Meta vs OpenAI | Kalshi Hits $2B

Robinhood, Drew Brees, Bezos, Altman, Chainsmokers, Forerunner; Kalshi, Abridge, Thinking Machines, Harvey AI, PhysicsX

“I use Brex for everything.” - Roy Lee, CEO of Cluely

Brex is the modern finance platform, combining the world’s smartest corporate card w/ integrated expense management, banking, bill pay, & travel. Over 30K+ companies, including ServiceTitan, Anthropic, Scale AI, Mercor, DoorDash, & Wiz, use Brex.

Spend smarter. Move faster. Sourcery subscribers get up to $500 toward Brex travel or $300 in cashback, plus exclusive perks (like billboards..) → brex.com/sourcery

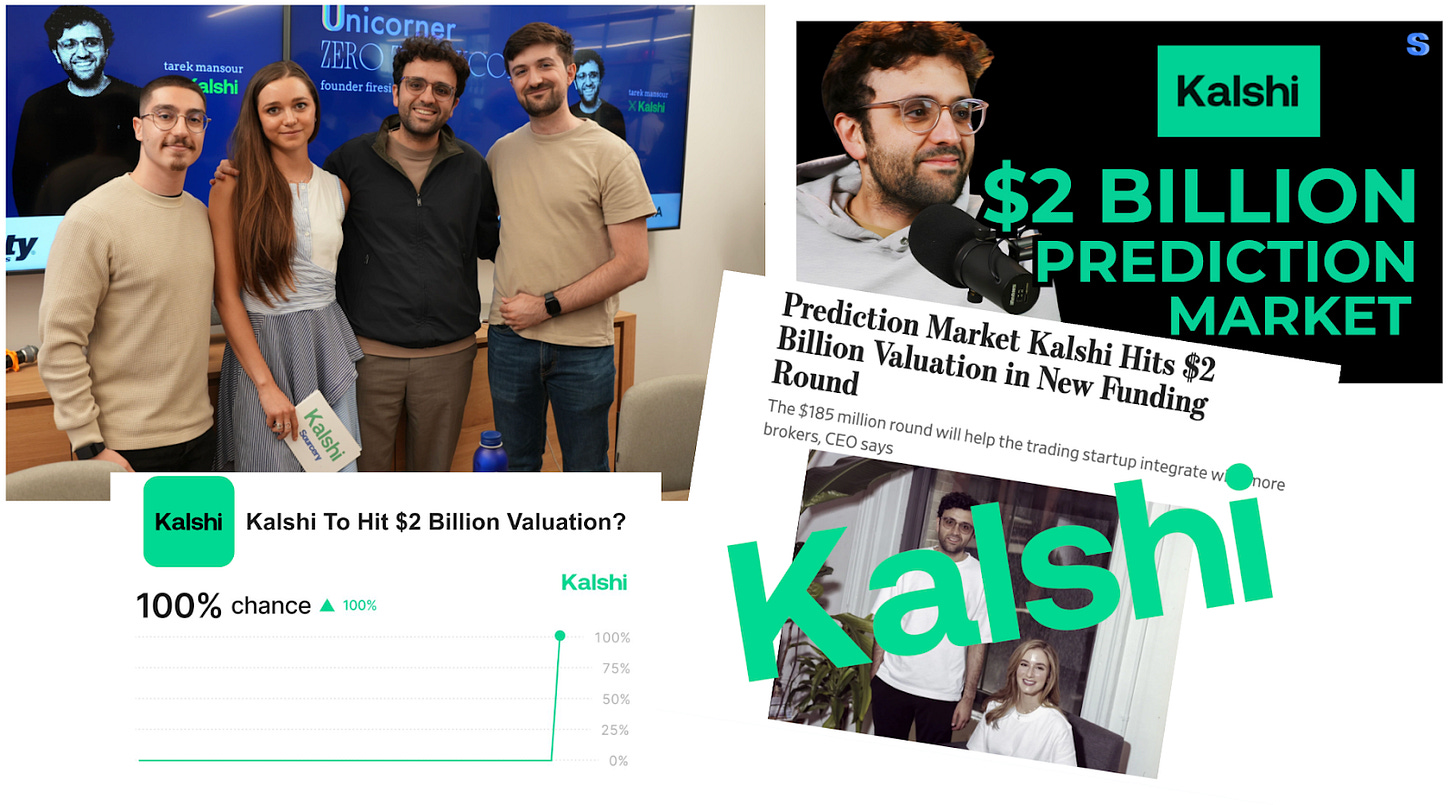

HUGE Congratulations

To Kalshi Co-Founders Tarek Mansour, Luana Lopes Lara & the whole Kalshi team on their $185 Million Series C at a $2 Billion Valuation Led by Paradigm!!!

It’s incredible to see Paradigm, the # 1 crypto VC in the world, going all in on Kalshi. With participation from Multicoin Capital, Sequoia Capital, Neo, Bond Capital, & notably, Peng Zhao, the CEO of Citadel Securities, this brings Kalshi’s total funding to $230M. A major milestone on the road to rival the stock market.

I've been lucky to interview Tarek twice, just a couple months apart—it’s clear, they’ve been unleashed. Kalshi has increased volume by 100x, users by 50x, & active markets by 5x. Hard execution, insanely fast growth, & a really strong team. Making history over & over again. Truly impressive. → Check out our interview here!

Busy Week..

Last week we met Drew Brees, Joe Lonsdale, Andrew Lacy (CEO of Prenuvo), & moderated a panel with Richard Kerby, Mike Smith, & Kelvin Beachum at Next Legacy’s Bridge Summit, attended Kirsten Green of Forerunner’s Humans in the Loop consumer AI summit, “attended” Jeff Bezos’ wedding, dropped our interview with Jack Altman, interviewed Cluely lead investor Bryan Kim (releasing this week), & went to the Chainsmokers set in Vegas with fresh Palantir merch (shoutout to Alex & Drew).

But still, there’s more to come.. this will be a fun summer.

Musings

Meta vs. OpenAI

Here Is Everyone Mark Zuckerberg Has Hired So Far for Meta’s ‘Superintelligence’ Team

"Regular rules don't apply" - Jack Altman

AI

MCP is trending, but wtf is MCP??

Crypto

Robinhood launches first-ever stock tokens for OpenAI & SpaceX

Vlad Tenev has reached “incomprehensible levels of locked in”

Top Interviews

→ Follow Sourcery on: X, YouTube, Spotify, Apple, Linkedin

Last Week (6/23-6/27):

Relevant deals include the 70+ deals across stages below. I've categorized the deals below into seven categories, Fintech, Care, Enterprise / Consumer, HardTech, Sustainability, Acquisition/PE, and Fund Announcements, and ordered from later-stage rounds to early-stage rounds.

VC Deals

Fintech:

- Kalshi, a New York City-based prediction market, raised $185 million in Series C funding at a $2 billion valuation. Paradigm led the round and was joined by Multicoin Capital, Sequoia, Neo, and Peng Zhao.

- Digital Asset, maker of the privacy-focused Canton blockchain, raised $135m. DRW Venture Capital and Tradeweb Markets led, joined by BNP Paribas, Circle Ventures, Citadel Securities, DTCC, Goldman Sachs, IMC, Liberty City Ventures, Optiver, Paxos, Polychain Capital, QCP, Republic Digital, 7RIDGE, and Virtu Financial.

- Finom, an Amsterdam-based financial services platform for entrepreneurs and small and medium enterprises, raised €115 million ($133.6 million) in Series C funding. AVP led the round and was joined by Headline Growth and existing investors General Catalyst, Northzone, and Cogito Capital.

- Zama, a Paris-based fully homomorphic encryption blockchain solutions developer, raised $57 million in Series B funding. Blockchange Ventures and Pantera Capital led the round and were joined by others.

- Spinwheel, an Oakland-based AI-powered consumer credit data and payments platform, raised $30 million in Series A funding. F-Prime led the round and was joined by QED Investors, Foundation Capital, and Fika Ventures.

- Veda, a New York City-based DeFi vault infrastructure platform, raised $18 million in funding. CoinFund led the round and was joined by Coinbase Ventures, GSR, Maelstrom, angel investors, and others.

- GTE, a decentralized exchange, raised $15m in Series A funding led by Paradigm

- Quinn, a New York City-based AI-powered financial planning platform, raised $11 million in seed funding. Viola Fintech led the round and was joined by existing investors.

- Blueprint Finance, a New York City-based DeFi infrastructure comapny, raised $9.5 million in funding. Polychain Capital led the round and was joined by Yzi Labs.

- Meridian, a Miami-based AI-powered private markets deal management platform, raised $7 million in seed funding. 645 Ventures led the round and was joined by existing investor Chaac Ventures and angel investors.

- Jarsy, a Palo Alto-based digital investment platform, raised $5 million in pre-seed funding. Breyer Capital led the round and was joined by Karman Ventures and angel investors.

- Stackup, a Los Angeles-based crypto digital asset management platform, raised $4.2 million in seed funding. 1kx led the round and was joined by Y Combinator, Goodwater Capital, Soma Capital, and others.

- COVR Global, a London-based AI-powered decision engine for insurers, raised $2.5 million in seed funding. MTech Capital led the round and was joined by B Capital.

- Nook, an Austin-based crypto savings app, raised $2.5 million in funding. Coinbase Ventures, defy.vc, and UDHC led the round and were joined by angel investors.

- YieldClub, a Washington D.C.-based crypto savings app, raised $2.5 million in pre-seed funding from Pharsalus, Flex Capital, The House Fund, Superlayer, and angel investors.

- Castle, a Miami-based bitcoin treasury solutions provider for small and medium-sized businesses, raised $1 million in pre-seed funding from Boost VC and Winklevoss Capital.

Care:

- Abridge, a Pittsburgh-based AI-powered healthcare technology company, raised $300 million in Series E funding. Andreessen Horowitz led the round and was joined by Khosla Ventures.

- Neuron23, a South San Francisco, Calif.-based neurological and immunological diseases therapies developer, raised $96.5 million in Series D funding from existing investors Westlake Village BioPartners, SoftBank Vision Fund 2, Redmile Group, and others.

- Arine, a San Francisco-based AI-powered medication intelligence platform, raised $30 million in Series C funding. Town Hall Ventures led the round and was joined by Kaiser Permanente Ventures and other existing investors.

- Elfie, a New York City-based health monitoring and rewards app, raised $12 million. White Star Capital led the round and was joined by LifeX Ventures and existing investors Integra Partners, FEBE Ventures, and Hustle Fund.

- SuperDial, an SF-based voice AI platform for health care, raised $12m in Series A equity funding. SignalFire led, joined by Slow Ventures, Box Group, and Scrub Capital.

- Empo Health, a San Bruno, Calif.-based health-monitoring devices developer, raised $7 million in funding. Story Ventures led the round and was joined by VTC Ventures and existing investors Ulu Ventures, SeaX Ventures, Arben Ventures, and Gaingels.

- Insight Health, an Austin-based AI agents developer for clinics, raised $4.6 million in funding. Kindred Ventures led the round and was joined by 43, RTP, Karman Ventures, and others.

- CalmWave, a Seattle-based alarm fatigue solution provider for ICUs, raised $4.4 million in seed+ funding from existing investors Third Prime, Bonfire Ventures, Catalyst by Wellstar, and Silver Circle.

- NexusMD, a Melbourne-based agentic AI health care solutions provider, raised $6.3 million AUD ($4.1 million) in seed funding from Square Peg.

Enterprise/Consumer:

- Thinking Machines Lab, the startup led by former OpenAI CTO Mira Murati, raised $2b in "seed" funding at a $10b valuation, per the FT. A16z led, joined by Conviction Partners

- Harvey, an SF-based legal AI startup, raised $300m in Series E funding at a $5b valuation. Kleiner Perkins and Coatue. led, joined by Sequoia Capital, GV, DST Global, Conviction Capital, Elad Gil, Open AI Startup Fund, Elemental, SV Angel, and REV

- Decagon, a San Francisco-based customer experience conversational AI platform, raised $131 million in Series C funding at a $1.5 billion valuation. Accel and Andreessen Horowitz led the round and were joined by Avra, Forerunner, Ribbit Capital, and existing investors A*, Bain Capital Ventures, and BOND.

- Certify, a New York City-based provider data intelligence company, raised $40 million in Series B funding. Transformation Capital led the round and was joined by SemperVirens and existing investors General Catalyst and Upfront Ventures.

- Metaview, a San Francisco-based AI-powered hiring platform, raised $35 million in Series B. GV led the round and was joined by existing investors Plural, Vertex Ventures, Seedcamp, and others.

- Niural, a San Francisco-based AI professional employment organization, raised $31 million in funding. Marathon Management Partners led the round and was joined by existing investors M13, Inspired Capital, Newform Capital, and others.

- Wispr, a San Francisco-based AI voice app developer, raised $30 million in Series A funding. Menlo Ventures led the round and was joined by Evan Sharp, Henry Ward, existing investors NEA, 8VC, Neo, and others.

- Kognitos, a San Jose-based business operations AI automation company, raised $25 million in Series B funding. Prosperity7 led the round and was joined by Khosla Ventures, Wipro Ventures, Engineering Capital, and others.

- Profound, a New York-based answer engine optimization tool for brands, raised $20m in Series A funding. Kleiner Perkins led, joined by NVentures, Saga Ventures, South Park Commons and SV Angel.

- Paraform, a San Francisco-based recruiting marketplace, raised $20 million in Series A funding. Felicis led the round and was joined by A*, BOND, DST Global, Liquid 2, and angel investors.

- Synthflow AI, a Berlin-based agentic AI platform for phone call automation, raised $20 million in Series A funding. Accel led the round and was joined by existing investors Atlantic Labs and Singular.

- Botpress, a Quebec-based AI agent developer and deployer, raised $25 million in Series B funding. FRAMEWORK led the round and was joined by Inovia Capital, Deloitte Ventures, HubSpot Ventures, Decibel, and existing investors.

- Profound, a New York City-based AI visibility platform for brands, raised $20 million in Series A funding. Kleiner Perkins led the round and was joined by NVentures, Khosla Ventures, Saga VC, angel investors, and others.

- Eventual, a San Francisco-based multimodal data AI infrastructure developer, raised $20 million in Series A funding. Felicis led the round and was joined by M12 Ventures and Citi.

- Delphi, a San Francisco-based AI-powered digital minds developer, raised $16 million in Series A funding. Sequoia Capital led the round and was joined by Menlo & Anthropic’s Anthology Fund, Proximity Ventures, Crossbeam, and others.

- Cluely, an app that lets users cheat on things like tests and job interviews, raised $15m led by a16z

- Lyceum, a Berlin and Zurich-based AI infrastructure developer, raised €10.3 million ($11.9 million) in pre-seed funding. Redalpine led the round and was joined by 10x Founders.

- Chronicle Studios, a Los Angeles-based entertainment studio, raised $11.6 million in seed funding. Patron and Point72 Ventures led the round and were joined by Z Ventures, Sands Capital, and others.

- SuperDial, a San Francisco-based voice AI platform for healthcare administration, raised $12 million in Series A funding. SignalFire led the round and was joined by Slow Ventures, Box Group, and Scrub Capital.

- Skyramp, a San Francisco-based AI-powered testing and debugging solution for engineering teams, raised $10 million in funding from Sequoia Capital.

- Qualytics, an Atlanta-based data quality platform for enterprises, raised $10 million in Series A funding. BMW i Ventures led the round and was joined by Conductive Ventures, The Hill Fund, and existing investors Tech Square Ventures, Knoll Ventures, Inner Loop Capital, and others.

- Bonfy.AI, a Mountain View, Calif.-based adaptive content security solutions provider, raised $9.5 million in seed funding. TLV Partners led the round and was joined by Saban Capital Partners.

- PoliCloud, a Cannes, France-based cloud infrastructure developer for cities, enterprises, and public institutions, raised €7.5 million ($8.8 million) in seed funding. Global Ventures led the round and was joined by MI8 Limited, OneRagtime, Inria, and others.

- Brij, a New York City-based AI-powered omnichannel marketing platform, raised $8 million in funding. Bright Pixel Capital and CEAS Investments led the round and were joined by Artemis Fund, Red Bike Capital, Lakehouse Ventures, angel investors, and others.

- Motorica, a Stockholm-based GenAI character animation company, raised €5 million ($5.8 million) in seed funding. Angular Ventures led the round and was joined by Luminar Ventures.

- Movemint, a San Francisco-based athletic events platform, raised $5 million in seed funding. Underscore VC led the round and was joined by Michael Horvath and Green D Ventures.

- Sitch, a New York City-based AI-powered matchmaking app, raised $5 million in seed funding. M13 led the round and was joined by existing investor a16z SpeedRun.

- Moonnox, a Chicago-based professional services delivery AI solution, raised $2 million in funding. M25 led the round and was joined by Hyde Park Angels, Early Light Ventures, and Service Provider Capital.

- Waypoint AI, a Berkeley-based AI-powered software maintenance solution, raised $3.1 million in pre-seed funding. 42Cap and Dreamcraft Ventures led the round and were joined by Berkeley SkyDeck Fund, Lumiere AI Ventures, and others.

- Blank Metal, a Minneapolis-based AI-native engineering company, raised $3 million in seed funding from Rally Ventures, Traction Capital, and Pure Play Partners.

- Mahalo, a Chicago-based post-purchase experience platform, raised $2.6 million in pre-seed funding. Motivate Venture Capital led the round and was joined by Diagram and Bridge Venture Fund.

HardTech:

- PhysicsX, a London-based AI startup focused on defense-tech design, raised $135m at nearly a $1b valuation from backers like Siemens, Temasek, Atomico, and Applied Materials.

- Pelico, a Paris-based AI-powered supply chain orchestration platform, raised $40 million in funding. General Catalyst led the round and was joined by existing investors 83North and Serena.

- Snowcap Compute, a Palo Alto-based superconducting compute platform developer, raised $23 million in seed funding. Playground Global led the round and was joined by Cambium Capital and Vsquared Ventures.

- Klutch AI, a Seattle-based agentic AI construction workflow automation company raised $8 million in seed funding. Bain Capital Ventures and Bling Capital led the round and were joined by Brick & Mortar Ventures, Original Capital, Anthology Fund, and angel investors.

- Voliro, a Zurich-based aerial robotics company, raised $7 million in Series A extension funding. noa led the round and was joined by existing investor Cherry Ventures and others.

- BackOps AI, a San Francisco-based AI-powered supply chain operations platform, raised $6 million in seed funding. Construct Capital led the round and was joined by existing investors Gradient and 10VC.

- Lux Aeterna, a Denver-based reusable satellite platform developer, raised $4 million in pre-seed funding. Space Capital led the round and was joined by Dynamo Ventures, Mission One Capital, Alumni Ventures, Service Provider Capital, and angel investors.

- Nascent Materials, a Newark-based battery materials company, raised $2.3 million in seed funding. SOSV led the round and was joined by New Jersey Innovation Evergreen Fund and UM6P Ventures.

Sustainability:

- Halter, an Auckland, New Zealand-based cattle ranch technology company, raised $100 million in Series D funding, at a $1 billion valuation. BOND led the round and was joined by NewView and existing investors Bessemer Venture Partners, DCVC, Blackbird, and others.

Acquisitions & PE:

- Mark Walter agreed to acquire a majority stake in the Los Angeles Lakers, a Los Angeles-based NBA team, from the Buss Family Trust for $10 billion, according to ESPN.

- New Home acquired Landsea Homes, a Dallas-based house building company, for $11.30 per share in an all-cash transaction at an enterprise value of approximately $1.2 billion.

- Illumina acquired SomaLogic, a Boulder-based proteomics technology company, from Standard BioTools for $350 million in cash upfront and up to $75 million in earnout payments.

- Spins, backed by Webster Capital, Warburg Pincus, General Atlantic, and others, acquired Datasembly, a Tysons, Va.-based pricing and promotion intelligence solution. Financial terms were not disclosed.

- TSG Consumer Partners acquired a minority stake in DUDE Wipes, a Chicago-based personal hygiene wipes brand. Financial terms were not disclosed.

- Xero agreed to acquire Melio, a New York City-based bill payments platform for small and medium-sized businesses, for $2.5 billion in cash and equity.

- Nordic Semiconductor acquired Memfault, a San Francisco-based device observability and over-the-air update platform, for a consideration of $120 million on a cash and debt-free basis.

IPOs:

- Circle priced its IPO earlier this month at $31 per share, and closed Friday trading at $240.38 per share. That's a whopping 675% increase. This included a 168% pop on its first day of trading, which was a record for a company that raised at least $1 billion in its IPO. Circle had originally filed to price at $26-$28 per share, before upping the range. Oak Investment Partners is one of the biggest winners from Circle's IPO, with shares worth in excess of $3 billion. Per Axios

- Navan (fka TripActions), a Palo Alto-based corporate travel agent, filed confidentially for an IPO, per Reuters. It's raised over $2b from VCs like a16z, Addition, Coatue, 01 Advisors, and Lightspeed.

- Wealthfront, a Palo Alto-based robo-adviser, said it's filed confidentially for an IPO. It's raised around $300m from firms like Index Ventures, Spark Capital, and Tiger Global. Three years ago it terminated an agreement to be acquired for $1.4b by UBS

Funds:

- Galaxy Ventures, the New York City-based venture strategy of Galaxy Digital, raised $175 million for its first fund focused on early-stage companies developing onchain economy infrastructure.

Today’s Sourcery is brought to you by Brex.

“I use Brex for EVERYTHING.” - Roy Lee, Cluely

Love merch? Check out our shop: sourcerymerch.com

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.