BREAKING: Carta's VC Fund Performance Report

Yikes? flight to quality + which funds are crushing.. Founders Fund, Altimeter, USV, Emergence Capital, Thrive Capital etc.

A Flight to Quality

Continuing off of our latest piece on the state of Liquidity Markets with Christian Garrett, Carta just dropped a new report on 2024 Fund performance that we needed to expand on..

The overall venture capital (VC) industry is undergoing significant transformations, with fundraising facing substantial headwinds, increasing pressure for returns, the adaptation & adoption of novel strategies, and a redefinition of what constitutes early-stage private investing. TLDR: the Power Law is alive and well.

All charts are shared below (no paywall) + check out which funds are crushing.. 👀

(*ehem* Founders Fund, Altimeter, USV, Emergence Capital, Thrive Capital etc.)

Thank you to the Carta team for compiling this information: Peter Walker, Michael Young, PhD, Kevin Dowd

Impact on VC Fundraising

Global VC fundraising has sharply declined, with total capital raised in 2024 dropping to $160.6 billion, a 60% decline from its 2021 peak of $403.6 billion (PitchBook). The number of funds closed also fell by 40.8%, reflecting a more selective environment as limited partners (LPs) pull back amid liquidity constraints. LPs are increasingly favoring established managers, with 68% of new commitments in 2024 directed toward experienced firms, further marginalizing smaller and emerging managers (Carta, PitchBook).

“Nearly 20% of the new commitments made during the year went to just the 10 largest funds, all with established firms. That figure may not be the largest portion in the past decade, but breaking it down at the firm level gives an even more concentrated look at the data.” (Pitchbook)

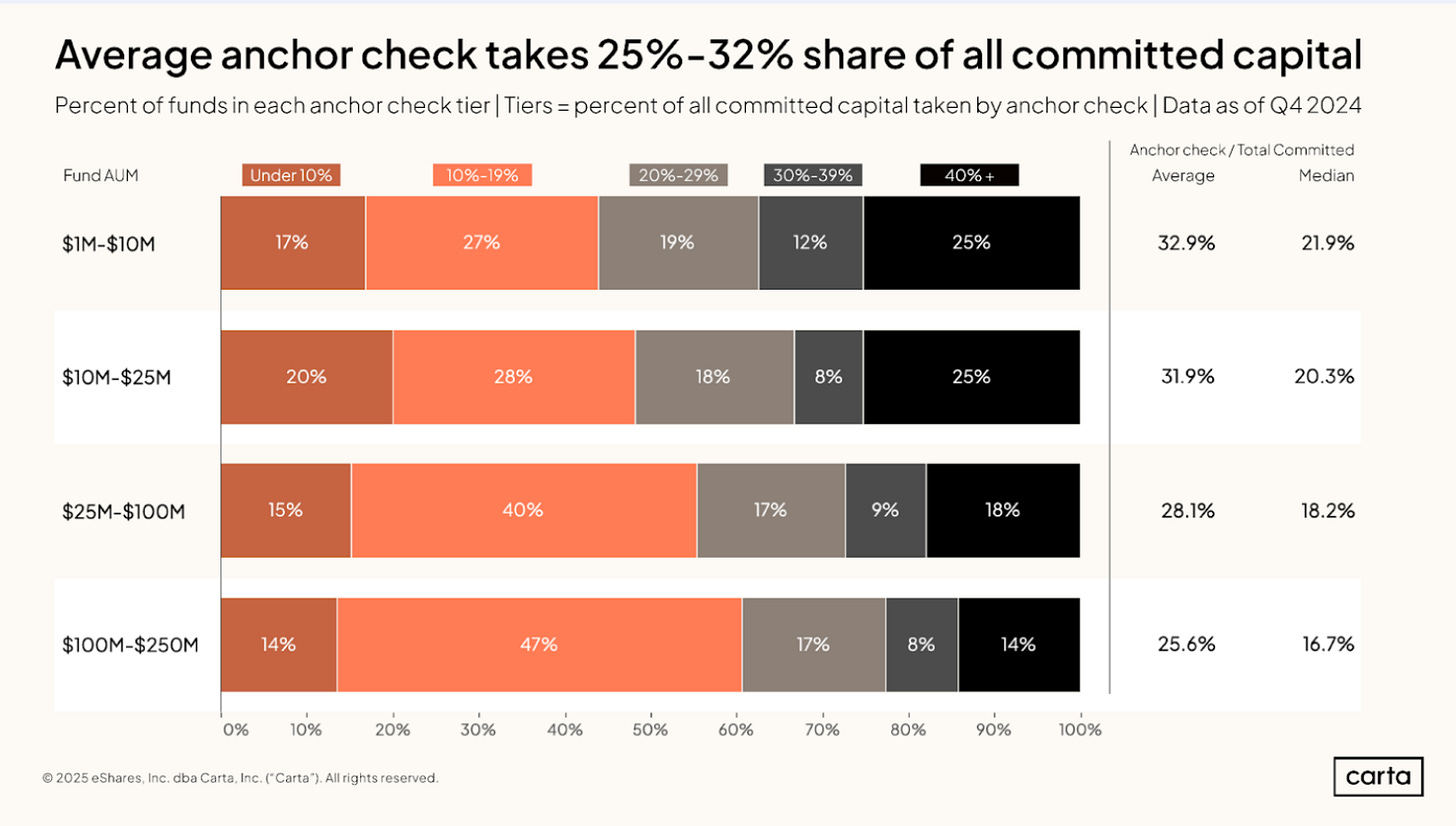

The median number of LPs per fund has dropped significantly. For funds managing $100 million to $250 million, the median number of LPs fell from 83 in 2022 to 47 in 2024, nearly a 50% reduction (Carta). To compensate, anchor check sizes have grown, with the median anchor check for these funds rising from $23.1 million in 2022 to $35 million in 2024. This reflects a "flight to quality," as fewer LPs write larger checks to select funds (Carta). Funds also face longer fundraising cycles. And this goes for ALL funds.. even the mega-funds. The median time to close a VC fund has grown significantly, with some funds now taking over two years to reach their final close.

Increased Pressure for Returns

The pressure on investors and fund managers to deliver returns has intensified, driven by a challenging exit environment. And look, it’s not everyday you get a 200x return on a $6M investment.. like Sequoia just did with Wiz’s $32B Google acquisition, cashing in a cool $6 billion. Luckily this exit is giving some hope for 2025!

In 2024, the U.S. venture-backed exit activity was down 82.2% from its 2021 high, with total exit value at $149.2 billion—lower than pre-2021 levels (PitchBook). Distributions to LPs have reached record lows, with DPI (Distributions to Paid-In Capital) at just 11% in 2024, compared to a historical average of 29% (2014–2017). This has left LPs hesitant to reinvest in new funds, exacerbating the fundraising challenges.

Adding to the strain is the aging of dry powder. Of the $677 billion in global VC dry powder, 53% is tied to funds between 3 and 5 years old, the largest proportion since the global financial crisis (PitchBook). Many of these funds face difficulties deploying capital efficiently, particularly in a slower deal and exit environment.

To address liquidity challenges, general partners (GPs) are increasingly turning to alternative mechanisms like secondaries, continuation funds, and NAV loans. In 2024, $360 billion was raised through such mechanisms. However, these tools provide only temporary relief and cannot fully replace traditional exits (Bain).

Novel Strategies in Venture Capital / PE

VC firms have adopted several novel strategies to navigate the current landscape:

Targeting Sovereign Wealth and Private Wealth: Sovereign wealth funds (SWFs) and private wealth channels are becoming critical sources of capital. Bain estimates that SWFs and private wealth will account for 60% of growth in alternative assets under management over the next decade.

Semiliquid Products: Firms are increasingly offering semiliquid products designed for retail investors, with lower minimums and more liquidity. In 2024, Blackstone raised $23 billion through such products (Bain).

Shift in Early-Stage Private Investing

The dynamics of early-stage private investing have shifted significantly:

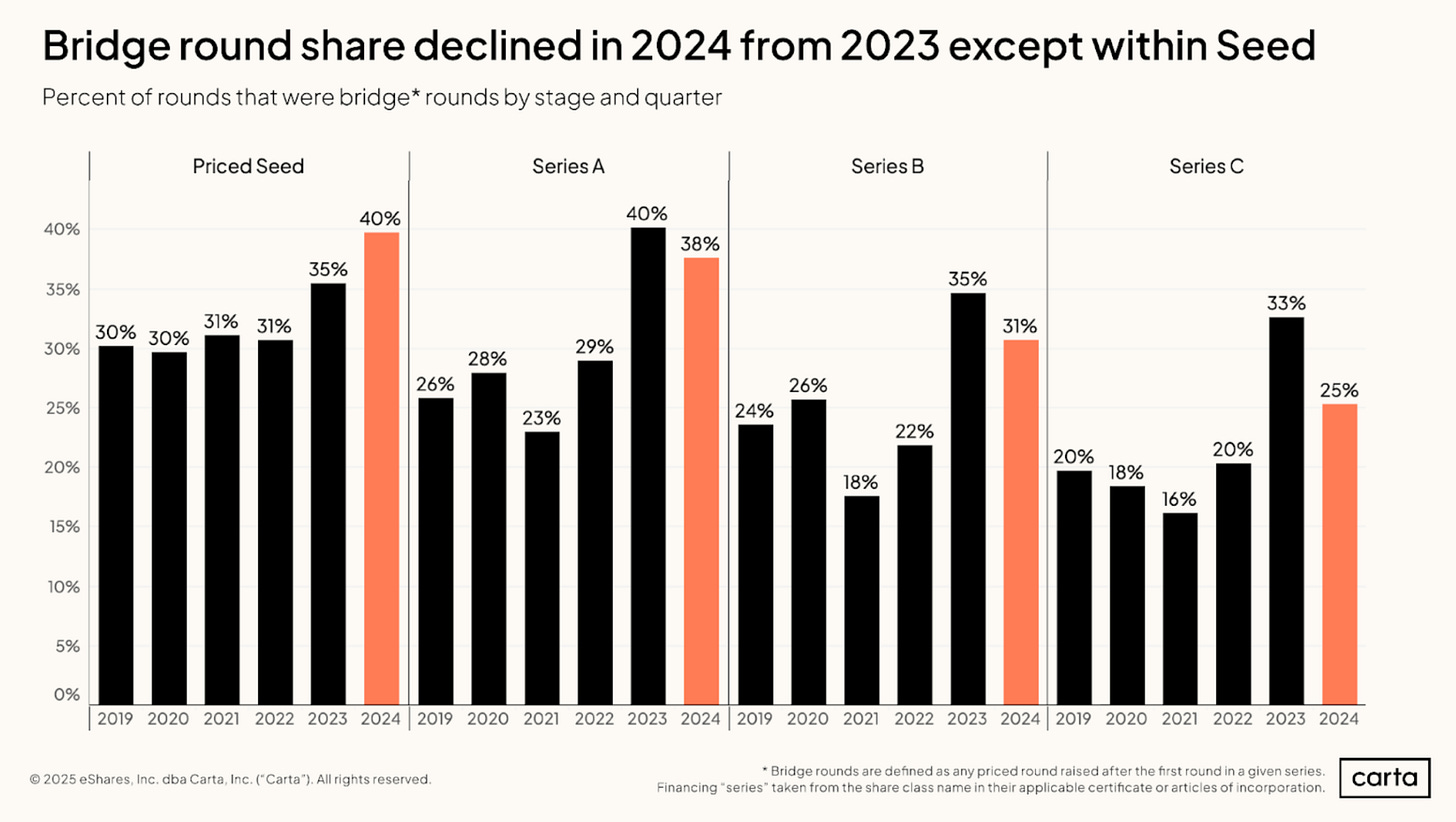

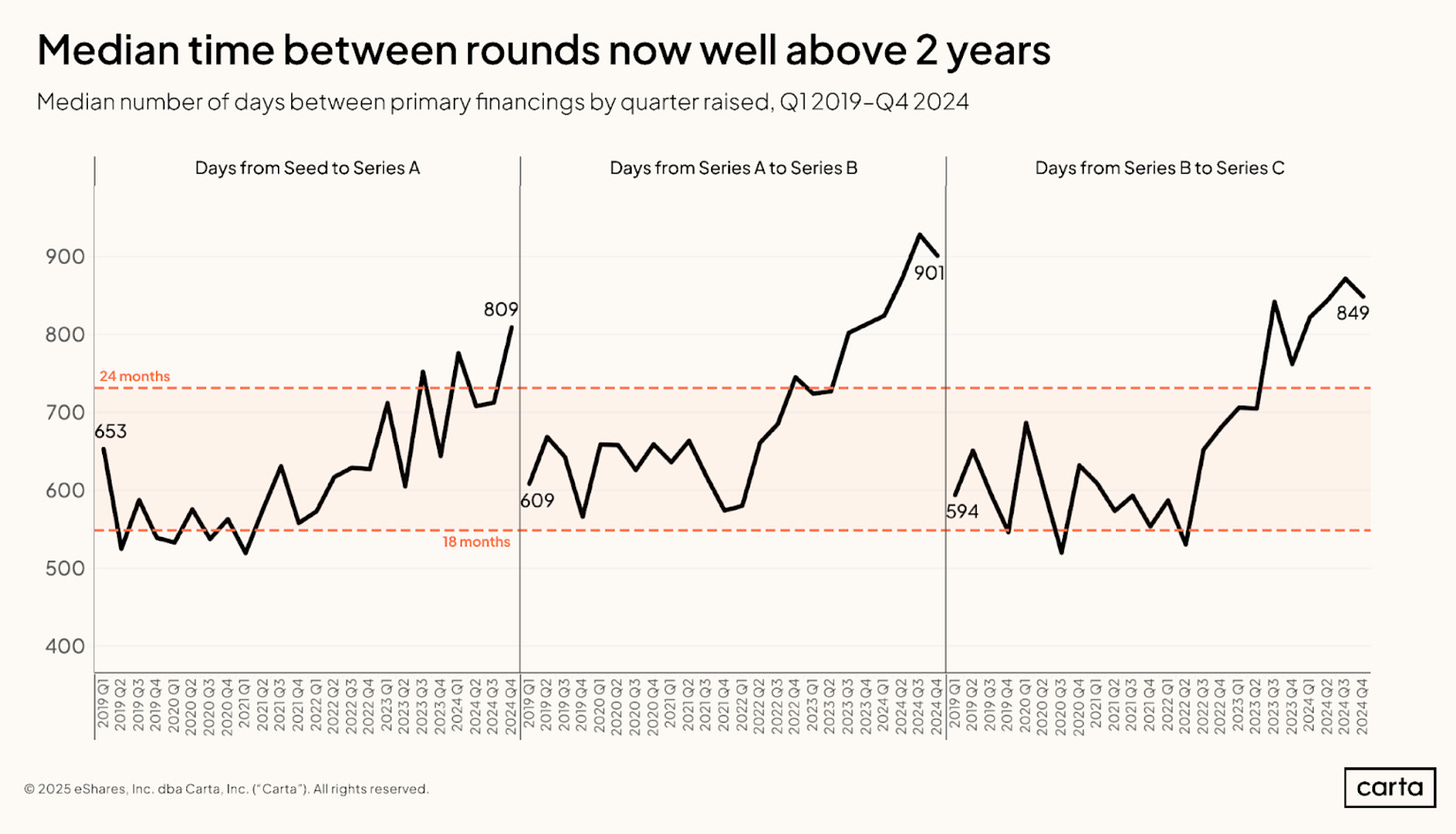

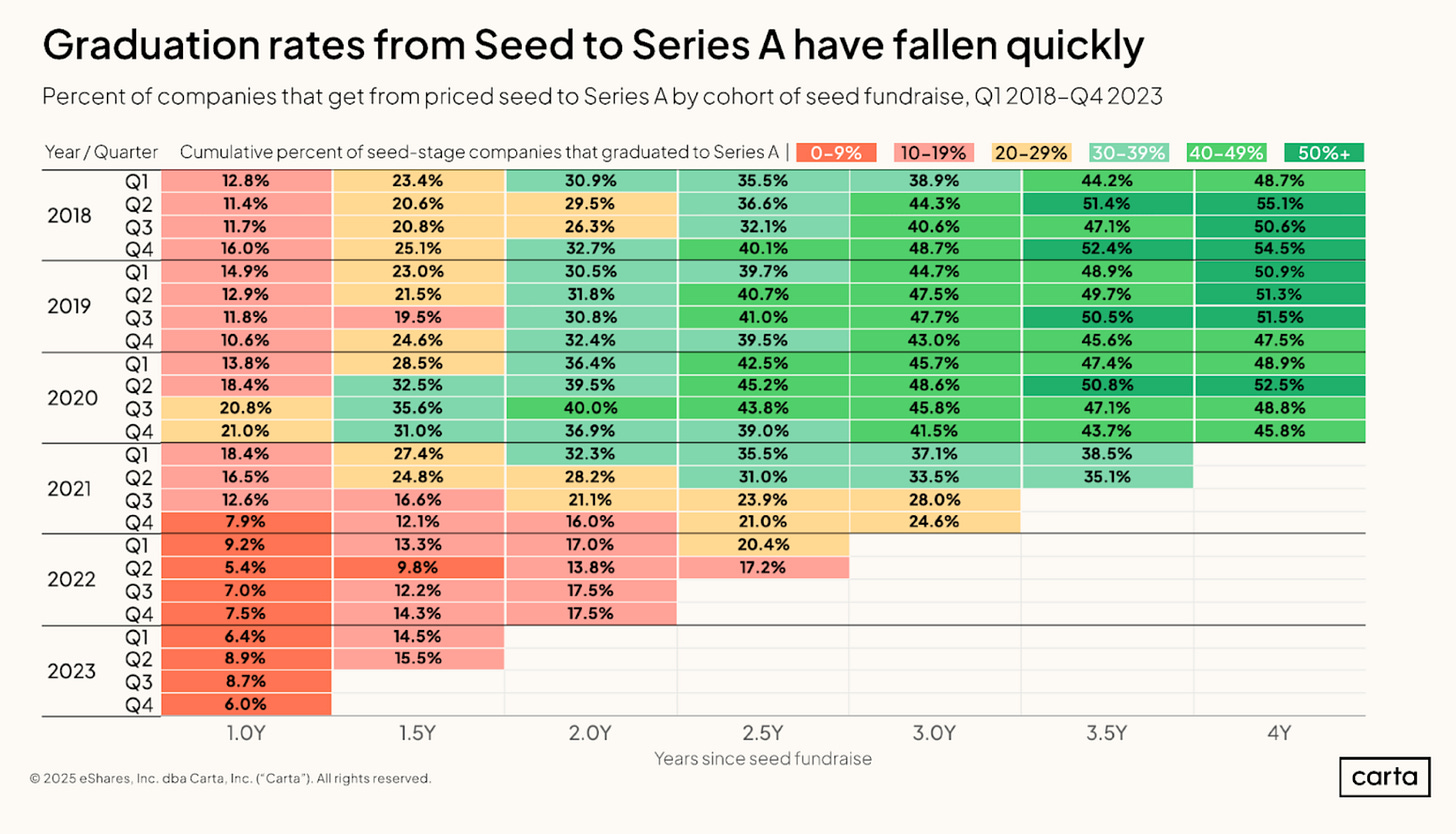

Longer Time Between Rounds: Startups are taking longer to raise subsequent funding rounds. For instance, the median time between a seed round and Series A in Q4 2024 was 809 days, up from 653 days in Q1 2019 (Carta). This has increased the need for bridge financing, with 40% of seed-stage rounds in 2024 categorized as bridge rounds.

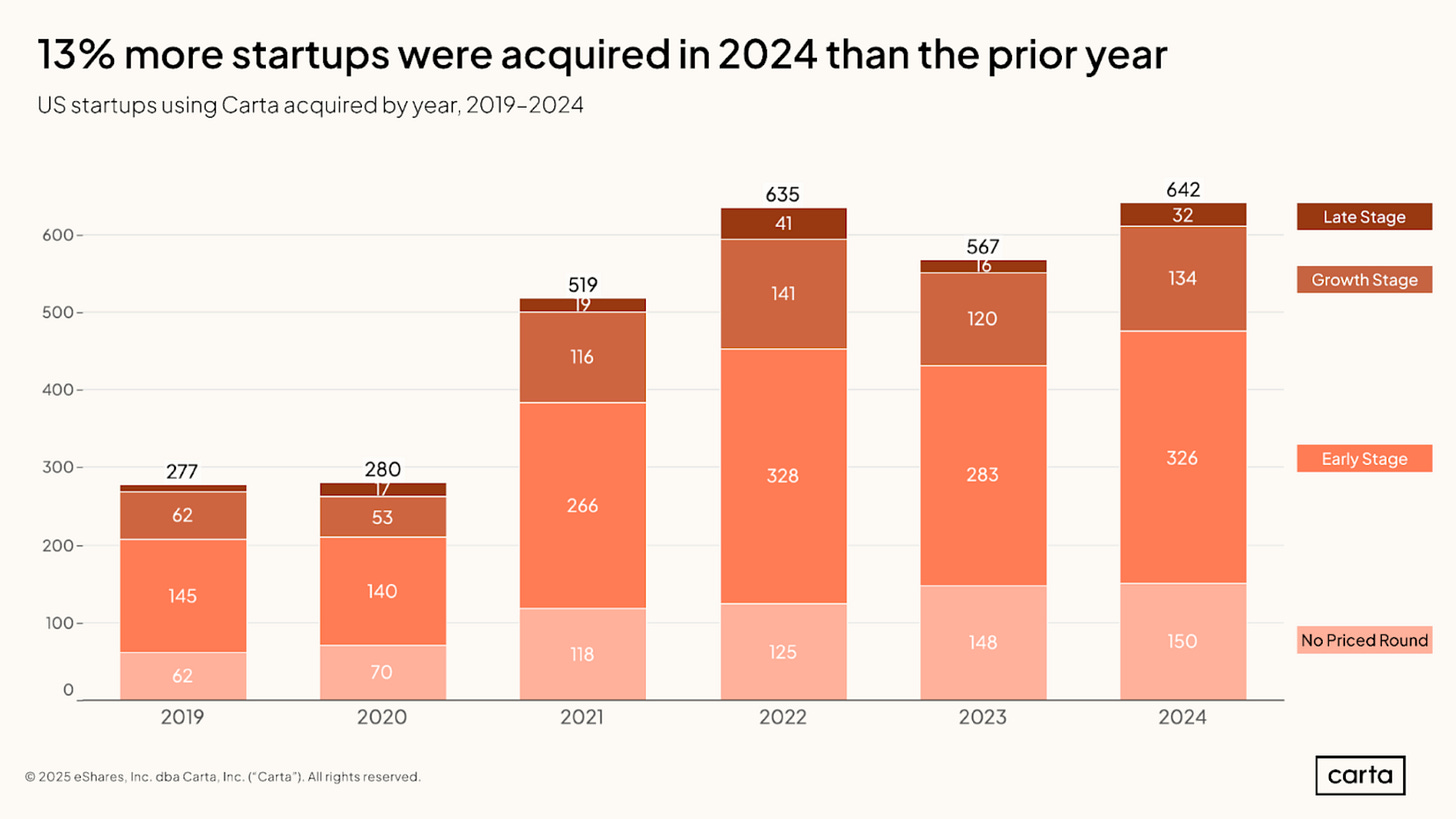

Acquisition of Early-Stage Startups: Early-stage startups are becoming prime targets for acquisitions, with 50% of acquisitions in 2024 involving seed or Series A companies (Carta).

Investor Focus on Profitability: Investors are prioritizing profitability and sustainability over growth-at-all-costs, reflecting a shift in investment ethos since the 2021 boom (PitchBook).

Personally, I think this trend will fade if it hasn’t already. Growth is king.

The Big Squeeze

The venture capital landscape is grappling with declining fundraising, liquidity challenges, and shifting investor preferences. To adapt, fund managers are adopting novel strategies, such as targeting alternative capital sources and offering semiliquid products. Early-stage investing, meanwhile, is evolving with longer funding cycles and a greater emphasis on driving revenue and profitability. As the industry recalibrates, the ability for funds to endure, innovate, and differentiate will be critical to navigating these dry times.. #prayingforexits #IPOs #M&A #makeitrain

Enter The Carta Report

Highlights

The venture slowdown is leaving a mark: For every fund vintage from 2017 through 2020, the past two to three years have brought significant declines in median IRR. For the 2017 vintage, for instance, median IRR fell from 16.8% as of Q4 2021 to 12.0% at the end of Q4 2024.

Top decile TVPI is highest in smaller funds: In the upper tiers of performance, the smallest venture funds often post the best returns. In the 2018 vintage, the 90th percentile for TVPI among funds with $1 million to $10 million in assets is 4.03x. For funds in the same vintage with $100 million or more in assets, the 90th percentile for TVPI is 1.67x.

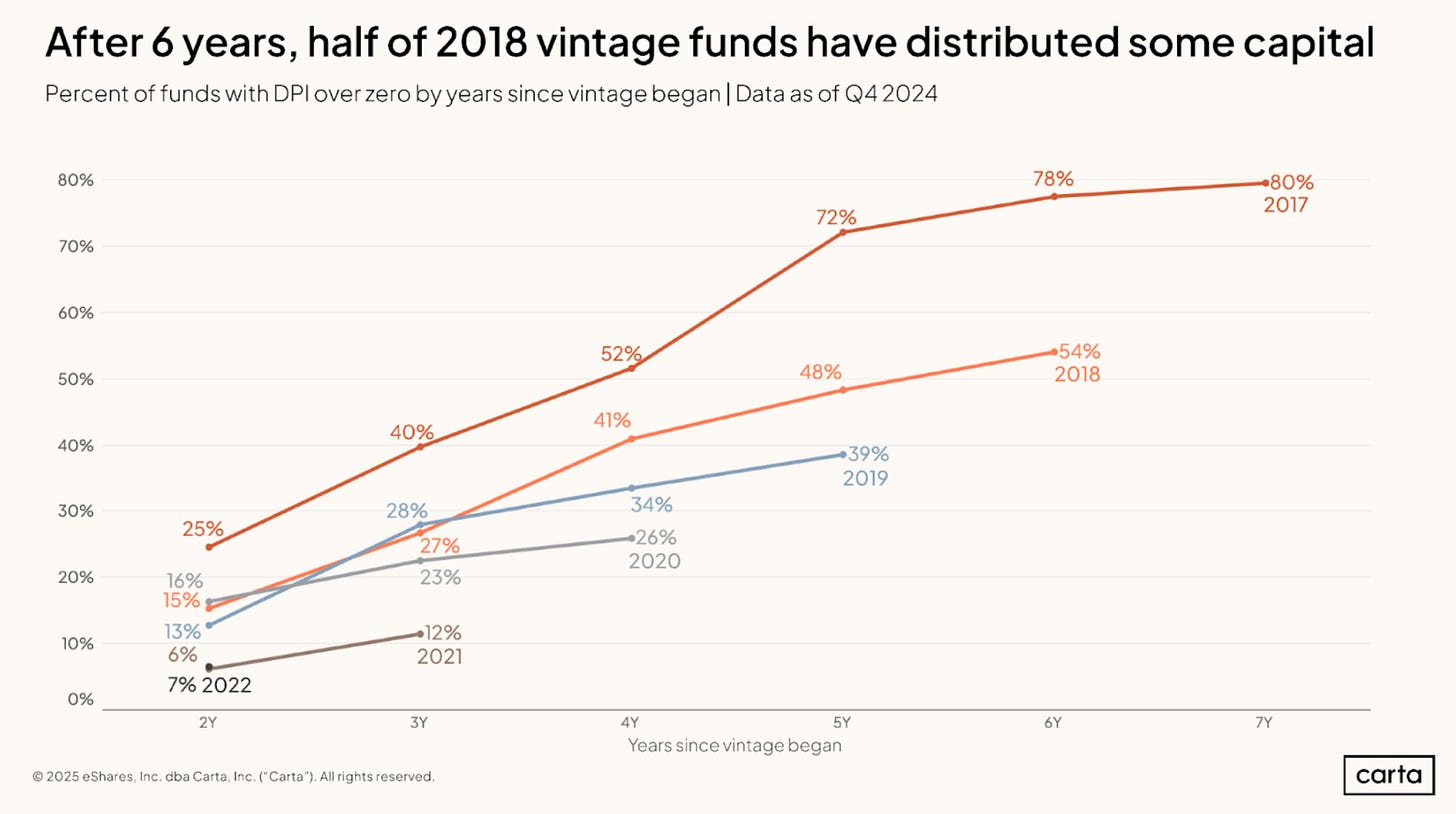

Most newer funds are still waiting for DPI: Half of all funds from the 2018 vintage have still not distributed any capital back to their LPs. For more recent vintages, distributions are even harder to find: Just 26% of funds from the 2020 vintage and 12% of funds from 2021 have begun to record DPI.

Summary

Performance indicators such as IRR, TVPI, and DPI underscore the challenges for recent fund vintages. Median IRRs have declined significantly across all vintage years, with funds from 2021 and 2022 struggling the most due to the valuation reset in 2022 and the broader venture downturn. Notably, after three years, the 2021 vintage recorded a median IRR of -0.3%, compared to 20% or higher for earlier vintages at similar stages. Smaller funds tend to outperform in terms of IRR and TVPI, as their size allows one or two successful investments to yield outsized returns. For example, the 90th percentile TVPI for 2018 vintage funds with $1 million to $10 million in AUM was 4.03x, compared to just 1.67x for funds over $100 million.

Distributions back to LPs (DPI) have been slow, with most recent vintages still awaiting meaningful exits. Only 12% of 2021 vintage funds have distributed capital after three years, a significant drop from earlier vintages like 2017, where 40% achieved DPI over zero in the same timeframe. The broader market context paints a difficult picture: startups are raising fewer and slower follow-on rounds, with median time between seed and Series A rounds lengthening by five months since 2019. Down rounds have increased significantly, further weighing on fund performance.

Despite these challenges, 2024 saw a resurgence in startup activity, with $93 billion raised—a 22% increase from 2023. However, this is still far below the 2021 peak, and bridge rounds remain prevalent, particularly at the seed stage.

Early signs from the 2023 vintage offer a glimmer of hope, with its 90th percentile IRR at 24.5% after one year, a strong rebound compared to the weaker figures for 2021 and 2022 vintages. Fund managers should note that smaller funds continue to demonstrate stronger top-tier performance, and raising larger anchor checks from fewer LPs is becoming the norm in this evolving market.