Sourcery (2/07/2020)

Deals of the day

Sources: TS, Pro Rata, FinSMEs

Landing, a membership-based provider of finished urban apartments, raised $20 million in Series A funding. Greycroft led, and was joined by Maveron and Abstract Ventures. The company also secured $10 million in debt. http://axios.link/l1Sv

AllVoices, a Los Angeles-based encrypted communications platform for making complaints to corporate HR departments, raised $3 million in seed funding from Crosscut Ventures, Greycroft, Halogen Ventures, and Vitalize VC. http://axios.link/DUSS

Sonoma Biotherapeutics, a developer of regulatory T-cell treatments for autoimmune and neurodegenerative diseases, raised $40 million in Series A funding from Arch Venture Partners, Milky Way Ventures, 8VC, and Lyell Immunopharma. http://axios.link/4LYT

Vineti, a San Francisco-based developer of logistics software for cell and gene therapies, raised $35 million in Series C funding. Cardinal Health led, and was joined by Novartis, Gilead Sciences, and return backers Canaan Partners, Threshold Ventures, Section 32, LifeForce Capital, Casdin Capital, and Hive Ventures. http://axios.link/WBsN

HopSkipDrive, a Los Angeles-based ride-share company focused on kids and families, raised $22 million in Series C funding from Cyrus Capital Partners, State Farm Ventures, and return backers Upfront Ventures, FirstMark Capital and Greycroft. http://axios.link/VQ2Y

Nurvv, a London-based maker of wearable tech for runners, raised $9 million in Series A funding from Hiro Capital. www.nurvv.com

SureSale, a Los Angeles-based provider of used vehicle certifications, raised $7 million in Series A funding. Upfront Ventures led, and was joined by Coffin Capital. http://axios.link/a6p3

OptimoRoute, a Palo Alto-based route optimization startup, raised $6.5 million in Series A funding led by Prelude Ventures. http://axios.link/6a2T

Byju, an Indian education startup, raised $200 million at an $8 billion valuation from existing backer General Atlantic, per TechCrunch. http://axios.link/rvrk

Cohley, a NYC-based platform for brands and agencies to generate and measure content, raised $1.5m in funding (read here)

Masabi , a London-based firm focused on public transport fares, raised an undisclosed amount from Shell. Masabi previously raised $20 million growth funding round led by Smedvig Capital.

Limehome, a 20-month-old, Munich, Germany-based startup that's turning apartment into hotel destinations, has raised €21 million. Lakestar led the round, joined by earlier backers HV Holtzbrinck Ventures and Picus Capital. More here.

Funds:

Carta, a VC-backed startup that helps other startups manage their equity, formed a corporate venture fund. http://axios.link/kwaT

General Catalyst reportedly is raising $600 million for its next early-stage fund, plus at least $1 billion for growth-stage and follow-on deals. http://axios.link/HvJB

Brookfield Infrastructure Partners closed its fourth fund with $20 billion, of which around 40% has already been committed. www.bip.brookfield.com

A/O PropTech, a new European VC firm focused on real estate tech, launched with €250 million of “permanent capital.” http://axios.link/RHjA

. . .

Sources: MorningBrew, Axios

U.S. markets: Can’t tell if we’re watching the stock market or the 1971–74 UCLA Bruins. Stocks are on a four-day winning streak, fueled by earnings and news that China will chop in half tariffs on $75 billion in U.S. imports.

U.S. economy: The January jobs report comes out this morning. Interesting note, per CNN Business: It’ll be the first Bureau of Labor Statistics jobs report to include same-sex couples in its count of married workers.

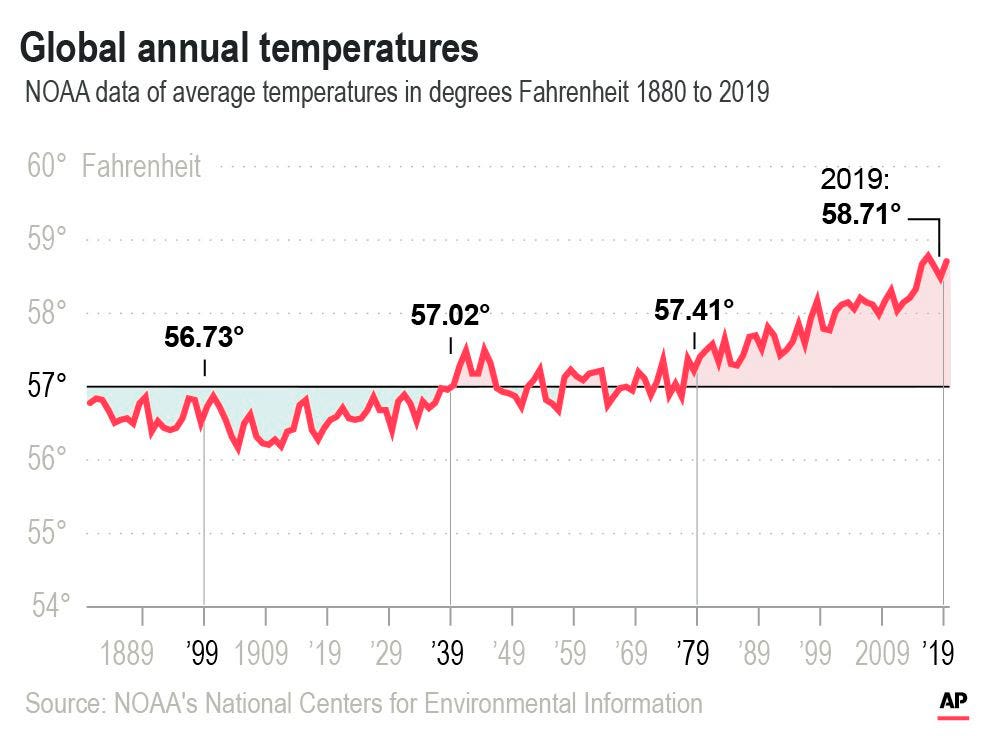

All at once, several simulators used to forecast planetary warming are saying we have less time than we thought, Bloomberg's Eric Roston reports.

Researchers don't agree on how to interpret the hotter results.

Why it matters: These same models have successfully projected global warming for a half century, Bloomberg points out:

"If the same amount of climate pollution will bring faster warming than previously thought, humanity would have less time to avoid the worst impacts."

Elliott Management has acquired around a $2.5 billion take in SoftBankGroup, saying the market "significantly undervalues" the Japanese group's assets.

So far the relationship appears to be friendly, but Elliott isn't shy about getting into the mud if that's where it feels the most profit lies.

Singer vs. Son would be the investment world's version of Ali-Frazier.

Why it matters: This puts pressure on SoftBank to partially liquidate its larger holdings, such as its 25% stake in Alibaba Group, as Elliott reportedly is seeking around $20 billion in stock buybacks (or maybe a bit less if combined with deleveraging). It also could slow Vision Fund 2 investments until SoftBank holds at least a first close on third-party commitments (or has enough Vision Fund 1 proceeds to recycle).

This is the largest investment Elliott has ever made in a Japanese company, although it's no stranger to the country (e.g., Samsung Electonics, Unizo).

Elliott bought at a particularly tricky moment for SoftBank. Not only because of questions surrounding Vision Fund 2, but also because its planned Sprint sale rests in the hands of a U.S. court.

SoftBank's market cap rose from around $89 billion to $95 billion on the news.

What Elliott is saying: "Elliott has engaged privately with SoftBank’s leadership and is working constructively on solutions to help SoftBank materially and sustainably reduce its discount to intrinsic value."

What SoftBank is saying:“SoftBank always maintains constructive discussions with shareholders regarding their views on the Company and we are in complete agreement that our shares are deeply undervalued by public investors. SoftBank welcomes feedback from fellow shareholders.”

The big question is how an activist hedge fund, which thinks in months and years, deals with a company that claims to think in centuries.

New York City has about 5.6 million renters, and if you gather them all in one room, you’ll end up with roughly 5.6 million complaints and 0.5 nice things to say.

As one of the most expensive rental markets in the world, the city’s real estate “quirks”—like skyscraper-high broker fees—have angered renters for years. But that might be changing.

Broker or broken

Last year, state regulators passed renter protections that capped application fees at $20 and security deposits at one month’s rent. On Tuesday night, they clarified those rules and casually slipped in an announcement that renters can no longer be charged broker fees, the NYT reports.

What are those? Brokers manage apartment listings, viewing appointments, and leases. They have almighty leverage over NYC renters because 1) inventory is so tight and 2) many landlords choose not to list units directly or deal with annoying prospective tenants. For their services, brokers collect fees of up to 15% of the annual lease.

For context, in December 2019 average monthly rent was $4,412 in Manhattan, $3,410 in Brooklyn, and $3,022 in Queens, according to Douglas Elliman.

Brokers can still collect fees, but they’ll have to pry it from landlords.

More controversial than a cinnamon and lox bagel?

Proponents of the change say it will protect tenants, lower barriers to housing, and reduce NYC's homeless population.

But critics—otherwise known as the real estate industry—have other thoughts. They claim the rule will disproportionately hurt small building owners who rely on brokers and upend a system that sustains 25,000+ licensed brokers.

Others predict the fees will be passed down to tenants by landlords raising prices. Around 1 million apartments in the city are rent-regulated, but 900,000+ aren’t—and those units could potentially face higher rents.

Looking ahead...the Real Estate Board of New York threatened to challenge the rule on legal grounds.

The steady decline in U.S. interest rates helped the housing sector recover from its malaise in early 2019, and the momentum is continuing so far in 2020.

But prospective homeowners are finding it increasingly difficult to find a home as the lower rates have brought on increased selling prices and fewer available homes.

Driving the news: National housing inventory fell by nearly 14% in January — the steepest year-over-year decline in more than four years, according to a survey released this morning from Realtor.com.

The supply of homes for sale in the U.S. is now at its lowest level since Realtor.com started tracking the data in 2012.

The company also notes that there is a supply shortage at every price tier, but especially in entry-level homes. The number of properties priced under $200,000 fell by 19% year over year.

What's happening: As mortgage rates decline, applications are spiking and so are prices.

The 30-year fixed rate for a mortgage fell to an average of 3.71% this week, its lowest level since October, the Mortgage Bankers Association reported Wednesday.

The refinance rate jumped by 15% to the highest level since June 2013, MBA said. Compared with a year earlier, it was up 183%.

Conversely, MBA's purchase index fell by 10% because of the challenge buyers had finding homes they could afford.

National home prices increased 4% year over year in December and are forecast to increase by 5.2% from December 2019 to December 2020, according to the latest report from CoreLogic released Tuesday.

What they're saying: “With fewer homes coming up for sale, we’ve hit another new low of for sale-listings in January,” Realtor.com chief economist Danielle Hale said.

“This is a challenging sign for the large numbers of millennial and Gen Z buyers coming into the housing market.”

. . .

More headlines…

Sources: MorningBrew

Uber heyyyyy. The ridesharing company reported a narrower loss than expected in Q4 2019 and said its goal is to run an operating profit by 2021.

Twitter posted quarterly revenue of >$1 billion for the first time. Shares rose over 15%.

Dr. Li Wenliang, the ophthalmologist who was hushed by Chinese local police for sounding the alarm on the coronavirus, died from the infection today.

SpaceX is planning to spin out and IPO Starlink, its satellite internet unit.

Related: British telecom company OneWeb launched 34 satellites into space this morning.

Boeing is fixing another software flaw in the grounded 737 Max, but the timeline for the aircraft's return shouldn’t change.

Waymo scaled back benefits for test drivers, The Verge reports.

Lightning Labs raised $10 million in Series A funding. The startup is developing the Lightning Network, a bitcoin-based payment protocol that supports rapid transactions.

Apple is beta testing a feature to unlock cars with an iPhone or Apple Watch.

Ancestry will lay off 6% of its workforce, following layoffs a few weeks ago at 23andMe. DNA test kit sales are slumping amid privacy concerns.

Plot twist: Huawei is suing Verizon for patent infringement.

The CIA is tapping Amazon rivals for new cloud computing contracts, Bloomberg reports.

Birchbox said it plans to lay off 25% of its staff by May.

Under Armour made two internal hires for chief operating officer and chief experience officer.

EU regulators opened an investigation into Ray-Ban maker EssilorLuxottica’s bid to acquire Dutch opticians group GrandVision.

Aerie debuted a new swim line made from recycled plastic bottles.

7-Eleven is testing a cashierless store at its Irving, TX, headquarters.

Tapestry beat fiscal Q2 earnings estimates, led by gains at Coach. We’ll talk about this more on Monday...