NVDA: $100B to OpenAI, + $$ to ElevenLabs

Autism, TikTok, Figure, Groq, Netskope, Modern Animal, Intel

Brought to you by Brex:

Brex is the intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast.

Spend smarter. Move faster. Sourcery subscribers get: 75,000 points after spending $3,000 on Brex card(s). Plus, white-glove onboarding, $5,000 in AWS credits, $2,500 in OpenAI credits, and access to $180k+ in SaaS discounts. On top of $500 toward Brex travel, $300 in cashback, plus exclusive perks (like billboards..) visit → brex.com/sourcery

Hello from Palo Alto

It’s nice here, I like it.

Musings

The next largest VC fund Sovereign wealth fund is.. NVDA ?

NVDA is investing in ElevenLabs, with support from Jensen Huang, see video..

NVDA to invest $100B into OpenAI.. NVIDIA announces strategic partnership to deploy 10 gigawatts of NVIDIA systems

Just joking. But I am continuously impressed by NVIDIA’s investment in US tech. Jensen is giving the Sovereign Wealth funds a run for their money..

It’s reached the point where it feels worth comparing NVDA’s commitments to U.S. AI & the broader tech ecosystem against the deep pockets of active Middle Eastern sovereign funds. (& yes, we can include SoftBank in that conversation too.. stay tuned.)

For perspective, as of Sept 2025, NVIDIA's market cap is ~$4.47T, while the Saudi Public Investment Fund's (PIF) AUM is valued at around ~$925B. This means NVIDIA's market cap is nearly 5x larger than the PIF's total assets.

(To be clear. This is not an apples-to-apples comparison for “dry powder..” one is a corporation & the other a sovereign fund. ie Saudi Aramco’s market cap is around USD $1.6T. But still, the relative scale is striking.)

And while PIF retains the largest pool of capital in the region, Mubadala with an AUM of $330B emerges as the most active sovereign wealth fund out of the Middle East — in 2024, Mubadala deployed ~$29.2B, surpassing PIF’s ~$19.9B — especially when considering recent deployment, strategic shift toward tech, space, AI, & high-growth sectors.

We’re watching..

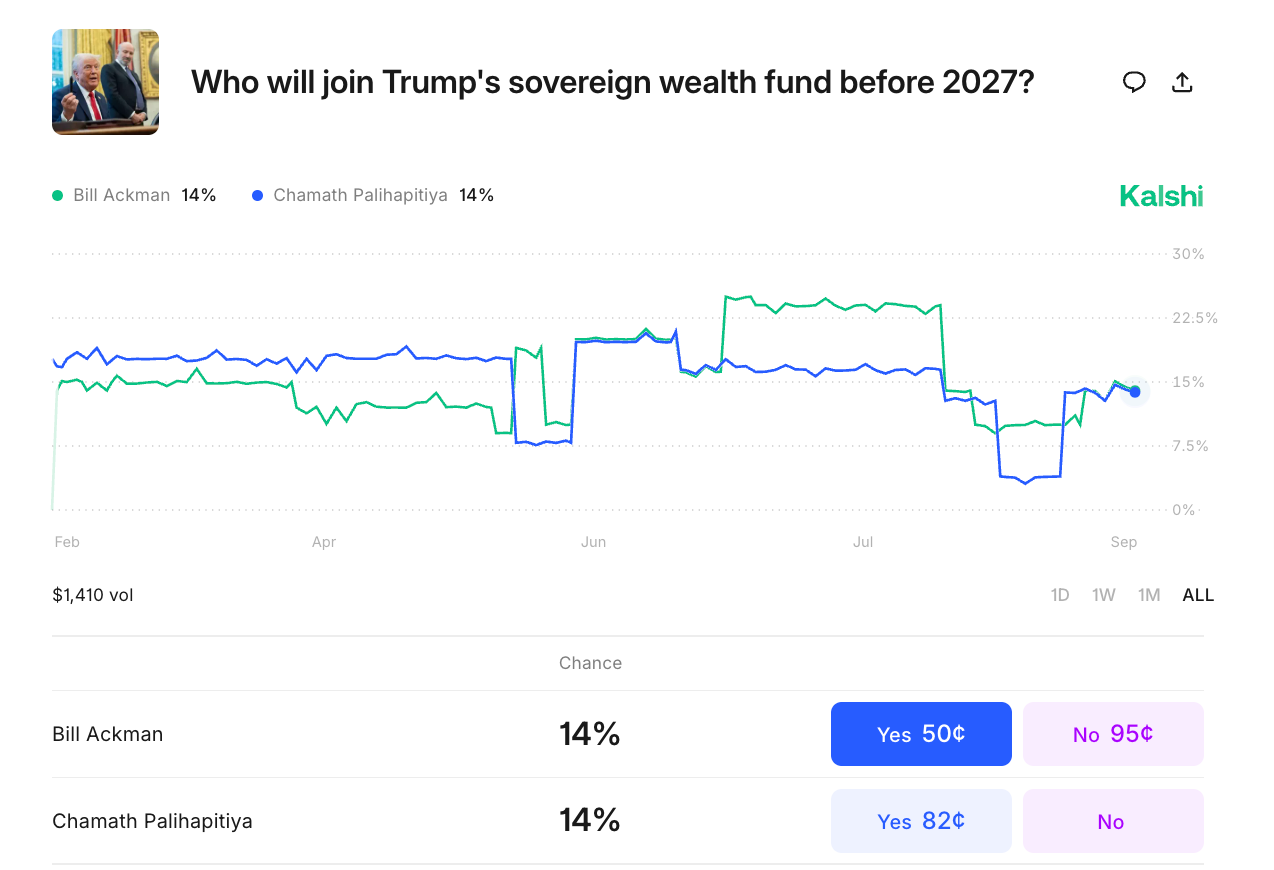

Check out Kalshi → The largest prediction market & the only legal platform in the US where you can trade directly on the outcomes of future events (sports, politics, weather, AI, etc).

More

Autism..

Afraid of losing the Tiz to your Rizz? Arielle Zuckerberg can protect you.

Congrats to Jack Altman & the Alt Cap team on their new $275M Alt Cap II Fund!

SoftBank is planning to lay off nearly 20% of its 300-person Vision Fund team

TikTok

TikTok, Boeing, & Rare Earths: What the U.S. Didn't Get in China

No Golden Share For US in TikTok Deal, White House Says

Oracle, Silver Lake & Andreessen Horowitz would control 80% stake in TikTok

Top Interviews

SpaceX, Stripe, X, Ramp, Anduril: Navigating Liquidity in Private Markets → Listen on X, Spotify, YouTube, Apple

Keith Rabois on Opendoor's $OPEN Activist Turnaround → Listen on X, Spotify, YouTube, Apple

Keith Rabois Returns. Lessons From Paypal Mafia, $OPEN, & Investing → Listen on X, Spotify, YouTube, Apple

→ Follow Sourcery on: X, YouTube, Spotify, Apple, Linkedin

Last Week (9/15-9/23):

Relevant deals include the 70+ deals across stages below. I've categorized the deals below into seven categories, Fintech, Care, Enterprise / Consumer, HardTech, Sustainability, Acquisition/PE, and Fund Announcements, and ordered from later-stage rounds to early-stage rounds.

VC Deals

Fintech:

- Extend, a provider of spend management software to banks, raised $20m in equity and debt. B Capital led the equity tranche, joined by March Capital, Point72 Ventures, FinTech Collective, and Commerce Ventures.

- SEON, an Austin, Texas-based fraud prevention and anti-money laundering compliance platform, raised $80 million in Series C funding. Sixth Street Growth led the round and was joined by IVP, Creandum, Firebolt, and others.

- Tabs, a New York-based developer of AI agents for finance teams, raised $55m in Series B funding. Lightspeed led, joined by General Catalyst, Primary Venture Partners, and World Innovation Lab.

- Arch, a digital way to track all private market investments raised $52 million in Series B funding led by Oak HC/FT, with participation from Menlo Ventures, Craft Ventures, Quiet Capital and others.

- WorkFusion, a developer of AI agents for financial crime compliance, raised $45m led by Georgian

- Numeral, an SF-based sales tax automation startup, raised $35m in Series B funding. Mayfield led, joined by Benchmark, Uncork Capital, YC, and Mantis VC.

- Finary, a French wealth management platform, raised €25m in Series B funding. PayPal Ventures led, joined by LocalGlobe, Hedosophia, Shapers, and existing investors Y Combinator and Speedinvest.

- Aleph, a New York-based provider of planning and analysis automation for finance teams, raised $29m in Series B funding, per Axios Pro. Khosla Ventures led, joined by Bain Capital Ventures and Picus Capital.

- Turnout, a San Diego, Calif.-based platform designed to help users access government and financial benefits, raised $21 million in seed funding. Shine Capital and LGVP led the round and were joined by Swish Ventures, Jaz Capital Partners, Zeev Ventures, HoneyStone, and others.

- Stablecore, a Dallas, Texas-based platform designed for regional banks and credit unions to offer stablecoins, raised $20 million in funding. Norwest Venture Partners led the round and was joined by Coinbase Ventures, Curql, BankTech Ventures, Bank of Utah and others.

- UiAgent, a New York-based developer of AI agents for large accounting firms, raised $4.6m in seed funding led by Marathon Management Partners

- Nestimate, a Lincoln, Neb.-based retirement income solutions platform, raised $3 million in funding. S3 Ventures led the round and was joined by PruVen Capital, TIAA Ventures, and Invest Nebraska.

Care:

- Modern Animal, a vet clinic network, raised $46m in Series D funding from Addition, Upfront Ventures, True Ventures, and Founders Fund

- Doctronic, a New York City-based personalized AI doctor platform, raised $20 million in Series A funding. Lightspeed Venture Partners led the round and was joined by Union Square Ventures, Tusk Ventures, Mantis VC, Seven Stars, and angel investors.

- Birches Health, a New York City-based provider of gambling addiction treatment, raised $20 million in Series A and seed funding. AlleyCorp led the Series A round and General Catalyst led the seed round.

- MoldCo, a Boston-based provider of virtual clinics for mold detox, raised $8m in seed funding led by Cantos and Collaborative Fund.

Enterprise/Consumer:

- Upscale.ai, a Palo Alto-based AI networking startup, raised $100m in seed funding, Mayfield and Maverick Silicon led, joined by StepStone Group, Celesta Capital, Xora, Qualcomm Ventures, Cota Capital, MVP Ventures, and Stanford University

- Irregular, an AI security startup, raised $80m led by Sequoia Capital and Redpoint Ventures.

- Remedio, a Tel Aviv, Israel-based cybersecurity company, raised $65 million in funding. Bessemer Venture Partners led the round and was joined by TLV Partners and Picture Capital.

- CodeRabbit, a San Francisco-based AI code review platform, raised $60 million in Series B funding. Scale Venture Partners led the round and was joined by Nventures and others.

- Vega, a Tel Aviv, Israel and New York City-based security operations platform, raised $65 million across seed and Series A rounds from Accel, Cyberstarts, Redpoint, and CRV.

- Omnea, a London, U.K.-based procurement intake and orchestration platform, raised $50 million in Series B funding. Insight Partners and Khosla Ventures led the round and were joined by Accel, Point Nine, First Round Capital, and Prosus.

- Terra Security, a Tel Aviv, Israel-based agentic AI-powered continuous penetration testing platform, raised $30 million in Series A funding. Felicis led the round and was joined by Dell Technology Capital and SVCI.

- Macroscope, a San Francisco-based product development tracking platform, raised $30 million in Series A funding. Lightspeed led the round and was joined by Adverb, Thrive Capital, and Google Ventures.

- RegScale, a McLean, Va.-based governance, risk, and compliance platform, raised $30 million in Series B funding. Washington Harbour Partners led the round and was joined by M12, Hitachi Ventures, and others.

- Spara, a New York City-based enterprise-grade chat, email, and voice AI platform for go-to-market workflows, raised $15 million in seed funding. Radical Ventures and Inspired Capital led the round and were joined by XYZ Ventures, FJ Labs, Remarkable Ventures, and angel investors.

- Envive AI, a Seattle, Wash.-based AI platform for retail brands, raised $15 million in Series A funding. FuseVC led the round and was joined by Point72 Ventures.

- MetalBear, a Tel Aviv, Israel-based developer of the open source Kubernetes development solution mirrord, raised $12.5 million in seed funding. TLV Partners led the round and was joined by TQ Ventures, MTF, and Netz Capital.

- Conduct, a London, U.K.-based developer of agentic AI technology designed to modernize IT systems, raised $12 million in seed funding. Creandum led the round and was joined by Lucid Capital, Booom, and angel investors.

- Ray Security, a Tel Aviv, Israel-based data security platform, raised $11 million in seed funding. Venture Guides and Ibex Investors led the round

- Rec, a San Francisco-based operating system for community recreation departments, raised $11 million in Series A funding. Crosslink Capital led the round and was joined by others.

- GridStrong, a New York City-based electric grid compliance and operations platform, raised $10 million in seed funding. Congruent Ventures led the round and was joined by Energize Capital and others.

- Phia, founded by Phoebe Gates and Sophia Kianni, raises $8 million seed round, led by Kleiner Perkins

- Iris Finance, a Chicago, Ill.-based AI-powered profit planning platform for consumer brands, raised $6.2 million in seed funding. Glasswing Ventures led the round and was joined by Founder Collective, Hyde Park Angels, and others.

- Overmind, a London, U.K.-based predictive change intelligence company, raised $6 million in seed funding. Renegade Partners led the round and was joined by Four Rivers, Operator Collective, Dan Scheinman, and Walter Kortschak.

- DianaHR, a San Francisco-based HR services platform for small and medium-sized businesses, raised $3.7 million in seed funding. SNR Ventures led the round and was joined by General Catalyst, Y Combinator, and others.

- Meela, a New York City-based developer of an AI voice companion for seniors, raised $3.5 million in seed funding. Bain Capital Ventures led the round.

- Ethosphere, a Seattle, Wash.-based developer of voice AI for retailers, raised $2.5 million in pre-seed funding. Point 72 Ventures led the round and was joined by A12 Incubator, Carya Ventures, Pack VC, and others.

HardTech:

- Figure, a San Jose, Calif.-based autonomous robot developer, raised $1 billion in Series C funding. Parkway Venture Capital led the round and was joined by Brookfield Asset Management, NVIDIA, Macquarie Capital, Intel Capital, Align Ventures, Tamarack Global, LG Technology Ventures, Salesforce, T-Mobile Ventures, and Qualcomm Ventures.

- Groq, a Mountain View, Calif.-based AI chipmaker, raised $750m at a $6.9b post-money valuation. Disruptive led, joined by BlackRock, Neuberger Berman, Deutsche Telekom Capital Partners, Samsung, Cisco, D1, and Altimeter.

- Divergent Technologies, a manufacturing platform for military parts, raised $290m in Series E funding ($250m in equity) at a $2.3b valuation led by Rochefort Asset Management.

- Nothing, a London-based smartphone developer, raised $200m in Series C funding at a $1.3b valuation. Tiger Global led, joined by Nikhil Kamath, Qualcomm Ventures and insiders GV, Highland Europe, EQT, Latitude, I2BF, and Tapestry.

- Dyna Robotics, a Redwood City, Calif.-based developer of general-purpose robots, raised $120 million in Series A funding. Robostrategy, CRV, and First Round Capital led the round and was joined by Salesforce Ventures, NVentures, and others.

- PassiveLogic, a Salt Lake City, Utah-based developer of physical AI technology for buildings, raised $74 million in Series C funding. noa led the round and was joined by Prologis Ventures, Johnson Controls, and PSP Growth.

- Luminary Cloud, a San Mateo, Calif.-based physics AI platform for engineering teams, raised $72 million in funding. N47 led the round and was joined by Sutter Hill Ventures and NVentures.

- GreenLite, a New York City-based developer of an AI-powered plan review and compliance platform for construction permits, raised $49.5 million in Series B funding. Insight Partners led the round and was joined by Energize Capital and existing investors Craft Ventures, LiveOak Ventures, and Chicago Ventures.

- Rodatherm, a Salt Lake City, Utah-based geothermal power generation company, raised $38 million in Series A funding. Evok Innovations led the round and was joined by TDK Ventures, Toyota Ventures, TechEnergy Ventures, MCJ, and others.

- Mueon, a Portland, Ore.-based "data center in a box," raised $15.5m. Intel Capital led, joined by Geodesic Alliance Fund and Oregon Venture Fund.

- Icarus, a New York City-based company developing robots designed for labor in space, raised $6.1 million in seed funding. Soma Capital and Xtal led the round and were joined by Nebular and Massive Tech Ventures.

Sustainability:

- Chestnut Carbon, a New York City-based developer of nature-based carbon credits, raised $90 million in additional Series B funding from Canada Pension Plan Investment Board.

- Genomines, a Paris, France-based plant-based metal farming company, raised $45 million in Series A funding. Engine Ventures and Forbion BioEconomy led the round and were joined by DeepTech & Climate Fonds, Wind, Lowercarbon Capital, Entrepreneurs First, and others.

Acquisitions & PE:

- Workday (Nasdaq: WDAY) agreed to buy Sana, a Swedish developer of enterprise AI agents, for around $1.1b. Sana had raised around $140m from firms like NEA, EQT Ventures and Menlo Ventures.

- Atlassian (Nasdaq: TEAM) agreed to acquire DX, a developer productivity insights platform, for $1b in cash and stock. DX had been seeded by such firms as Preface Ventures, Prototype Capital and Iconiq.

- Apollo Global Management is weighing a sale of AOL, which could fetch around $1.5b

- Thomson Reuters (Nasdaq: TRI) acquired Additive, an SF-based tax document processing automation startup that had raised funding from Mantis VC and Quiet Capital

- Adnoc, ADQ and Carlyle pulled their US$18.7b offer to buy Australian oil and gas giant Santos (ASX: STO). BFD flashback

IPOs:

- Netskope, a Santa Clara, Calif.-based cloud security provider, raised $908m in its IPO. It priced at the top of its upwardly revised range, for a $9b fully diluted value, and will list on the Nasdaq (NTSK). Major shareholders include Lightspeed Venture Partners, Iconiq, and Accel.

- Pattern Group, a Lehi, Utah-based online reseller for consumer brands, raised $300m in its IPO. It priced in the middle of its $13-$15 range, for a $2.6b fully diluted value, and will list on the Nasdaq (PTRN). The company has raised over $270m from firms like KSV and Knox Lane.

Funds:

- Alt Capital, an enterprise AI-focused VC firm led by Jack Altman, raised $275m for its second fund

Axios Final Numbers:

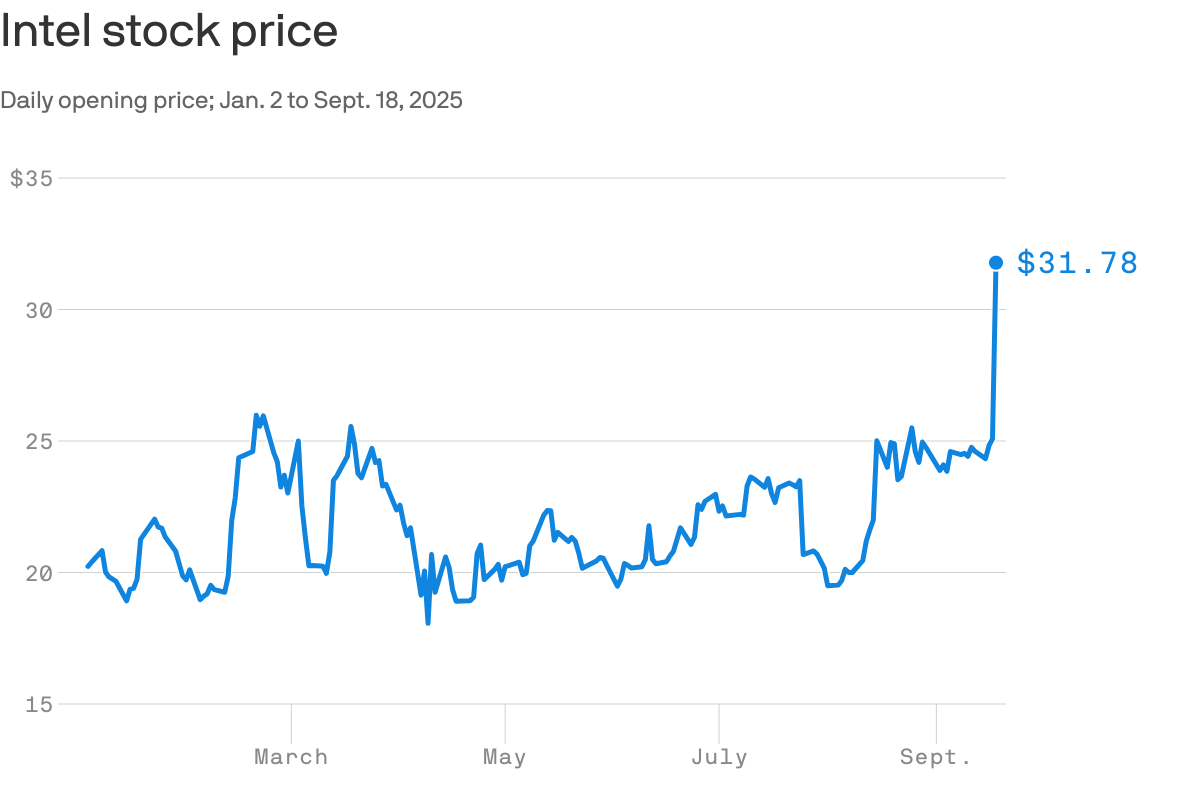

Data: Financial Modeling Prep; Chart: Axios Visuals

Intel shares surged at today's open, on news that Nvidia will invest $5 billion into the chipmaker, as part of a broader strategic agreement.. Or, put another way, a major deal for America's AI tech stack.

Love merch? Check out our shop: sourcerymerch.com

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.