CEO Bezos, Alex Karp, Elad Gil

Deals: Thinking Machines, Databricks, Cursor, Valar Atomics, Exowatt, Clio, Skims, GoPuff, Public.com | Apollo, Ares, Blue Owl

Brought to you by Brex:

Brex is the intelligent finance platform, combining the world’s smartest corporate card with integrated expense management, banking, bill pay, & travel. Trusted by 35,000+ companies, including ServiceTitan, Anthropic, Scale AI, Mercor, DoorDash, and Wiz. Built for scale. Spend smarter, move faster.

Hello from LA

As Drake once famously quoted the 1977 Canadian rock song by Trooper in Big Sean’s song Blessings ft. Drake, Kanye West: I’m here for a good time, not a long time.

Heading off to DC shortly. A bit late on sharing deals as I just got back from a 20 hour travel day (yesterday), where I had zero wifi on my 12 hour big bus A380 Lufthansa haul.. forcing me to catch up on sleep & podcasts.. the nerve. And yet, I still wake up at 2am PT (reasonable Warsaw hour) to catch up on work. yw.

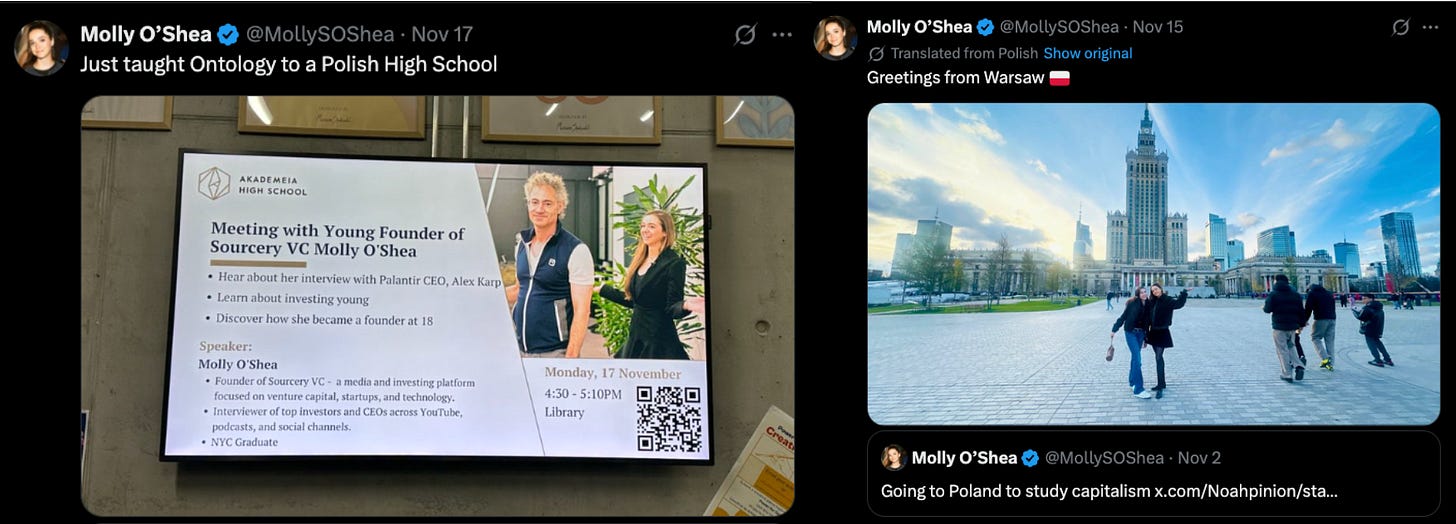

Where was I? NYC → London → Warsaw

Takeaway? Warsaw is underrated. Deep history, unbelievable economic growth, positive energy, lovely people, incredible food. Excited to go back.

Thank you to Sourcery’s Head of Special Ops, Charlotte Wejchert for a fantastic Warsaw tour, & Bruno Jan Wejchert of Strike Capital for some Poland alpha.

Musings

Macro

Dept of War releases new list of Critical Technology Areas.

Under Secretary of War for Research and Engineering, Emil Michael shares more

Ares Management’s CEO on Public Markets, Private Equity, & More

Public Launches Generated Agents with Sick Promo Video.

A new type of asset. Generated by AI. → Now, you can create an investable index with AI. It’s like an ETF, but with infinite possibilities.

Bearish

AI

SoftBank sells its entire stake in Nvidia for $5.83 billion to capitalize on its “all in” bet on ChatGPT maker OpenAI.

Thinking Machines Lab, founded by OpenAI’s former Mira Murati, is in talks to raise a new round at a $50 billion-$60 billion valuation

Databricks in talks to raise capital at above $130 billion valuation

More

Elad Gil Doubles Fund Target to Nearly $3 Billion

Elad has invested in more than 200+ companies, ~40+ valued at $1B+ each, from Stripe, Airbnb, Brex, Deel, & Coinbase to next-gen AI leaders like Perplexity, Harvey, & Decagon.

Top Interviews

Exclusive Interview Inside Palantir w/ CEO Alex Karp | PLTR NYC Office → Listen on X, Spotify, YouTube, Apple

Elad Gil, of Gil Capital + Gil & Co → Listen on X, Spotify, YouTube, Apple

Elad Gil Part II: Incubations, Markets, Startup Redemption Stories → Listen on X, Spotify, YouTube, Apple

→ Follow Sourcery on: X, YouTube, Spotify, Apple, Linkedin

Last Week (11/10-11/14):

Relevant deals include the 70+ deals across stages below. I’ve categorized the deals below into seven categories, Fintech, Care, Enterprise / Consumer, HardTech, Sustainability, Acquisition/PE, and Fund Announcements, and ordered from later-stage rounds to early-stage rounds.

VC Deals

Fintech:

- Lighter, an Ethereum-based DEX and Layer 2 network, raised $68m at a $1.5b valuation; Founders Fund and Ribbit Capital led, with Haun Ventures and Robinhood participating.

- Maybern, a N.Y.-based provider of software that automates calculations for private fund managers, raised a $50m Series B led by Battery Ventures, and joined by Primary Venture Partners, Human Capital, MetaProp, Grafton Street Partners, Camber Creek, and Friends & Family Capital

- Arrived, a Seattle, Wash.-based platform for fractional real estate investing, raised $27 million in funding. Neo led the round and was joined by Forerunner Ventures, Bezos Expeditions, Core, and others.

- Anzen, a San Francisco-based AI-powered distribution platform for commercial insurance, raised $16 million in Series A funding. Madrona led the round and was joined by Sandbox Industries, SNR, Andreessen Horowitz, and others.

- District Cover, a Nashville, Tenn.-based insurance agency focused on covering small businesses in underserved urban communities, raised $6 million in funding. IA Capital led the round and was joined by Mosaic, Impact America Fund, and existing investors.

- Adclear, a London, U.K.-based AI-powered platform designed for financial promotions compliance, raised £2.1 million ($2.7 million) in seed funding. Outward VC led the round and was joined by AFG Partners, Tenity, and others.

- Greenshoe, a Chicago, Ill.-based AI platform designed for SEC disclosure automation and investor relations, raised $3 million in seed funding. AIX Ventures led the round and was joined by Hearst Level Up Ventures, Blueprint FTC, Service Provider Capital, and others.

- FALKIN, a London, U.K.-based digital payment security platform, raised $2 million in pre-seed funding. TriplePoint Ventures led the round and was joined by Notion Capital, Back Future Ventures, Aviva/Founders Factory, Haatch, and others.

Care:

- Beacon Biosignals, a Boston, Mass.-based AI-powered brain health company, raised $86 million in Series B funding from Innovia, Google Ventures, Nexus NeuroTech Ventures, and others.

- House Rx, as developer of in-clinic specialty pharmacies, raised $35m in Series B equity funding led by NEA and Town Hall Ventures. It also secured $20m in debt

- Robyn AI, a San Francisco-based AI assistant designed for emotional support, raised $5.5 million in seed funding. M13 led the round and was joined by others.

- Evidium, a San Francisco, Calif.-based health care AI company, raised $22 million in Series A funding. Health2047 and WGG Partners led the round and were joined by Interwoven Ventures and Mindset Ventures.

- Joy, a San Francisco-based platform that connects parents with parenting experts, raised $14 million in Series A funding. Forerunner Ventures and Raga Partners led the round and were joined by Magnify Ventures, Ingeborg Investments, and others.

- Modulight Biotherapeutics, a Boston, Mass.-based developer of medicines for people with neurological disorders, raised $12.2 million in seed funding. Jibe Ventures and LocalGlobe led the round and were joined by Nexus Neurotech Ventures, RedSeed VC, Secret Chord Ventures, and others.

- Preveta, a Los Angeles, Calif.-based AI-powered care navigation platform designed for specialty care, raised $2.4 million in a Series A extension. Navigate Ventures and Sovereign Capital led the round and were joined by Bullpen Capital and TMV.

Enterprise/Consumer:

- Anysphere, the maker of coding assistant Cursor, raised $2.3b at a $29.3b post-money valuation. Accel and Coatue led, joined by Thrive Capital, DST Global, Nividia, and Google

- Clio, a Canadian legal practice management platform, raised US$500m in Series G funding at a $5b valuation. NEA led, joined by TCV, Goldman Sachs Asset Management, Sixth Street Growth, and JMI Equity. It also raised $350m in debt led by Blackstone and Blue Owl Capital.

- Gopuff, a Philadelphia, Penn.-based courier service, raised $250 million in funding. Eldridge Industries and Valor Equity Partners led the round and were joined by Baillie Gifford, Equalis Capital, and others.

- SKIMS, a Los Angeles, Calif.-based shapewear company, raised $225 million in funding. Goldman Sachs Alternatives led the round and was joined by BDT & MSD Partners.

- Alembic, a San Francisco-based developer of a casual AI platform designed to provide marketing analytics for C-Suite executives, raised $145 million in Series B funding. Prysm Capital and Accenture led the round and were joined by Silver Lake Waterman, Liquid 2 Ventures, and others.

- Parallel, a Palo Alto, Calif.-based company led by ex-Twitter CEO Parag Agrawal developing infrastructure designed to enable AI agents to access and think with the web, raised $100 million in Series A funding. Kleiner Perkins and Index Ventures led the round and were joined by Spark Capital and existing investors.

- Wonderful, an Amsterdam, The Netherlands-based AI agent for enterprises, raised $100 million in Series A funding. Index Ventures led the round and was joined by Insight Partners, IVP, and existing investors Bessemer and Vine Ventures.

- Sweet Security, a Tel Aviv, Israel-based runtime CNAPP and AI security solutions platform, raised $75 million in Series B funding. Evolution Equity Partners led the round and was joined by Munich Re Ventures, Glilot Capital Partners, and others.

- Tenzai, an Israeli penetration testing startup, raised $75m in seed funding from Greylock, Battery Ventures, Lux Capital, and Swish Ventures.

- Scribe, an SF-based workflow documentation startup, raised $75m in Series C funding at an $1.3b valuation. StepStone led, joined by Amplify Partners, Redpoint Ventures, Tiger Global, Morado Ventures, and New York Life Ventures.

- CoLab, a Canadian maker of collaboration software for manufacturers, raised US$72m in Series C funding. Intrepid Growth Partners led, joined by Insight Partners, YC, Pelorus VC, Killick Capital, and Spider Capital

- Gamma, a San Francisco-based AI-powered presentation-making platform and website builder, raised $68 million in Series B funding. Andreessen Horowitz led the round and was joined by Accel, Uncork Capital, and others.

- GC AI, a San Francisco-based AI platform for in-house legal teams, raised $60 million in Series B funding. Scale Venture Partners and Northzone led the round and were joined by Sound Ventures, Aglaé Ventures, and others.

- WisdomAI, a San Francisco-based developer of an AI data analyst platform, raised $50 million Series A funding. Kleiner Perkins led the round and was joined by NVentures and existing investors.

- 1mind, a San Francisco-based AI platform designed to lead marketing, sales, and customer success, raised $40 million in funding, including a $30 million Series A round led by Battery Ventures and joined by Primary Ventures, Wing Venture Capital, and others.

- AirOps, a New York City-based content engineering platform for AI search, raised $40 million in Series B funding. Greylock led the round and was joined by Unusual Ventures, Wing Venture Capital, XFund, Village Global VC, and Frontline VC.

- Tavus, a San Francisco-based developer of AI companions designed to handle tasks proactively and interpret human body language, raised $40 million in Series B funding. CRV led the round and was joined by Scale Venture Partners, Sequoia Capital, Y Combinator, HubSpot Ventures, and Flex Capital.

Carta—Carta connects founders, investors, and limited partners through software purpose-built for private capital. Trusted by 2.5M+ equity holders, 65,000+ companies in 160+ countries, Carta’s platform of software & services lays the groundwork so you can build, invest, and scale with confidence.

- Fastbreak AI, a Charlotte-based provider of sports operations software, raised $40m in Series A funding from Greycroft, GTMfund, the NBA, NHL, and TMRW Sports

- TRIP, a botanical beverage brand, raised $40m at over a $300m valuation from Coefficient Capital, Joe Jonas, Alessandra Ambrosio, Paul Wesley, and Ashley Graham

- Code Metal, a Boston, Mass.-based verifiable code translation platform for mission critical industries, raised $36.5 million in Series A funding. Accel led the round and was joined by RTX Ventures, Bosch Ventures, and others.

- Beside, a Paris, France-based developer of an AI application designed to handle calls and texts, raised $32 million across Series A and seed rounds. EQT Ventures led the Series A round and Index Ventures led the seed round.

- Attentive.ai, a Wilmington, Del.-based developer of AI-powered takeoff software for field service and construction companies, raised $30.5 million in Series B funding. Insight Partners led the round and was joined by Vertex Ventures, Tenacity Ventures, and InfoEdge Venture Fund.

- CloudX, a San Francisco-based AI-powered advertising platform for mobile publishers, raised $30 million in Series A funding. Addition led the round and was joined by DST Global, Terrain, and others.

- BoomPop, an SF-based company events platform, raised $25m. Wing VC led, joined by Atomic, Acme, Four Rivers, Thayer Investment Partners, the Fund of Operators Guild, and Gaingels. It also secured $16m in debt from SVB

- Rebel, a Kannapolis, N.C.-based recommerce marketplace for open-box and overstock goods, raised $25m in Series B funding led by MarcyPen

- sunday, an Atlanta, Ga.-based payment platform designed for restaurant hospitality, raised $21 million in Series B funding from DST Global Partners and others.

- Agency, a customer success startup, raised $20m in Series A funding. Menlo Ventures led, joined by Sequoia Capital, Felicis Ventures, Snowflake Ventures, and Databricks Ventures.

- Humanix, a San Francisco-based cybersecurity platform designed to detect cyber threats preying on employees, raised $18 million across Series A and seed funding. Acrew Capital led the Series A round and BoldStart Ventures led the seed round.

- Vend Park, a Boston, Mass.-based AI-powered parking technology and operations company, raised $17.5 million in Series A funding. Blue Heron Capital led the round and was joined by Nuveen’s Real Asset Ventures, Communitas Capital, and others.

- The Snow League, a New York City-based winter sports league, raised $15 million in funding from 359 Capital, BITKRAFT Ventures, Wise Ventures, and others.

- Uare.ai (fka: Eternos), a developer of personal AIs, raised $10.3m in seed funding led by Mayfield and Boldstart Ventures

- Milestone, a Tel Aviv, Israel-based platform for measuring the adoption and impact of AI coding tools, raised $10 million in seed funding. Heavybit and Hanaco Ventures led the round and were joined by Atlassian Ventures and angel investors.

- Obello, a San Francisco-based AI-powered graphic design platform, raised $8.5 million in seed funding. Obvious Ventures led the round and was joined by Baukunst and others.

- Deductive AI, a Mountain View, Calif.-based AI-powered root cause analysis and resolution platform, raised $7.5 million in seed funding. CRV led the round and was joined by Databricks Ventures, Thomvest Ventures, and PrimeSet.

- NLPatent, a Toronto, Canada-based AI-powered patent research and intelligence platform, raised $3 million in funding. Mighty Capital and Draper Associates led the round and were joined by The Legal Tech Fund, Storytime Capital, and The51.

- Relixir, a San Francisco-based AI search inbound engine, raised $2 million in seed funding from Y Combinator, z21 Ventures, 468 Capital, and others.

HardTech:

- CHAOS Industries, a Los Angeles, Calif.-based developer of threat-detection and anti-radar software for the defense industry, raised $510 million in Series D funding. Valor Equity Partners led the round and was joined by 8VC and Accel.

- d-Matrix, a Santa Clara, Calif.-based developer of a data center AI inference platform, raised $275 million in Series C funding. A consortium of investors including BullhoundCapital, Triatomic Capital, and Temasek led the round and were joined by others.

- Forterra, a Clarksburg, Md.-based provider of autonomous commercial and military vehicles, raised $238m in Series C equity and debt funding. Moore Strategic Ventures led the equity tranche, joined by Salesforce Ventures, Franklin Templeton, Balyasny Asset Management, 645 Ventures, Hanwha Asset Management, 9Yards, XYZ Venture Capital, Enlightenment Capital, and Hedosophia. Debt came from Crescent Cove.

- Harbinger, a maker of commercial EVs, raised $160m in Series C funding. FedEx, Capricorn, and THOR Industries led, joined by Ridgeline, Tiger Global, Leitmotif, Maniv Mobility, Schematic Ventures, Overture Climate, Ironspring Ventures, ArcTern Ventures, Litquidity Ventures, and The Coca-Cola System Sustainability Fund.

- Teradar, a Boston-based developer of solid-state sensors, raised $150m in Series B funding from Capricorn Investment Group, Lockheed Martin Ventures, IBEX Investors, and VXI Capital.

- Valar Atomics, a Hawthorne, Calif.-based developer of nuclear gigasites, raised a $130m Series A. Snowpoint Ventures, Day One Ventures and Dream Ventures led, joined by Riot Ventures, Balerion Ventures, Contrary, and Palmer Luckey

- Majestic Labs, a San Francisco-based developer of AI servers, raised $100 million in Series A funding. Bow Wave Capital led the round and was joined by Lux Capital, SBI, Upfront, and others.

- Neros, an El Segundo, Calif.-based military drone maker, raised $75m in Series B funding. Sequoia Capital led, joined by Vy Capital and Interlagos

- Carbon, a Redwood City, Calif.-based 3D printing company, raised $60 million led by insiders Sequoia Capital and Silver Lake. With participation from Adidas, Baillie Gifford, Madrone, and Northgate. The company previously raised over $700 million.

- Fabric8Labs, a San Diego, Calif.-based developer of advanced additive manufacturing facilities that can create metal parts that cannot be created with traditional manufacturing, raised $50 million in funding. NEA and Intel Capital led the round and were joined by existing investors Lam Capital, TDK Ventures, SE Ventures, and others.

- Extellis, a Durham, N.C.-based satellite imaging company, raised $6.8 million in seed funding. Oval Park Capital led the round.

- Spectral Compute, a London, U.K.-based developer of a software designed to enable Compute Unified Device Architecture applications to run on any GPU, raised $6 million in seed funding. Costanoa led the round and was joined by Crucible and angel investors.

- Dryft, a San Francisco-based developer of an AI platform designed to automate human decisions in manufacturing operations, raised $5 million in seed funding. General Catalyst led the round and was joined by Neo, Sandberg Bernthal Venture Partners, and angel investors.

- Sensetics, a Princeton, N.J.-based haptics and touch data company, raised $1.8 million in pre-seed funding. MetaVC Partners and Fitz Gate Ventures led the round and were joined by Blue Sky Capital and AIC Ventures.

- Litmus, a San Jose, Calif.-based industrial edge data platform, raised funding from Insight Partners and Munich Re Ventures.

Sustainability:

- Exowatt, a Miami-based solar storage startup, raised $50m in a Series A extension round, led by by MVP Ventures and 8090 Industries and including The Florida Opportunity Fund, DeepWork Capital, Dragon Global, Massive VC, New Atlas Capital, BAM, Overmatch, Protagonist, StepStone, Atomic, and Bay Bridge Ventures

- ElectronX, a Chicago-based energy exchange, raised a $30 million Series A round led by DCVC, and joined by XTX Markets, Five Rings, NGP, GTS, and JACS Capital

- Bindwell, a San Francisco-based company using AI to develop pesticides designed to be safer, raised $6 million in seed funding. General Catalyst and A Capital led the round and were joined by SV Angel and Paul Graham.

Acquisitions & PE:

- Megaport agreed to acquire Latitude.sh, a New York City-based CPU and GPU infrastructure provider, for $300 million.

- TSG Consumer acquired a minority stake in Pura Vida Miami, a Miami, Fla.-based all-day cafe and lifestyle brand. Financial terms were not disclosed.

- Pfizer (NYSE: PFE) won the takeover battle for Metsera (Nasdaq: MTSR), beating out Novo Nordisk (NYSE: NVO).

- Bill.com (NYSE: BILL) is weighing a sale, following activist pressure from Starboard Value

- C3 AI (NYSE: AI) is weighing a sale, following the recent resignation of CEO Tom Siebel

- Fabric, an NYC-based health-care ops enabler, acquired UCM Digital Health, a Claymont, Del.-based telehealth provider for payors and employers

- LVMH (Paris: MC) agreed to buy a minority stake in Swiss watchmaker La Joux-Perret

- Quadrum Global, a London-based real estate investor, is seeking to sell boutique lodging chain Arlo Hotels

- State Street (NYSE: STT) acquired PriceStats, a Cambridge, Mass.-based provider of daily inflation statistics.

- Activated Insights, backed by Cressey & Co., acquired CareAcademy, a Boston-based caregiver education and compliance automation provider that had raised over $30m from firms like Multiplier Capital, Seae Ventures, Rethink Capital Partners, and Impact America Fund

- Aston Martin chair Lawrence Stroll has explored a deal with Public Investment Fund to take the U.K. luxury car maker private

- Coinbase (NASDAQ: COIN) has reportedly ended talks to acquire U.K.-based stablecoin infrastructure startup BVNK in a deal that could have been worth around $2b

- Cursor, the coding assistant maker that raised $2.3b at a $29.3b post-money valuation, acquired Growth by Design, a U.K.-based tech recruiting strategy company

- Public, a NYC-based long-term investing platform, acquired the CryptoIRA business from Alto, a Nashville, Tenn.-based self-directed IRA platform, for $65m

IPOs:

- Corvex, a Washington, D.C.-based cloud computing company, agreed to go public via a reverse merger with Movano (Nasdaq: MOVE).

- Einride, a Swedish provider of autonomous freight trucks, agreed to go public at an implied $1.8b pre-money valuation via Legato Merger Corp III (NYSE: LEGT). Einride has raised over $800m from firms like Abony Capital, EQT Ventures, IonQ, and NordicNinja

- Grayscale, a crypto asset manager controlled by Digital Currency Group, filed for an IPO. It reports $35b in AUM and plans to list on the NYSE.

Funds:

- J2 Ventures, a Boston, Mass.-based venture capital firm, raised $250 million for its new Brookhaven Fund focused on developing technologies across advanced computing, cybersecurity, AI, and other tech fields.

- Glasswing Ventures, a Boston, Mass.-based venture capital firm, raised $200 million for its third fund focused on pre-seed and seed investments in AI-native and frontier tech companies.

Love merch? Check out our shop: sourcerymerch.com

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.