Carta Acquires Sirvatus: Private Credit's Ascent

LBOs & Competition w/ Banks

Brought to you by Brex:

Brex is the intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast.

Private Credit Just Got an Upgrade.

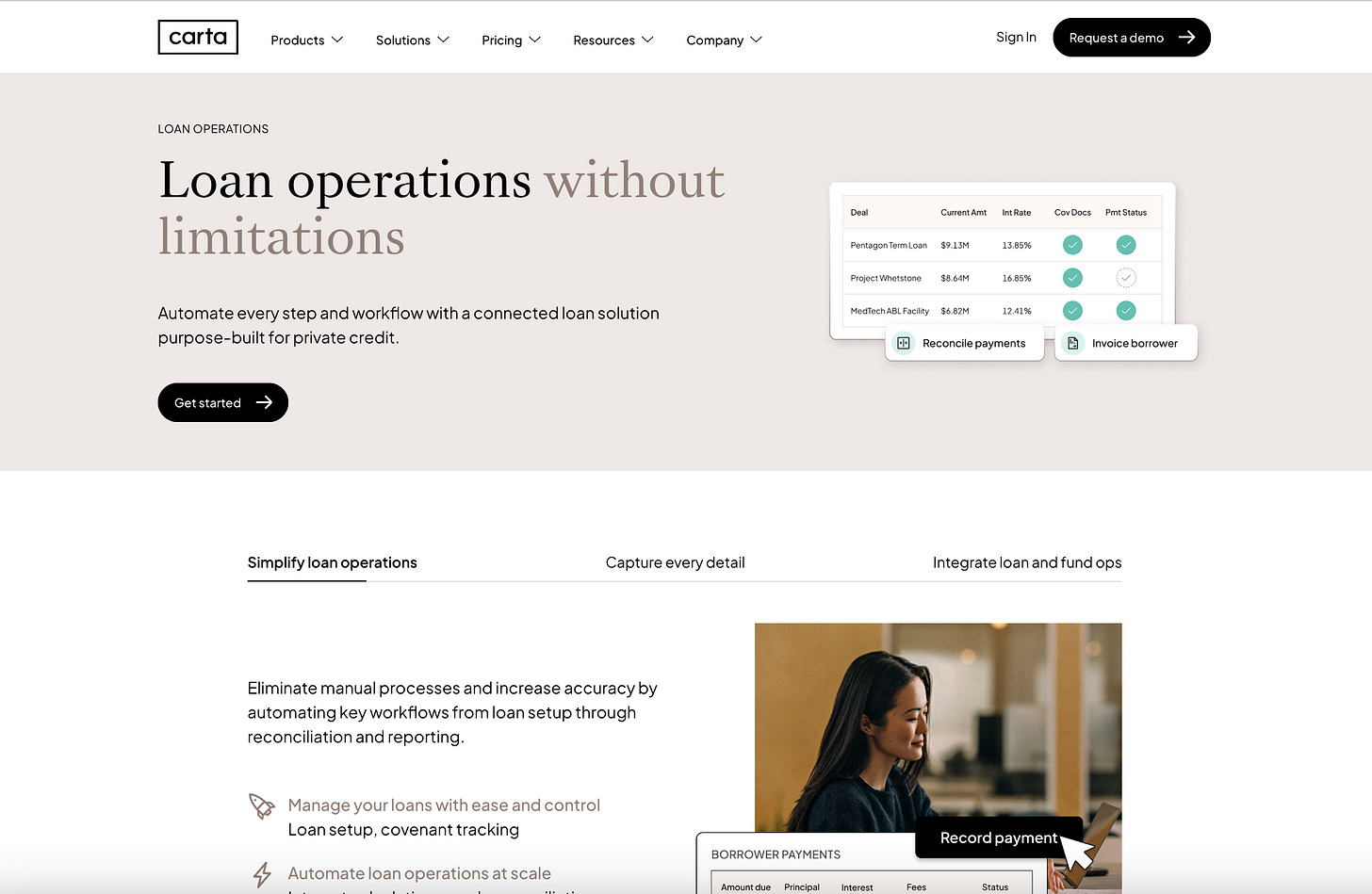

Carta just completed their acquisition of Sirvatus, the leading loan administration platform, to launch Carta Loan Operations. Bringing automation, reconciliation, and audit-ready transparency to one of the fastest-growing asset classes in the world.

And this isn’t just about one product launch. Between Carta Loan Operations and their recent LP Portfolio Analytics rollout with their Accelex acquisition, Carta is going full speed to serve every corner of private capital: VC, PE, private credit, & LPs. Another decisive step toward building the single end-to-end infrastructure layer for global private markets.

Why Private Credit, Why Now

Private credit is on track to reach $3.5 trillion by 2028, yet many fund managers are still running operations on spreadsheets. CFOs face mounting pressure from investors for faster closes, clearer reporting, and airtight audits.. but the tools haven’t kept up → Enter Carta.

The Macro: A Market in Transition, Private Credit Displacing Banks

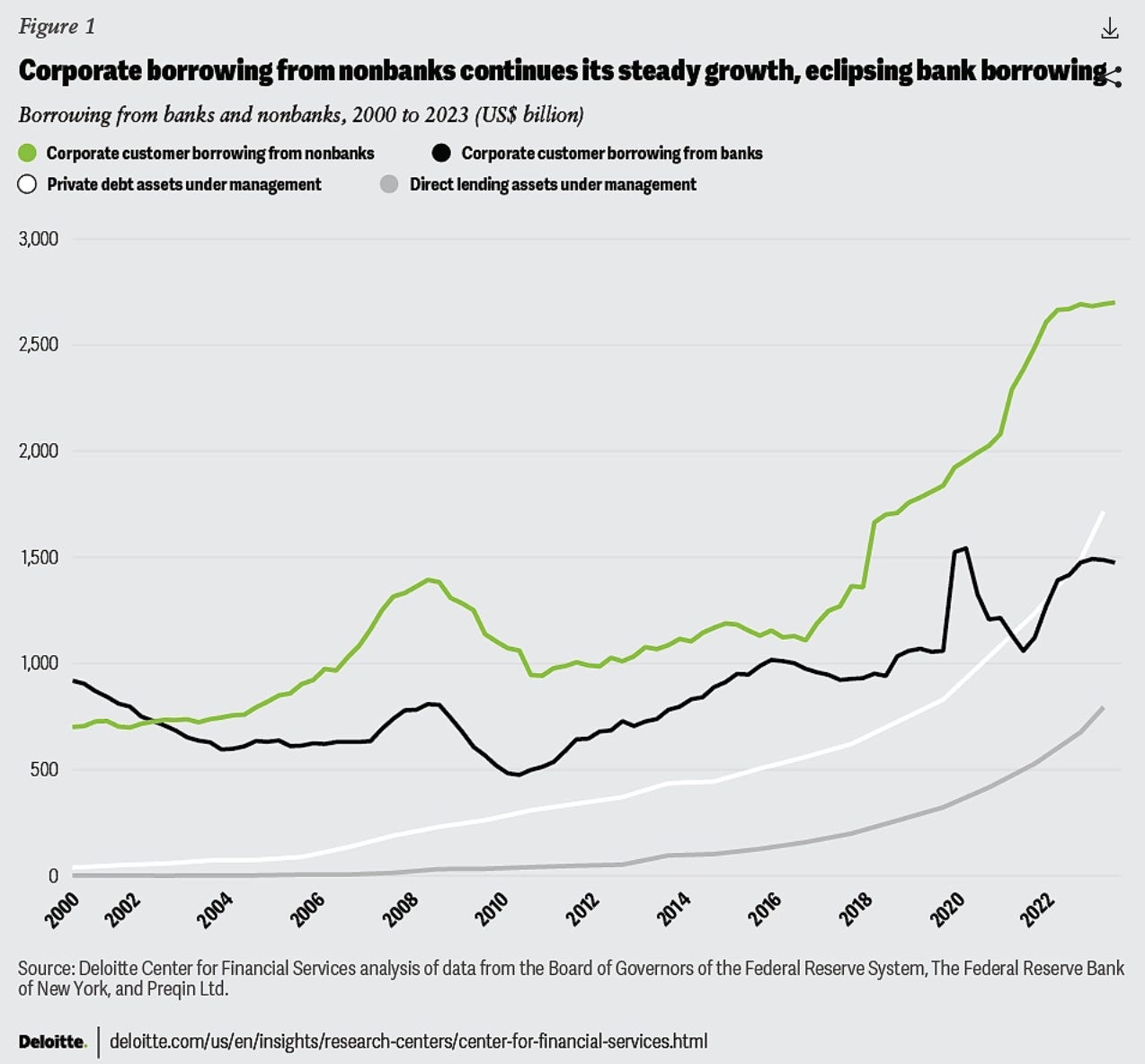

The rise of private credit is reshaping corporate finance in real time. According to Deloitte, bank lending has fallen from 44% of corporate borrowing in 2020 to just 35% in 2023, while nonbank lending surged to $1.6 trillion in AUM globally, now on track to hit $3.5 trillion by 2028. Private credit loans today are far larger than typical bank loans, averaging more than $80 million, a scale once reserved for syndicates of the largest banks.

Private credit managers used to focus on boutique strategies, such as distressed debt.2 But now, direct lending is the dominant strategy; according to Preqin data, it has reached ~US$800 billion in AUM, or about half of all private credit investments.3 The significant growth in direct lending and its mainstream adoption by corporate borrowers helps set it apart from other nonbank lenders.

TLDR Private credit has grown up. What started as niche, opportunistic lending (distressed debt) is now mainstream corporate finance (direct lending), commanding huge pools of capital and competing directly with banks.

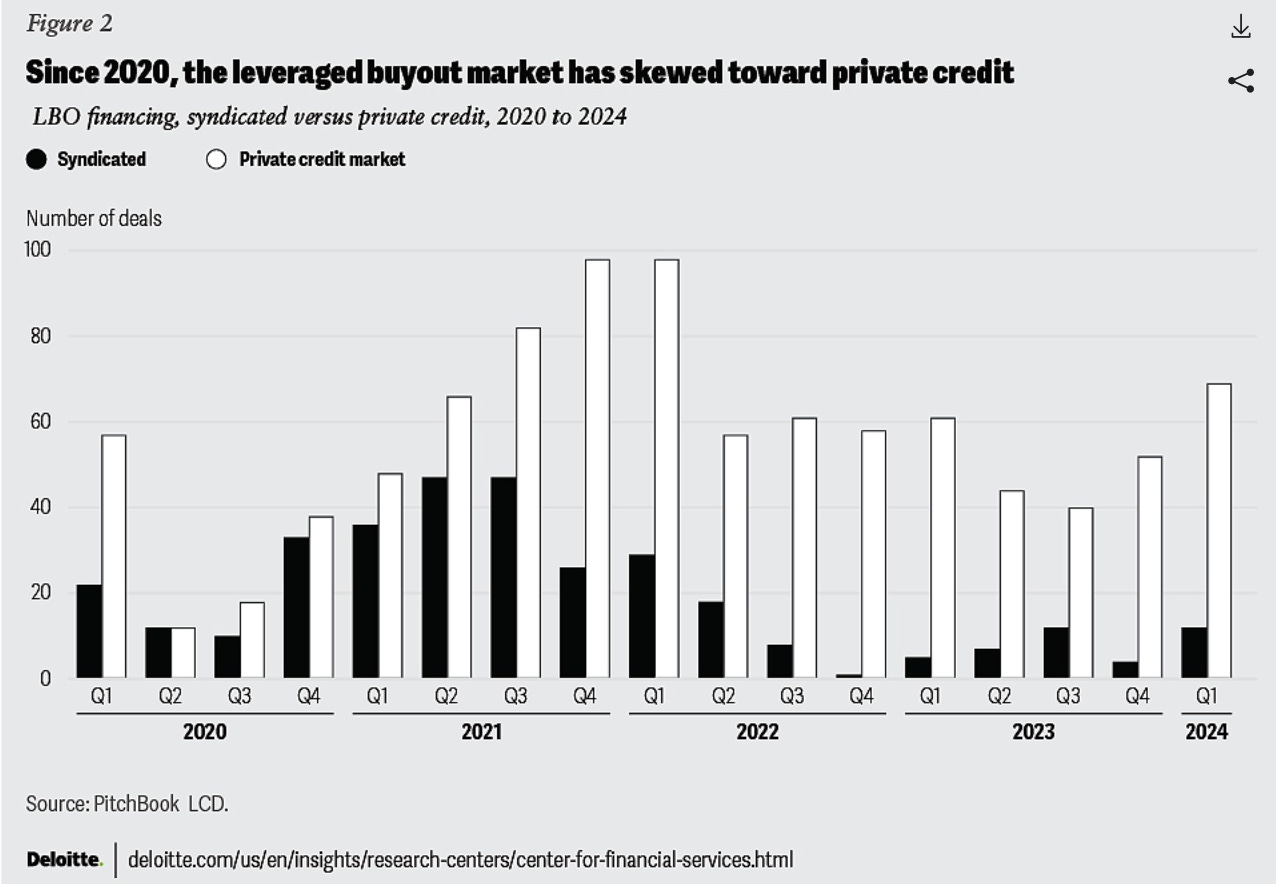

This shift is perhaps most visible in leveraged buyouts, where private credit has displaced banks as the dominant lender. Since 2020, more LBOs have been financed by private credit funds than by the syndicated loan market.

For banks, the implications are enormous. Syndicated loans historically generated billions in underwriting and syndication fees. Now, those revenue streams are eroding as private credit funds step in. Some global institutions, like Goldman Sachs, are responding by scaling their own private credit platforms, while regional banks risk being left behind without a clear strategy.

Against this backdrop, Carta’s move into private credit infrastructure is not just timely, it’s essential. As the balance of power shifts away from banks and into the hands of private credit managers, the demand for modern, integrated fund management systems is only accelerating.

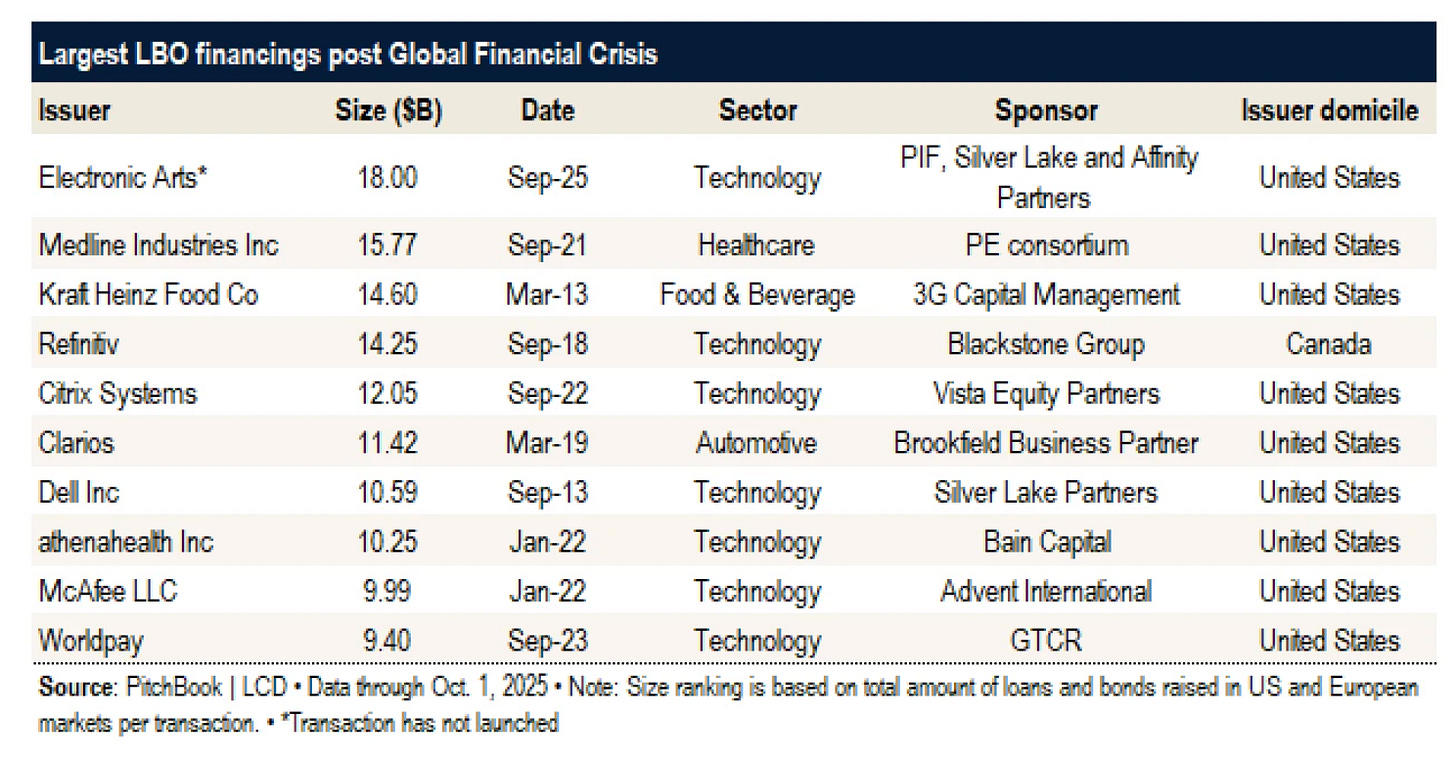

Largest LBO in History

The recent $55 billion leveraged buyout of Electronic Arts, led by Jared Kushner’s Affinity Partners, has become a flashpoint in the debate over how large private credit can go. Backed by a $20 billion debt financing package from JPMorgan (with $18B expected to be funded at close), the EA deal underscored banks’ continuing dominance in mega-cap financings.

But just as importantly, it has put pressure on private credit to prove how big a transaction the market could support.. and might’ve just intensified competition between the two sides.

“The record-breaking $55 billion LBO for Electronic Arts has stoked debate on just how large a loan the private credit market could muster. The EA buyout is backed by a $20 billion debt financing commitment from JPMorgan, of which $18 billion is expected to be funded at close.” Pitchbook

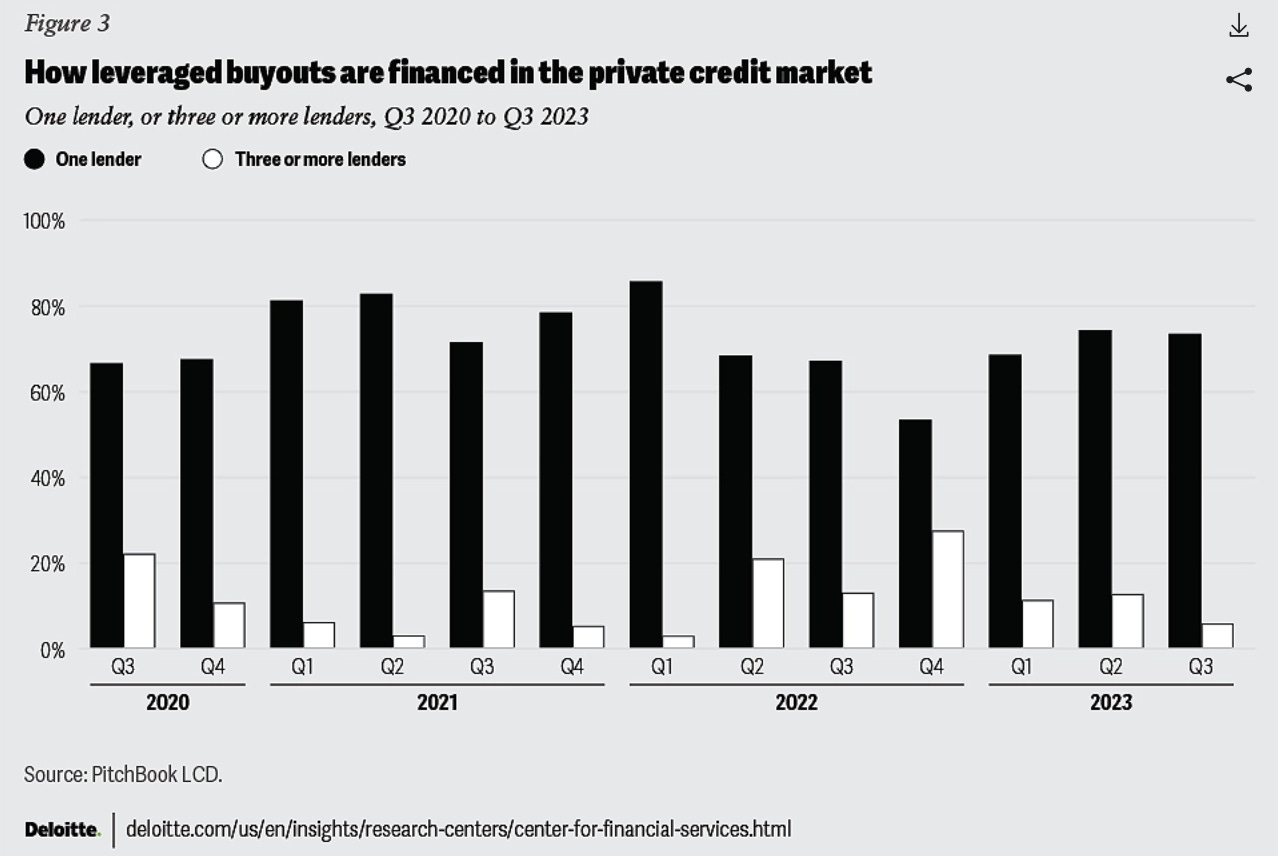

“Given the scale of current commitments and the depth of the market, a $10 billion transaction is potentially achievable for businesses with strong fundamental value,” said Doug Cannaliato, co-head of originations at Antares Capital.

“We’ve seen multiple multi-billion-dollar transactions successfully executed through club deals among relationship-driven private credit investors, including Antares. Private credit investors are increasingly taking on larger hold sizes, especially for high-quality credits,” Cannaliato added.

With this acquisition, Carta will offer:

Native support for complex structures: Capture bespoke deal terms like cash sweeps, PIK toggles, unitranche loans, and amendments directly from loan agreements in a purpose-built system

Automated loan tracking: Real-time dashboards display current loan positions, payment schedules, interest rates, loan and portfolio-level returns modeling and compliance status.

Integrated accounting and reconciliation: Fund accounting updates instantly with every loan transaction, eliminating manual data entry and reconciliation.

Seamless investor reporting: Institutional investors received transparent, timely performance data and customizable reports through Carta’s consolidated LP Portal.

Scalable, audit-ready infrastructure: Built to support funds of all sizes, with automated workflows to ensure accuracy and streamline audits.

As CEO Henry Ward put it:

“Private credit is one of the fastest-growing asset classes, and loan operations are the ERP cornerstone specific to this market. By acquiring Sirvatus, we’re expanding Carta’s ERP to serve private credit fund CFO’s with the same transparency and automation we’ve brought to private equity & venture capital,”

“The acquisition of Sivatus brings us one step closer to our mission of building the definitive system of record for the private markets—one that connects every workflow, from loan data to fund financials, taxes, and LP reporting, on a single integrated platform.”

Completing the Capital Markets Flywheel

This deal caps off a string of strategic moves that show Carta’s ambition to move up-market. The acquisition of Accelex earlier this month expanded Carta’s ability to extract and analyze private market data. Partnerships with Morgan Stanley Wealth Management and the NYSE have extended its reach into distribution and listings.

Taken together, these initiatives are more than incremental. They’re shaping Carta into the operating system for private capital. From startup equity to global credit funds, Carta is building the connective tissue that links assets, funds, and investors in one integrated platform.

Sharp analysis of private credit's ascent and Carta's strategic positioning - particularly insightful how you've highlighted the operational infrastructure gap as private credit displaces traditional bank lending. The automation and transparency challenges in loan operations mirror similar needs in trade credit management. TCLM explores related working capital and credit automation themes from an operational finance perspective.

(It’s free)- https://tradecredit.substack.com/