cisco's $28 billion acquisition of Splunk and HPE's $14 billion acquisition of Juniper Networks were both driven by the strategic goal of enhancing AI networking capabilities.

The IPO market has also seen renewed activity, with Reddit's IPO debuting at $34 per share, nearly doubling to $63 within three months, now more than tripled to around $102/share

Notable Companies Facing Exit Pressure

Several of the largest and most well-funded private technology companies are expected to pursue IPOs or other exit strategies in the near future, driven by both market conditions and investor liquidity needs. Among these companies:

Stripe, a leader in payment processing technology, has maintained a valuation of $91.5 billion despite challenging market conditions.

(1:35:42) Why Stripe hasn't gone public yet, despite great metrics

Databricks, an AI-driven data analytics platform, has raised nearly $14 billion and is valued at $62 billion.

Canva, a design software platform, holds a valuation of $49 billion.

Revolut, a financial technology company, is valued at $45 billion.

These companies represent some of the most anticipated IPO candidates, as their scale and market leadership position them well for public market entry. However, the timing of these exits will depend on broader market conditions and the ability of these firms to meet investor expectations for liquidity.

→ 2025 IPO Watch List At The Bottom

20 of The Largest Private Tech Companies

SpaceX - $350 billion (December 2024, following a $1 billion funding round)

Aerospace

OpenAI - $157 billion (October 2024, after a $6.6 billion funding round)

Artificial Intelligence

Stripe - $91.5 billion (February 2025, after secondary round)

Fintech

Notes: Payment processing platform; valuation has moderated from a $95 billion peak in 2021.

Databricks - $62 billion (January 2025, after a $10 billion round)

Data Analytics/AI

xAI - $51 billion (December 2024)

Artificial Intelligence

Notes: xAI, is reportedly seeking a $75 billion valuation in a potential $10 billion funding round

X - $44 billion (March 2025 - post secondary round)

Social Media

Epic Games - $31.5 billion (April 2022, after a $2 billion raise)

Gaming/Software

Notes: Creator of Fortnite and Unreal Engine.

Fanatics - $31 billion (December 2022, after a $700 million round)

Sports Tech/E-commerce

Anduril - $30 billion (January 2025, after a $2.5 billion round)

Defense Tech

Chime - $25 billion (August 2021, after a $750 million round)

Fintech

Notes: Digital banking services; valuation may have adjusted downward in private markets.

Anthropic - $18.4 billion (March 2024, after a $2.75 billion investment from Amazon)

Artificial Intelligence

Notes: Founded by ex-OpenAI researchers, focuses on safe AI.

Discord - $15 billion (September 2021, after a $500 million round)

Communication/Social

Scale AI - $13.8 billion (May 2024, after a $1 billion round)

Artificial Intelligence

Rippling - $13.5 billion (March 2023, after a $500 million round)

HR Tech

Plaid - $13.4 billion (April 2021, after a $425 million round)

Fintech

Ramp - $13 billion (March 2025, after a $150 million secondary share sale)

Fintech

Figma - $10 billion (June 2021, after a $200 million round; pre-Adobe acquisition collapse)

Design Software

Notes: Collaborative design tool; remains private despite acquisition talks.

Gusto - $9.5 billion (August 2021, after a $175 million round)

HR Tech

Redwood Materials - $7 billion (July 2023, after a $1 billion round)

Battery Recycling/Tech

Verkada - $3.2 billion (June 2022, after a $205 million round)

Security Tech

Garrett’s Market Takes

IPO Window: Is It Opening?

While private companies have increasingly delayed going public in recent years, there are signs that the IPO window may be reopening. Garrett predicts a wave of IPOs beginning this year and continuing into 2026, as market conditions improve and companies seek to provide liquidity to investors. However, he emphasizes that the decision to go public is often driven by strategic considerations rather than purely financial metrics or valuations.

Remaining private offers companies several advantages, including the ability to focus on long-term investments, such as research and development, without the pressures of quarterly earnings reports or public market scrutiny. As Garrett notes, "In the private markets, you get a ton of additive benefits," which can include greater operational flexibility and the ability to make decisions that prioritize innovation over short-term profitability.

Nonetheless, as investor demand for liquidity grows, particularly in the venture capital space, some companies may find themselves compelled to pursue public offerings. This dynamic suggests that while the private market remains a dominant force in value creation, the public market will continue to play a critical role in providing liquidity and enabling broader access to capital.

Underappreciated Generational Talent: From Anduril to SpaceX to Palantir

The tech industry often overlooks the "generational talent" driving its most successful companies, according to Garrett. He highlights several exceptional leaders who have played pivotal roles in scaling their organizations from startups to global enterprises:

Matt Grimm (COO, Anduril): Described as "one of the best COOs, if not the best, in the industry," Grimm has been instrumental in Anduril’s rapid growth in defense technology.

Gwynne Shotwell (President, SpaceX): Regarded as "the best operator in the industry," Shotwell has been a critical force behind SpaceX’s operational and financial success.

Shyam Sankar (CTO, Palantir): Recognized for helping lead "one of the largest enterprise software businesses in the world," Sankar has been a key figure in Palantir’s evolution.

What sets these individuals apart is their rare ability to grow alongside their companies as they scale into massive enterprises. Garrett notes, "It’s extremely rare for founders and operators to scale like this," reflecting the unique skillsets required to navigate such transitions successfully.

Why Defense Tech May Be Overrated Right Now

While Garrett remains a strong advocate for defense technology, he argues the sector is currently "overrated" due to its concentrated value creation. Despite the massive total addressable market (TAM) tied to global defense budgets—trillions of dollars annually—Garrett points out that much of the value tends to accrue to only a few dominant companies.

"In defense tech, it’s not like enterprise software where there will be hundreds of great companies," he explains. For example, within aerospace, the majority of value has accrued to SpaceX. This consolidation of value suggests that investors may find the most success by concentrating their bets on the clear winners. Garrett recommends a strategic focus: "Invest more in the winner."

Silicon Valley’s Growing Relationship with Washington, D.C.

Garrett sees a growing and increasingly genuine relationship between Silicon Valley and Washington, D.C., as tech leaders and policymakers collaborate more closely. He notes a significant uptick in tech founders and investors spending time in Washington, which he views as a positive development. "Policy really matters," Garrett emphasizes, underscoring the importance of educating policymakers and fostering relationships between the tech and government sectors.

He highlights government initiatives such as the Replicator Initiative, designed to modernize defense procurement, and FedRAMP, which standardizes cloud security frameworks for government vendors. These programs demonstrate the government’s willingness to embrace modern technology and create opportunities for startups. Garrett believes these initiatives reflect a broader alignment between Silicon Valley and Washington, one that offers mutual benefits for innovation and policy.

The Origins of the Hill & Valley Forum

The Hill & Valley Forum, co-founded by Garrett, Jacob Helberg (U.S. Under Secretary of State (E) Designate, and Senior Advisor to CEO at Palantir), and Delian Asparouhov (Founders Fund and Varda), was created to bridge the gap between the technology sector and government. What began as an informal dinner has since grown into one of the largest and most influential gatherings of tech and government leaders. The forum now attracts more elected officials than even the World Economic Forum in Davos.

Garrett emphasizes the forum’s bipartisan nature, describing it as a rare space for leaders across the political spectrum to unite around shared goals. "It’s a space where we can unify around the goal of maintaining America’s technological supremacy," he explains. The forum’s ability to foster collaboration between tech innovators and policymakers has made it a critical platform for addressing challenges in national security, technology, and economic competitiveness.

Personal Career Journey & Lessons from Trae Stephens

Garrett attributes much of his career success to mentorship, particularly from Trae Stephens of Founders Fund. His first major investment in Anduril, a company co-founded by Stephens, marked a pivotal moment in his career. "Being able to invest in Anduril early was an incredible opportunity," Garrett reflects, noting how this investment shaped his trajectory as an investor.

Like many others, Christian was deeply influenced by Trae’s “choose good quests” CTA. This framework encourages people to build their careers around meaningful, mission-driven challenges—pursuits that are hard, impactful, and worth dedicating years to solving. It is a banger, and an continual must-read.

Choose Good Quests

By Trae Stephens

Stephens remains a source of invaluable wisdom and guidance. Their dynamic illustrates the value of contrasting perspectives: "I’m younger, more optimistic, and energetic, while Trae is more skeptical and pessimistic," Garrett says. This balance has been instrumental in refining Garrett’s investment philosophy, combining his energy and vision with Stephens’ measured and analytical approach. Together, these perspectives have informed Garrett’s ability to identify and invest in transformative companies. And he’s not afraid to give credit where it’s due.

Spicy Hot Takes

Garrett is not afraid to challenge conventional wisdom:

Return to Office (RTO): He believes WFH has become a scapegoat for businesses post the 2022 market correction. "Work from home is not the bastion of all evil," he says, noting that most companies are de facto hybrid now.

San Francisco: While bullish on San Francisco’s talent density, he argues that it’s no longer the sole center of gravity for tech. "The ecosystem is more distributed now, with hubs in LA, New York, Austin, and Miami," he says.

Europe: Garrett is bullish on Europe, particularly its defense tech ecosystem. He argues that the lack of mature capital markets allows winners to compound value without facing significant competition.