Ken Griffin & Citadel Securities

EA LBO, OpenAI Markets, Jim Esposito, Kalshi, Cerebras, Vercel, Supabase

“I use Brex for EVERYTHING.” - Roy Lee, Cluely

Brex is the intelligent finance platform, combining the world’s smartest corporate card with integrated expense management, banking, bill pay, & travel. Trusted by 35,000+ companies, including ServiceTitan, Anthropic, Scale AI, Mercor, DoorDash, Superhuman, & Wiz. Built for scale. Spend smarter, move faster.

Pictured on right: Alfred Lin, Sequoia; Luana & Tarek, Kalshi; Molly, Sourcery

Hello from Citadel Securities

Finance is in the air.

Yesterday, just before Ken Griffin hit the stage, I had the privilege of moderating a panel with my two favorite MIT math nerds at the Citadel Securities conference. A truly special moment for Kalshi. Both Tarek & Luana began their careers at Citadel (Tarek on the hedge fund side & Luana at Citadel Securities) which made the conversation a full-circle milestone for them both.

It’s incredible to watch their paths converge, as they’ve spent nearly 7 years battling regulation (including suing the government) to build an entirely new era of capital markets.. now, they’re peers with the industry heavyweights speaking on stage. Kalshi now covers 70% of global prediction markets volume, despite being live in just one country, America.

Remarkable. Inspiring. And..

“It’s just the beginning” Tarek Mansour, CEO of Kalshi

Citadel Securities Conference

“At our conference today, we have the founders of Kalshi, who are making a market for event contracts. You can think of that as making positions or trades in terms of the probability of a political outcome or an economic release. We’re not yet involved in event contracts, but there’s no reason why we couldn’t consider that in the future.” President, Jim Esposito

Citadel Securities Doing for Trading What ‘Amazon Did for E-Commerce,‘ Esposito

“We represent about ⅓ of the volume on the New York Stock Exchange. We’re obviously doing a lot in retail markets where we take flow off the books of Robinhood, Charles Schwab, Interactive Brokers, where 35% of retail volumes in this country. And more importantly, with this conference, we’re directly covering institutions and we’re trading their flow both via the electronic and voice channel. I point out the big banks are only represented in one of those three channels nowadays. So in many ways, when I talk about Amazon, we’re creating a network liquidity effect that our clients are benefiting from.”

Ken Griffin

Ken Griffin Says Government Shutdown ‘Completely Irresponsible’

Citadel’s Griffin Calls Rush to Gold as Safer Asset ‘Concerning’

“There’s a sense of almost inevitability that the inflation genie is going to go back in the bottle. But I think that’s a very premature conclusion.”

Musings

Capital Markets

Largest LBO Ever. EA to be Acquired for $55B by PIF, Silver Lake, & Affinity Partners

AI

Altimeter’s Brad Gerstner on OpenAI’s dealmaking with AMD, Nvidia: ‘The best chips will win’

Dylan Patel on the Trillion-Dollar AI Buildout, Invest like the Best

Cerebras CEO, Andrew Feldman on Raising $1BN & Delaying their IPO & Why NVIDIA’s Worried About Growth, 20VC

Is the Sam Altman Effect Greater than Sydney Sweeney?

OpenAI is so much more than fun videos on Sora 2, or automating your investments memos for an SPV in a triple tiered SpaceX secondary.. they’re moving markets.

Top Interviews

17x Midas List VC Navin Chaddha on The 100x AI Opportunity | $3B+ in AUM, 120 IPOs, 225+ M&A → Listen on X, YouTube, Spotify, Apple

CEOs of Epirus & Galvanick on the Future of Defense & Cybersecurity

Drones + Shocking Unclassified Information → Listen on X, Spotify, YouTube, Apple

Quantum’s SpaceX Moment? Ashlee Vance on PsiQuantum’s $1B Series E → Listen on X, Spotify, YouTube, Apple

→ Follow Sourcery on: X, YouTube, Spotify, Apple, Linkedin

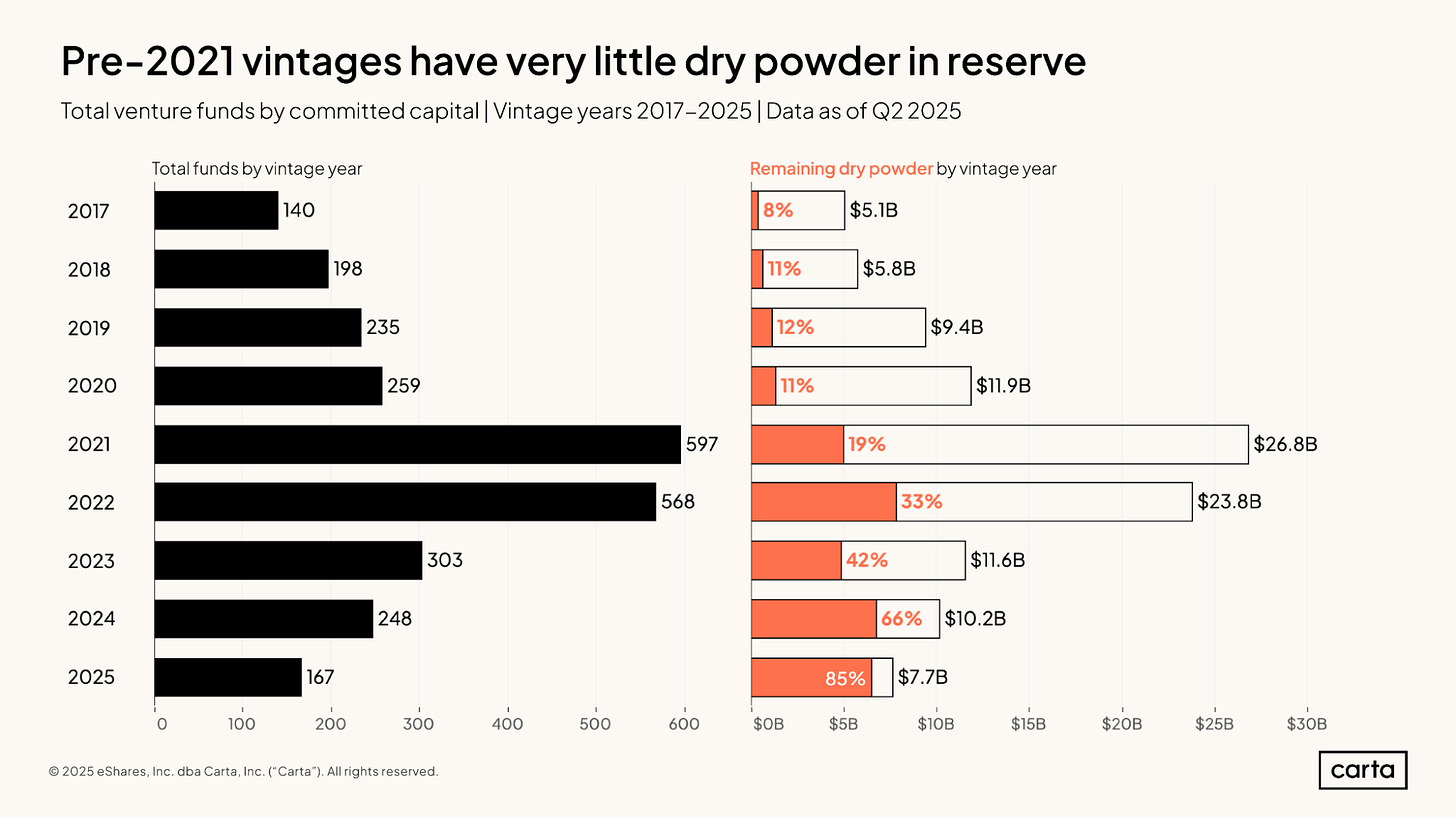

And that’s just the start. The full report includes 21 more charts — dive in here: Q2 2025 Fund Performance.

Last Week (9/29-10/3):

Relevant deals include the 70+ deals across stages below. I’ve categorized the deals below into seven categories, Fintech, Care, Enterprise / Consumer, HardTech, Sustainability, Acquisition/PE, and Fund Announcements, and ordered from later-stage rounds to early-stage rounds.

VC Deals

Fintech:

- Flying Tulip, a New York-based on-chain exchange, raised $200m from Brevan Howard Digital, CoinFund, DWF, FalconX, Hypersphere, Lemniscap, Nascent, Republic Digital, Selini, Sigil Fund, Susquehanna Crypto, Tioga Capital, and Virtuals Protocol

- DualEntry, a New York City-based AI-native ERP, raised $90 million in Series A funding. Lightspeed Venture Partners and Khosla Ventures led the round and were joined by GV, Contrary, and Vesey Ventures.

- Baselane, a New York City-based banking and financial platform designed for real estate investors, raised $34.4 million across Series A and B rounds. Thomvest Ventures led the $20 million Series B round and Matrix Partners led the $14.4 million Series A round.

- Kanastra, a São Paulo, Brazil-based fintech company for private credit funds and securitizations, raised $30 million in Series B funding. F-Prime led the round and was joined by the International Finance Corporation and others.

- Paid, a London, U.K.-based monetization and cost tracking platform for AI agents, raised $21.6 million in seed funding. Lightspeed Venture Partners led the round and was joined by FUSE and existing investor EQT Ventures.

- Remitee, a Buenos Aires, Argentina-based remittance infrastructure provider, raised $20 million in funding. Krealo led the round and was joined by Copec Wind Ventures, Soma Capital, Redwood Ventures, Latitud, and Algorand.

- Maximor, a New York City-based developer of agentic AI technology for CFOs, raised $9 million in seed funding. Foundation Capital led the round and was joined by Gaia Ventures, Boldcap, and angel investors.

- Mesta, a San Francisco-based global fiat and stablecoin payment network, raised $5.5 million in seed funding. Village Global led the round and was joined by Circle Ventures, Paxos, Canonical Crypto, WTI, and existing investors Garuda Ventures, Everywhere Ventures, and Inventum Ventures.

Care:

- Assort Health raises $76 million Series B to build on voice AI healthcare platform

- Gelt, a Miami-based maker of doctor-focused tax tools, raised $13m in Series A funding from Rimon Group, Vintage, and TLV Partners.

- Neura Health, a NYC-based virtual neurology clinic, raised $11.4 million in Series A funding. The American Heart Association’s Go Red for Women Venture Fund led the round and was joined by Norwest Venture Partners, Koch Disruptive Technologies, Esplanade Ventures, and others.

- Confido Health, a New York City-based agentic AI platform for health care operations, raised $10 million in Series A funding. Blume Ventures led the round and was joined by Schema Ventures, Vicus Ventures, and others.

Enterprise/Consumer:

- Periodic Labs, an “AI scientist” startup, raised $300m in seed funding. A16z led, joined by a16z, DST, Nvidia, Accel, Elad Gil, Jeff Dean, Eric Schmidt, and Jeff Bezos

- Vercel, a San Francisco-based AI-native infrastructure building platform, raised $300 million in Series F funding. Accel and GIC led the round and were joined by BlackRock, StepStone, Khosla Ventures, Schroders, and others.

- Supabase raises $100 million at $5 billion valuation as vibe coding soars

- Eve, a San Mateo, Calif.-based legal AI platform for plaintiff law firms, raised $103 million in Series B funding. Spark Capital led the round and was joined by existing investors Andreessen Horowitz, Lightspeed Venture Partners, and Menlo Ventures.

- Modal Labs, a New York-based serverless cloud platform, raised $87m at $1.1b valuation. Lux Capital led, joined by Amplify Partners, Redpoint Ventures, Dimension Capital, and Definition.

- Axiom Math, a San Francisco-based superintelligence platform, raised $64 million in seed funding. B Capital led the round and was joined by Greycroft, Madrona, and Menlo Ventures.

- Phaidra, a provider of AI agents that help manage data centers, raised $50m in Series B funding. Collaborative Fund led, joinerd by Sony Innovation Fund, Helena, Index Ventures, and Nvidia.

- Dash0, a New York City-based AI-powered observability platform, raised $35 million in Series A funding. Accel and Cherry Ventures led the round and were joined by existing investor DIG Ventures.

- Descope, a Los Altos, Calif.-based external IAM platform, raised $35 million in a seed extension from existing investors Notable Capital, Lightspeed Venture Partners, Dell Technologies Capital, and others.

- Oneleet, a Wilmington, Del.-based cybersecurity and compliance platform, raised $33 million in Series A funding. Dawn Capital led the round and was joined by Y-Combinator and others.

- Cypher Games, an Istanbul, Turkey-based mobile games company, raised $30 million in funding. The Raine Group and Play Ventures led the round and were joined by others.

- Moonlake AI, a San Francisco-based AI research lab, raised $28 million in seed funding from AIX Ventures, Threshold, NVIDIA Ventures, and others.

- MAI, a San Francisco-based platform designed to automate and optimize performance marketing, raised $25 million in seed funding. Kleiner Perkins led the round and was joined by Gaorong Ventures, UpHonest Capital, and others.

- Outsmart, a New York-based online learning platform, raised $25m. DST Global Partners and Forerunner led, joined by Khosla Ventures, Lightspeed, Reach Capital, Abstract, and Latitud.

- Flox, a New York City-based platform designed to simplify software development life cycles, raised $25 million in Series B funding. Addition led the round and was joined by NEA, the D. E. Shaw group, Hetz Ventures, and Illuminate Financial.

- Lexroom.ai, a Milan, Italy-based developer of legal AI software, raised $19 million in Series A funding. Base10 Partners led the round.

- Zania, a Palo Alto, Calif.-based agentic AI company for security governance, risk, and compliance, raised $18 million in Series A funding. NEA led the round and was joined by Anthology Fund, Palm Drive Capital, and others.

- Mondoo, a San Francisco-based developer of a vulnerability management platform for agentic AI, raised $17.5 million in funding. HV Capital led the round and was joined by T.Capital and existing investors Atomico, Firstminute Capital, and System.One.

- Goodfit, a London, U.K.-based data platform for go-to-market strategy, raised $13 million in funding. Notion Capital led the round and was joined by Salica Investments, Inovia Capital, Robin Capital, Common Magic, and Andrena Ventures.

- Anything, a San Francisco-based app development platform, raised $11 million in Series A funding. Footwork led the round and was joined by M13.

- Filament, a New York City-based invite-only connection platform for professionals, raised $10.7 million in seed funding from EQT Ventures, Flybridge Capital, Oceans Ventures, and others.

- Tie, a Miami, Fla.-based AI-powered identity platform, raised $10 million in Series A funding. Innovating Capital led the round and was joined by Stage 2 Capital, Hawke Ventures, and others.

- Notch.cx, a Tel Aviv, Israel-based AI customer support platform, raised $7 million in seed funding. Lightspeed Venture Partners led the round and was joined by Jibe Ventures, LionTree, Phoenix, and Munich Re Ventures.

- DJUST, a Paris, France-based business-to-business operations platform, raised €7 million ($8.2 million) in a Series A extension. NEA led the round and was joined by Elaia and Speedinvest.

- Supernova, a Dover, Del.-based developer of an AI-powered collaborative workspace for product teams, raised $9.2 million in Series A funding. Taiwania Capital led the round and was joined by J&T Ventures, Reflex Capital, and existing investors.

- Clarifeye, a Paris, France-based platform designed for enterprises to build expert AI agents at scale, raised €4 million ($4.7 million) in pre-seed funding. EQT Ventures led the round and was joined by Drysdale Ventures, and others.

- Arqh, a Zurich, Switzerland-based AI company developing a decision-intelligence engine for complex operations, raised $3.8 million in pre-seed funding. Founderful led the round and was joined by Merantix Capital.

HardTech:

- Cerebras Systems, a Sunnyvale, Calif.-based AI chipmaker, raised $1.1 billion at an $8.1B valuation in Series G funding. Fidelity Management & Research Company and Atreides Management led the round and were joined by Tiger Global, Valor Equity Partners, 1789 Capital, and others.

- Einride, a Stockholm, Sweden-based provider of digital, electric, and autonomous solutions for road freight, raised $100 million in funding from EQT Ventures and others.

- Phaidra, a Seattle, Wash.-based developer of AI agents for AI factories, raised $50 million in Series B funding. Collaborative Fund led the round and was joined by Helena, Index Ventures, NVIDIA,

- Alvys, a Solana Beach, Calif.-based developer of AI technology for freight operations, raised $40 million in Series B funding. RTP Global led the round and was joined by Alpha Square Group and others.

- Commcrete, a Tel Aviv, Israel-based developer of satellite communication systems, raised $29 million in funding across seed and Series A rounds. Greenfield Partners led the $21 million Series A and was joined by Redseed Ventures and existing investors. Professor Amnon Shashua led the seed round and was joined by Q Fund and angel investors.

- Electroflow, a Burlingame, Calif.-based battery materials developer, raised $10m in seed funding. USV and Voyager led, joined by Fifty Years and Harpoon Ventures.

- InOrbit.AI, a Mountain View, Calif.-based AI-powered robot orchestration platform, raised $10 million. L’ATTITUDE Ventures and Globant Ventures led the round.

- Anode, a San Francisco-based provider of on-demand power from mobile microgrids, raised $9 million in seed funding. Eclipse led the round.

Sustainability:

- OXCCU, an Oxford, U.K.-based sustainable aviation fuel company, raised $28 million in Series B funding from International Airlines Group, Safran Corporate Ventures, Orlen, Aramco Ventures, and others.

Acquisitions & PE:

- Video game maker Electronic Arts agreed to taken private in what would be the largest leveraged buyout ever. The buyers are Saudi Arabia’s Public Investment Fund, Silver Lake Partners, and Jared Kushner’s Affinity Partners.

- KKR agreed to buy a 50% stake in the North American solar assets of French oil giant TotalEnergies (Paris: TTE) for $1.25 billion.

- Mubadala Capital acquired a 42% stake in LA-based credit manager Silver Rock Financial

- Thoma Bravo agreed to buy PROS Holdings (NYSE: PRO), a Houston-based provider of revenue management software to airlines. for $1.4b. It will run the travel business as a standalone platform investment, while merging PROS’ B2B business with existing portfolio company Conga

- Rose Rocket, a Toronto-based provider of transportation management software for trucking companies, acquired supply chain risk startup Centro. Rose Rocket has raised over US$60m from firms like Scale Venture Partners, YC, Addition, Shine Capital, Scale-Up Ventures, and Funders Club. Centro backers include Ripple Ventures.

- Global Infrastructure Partners, owned by BlackRock, is in advanced talks to acquire Virginia-based power group AES (NYSE: AES) for around $38 billion, per the FT.

- Meta (Nasdaq: META) agreed to acquire Rivos, a Santa Clara, Calif.-based chip startup that reportedly was raising new funding at a $2b valuation. Rivos was cofounded by Intel CEO Lip-Bu Tan, and had raised $370m from firms like Matrix Capital Management, Intel Capital, Cathay, Dell Technologies Capital, and Koch Disruptive Ventures.

- Zebra Technologies (Nasdaq: ZBRA) completed its $1.3b cash takeover of Elo Touch Solutions, a Milpitas, Calif.-based touchscreens maker, from Crestview Partners

- Yahoo, owned by Apollo Global Management, is in advanced talks to sell AOL for $1.4 billion to Italy’s Bending Spoons, per Reuters.

- Perplexity acquired Visual Electric, an image generation startup seeded by Sequoia Capital

IPOs:

- Once Upon a Farm, a Berkeley, Calif.-based producer of organic baby food, filed for an IPO. It reports a $28m net loss on $111m of revenue in the first half of 2025, and plans to list on the NYSE (OFRM). The company has raised nearly $100m from CAVU, Cambridge Cos., Access Capital, S2G Investments, Beechwood Capital, and co-founder Jennifer Garner.

- Wealthfront, a Palo Alto, Calif.-based robo-adviser, filed for an IPO. It reports $61m of net income on $176m in revenue for the first half of 2025, and plans to list on the Nasdaq (WLTH). The company raised around $300m from firms like Tiger Global (19.7% pre-IPO stake), DAG Ventures (12.3%), Index Ventures (11.5%), and Ribbit Capital (8.8%). Three years ago it terminated an agreement to be acquired for $1.4b by UBS.

Funds:

- Avenue Capital Group raised $1b for its debut sports fund

- Boost VC, a deep-tech firm led by Adam Draper, raised $87m for its fourth fund

- Radian Capital, a New York-based growth equity firm, raised $600m for its fourth fund

- Evantic Capital, a VC firm formed by Matt Miller (ex-Sequoia Capital), raised $400m for its debut fund

- Better Tomorrow Ventures raised $140m for its third fintech-focused fund.

Axios Final Numbers: U.S. AI VC deals

Source: PitchBook First Look report. Data through Sept. 30, 21025

AI deals fetched 64.3% of U.S. venture disbursements through the first three quarters of 2025, and represented 37.5% of all such deals, per PitchBook. Globally, those figures were 52.5% and over 30%.

Love merch? Check out our shop: sourcerymerch.com

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.

The ZBRA acquisition of Elo Touch for $1.3B makes a ton of sense when you think about where warehouse automation is headed. Touchscreen interfaces are becoming more important as warehouses deploy more sophsticated robots and systems that need intuitive human control points. By bringing this in house, Zebra can better intgrate the hardware and software stack for their warehouse customers. It's vertical integration at its best. I'm curious how quickly they can realize synergies here, especially in terms of product developement cycles. Being able to customize touchscreen tech specifically for logistics and supply chain use cases could be a real differentiator compared to using generic touchscreen solutions. Smart move by management.