BREAKING: Altimeter Leads $65M Series A in the Rarest Company On Earth

Vulcan Elements

The Rarest Company on Earth

Vulcan Elements CEO John Maslin joins Sourcery to announce their $65M Series A led by Altimeter (Brad Gerstner, Erik Kriessmann) with participation from One Investment Management (Rajeev Misra) to build the most advanced rare earth magnet factory in America, fully decoupled from China.

Brining their total funding to $75M.

→ Listen on X, Spotify, YouTube, Apple

In this interview, we cover why rare earth magnets are the “essential invisible building blocks of the economy,” powering everything from everyday consumer electronics, AI data centers, EVs, & robotics to satellites, drones, & every major U.S. defense platform. Maslin explains why China’s 90%+ dominance in magnet manufacturing is a national security risk, how Vulcan has decoupled from Chinese supply chains, & the company’s plans to scale from hundreds to thousands of tonnes of production this decade.

From building a factory from scratch in Durham, North Carolina, to deploying AI inside the magnet-making process, this is a behind-the-scenes look at the startup quietly powering the future of U.S. national security & AI.

Highlights:

$65M Series A led by Altimeter, bringing total funding to $75M

China makes 94% of magnets; the U.S. makes less than 1%

Magnets power everything: phones, drones, data centers, robotics, EVs (demand could 10x from robotics alone)

Reindustrializing America: Durham, North Carolina “Research Triangle” facility with U.S.-made equipment, local talent, SpaceX alums, & PhDs

Next-gen factory: AI-driven production using Vulcan’s own sensor and material data for a “2025-era” industry 4.0 plant

Disclaimer: I am an investor in the company.

Brought to you by:

Brex—The modern finance platform, combining the world’s smartest corporate card with integrated expense management, banking, bill pay, and travel.

Turing—Turing delivers top-tier talent, data, and tools to help AI labs improve model performance, and enable enterprises to turn those models into powerful, production-ready systems. Visit: turing.com/sourcery

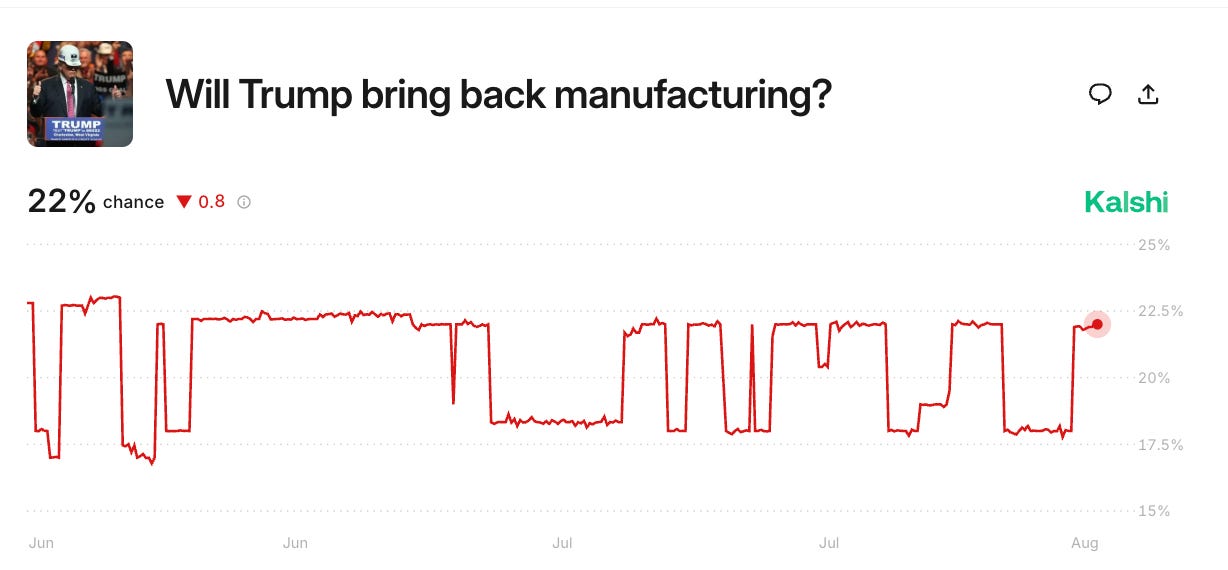

Kalshi—The largest prediction market & the only legal platform in the US where people can trade directly on the outcomes of future events (sports, politics, weather, AI, etc).

Fourthwall—The #1 way to sell merch online — Fourthwall is the easiest way to launch a fully branded merch store—used by big brands like MKBHD, Acquired, & even the Smithsonian. 100+ products. No upfront cost.

Timestamps

(00:00) Introduction to Domestic Production and Resilient Supply Chains

(01:59) $65M Series A Led by Altimeter

(04:01) Vulcan Elements

(05:27) Why Rare Earth Magnets Are Critical

(08:58) Decoupling from China: Challenges & Strategies

(12:24) American Talent & Reindustrialization

(14:23) Assembling a SpaceX-Level Team in the Research Triangle

(17:58) Scaling Up: New Facilities and Hiring Plans

(19:14) The Manufacturing Process of Rare Earth Magnets

(29:25) Challenges and Innovations in Manufacturing

(32:02) The Role of AI and Advanced Technologies

(36:18) Future Milestones and Policy Impacts

Rebuilding America’s Supply Chain

A Familiar Story

The rare earth magnet market, estimated at $29B globally in 2025, is in a position strikingly similar to uranium enrichment (<.1% global nuclear fuel enrichment): a critical, high-barrier technology the U.S. once dominated, only to abandon under the assumption global supply chains would always be stable, & diversification is good. After the Cold War, America convinced itself it could outsource almost everything, trading industrial self-reliance for short-term cost savings. In magnets, as with enrichment, that thinking created a single-point-of-failure dependency on geopolitical rivals.

China now produces roughly 94% of the world’s high-performance magnets, leaving the U.S. with less than 1% of capacity. This is more than a trade imbalance, it’s a structural vulnerability that could freeze production lines for everything from missiles to MRI machines overnight if supply is cut off. Rebuilding this capability isn’t just about catching up; it’s about ensuring America can compete, defend itself, and innovate without asking for permission.

More specifically: By the early 2000s, the United States had essentially exited the rare earth magnet market. In 2000, Magnequench moved its NdFeB magnet production facilities from Indiana to Tianjin, China, marking the end of large-scale U.S. manufacturing in this critical sector. Supporting this shift, a 2019 analysis notes that the U.S. "finally stopped its rare earth production in 2002" due to price pressures and enviqonmental disadvantages compared to China.

Once trusted to be part of America's industrial backbone, rare earth magnet production was quietly outsourced, an emblem of misplaced post–Cold War confidence. Today, this decision now leaves the U.S. highly vulnerable to supply disruptions in everything from consumer electronics to national defense.

“Rarest Company on Earth”

Vulcan Elements has secured a $65 million Series A, led by Altimeter Capital with significant participation from One Investment Management, bringing total investment to $75 million. The capital will scale Vulcan’s U.S.-based rare earth magnet production from pilot to commercial capacity.

“This Series A enables Vulcan to scale with the speed and seriousness that this moment and the nation demand,” said Vulcan CEO John Maslin. “With Altimeter, OneIM, and others, we’ve brought together investors who understand what it takes to build enduring American industrial champions”

Brad Gerstner, Founder & CEO of $12B AUM investment firm, Altimeter, believes Vulcan will:

“Anchor the next century of American innovation and national security..

Vulcan’s relentless execution has put it at the forefront of the industry. Vulcan has already emerged as a best-in-class manufacturer within two years of incorporation. There’s no one else in the rare earth space moving at this pace and with this level of performance.”

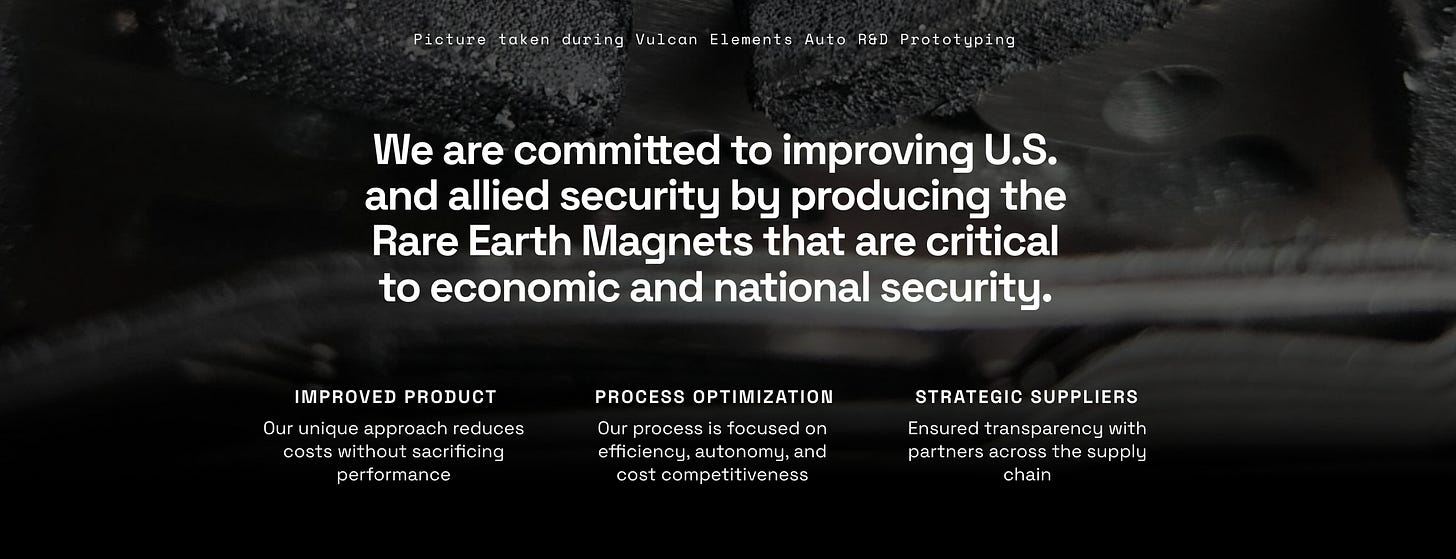

An Urgent Problem: Decoupling from China

Maslin frames the rare earth magnet market as one of the most dangerous single points of failure in the U.S. economy and national security apparatus. China currently manufactures 90–94% of global high-performance magnets, while the U.S. produces less than 1%. These magnets are critical for “every satellite, every drone, every missile, every tank, every ship, every submarine” as well as commercial technologies like EVs, robotics, AI data centers, and consumer electronics.

“China has already weaponized its dominance of the magnet supply chain, most notably by cutting off magnet exports in April… That’s unacceptable, and Vulcan Elements is bringing this supply chain back home”

This dominance means China can, at will, freeze U.S. industrial production lines, stalling both the economy and defense readiness.

Why Competitors Aren’t Able to Fully Decouple

Maslin explains that the real bottleneck isn’t raw material availability — allied nations like Australia and new U.S. mines can supply ore. The choke point is equipment and manufacturing know-how.

“If China manufactures 94% of the global supply of these magnets, where do you think all of the equipment to make those magnets comes from? It’s virtually 100%”

Because almost all magnet-making machinery is designed and built in China, competitors who claim to be U.S.-based still rely on Chinese-origin equipment, software, or materials. That leaves them exposed to the same geopolitical risks and export controls. Vulcan has instead co-developed the first new U.S.-made magnet manufacturing equipment in the 21st century, partnering with domestic suppliers to break this dependency.

Policy Environment Making Decoupling Critical

Two key policy drivers make this transition urgent:

National Defense Authorization Act (NDAA) Magnet Ban: Under Section 844 of the FY 2021 NDAA and later amendments, by January 1, 2027, any magnets in U.S. defense systems must have fully traceable origin — from mining and refining to finished magnet, with no steps in China, Russia, North Korea, or Iran. This effectively forces DoD suppliers to find allied-source magnets or risk non-compliance.

DFARS Restrictions: The Defense Federal Acquisition Regulation Supplement prohibits DoD from acquiring samarium-cobalt and neodymium-iron-boron magnets from covered countries, with 2024 updates expanding the ban to mining, refining, and separation.

Together, these rules mean that defense contractors, and by extension many commercial suppliers, must rebuild a secure, domestic or allied supply chain or lose access to government contracts.

“If America does not start manufacturing things, we’re gonna have to ask China what we’re allowed to build and buy in five years… down to the critical component level”

Supply Chain

Unlike most competitors, Vulcan’s supply chain is fully allied-sourced.

“All of Vulcan’s material and equipment is sourced from the United States and its allies, ensuring complete traceability and transparency”

Maslin stresses:

“If you’re just copying and pasting China into the United States… you are doomed”

Next-Generation Manufacturing

Vulcan is more than a China alternative. They’re setting a new standard for magnetics science and innovation. The company’s manufacturing process integrates novel technologies to speed production and drive down costs, with its magnet chemistry and methods validated by the Department of Energy’s Ames National Laboratory.

Backed by Department of Defense support and contracts with the Air Force, Army, and Navy, Vulcan is advancing U.S. capability in a field long dominated abroad. Chief Technology Officer Dr. Piotr Kulik, who founded the first U.S. rare earth magnetics lab in over 20 years, continues to push magnetic performance forward while training the next generation of specialists.

Vulcan is embedding AI and advanced analytics into its magnet production to accelerate learning and improve yields.

“Within an hour of every step of the process, we’re feeding that data into our own models… showing us how we can optimize our own recipes”.

The goal: a “2025-era” industry 4.0 factory that can scale from hundreds to thousands of tonnes of magnets annually.

Investor in Vulcan, Rajeev Misra of $7B AUM One Investment Management (former CEO of SoftBank’s $100B Vision Fund), who has helped build some of the most consequential businesses of the past decade, like NVIDIA, Uber, & Grab, explains:

“It’s rare to see a company in this space move with this level of speed, technical rigor, and focus.. The importance of the magnet supply chain is more vivid than ever, and Vulcan is on track to be a cornerstone company for global manufacturing and innovation.”

A Rare Team

Vulcan Elements is led by a high-powered team with deep expertise in defense, advanced manufacturing, & magnetics science.

CEO John Maslin, spent several years as the financial manager for the U.S. Navy’s nuclear propulsion program (Naval Reactors). Executing a $2B annual budget to finance and procure sensitive materials and components for nuclear reactors on the Navy’s newest aircraft carriers & submarines. Maslin holds degrees from Harvard, Cambridge, & Colorado Boulder.

COO Jake Bowles spent a decade in advanced manufacturing at SpaceX & Ursa Major. CTO Dr. Piotr Kulik, one of only four magnet science professors in the U.S., founded the first domestic rare earth magnetics lab in over 20 years. VP of Commercialization Scott Glover brings McKinsey-led supply chain strategy experience, while VP of R&D Joe Croteau offers 15 years in powder metallurgy at Kymera International. Chief of Staff Jonah Glick-Unterman brings Pentagon & defense strategy expertise, having advised multiple Secretaries of Defense & State, contributing deep policy & national security insight.

“The technicians… are the smartest people at this company. You don’t need to go to MIT or Harvard to make a difference—you just need to be intellectually curious and willing to get your hands dirty.

Team is everything.”

Engineers & technicians are the core of Vulcan’s culture. With this new funding and demand, the company is hiring out more talent in powder metallurgy, magnetics, advanced manufacturing, and scaling commercial operations to join its rapidly expanding team. Current openings are listed here.

Demand Already Far Exceeds Supply

Vulcan’s pilot facility has been sold out more than a year in advance.

“We could have sold this pilot facility out 15 times… we actually sold it out over 12 months ago”.

The Series A will fund commercial-scale expansion to meet demand from defense, robotics, automotive, and tech customers.

“Every dollar matters. Putting product in customer hands is the mission”

P.S. Did we mention they’re rare?

Pictured: COO Jake Bowles

As a Sourcery subscriber you get: 75,000 points after spending $3,000 on Brex card(s), white-glove onboarding, $5,000 in AWS credits, $2,500 in OpenAI credits, & access to $180k+ in SaaS discounts. On top of $500 toward Brex travel, $300 in cashback, plus exclusive perks (like billboards..) visit → brex.com/sourcery