Figma's >30x Oversubscribed IPO

Jensen Huang, PLTR, Elad Gil, Armada, Vanta, Delve, Winning the AI Race

Today’s Sourcery is brought to you by Brex.

Brex is the modern finance stack built for speed. Corporate cards, expense management, bill pay, travel, & banking, all in one sleek platform.

Helping companies like Anysphere (Cursor) build the future of AI with Brex as their mission control; Superhuman move 2x as fast; BambooHR manage spend across 1,500+ employees; EZ Bombs generate $80K in yield from viral growth.

Brex helps teams spend smarter & move faster—without the friction.

Hello from Computer

Lots of eyes on Figma’s IPO this week. #PrayingForExits

Biggest takeaway from last week’s huuuge AI event? Brain power.

Brain power, instead of celebs & influencers, have captivated the White House, leading to one of the most actionable technological transformations in history. Technology is at the national forefront. Summarized, quite well, by POTUS:

"What a group of smart ones we have in front of me today.. That's about as good as it comes.. up here.. the brain power."

Musings

Figma

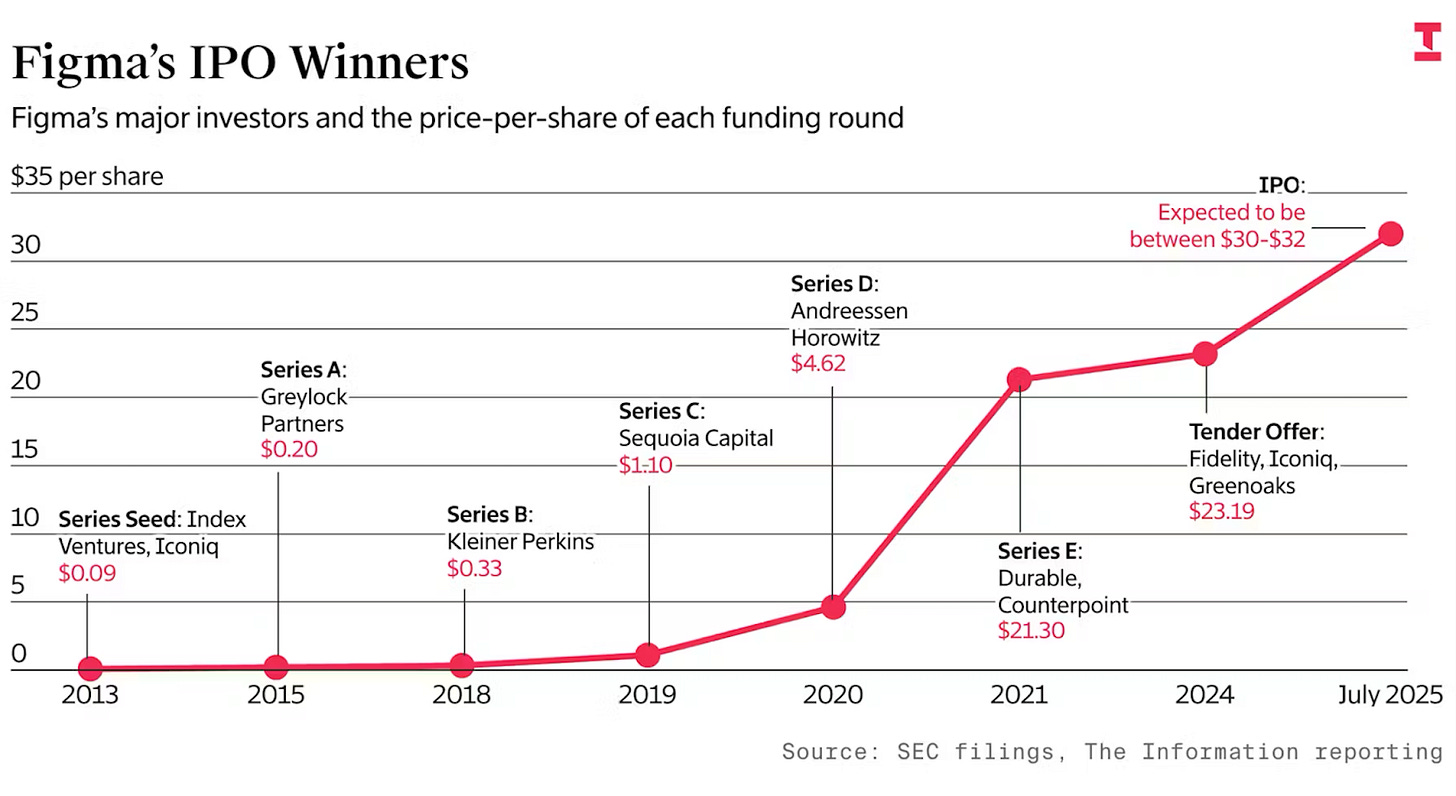

Following the launch of Figma’s roadshow last week, we’re announcing an increased price range for our proposed IPO: between $30 & $32 per share, Figma

Bloomberg reporting that Figma IPO is >30x oversubscribed, Ed Ludlow

Figma targets $18.8 billion valuation in US IPO after bumping up price range, Reuters

The new valuation puts Figma closer to the $20 billion it had commanded when Adobe agreed to buy it. Figma reported $228.2 million in revenue for the three months ended March 31, up 46% from a year earlier, and its net income jumped threefold to $44.9 million.

Figma dominating, Adobe shrinking [see chart]

Since 2019, 70% fewer new startups chose Adobe for design, Art Levy

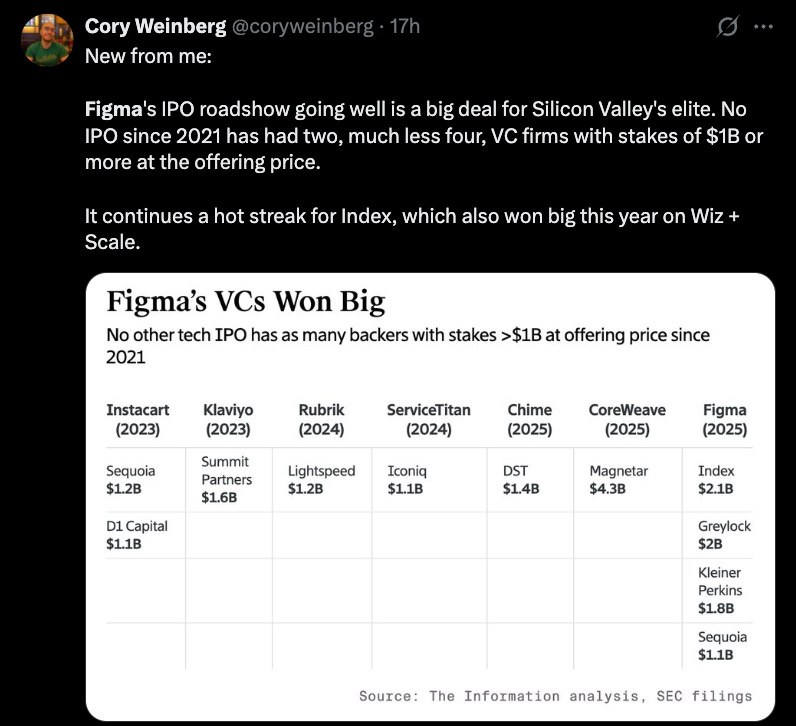

Figma IPO Set to Be a Windfall for Silicon Valley’s Biggest Names, Information

Winning The AI War

America’s AI Action Plan, Dean W. Ball

“I’ve created more billionaires on my management team than any CEO in the world” Jensen Huang

Christian Garrett, 137 Ventures, Winning the AI Race & Reindustrialization

Not Boring by Packy McCormick | AI Action Plan, Aeneas, Genome Engineering, Male Contraceptive, FREP1, Zach Dell, New York

AI

Elad Gil → AI Market Clarity: A subset of AI markets have crystalized in the last 12 months, with the likely market leaders for the next year or two suddenly clear

Armada Raises $131M to Launch Leviathan The Megawatt-Scale Modular Data Center Poised to Redefine AI Infrastructure

Check out Kalshi → The largest prediction market & the only legal platform in the US where you can trade directly on the outcomes of future events (sports, Cluely, politics, weather, AI, etc).

Top Interviews

Nat Friedman Leads $15M Seed in AIUC, Launching Out of Stealth

Made in America

Chris Power, CEO of Hadrian, Raising a $260M Series C Led by Delian Asparouhov of Founders Fund & Lux Capital

Greg Little, Senior Counselor at Palantir, How Palantir Is Modernizing the Military With AI

Palantir joins list of 20 most valuable U.S. companies.. Coincidence??

→ Follow Sourcery on: X, YouTube, Spotify, Apple, Linkedin

Last Week (7/21-7/25):

Relevant deals include the 70+ deals across stages below. I've categorized the deals below into seven categories, Fintech, Care, Enterprise / Consumer, HardTech, Sustainability, Acquisition/PE, and Fund Announcements, and ordered from later-stage rounds to early-stage rounds.

As a Sourcery subscriber you get: 75,000 points after spending $3,000 on Brex card(s), white-glove onboarding, $5,000 in AWS credits, $2,500 in OpenAI credits, & access to $180k+ in SaaS discounts. On top of $500 toward Brex travel, $300 in cashback, plus exclusive perks (like billboards..) visit → brex.com/sourcery

VC Deals

Fintech:

- Xelix, a New York City-based developer of AI software in the accounts payable space, raised $160 million in Series B funding. Insight Partners led the round and was joined by Passion Capital and LocalGlobe.

- april, a New York City-based embedded, AI tax platform, raised $38 million in Series B funding. QED Investors led the round and was joined by Nyca Partners and Team8.

- BetterComp, a San Francisco, Calif.-based provider of compensation management software, raised $33 million in Series A funding. Ten Coves Capital led the round.

- Delve, a San Francisco-based provider of AI agents for compliance, raised $32 million in Series A funding. Insight Partners led the round and was joined by others.

- Alix, a San Francisco-based AI-powered estate settlement platform, raised $20 million in Series A funding. Acrew Capital led the round and was joined by Charles Schwab, Edward Jones Ventures, Initialized Capital, Scribble, Magnify Ventures, and more.

- Mango, a Monterrey, Mexico-based provider of risk infrastructure for the construction industry, raised $3 million in seed funding. Ironspring Ventures led the round and was joined by Brick & Mortar Ventures, Great North Ventures, Buildtech Ventures, Incisive Ventures, and First Check Ventures.

Care:

- Nudge, a San Francisco-based developer of brain interface technology, raised $100 million in Series A funding led by Thrive Capital and Greenoaks.

- Everlab, a Melbourne, Australia-based AI-powered health platform designed for preventive care, raised $10 million in seed funding. Left Lane Capital led the round.

- Journey, a New York City-based enterprise mental health platform, raised $8 million in Series A funding. Cambrian Growth Partners led the round and was joined by Manchester Story, Canaan Partners, J-Ventures, J-Impact, Life Science Angels, HealthTech Capital, and others.

Enterprise/Consumer:

- Vanta, a San Francisco-based AI-powered trust management platform, raised $150 million in Series D funding. Wellington Management led the round and was joined by Growth Equity at Goldman Sachs Alternatives, Sequoia, J.P. Morgan, Craft Ventures, Y Combinator, Atlassian Ventures, and CrowdStrike Ventures.

- Buena, a Berlin, Germany-based developer of AI property management software, raised $58 million in Series A funding. Google Ventures led the round and was joined by 20VC, Stride, and Capnamic.

- LegalOn Technologies, a San Francisco-based developer of a legal AI for contracting, raised $50 million in Series E funding. Goldman Sachs led the round and was joined by existing investor World Innovation Lab and others.

- Ashby, a San Francisco-based recruiting platform, raised $50 million in Series D funding. Mark McLaughlin at Alkeon and Lachy Groom led the round and were joined by F-Prime, Elad Gil, Gaingels, and existing investors.

- inforcer, a London, U.K.-based software platform for Managed Service Providers, raised $35 million in Series B funding. Dawn Capital led the round and was joined by existing investor Meritech Capital.

- Courtyard, a New York-based startup, raised $30 million in Series A funding led by Forerunner Ventures. With participation from NEA and Y Combinator.

- Composio, a San Francisco-based developer of tools designed to help AI agents learn from experience, raised $25 million in Series A funding. Lightspeed Venture Partners led the round and was joined by existing investors Elevation Capital, Together Fund, and others.

- Poseidon, a San Francisco-based full-stack decentralized data layer built for AI training workflows, raised $15 million in seed funding. A16z crypto led the round.

- Cambridge Terahertz, a Sunnyvale, Calif.-based developer of AI technology designed to scan for threat detection, raised $12 million in seed funding. Felicis led the round and was joined by Amazon, Tishman Speyer, Plug and Play, Good Growth Capital, Stata Capital, and others.

- Hypernatural, a New York City-based AI video making platform, raised $9.2 million across two rounds. AIX Ventures and Underscore VC, respectively, led the rounds and were joined by Adverb, Character.vc, and 43 VC.

- Memories.ai, a San Francisco-based AI research lab, raised $8 million in seed funding. Susa Ventures led the round and was joined by Samsung Next, Crane Venture Partners, Fusion Fund, Seedcamp, and Creator Ventures.

- Daylight Security, a Tel Aviv, Israel-based developer of agentic AI technology designed to detect and respond to cyber threats, raised $7 million in seed funding. Bain Capital Ventures led the round and was joined by Maple VC and angel investors.

- Lyra, a San Francisco, Calif.-based AI-native video call platform designed for revenue teams, raised $6 million in seed funding. 468 Capital led the round and was joined by Rebel Fund, Y Combinator, and others.

- IdentifAI, a Milan, Italy-based AI-powered platform designed to detect AI generated or manipulated content, raised €5 million ($5.9 million) in funding. United Ventures led the round.

- Volca, a New York City-based AI-powered marketing platform designed for home service businesses, raised $5.5 million in seed funding. Pathlight Ventures led the round and was joined by MetaProp, GTMFund, Recall Capital, and others.

- Olto, a San Francisco-based developer of an AI demo engineer, raised $5.1 million in pre-seed funding. Nexus Venture Partners and The General Partnership led the round and were joined by Afore Capital, Recall Capital, Ligature, FirstHand, and others.

- Maro, a New York City-based cognitive security platform designed to control human risk, raised $4.3 million in seed funding from Downing Capital Group.

- Rocksalt, a Redwood City, Calif.-based platform designed to help executives and subject matter experts with their credibility in professional communities, raised $3.5 million in seed funding. Lightspeed Venture Partners led the round and was joined by defy.vc and angel investors.

- OpenLaw, a San Francisco-based platform that uses AI to connect people with attorneys, raised $3.5 million in seed funding. Flint Capital and Slauson & Co. led the round and were joined by The LegalTech Fund, Mindful Venture Capital, Everywhere VC, and others.

- Crew, a Phoenix, Ariz.-based home services platform designed for short-term rental owners, raised $3 million in seed funding. RET Ventures led the round and was joined by Tandem Ventures, Element Ventures, Forever 6, and Convoi Ventures.

- Chipp, a Fargo, N.D.-based no-code AI agent builder, raised $2 million in funding. Homegrown Ventures led the round and was joined by M25, gener8tor 1889, Cambrian Ventures, and Jutta Steiner.

HardTech:

- Radical AI, a New York City-based developer of autonomous labs for materials R&D, raised $55 million in a seed round. RTX Ventures led the round and was joined by Nvidia, Alleycorp, and others.

- Swift Navigation, a San Francisco-based developer of satellite positioning technology designed for autonomous vehicles and devices, raised $50 million in Series E funding. Crosslink Capital led the round and was joined by existing investors NEA, Eclipse Ventures, EPIQ Capital Group, First Round Capital, TELUS Global Ventures, Potentum Partners, and others.

- xLight, a Palo Alto, Calif.-based builder of lasers for semiconductor manufacturing, raised $40 million in Series B funding. Playground Global led the round and was joined by Bordman Bay Capital Management, Morpheus Ventures, Marvel Capital, and IAG Capital Partners.

- Rune Technologies, an Arlington, Va.-based developer of AI-enabled predictive software for military logistics, raised $24 million in Series A funding. Human Capital led the round and was joined by Pax VC, Washington Harbour Partners, and existing investors.

- Relativity Networks, an Orlando, Fla.-based fiber-optic technology provider, raised $6.1 million in seed funding from Prysmian, GOVO Venture Partners, and others.

- Nexxa.ai, a Sunnyvale, Calif.-based company developing AI technology for industrial companies, raised $4.4 million in pre-seed funding. A16z speedrun led the round and was joined by Augment Ventures, Propeller Ventures, Plug and Play, and others.

- Dockware, a Tulsa-based AI-powered transportation and logistics company, raised $2.5 million in seed funding. Zenda VC led the round and was joined by Four More Capital, Karman Ventures, Hustle Fund, Starframe Capital, Cortado Ventures, and Operator Stack.

Sustainability:

- Provectus Algae, a Noosaville, Australia-based agriculture tech company, raised $10.1 million in Series A funding. At One Ventures led the round and was joined by Methane Mitigation, Mort & Co, and existing investors including Hitachi Ventures.

- Nevoya, a San Francisco-based electric trucking carrier, raised $9.3 million in seed funding. Lowercarbon Capital led the round and was joined by Floating Point, LMNT Ventures, and existing investors Third Sphere, Stepchange, Never Lift, and others.

Acquisitions & PE:

- Darktrace, a portfolio company of Thoma Bravo, acquired Mira Security, a Harmony, Pa.-based provider of network traffic visibility solutions. Financial terms were not disclosed.

- Generous Brands agreed to acquire Health-Ade, a Los Angeles-based kombucha brand, from Manna Tree and First Bev for $500 million.

- Blackstone agreed to acquire a majority stake in NetBrain Technologies, a Burlington, Mass.-based network automation and AI platform. The investment values NetBrain Technologies at $750 million.

- TA Associates acquired KX, a New York City-based analytics database. Financial terms were not disclosed.

Love merch? Check out our shop: sourcerymerch.com

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.