Windsurf → Cognition (+$2.4B Google Deal)

Turing $300M+ Rev, X CEO?, Varda, Harmonic, Bilt, Brex, Kalshi's Virality Machine, Revolut

Sourcery is brought to you by Brex..

Brex is the modern finance platform, combining the world’s smartest corporate card with integrated expense management, banking, bill pay, and travel. Over 30,000 companies.. ServiceTitan, Anthropic, Scale AI, Cursor, DoorDash, & Wiz, use Brex.

As a Sourcery subscriber you get: 75,000 points after spending $3,000 on Brex card(s), white-glove onboarding, $5,000 in AWS credits, $2,500 in OpenAI credits, & access to $180k+ in SaaS discounts.. on top of $500 toward Brex travel, $300 in cashback, plus exclusive perks (like billboards..) visit → brex.com/sourcery

Hello from Detroit

Well, almost, heading there shortly for Reindustrialize 2025!! Check out some of the latest headliners, updates, & link to the livestreams → @reindsummit.

I’ll be there cooped up in a conference room but be sure to say hi if you can! A LOT of fun content to come..

Sourcery Update

Sourcery launches NEW submission portal to feature MORE fundraise announcements - DM me for access & to be featured!

Musings

New X CEO?

Viral, Again

Kalshi went viral again, for their latest cinematic debut: History was made by the Underdogs

Viral AI filmaker “PJ Ace” breaks it all down..

Windsurf

Windsurf: The Making of a Billion-Dollar AI Company | Leigh Marie Braswell, Kleiner Perkins

Google and Windsurf, Stinky Deals, Chesterton’s Fence and the Silicon Valley Ecosystem - Stratechery

OpenAI deal for Windsurf falls apart; Google paying $2.4B for Windsurf tech

Reverse-acquihire (noun): When the team starts at Google next Monday and investors cash out, but the startup is technically still alive with a tech license deal... [More + a chart from Selina Wang of Altimeter]

Power Move → Cognition’s acquisition of Windsurf, the agentic IDE.

$82M of ARR

350+ enterprise customers, 100ks+ DAUs

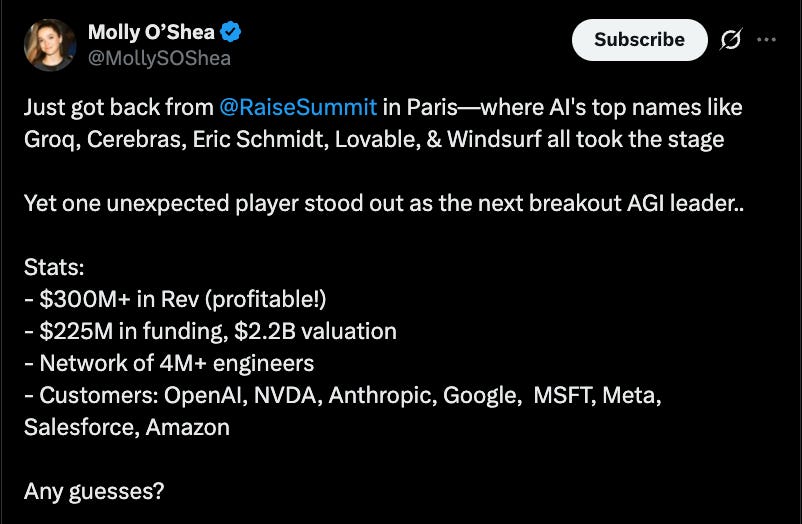

Paris Raise AI Highlight?

Finding an extremely underrated company..

Top Tech Parlay

Check out Kalshi → The largest prediction market & the only legal platform in the US where you can trade directly on the outcomes of future events (sports, Cluely, politics, weather, AI, etc).

Top Interviews

The Golden Age of M&A + AI Consolidation: OpenAI, Google, Meta, Stripe | Art Levy, CBO, Brex

Windsurf: The Making of a Billion-Dollar AI Company | Leigh Marie Braswell, Kleiner Perkins

Bryan Kim, Partner at a16z | ElevenLabs, Captions, Function Health, BeReal, Cluely

Jack Altman Interviews Marc Andreessen, Sam Altman, Keith Rabois, Elad Gil, Qasar Younis

→ Follow Sourcery on: X, YouTube, Spotify, Apple, Linkedin

Last Week (7/7/-7/11):

Relevant deals include the 70+ deals across stages below. I've categorized the deals below into seven categories, Fintech, Care, Enterprise / Consumer, HardTech, Sustainability, Acquisition/PE, and Fund Announcements, and ordered from later-stage rounds to early-stage rounds.

VC Deals

Fintech:

- Bilt, a New York-based rent credit card provider, raised $250m at a $10.75b valuation led by General Catalyst and GID

Congrats to Ankur & the Bilt team!! I had the opportunity to interview CEO, Ankur just a month ago & got a sneak peek into their insane growth metrics..

- iCapital, a New York-based provider of private markets tech platform for financial advisors, raised more than $820m at a $7.5b valuation. T. Rowe Price and SurgoCap Partners led, joined by insiders Temasek, UBS, and BNY

- Revolut, a U.K. neobank, is in advanced talks to raise primary and secondary funding at a $65 billion blended valuation. Greenoaks is likely to lead, with Dragoneer and Coatue also participating.

- MaintainX, an SF-based asset management platform, raised $150m in Series D funding at a $2.5b valuation from Bessemer Venture Partners, Bain Capital Ventures, D.E. Shaw Ventures, Amity Ventures, August Capital, Founders Circle Capital, Sozo Ventures, and Fifth Down Capital.

- Harmonic, a Palo Alto-based AI lab specializing in mathematical superintelligence, raised $100 million in Series B funding. Kleiner Perkins led the round and was joined by Paradigm, Ribbit Capital and existing investors Sequoia Capital, Index Ventures, and Charlie Cheever.

- Agora, a stablecoin startup, raised $50m in Series A funding led by Paradigm, with participation from Dragonfly

- Moment, a New York City-based company automating trading and portfolio management workflows for fixed income teams, raised $36 million in Series B funding. Index Ventures led the round, and was joined by A16z, Lightspeed and others.

- Abacus, an agentic AI company focused on developing CPA assistants for accounting firms, raised $6.6 million in seed funding. Menlo Ventures led the round and was joined by Pear VC, Recall Capital, and Original Capital.

- Layer, a San Francisco-based embedded accounting platform for SMB software, raised $6.6 million in seed funding. Emergence Capital led the round, and was joined by Better Tomorrow Ventures.

- Circuit, an New York-based digital asset recovery platform, raised $4.5m in seed funding. Nyca Partners led, joined by Soma Capital, New Form Capital, The Venture Dept, Silicon Badia, Druid Ventures, and Belvedere Strategic Capital

- BridgePort, a New York City-based middleware software provider for crypto trading, raised $3.2 million in seed funding. Further Ventures led the round and was joined by Virtu, XBTO, Blockchain Founders Fund, Fun Fair Ventures, and Humla Ventures.

Care:

- Bumo, a Pasadena, Calif.-based child care marketplace, raised $10 million in seed funding. Offline Ventures and True Ventures led the fund and were joined by Goodwater Capital, Marketplace Capital, and others.

- Welli, a Bogotá-based healthcare fintech company, raised $8 million in Series A funding. Costanoa Ventures led the round and was joined by Animo VC and Crestone.

Enterprise/Consumer:

- Mistral, a French generative AI firm, is in talks to raise up to $1b from such investors as MGX, plus hundreds of millions of dollars in debt from French lenders

- Airalo, an eSIM provider, raised $220 million in funding. CVC led the round and was joined by Peak XV and Antler Elevate.

- Talon.One, a Berlin-based enterprise loyalty and promotion software company, raised $135 million in funding. Silversmith Capital Partners and Meritech Partners led the round and were joined by existing investor CRV.

- SandboxAQ, a Palo Alto, Calif.-based Alphabet spinoff developing AI models for enterprises, raised $95m in a secondary offering from insiders Rizvi Traverse, Forge Global, and Ava Family Office

- CarOnSale, a Berlin-based B2B marketplace for used car trading, raised €70 million ($82 million) in Series C funding. Northzone led the round and was joined by existing investors HV Capital, Insight Partners, Stripes, and Creandum.

-Honor Education, a San Francisco-based learning platform and solutions provider, raised $38 million in Series A funding. Alpha Edison, Wasserstein & Co., Audeo Ventures, Interlock Partners, New Wave Capital, and other investors joined the round.

- Datafy, a Tel Aviv-based autonomous storage optimization startup, raised $20 million in seed funding. Bessemer Venture Partners led the round and was joined by existing investor Insight Partners.

- GetWhy, a market research startup that derives insights from video interviews, raised $20m in Series A extension funding led by insider PeakSpan Capital

- Vellum, a New York City-based AI development platform, raised $20 million in Series A funding. Leaders Fund led the round and was joined by Socii Capital and existing investors Y Combinator, Rebel Fund, Pioneer Fund, and Eastlink Capital.

- Nominal, a New York City-based AI-native enterprise resource planning startup, raised $20 million in Series A funding. Next47 led the round and was joined by Workday Ventures, Bling Capital, and Hyperwise Ventures.

- Tolan, an AI companion, raised $20m in Series A funding. Khosla Ventures led, joined by NFDG, Bloomberg Beta, Homebrew, and Lachy Groom

- Polimorphic, a New York City-based AI company for service-first governments,, raised $18.6 million in Series A funding. General Catalyst led the round and was joined by existing investors M13 and Shine.

- Gradient Labs, a London-based agentic AI startup focused on regulated industries, raised $13m in Series A funding. Redpoint Ventures led, joined by Localglobe, Puzzle Ventures, Liquid 2 Ventures, and Exceptional Capital.

- Ryft, a New York City and Tel Aviv-based cloud data management platform, raised $8 million in seed funding. Index led the round and was joined by Bessemer Venture Partners and others.

-Circle Games, an Istanbul, Turkey-based mobile game studio, raised $7.25 million in seed funding. BITKRAFT Ventures led the round and were joined by a16z Speedrun, Play Ventures, APY Ventures, and e2vc.

- Knox, a New York City-based federal managed cloud provider, raised $6.5 million in seed funding. Felicis led the round and was joined by Ridgeline and FirsthandVC.

- BQP, a Syracuse, New York-based simulation software company, raised $4.8 million in seed funding. Monta Vista Capital led the round and was joined by Arc Ventures, Armory Square Ventures, Emergent Ventures, and more.

- OneText, a text-to-buy network for e-commerce, raised $4.5m in seed funding from Khosla Ventures, Coatue, Citi Ventures, YC, and Good Friends

- ZeroEntropy, a San Francisco-based startup that makes an AI retrieval engine for developers, raised $4.2 million in seed funding. Initialized Capital led the round and was joined by Y Combinator, Transpose Platform, 22 Ventures, a16z Scout, and others.

- Oraion, an AI-powered enterprise intelligence and automation platform, raised $3.5 million in pre-seed funding. Studio VC led the round and was joined by Enterprise Ireland and others.

- Ollygarden, a remote-first telemetry efficiency company, raised $1.6 million in pre-seed funding. DIG Ventures led the round and was joined by Datadog Ventures, Grafana Labs, Dash0, and others.

HardTech:

- Groq, a Mountain View, Calif.-based AI chipmaker, is in talks to raise between $300-$500m at a $6b post-money valuation - The Information.

- Also, a micromobility startup spun out of Rivian, raised $200m from Greenoaks Capital at a $1b valuation

- Varda Space Industries, an El Segundo, Calif.-based space research company, raised $187 million in Series C funding. Natural Capital and Shrug Capital led the round and were joined by Founders Fund, Peter Thiel, Khosla Ventures, Caffeinated Capital, Lux Capital, and Also Capital.

- ServiceUp, a Los Gatos-based repair platform for fleets and insurance carriers, raised $55 million in Series B funding. PeakSpan Capital led the round and was joined by existing investors Hearst Ventures, Trestle Partners, Capital Midwest Fund, and Litquidity Ventures.

- RealSense, a Santa Clara-based AI-powered robotics company, raised $50 million in Series A funding. Intel Capital and MediaTek Innovation participated in the round.

- QEDMA, a Tel Aviv-based quantum computing company, raised $26 million in Series A funding. Glilot Capital Partners led the round and was joined by IBM, Korea Investment Partners, existing investor TPY Capital, and others.

-Arago, a Paris and Silicon-Valley based photon-powered AI chip startup, raised $26 million in seed funding. Earlybird, Protagonist, and Visionaries Tomorrow led the round, and were joined by Generative IQ, C4 Ventures, and others.

-AirGarage, a San Francisco-based parking real estate company, raised $23 million in Series B funding. Headline led the round and was joined by existing investors Founders Fund and Fourthline Capital Management.

-Parspec, a San Mateo, Calif.-based AI-native wholesale distribution platform for construction products, raised $20 million in Series A funding. Threshold Ventures led the round and was joined by existing investors Innovation Endeavors, Building Ventures, Heartland Ventures, and Hometeam Ventures.

- Dextall, a New York City-based construction tech startup, raised $15 million in Series A funding. L+M Development Partners, Essence Development, and Simpson Strong-Tie led the round.

-Augmentus, a Singapore-based robotics company, raised $11 million in Series A+ funding. Woori Ventures led the round and was joined by EDBI, Sierra Ventures, and Cocoon Capital.

- Parter, a New York-based hardware manufacturing data startup, raised $5.5 million in seed funding. StageOne Ventures led, joined by Zenda Capital and Mercer Ventures.

- Nordic Air Defence, a Stockholm-based defense tech startup, has raised $3 million in strategic funding. Inflection led the round.

- Yplasma, a Newark-based deep tech startup in the electronics and semiconductor industry, raised $2.5 million in seed funding. Faber led the round and was joined by SOSV.

Acquisitions & PE:

- CoreWeave (Nzsdaq: CRWV) agreed to buy crypto miner Core Scientific (Nasdaq: CORZ) for around $9b in stock.

- The U.S. Department of Defense agreed to buy $400 million of preferred shares in MP Materials (NYSE: MP), owner of America's only operational rare earths mine, as part of a broader strategic agreement.

- OpenAI completed its $6.5b purchase of io, a hardware startup founded by ex-Apple chief design officer Jony Ive.

- OpenSea, rhe NFT marketplace once valued by VCs at $13.3b, acquired Rally.xyz, a crypto wallet and NFT collecting startup backed by Exponential and 6th Man Ventures

- Thoma Bravo agreed to acquire Olo, a New York City-based SaaS restaurant platform, in an all-cash deal valuing the company at approximately $2 billion.

- TPG Capital acquired a 70% stake in DIRECTV, an El Segundo, Calif-based satellite television company, from AT&T for $7.6 billion in cash.

- Amplitude acquired Kraftful, a San Francisco-based AI-native Voice of Customer startup. Financial terms were not disclosed.

-Samsung agreed to acquire Xealth, a Seattle-based digital health platform. Financial terms were not disclosed.

-Pendo acquired Forwrd.ai, a Tel Aviv-based predictive analytics platform. Financial terms were not disclosed.

- Autodesk (Nasdaq: ADSK) is considering a cash-and-stock takeover bid for PTC (Nasdaq: PTC), a rival engineering software firm with a $25b market cap

- Flutter (NYSE: FLUT) agreed to buy Boyd Gaming's (NYSE: BYD) 5% stake in FanDuel for $1.76b, giving Flutter 100% control of the sports betting app.

Funds:

- Cyberstarts, a Tel-Aviv based cybersecurity venture firm, raised $300 million for its employee liquidity fund focused on rewarding startup employees and ignite greater momentum at breakout companies across the firm’s portfolio.

-OnePrime Capital, a Palo Alto-based investment firm, raised $305 million for its third fund focused on specialized technology secondary strategy.

-Boldstart Ventures, a Miami-based venture capital firm, raised $250 million for its seventh fund focused on AI-native infrastructure, secure identity and permissionless coordination, agents driving autonomous execution, and more.

- Propel Venture Partners, a San Francisco-based seed-stage venture firm, raised $100 million for its fifth fund, focused on early stage investments in the financial services ecosystem.

Today’s Sourcery is brought to you by Brex.

Brex is the modern finance stack built for speed—corporate cards, expense management, bill pay, travel, & banking, all in one sleek platform.

Helping companies like Anysphere (Cursor) build the future of AI w/ Brex as their mission control; Superhuman move 2x as fast; BambooHR manage spend across 1,500+ employees; EZ Bombs generate $80K in yield from viral growth — all w/ Brex.

As a Sourcery subscriber you get: 75,000 points after spending $3,000 on Brex card(s), white-glove onboarding, $5,000 in AWS credits, $2,500 in OpenAI credits, & access to $180k+ in SaaS discounts. On top of $500 toward Brex travel, $300 in cashback, plus exclusive perks (like billboards..) visit → brex.com/sourcery

Love merch? Check out our shop: sourcerymerch.com

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.

More than valuations what will be decisive is how well the teams integrate. Most deals fail in the first 90 days after the closing. One thing is that cultural misalignment kills more deals than any financial metrics ever do.