🚀 Eric Schmidt joins Space Club

Varda, Manus, Cursor, Moveworks, Weights & Biases, Shield AI, Epirus, Ramp, Anthropic, Peregrine, Aescape, Zietview, AvatarOS, Flex

Today’s Sourcery is brought to you by Archer..

Learn more about how Archer is set to open a new world of opportunity for passengers by providing safe and efficient access to people, places, and events across the communities they live at archer.com

Hello from Space

Move over Yellowstone Club.. Eric Schmidt has officially joined the more exclusive, Space Club, as the new CEO of Relativity. Fomo must’ve be real in the group chats as Musk and Bezos continue to dominate headlines.. and I get it. Space is just too fun, and too cool. It’s hard to resist the mission and the physicality of building for the cosmos. And while I didn’t make the list for Lauren Sánchez’s GNO Blue Origin flight, I did get pulled into a space factory Sunday night to help a friend make schedule for their lunar rover by preparing battery cells & making wire harnesses 😅 (soldering is fun). The hype is real.

Relativity is among the ranks of the vibrant SoCal ecosystem that’s been heavily pulling talent, attention, and VC dollars for the past couple of years. Neighboring companies include SpaceX, Rocket Lab, Varda, Impulse Space, Apex, AstroLab, SpaceForge, Starpath, Reflect Orbital, K2 Space, Northwood, and more. #LongLA

News: Varda space capsule returns to Earth in 1st commercial landing in Australian Outback (check out photos + videos on X)

Musings

Macro

Global private markets fundraising report [Pitchbook]

Global Private Equity Report 2025 [Bain]

BlackRock to buy Panama Canal ports after pressure from Donald Trump [FT]

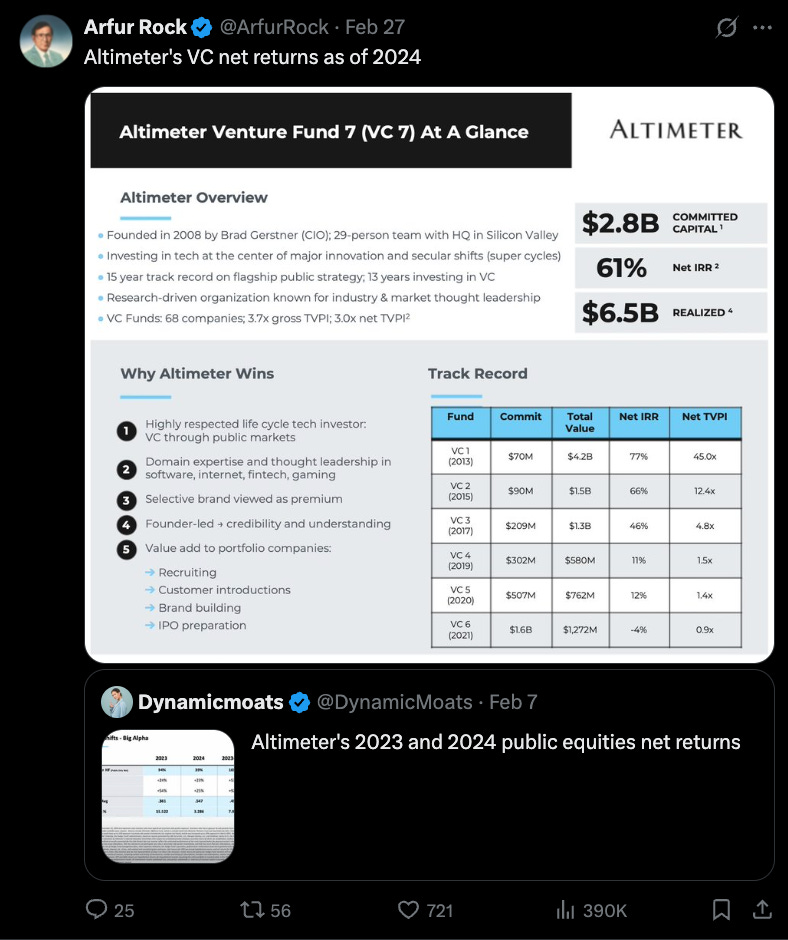

Arfur Rock continues to go on a tear.. leaking impressive figures for startups & funds 👀

M&A

ServiceNow Nears Deal to Buy AI Assistant Maker Moveworks for almost $3B [Bloomberg]

Rocket Companies to buy real estate firm Redfin in $1.75 billion deal [Reuters]

CoreWeave and Weights & Biases to Join Forces for around $1.7B [Information]

AI

Coding app Cursor in talks for $10B valuation, surpassed $100 million in recurring revenue in 12 months [Bloomberg]

PTSD of 2021 valuation levels.. didn’t we learn from the big repricing? (ie. Klarna, Plaid, etc)

Manus probably isn’t China’s second ‘DeepSeek moment’ [TechCrunch]

If you want an access code DM me

More

How Kettle & Fire Turned Bone Broth Into A $100 Million Business [Forbes]

Renewables Account for 90% of US Power Generation in 2024 [REI]

Shoutout to Simon Wu of Cathay Innovation for sharing this prospective fintech IPO pipeline - see slide 21

Congrats to Kristin McDonald!!!

Startup of the Week: AvatarOS

AvatarOS snags $7M seed round from M13 to build an AI-powered virtual influencer platform. Founder Isaac Bratzel, previously created popular viral influencers such as Lil Miquela and Amelia 2.0.

Top Interviews

Delian Asparouhov of Varda & Founders Fund | Varda's Landing, Peter Thiel, & El Segundo

Aramco of The Moon: Starpath | Lunar Ice Mining For Multi-planetary Species

Kalshi CEO, Tarek Mansour | The Future of Free Markets Raising $110M. Rise of Prediction Markets.

Last Week (3/3-3/7):

Relevant deals include the 70+ deals across stages below. I've categorized the deals below into seven categories, Fintech, Care, Enterprise / Consumer, HardTech, Sustainability, Acquisition/PE, and Fund Announcements, and ordered from later-stage rounds to early-stage rounds.

Final Numbers

Klarna’s Valuation Rollercoaster

VC Deals

Fintech:

- Ramp, a New York-based financial operations platform, announced a $150m secondary share sale at a $13b valuation. Backers include Stripes, GIC, Avenir Growth, Thrive Capital, Khosla Ventures, General Catalyst, Lux Capital, 137 Ventures, and Definition Capital.

- Grain, a Tel Aviv, Israel-based capital markets platform designed for microtransactions, raised $33 million in Series A funding. Bain Capital Ventures led the round and was joined by existing investors Aleph, Vessey Ventures, and Hanaco Ventures.

- Flex, a Miami, Fla.-based financial platform designed for personal and business uses, raised $25 million in funding. Titanium Ventures led the round and was joined by Companyon Ventures, Florida Funders, MS&AD Ventures, AAF Management, and First Look Partners.

- Numeral, a San Francisco-based sales tax compliance platform for ecommerce and SaaS companies, raised $18 million in Series A funding. Benchmark Capital led the round and was joined by existing investors Uncork Capital, Y Combinator, and FundersClub.

- Zocks, a San Francisco-based AI platform designed for financial advisors, raised $13.8 million in Series A funding. Motive Ventures led the round and was joined by Lightspeed Venture Partners, Expanse Venture Partners, Entrée Capital, and 14Peaks.

- CoverForce, a New York City-based insurance infrastructure platform, raised $13 million in Series A funding. Insight Partners led the round and was joined by Nyca Partners.

- August, a New York City-based crypto-focused prime brokerage firm, raised $10 million in Series A funding. Dragonfly Ventures led the round and was joined by SCB Limited, 6th Man Ventures, and Foresight Ventures.

- FairPlay, a provider of fairness testing software for lenders, raised $10m from Infinity Ventures, JPMorganChase, and Nyca Partners.

- Alta, a Tel Aviv-based revenue workforce solutions provider, raised $7 million in seed funding. Entrée Capital and Target Global led the round and were joined by Ben Lang and others.

- Outmarket AI, a San Francisco-based AI-powered platform designed for insurance workflows, raised $4.7 million in seed funding. Fika Ventures led the round and was joined by TTV and Dash Fund.

Care:

- Freed, a San Francisco-based AI-powered clinician tool, raised $30 million in Series A funding. Sequoia Capital led the round and was joined by Scale Venture Partners, Daniel Gross, Gokul Rajaram, and Ted Zagat.

- Ataraxis AI, a New York City-based precision medicine company, raised $20.4 million in Series A funding. AIX Ventures led the round and was joined by Floating Point, Thiel Bio, Founders Fund, Bertelsmann Investments, Giant Ventures, Obvious Ventures, and angel investors.

- Heidi Health, a Melbourne, Australia-based AI-powered medical scribe for clinicians, raised $16.6 million in Series A funding. Headline led the round and was joined by Local Globe, Anthology, and existing investors Blackbird, HESTA, Possible Ventures, and Archangel Ventures.

- Gem Specialty Health, a Minneapolis, Minn.-based sleep care company, raised $7 million in Series A funding. HealthTrend Capital and LFE Capital led the round and were joined by existing investors Base10 Partners and Mairs & Power Venture Capital.

Enterprise/Consumer:

- Anthropic, the generative AI juggernaut, has raised $3.5 billion led by Lightspeed Venture Partners at a $61.5 billion post-money valuation, 0ther investors include Cisco Investments, Fidelity, D1 Capital Partners, Menlo Ventures, General Catalyst, Jane Street, and Salesforce Ventures.

- Peregrine Technologies, a San Francisco-based data intelligence platform, raised $190 million in Series C funding. Sequoia Capital led the round and was joined by existing investors Goldcrest Capital, Friends & Family Capital, Fifth Down Capital, OG Venture Partners, and Godfrey Capital.

- Quantexa, a London-based developer of decision intelligence technology, raised $175 million in Series F funding. Teachers’ Venture Growth led the round and was joined by existing investors including British Patient Capital.

- Turing, a Palo Alto, Calif.-based AI engineer HR platform, raised $111m in Series E funding at a $2.2b valuation. Khazanah Nasional Berhad led, and was joined by Westbridge Capital, Sozo Ventures, Uphonest Capital, AltaIR Capital, Amino Capital, Plug and Play, MVP Ventures, Fortius Ventures, Gaingels, and Mastodon Capital Management.

- Odeko, a New York-based provider of ordering and supply chain software to restaurants and cafes, raised $96m in Series E funding. B Capital led, and was joined by Balius Partners, Era Funds, FJ Labs, KSV, Tiger Global Management, Two Sigma Ventures, and Primary Ventures. It also secured a $30m credit facility.

- PetScreening, a Mooresville, N.C.-based platform designed to help property owners manage their pet policies, raised $80 million in Series B funding from Volition Capital, Guidepost Growth Equity, and others.

- Mews, a New York City-based hospitality technology platform, raised $75 million in funding. Tiger Global led the round and was joined by existing investors Kinnevik, Growth Equity at Goldman Sachs Alternatives, and Battery Ventures.

- SpecterOps, an Alexandria, Va.-based cyber security company, raised $75 million in Series B funding. Insight Partners led the round and was joined by Ansa Capital, M12, Ballistic Ventures, Decibel, and Cisco Investments.

- Firsthand,, a developer of AI agents for brands and publishers, raised $26m in Series A funding. Radical Ventures led, and was joined by FirstMark Capital, Aperiam Ventures, and Crossbeam Venture Partners.

- Auxia, a Palo Alto, Calif.-based marketing technology platform, raised $23.5 million in funding. VMG Technology Partners led the round and was joined by MUFG Innovation Partners (MUIP), Incubate Fund, Vela Partners, Stage 2 Capital, and others.

- Swap, a London, U.K.-based e-commerce operating system, raised $40 million in Series B funding. ICONIQ Growth led the round and was joined by existing investors Cherry Ventures, QED Investors, and 9900 Capital.

- Rinse, a San Francisco-based laundry and dry cleaning pickup and delivery app, raised $23 million in Series D funding. LG Electronics led the round and was joined by Trinity Capital.

- LlamaIndex, a San Francisco-based developer of AI agents designed to analyze with and work through enterprise data, raised $19 million in Series A funding. Norwest Venture Partners led the round and was joined by existing investor Greylock.

- Instant, a Sydney, Australia-based retention marketing platform for ecommerce brands, raised $18 million in Series A funding. Hummingbird Ventures led the round and was joined by existing investors.

- Archipelo, a San Francisco-based cybersecurity startup designed to secure human and AI-generated code from security breaches, raised $12 million across pre-seed and seed rounds. The $4 million pre-seed round was led by David Weisburd, Bill Tai, Eric Yuan, Gil Penchina, and Andy Bechtolsheim, who were joined by Samsung Next, Sriram Krishnan, Steve Suda, and David Lee, Nima Capital, Anima Anandkumar, and Global Founders Capital. The $8 million seed round was led by Dell Technologies Capital and joined by Bill Tai, Sangha Capital, David Weisburd, Gil Penchina, and existing investors.

- Ceramic.ai, a San Francisco-based generative AI model training for enterprises, raised $12 million in seed funding from NEA, IBM, Samsung Next, Earthshot Ventures, and Alumni Ventures.

- FairPlay, a Los Angeles-based AI governance platform, raised $10 million in funding from Infinity Ventures, JPMorganChase, and existing investor Nyca Partners.

- Aryon Security, a Tel Aviv-based Cloud Security Enforcement Platform designed to prevent enterprise cloud risks before they are deployed in production systems, raised $9 million in seed funding. Viola Ventures and Blumberg Capital led the round and were joined by Shlomo Kramer and other angel investors.

- MaxIQ, a San Ramon, Calif.-based AI-powered customer journey management platform, raised $7.8 million in seed funding. Dell Technologies Capital led the round and was joined by Intel Capital.

- welevel, a Munich-based video game studio, raised $5.7 million in seed funding. BITKRAFT Ventures led the round and was joined by BMWK (DLR), goodwater, and angel investors.

- Copley, a Boston, Mass.-based AI-powered content optimization platform, raised $4.8 million in funding. Asymmetric Capital Partners and Underscore VC led the round and were joined by angel investors.

- Uniti AI, a New York City-based developer of AI agents for the real estate industry, raised $4 million in seed funding. Prudence led the round and was joined by Alate Partners, Flex Capital, Observer Capital, and RE Angels.

- Intangible, a San Francisco-based company that makes AI-powered tools for creating 3D content, raised $4 million in funding from a16z Speedrun, Crosslink Capital, Karman Ventures, and angel investors.

- Momentic, a San Francisco-based AI end-to-end testing platform for developers, raised $3.7 million in seed funding from FundersClub, General Catalyst, Y Combinator, AI Grant, and angel investors.

- HeyMilo, a New York City-based AI-powered candidate screening platform, raised $2.2 million in seed funding. Canaan Partners led the round and was joined by Alumni Ventures and Entrepreneurs Roundtable Accelerator.

- Platter, which helps brands build Shopify storefronts, raised $1.6m in pre-seed funding. Animal Capital led, and was joined by Visionary Ventures.

HardTech:

- Shield AI, a San Diego-based developer of drone tech for the military, raised $240m in Series F-1 funding at a $5.3b valuation from L3Harris, Hanwha Aerospace and insiders a16z, U.S. Innovative Technology, and Washington Harbour

- Epirus, a Redondo Beach, Calif., developer of anti-drone systems, raised $200m in Series D funding. 8VC and Washington Harbour Partners co-led, and were joined by Gaingels and General Dynamics Land Systems.

- Aescape, a New York City-based developer of AI-powered massage robots, raised $83 million in funding. Valor Equity Partners led the round and was joined by existing investor Alumni Ventures and others.

- Zeitview, a Los Angeles, Calif.-based developer of inspection software for energy and infrastructure assets, raised $60 million in funding. Climate Investment led the round and was joined by Valor Equity Partners, Union Square Ventures, Upfront Ventures, Euclidean Capital, Energy Transition Ventures, Hearst Ventures, and Y Combinator.

- Viam, a New York-based hardware automation platform, raised $30m in Series C funding. USV led, and was joined by Battery Ventures and Neurone

- Cloudsmith, a Belfast, Northern Ireland-based software supply chain security platform, raised $23 million in Series B funding. TCV led the round and was joined by Insight Partners and existing investors.