Part II: Alfred Lin, Sequoia

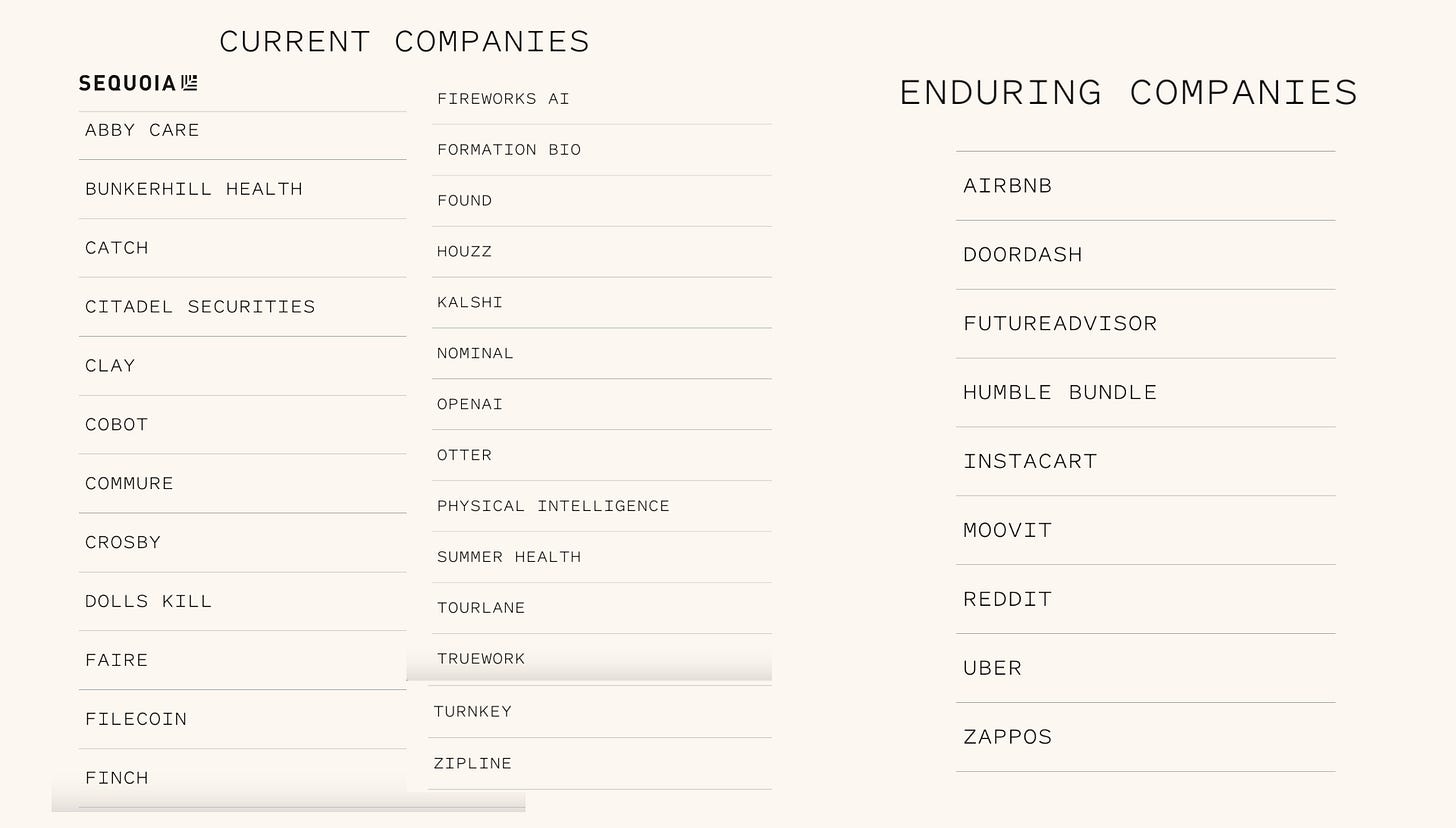

OpenAI, Airbnb, Citadel Securities, Profound, Clay, Kalshi

Founder-Market Fit, Backing Category Creators, Surviving Crises, & Building for the World

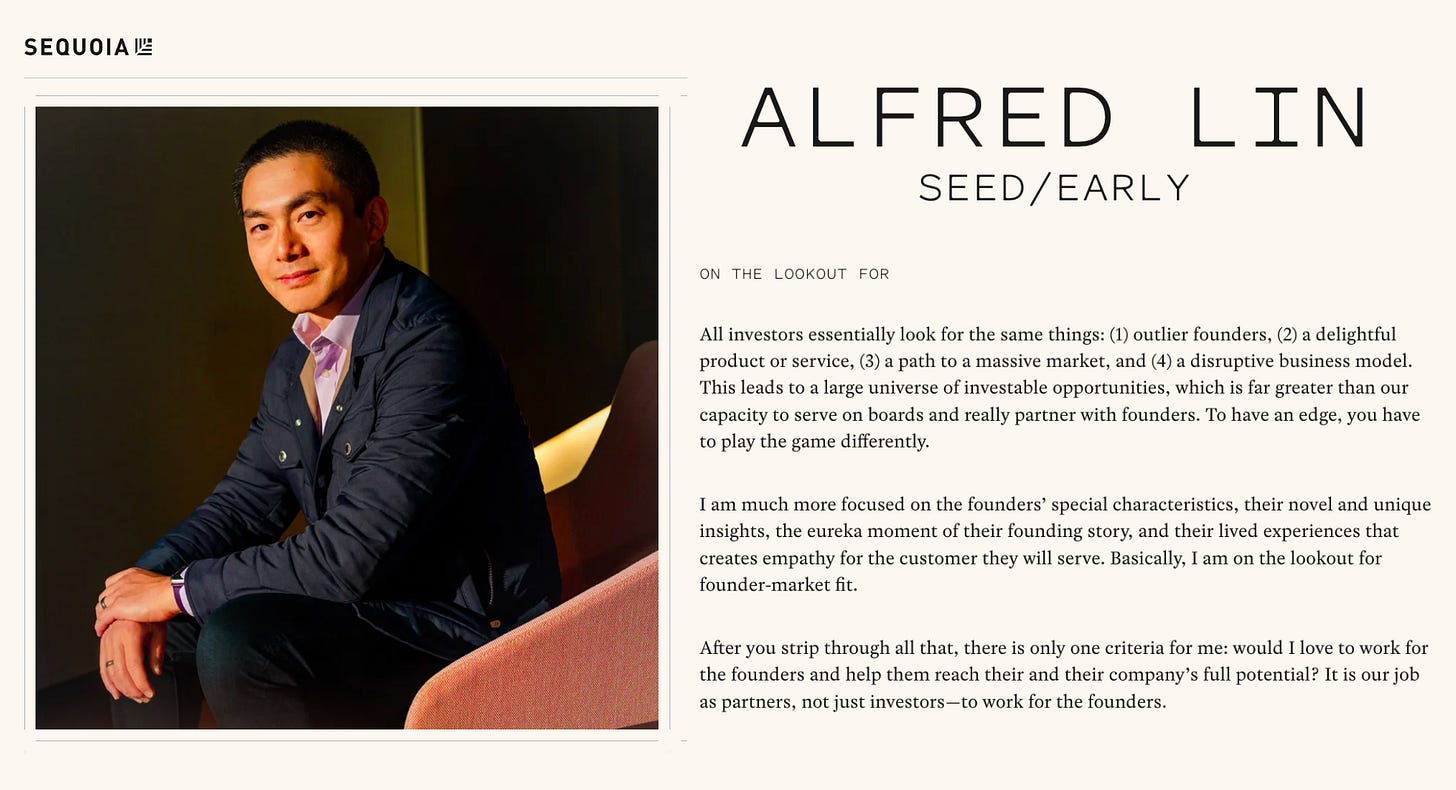

Alfred Lin, Partner at Sequoia Capital and three-time #1 Midas List investor, has backed some of the most transformative companies of the past two decades. His portfolio spans early bets on Airbnb, DoorDash, Uber, Instacart, Reddit, Zipline, Kalshi, Fireworks AI, Physical Intelligence, & Commure, to growth-stage partnerships with OpenAI & Citadel Securities. Alfred consistently identifyies founders & businesses that redefine entire markets.

→ Listen on X, Spotify, YouTube, Apple

He continues this track record today with next-generation category creators like Profound, which is building AI-powered brand visibility, Nominal, which is powering mission-critical engineering with a unified data stack, and Clay, which evolved into a go-to-market engine by relentlessly adapting to innovation.

In this conversation, Alfred shares his philosophy on founder-market fit, resilience, and backing visionaries who create new categories. He reflects on Airbnb’s near-collapse during COVID, DoorDash’s rise, and Sequoia’s landmark investment in Citadel Securities, while breaking down how he evaluates IPOs, valuations in the AI era, and why the next decade will be defined by reimagined consumer experiences.

We Dive Into:

Airbnb’s COVID Crisis (80% revenue drop)

$1B Citadel Securities Partnership

OpenAI’s $1 Trillion Potential

Below we go into Alfred’s companies, with quotes from founders, dive into the Citadel Securities, & timestamps of the conversation.

Brought to you by:

Brex—The intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast. Visit → brex.com/sourcery

Turing—Turing delivers top-tier talent, data, and tools to help AI labs improve model performance, and enable enterprises to turn those models into powerful, production-ready systems. Visit → turing.com/sourcery

Carta—Carta connects founders, investors, and limited partners through software purpose-built for private capital. Trusted by 2.5M+ equity holders, 65,000+ companies in 160+ countries, Carta’s platform of software & services lays the groundwork so you can build, invest, and scale with confidence. Visit → Carta.com/sourcery

Kalshi—The largest prediction market & the only legal platform in the US where people can trade directly on the outcomes of future events (sports, politics, weather, AI, etc).

𝐓𝐈𝐌𝐄𝐒𝐓𝐀𝐌𝐏𝐒

(00:00) Alfred Lin, Sequoia

(01:31) Keeping up with AI cycles

(03:55) Why markets often consolidate to 2–3 leaders

(05:07) “Build for the world, not San Francisco”

(07:14) Airbnb’s COVID crisis and Brian Chesky’s leadership

(13:15) Culture under stress: resilience in tough times

(15:45) The essence of founder-market fit

(16:20) Motion ≠ progress: why velocity matters

(17:55) Resetting company culture in the AI era

(19:55) Clay’s pivot into a go-to-market engine

(21:10) Profound and the rise of AI-powered brand visibility

(25:15) Breaking through to invest in Citadel Securities

(29:45) IPOs, exits, and what makes a public company

(33:05) Performance metrics: numbers behind the numbers

(33:58) AI premiums, valuations, and when they turn reckless

(39:45) OpenAI’s $500B valuation + $1 Trillion potential

Alfred Lin

Alfred’s outlook as Sequoia launches Seed Fund VI ($200M) & Venture Fund XIX ($750M)

“Almost every single industry will be disrupted by AI. If you study the history of the internet, mobile, and cloud, each of those technology waves brought business model transformations. The same will be true of AI.

So far, AI has automated some of our most mundane work, but we look forward to the new creative ideas that can come out of AI. New business processes, consumer experiences we haven’t seen before, new ways to play… I think many of those experiences can be truly transformative in our lives.”

Companies

Founder Quotes

Tanay Tandon, CEO of Commure

“I think he’s truly the most operationally excellent VC we know. He has a CFO + COO brain vs a VC brain. Which makes it really helpful to talk real day to day stuff with him.”

Cameron McCord + Bryce Strauss, Co-Founders of Nominal

“Alfred’s the best at category creation we’ve ever seen. He doesn’t just “get it” by pattern matching, he asks insanely specific questions that uncover what actually matters in a market. Within 30 minutes he had a better handle on our space than most people do after months, he even recalculated our TAM and proved we were undershooting it.

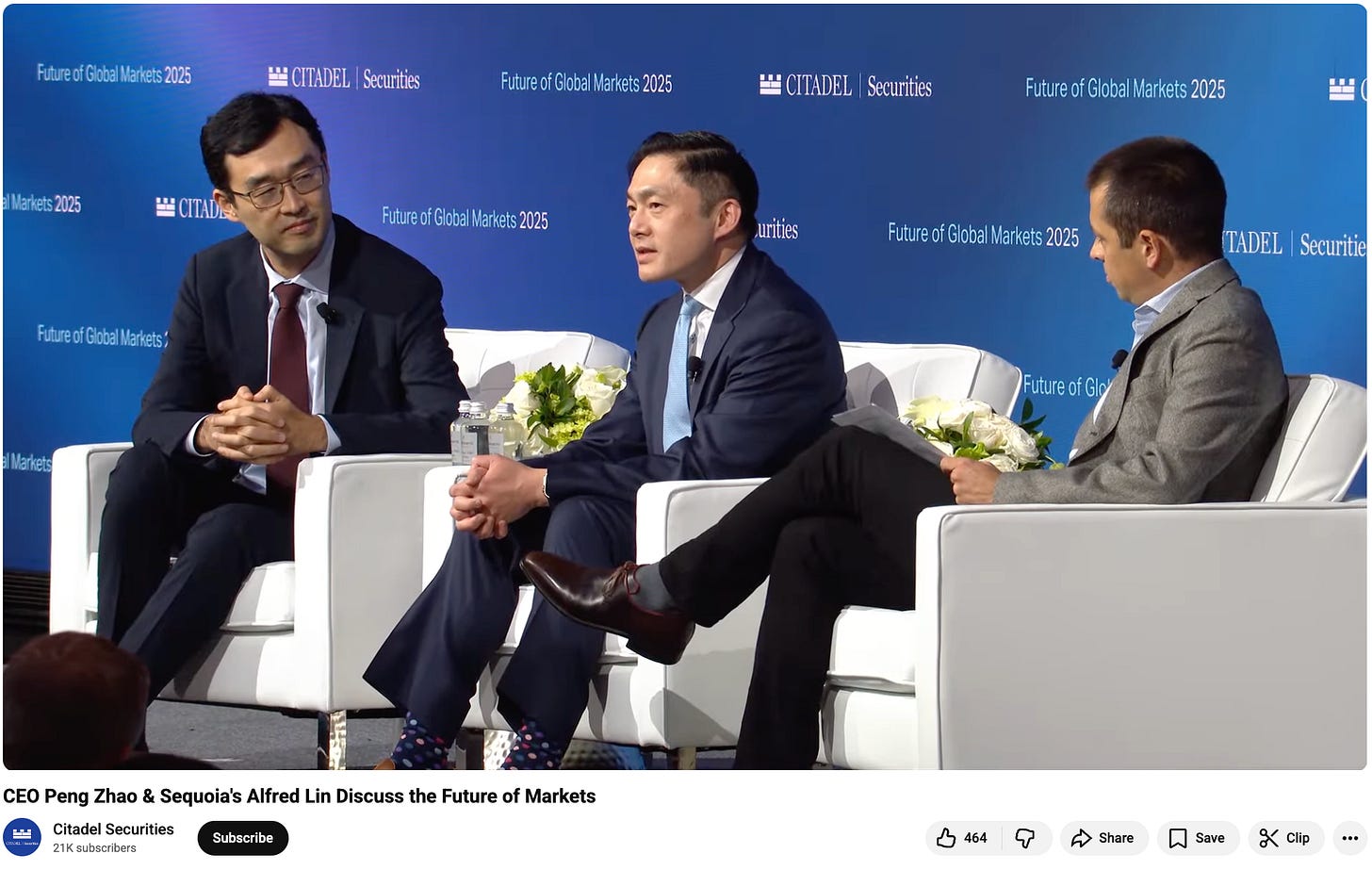

Citadel Securities Conference

Fun Fact: Sequoia was the first outside check with $1M into NVIDIA + $1B into Citadel Securities.

“We represent about ⅓ of the volume on the New York Stock Exchange. We’re obviously doing a lot in retail markets where we take flow off the books of Robinhood, Charles Schwab, Interactive Brokers, where 35% of retail volumes in this country.

Citadel Securities is Doing for Trading What ‘Amazon Did for E-Commerce, President, Jim Esposito

CEO Peng Zhao & Sequoia’s Alfred Lin Discuss the Future of Markets

Peng Zhao, CEO of Citadel Securities, and Alfred Lin, Partner at Sequoia Capital, joined a discussion moderated by Jeff Maurone, COO, Technology and Low Latency, on how artificial intelligence, automation, and an obsession with client experience are transforming global markets.

$1 Billion Investment

Alfred: “I joined Sequoia Capital in 2010. So I’ve been there for about 15 years, and I work with a variety of companies, such as Airbnb, DoorDash, and Kalshi that you saw before, and Citadel Securities.

We were invited to invest $1 billion, not $1 million, but $1 billion, into Citadel Securities. And, we graciously took it. So I get to work with Peng on this board.”

How Citadel Securities Prepared for Meme Stock Crisis

Peng: “During the meme-stock frenzy, we were able to operate through that entire episode with zero seconds of downtime. And that was actually no easy feat. That was only possible because we planned for six times the capacity of the previous market peak.

And why was it six times? Because one, you’re starting off to say, “I need to have enough capacity for the highest amount of volume of message rate I’ve ever seen.” That’s your starting point. Now, obviously, your next market peak is going to be higher than the previous one. So you double the whatever the previous peak was.

But then, we told us, we hold ourselves, I mean, then we thought to ourselves that, “Hey, I don’t think our competitors is going to spend a tech budget to plan for that kind of market peak and disruption and volume that they need to handle.

What if they all go down. And if we’re 35 to 40% of the market and then to triple my capacity yet from there on out.”

So we literally went through that math and planned for six times the capacity from the previous peak capacity that we needed.

And we almost had to use all of it. So a very tax-centric, anticipatory, planning tech roadmap allowed us to be there when our clients and customers needed us the most. And that was the case during each individual one of the market meltdowns & melt-ups that was there during each one of the crises that was in the marketplace.

We think about how do we scale the way we serve our clients during the times of stress, rather than how much doing now cost us on a day in, day out basis?”

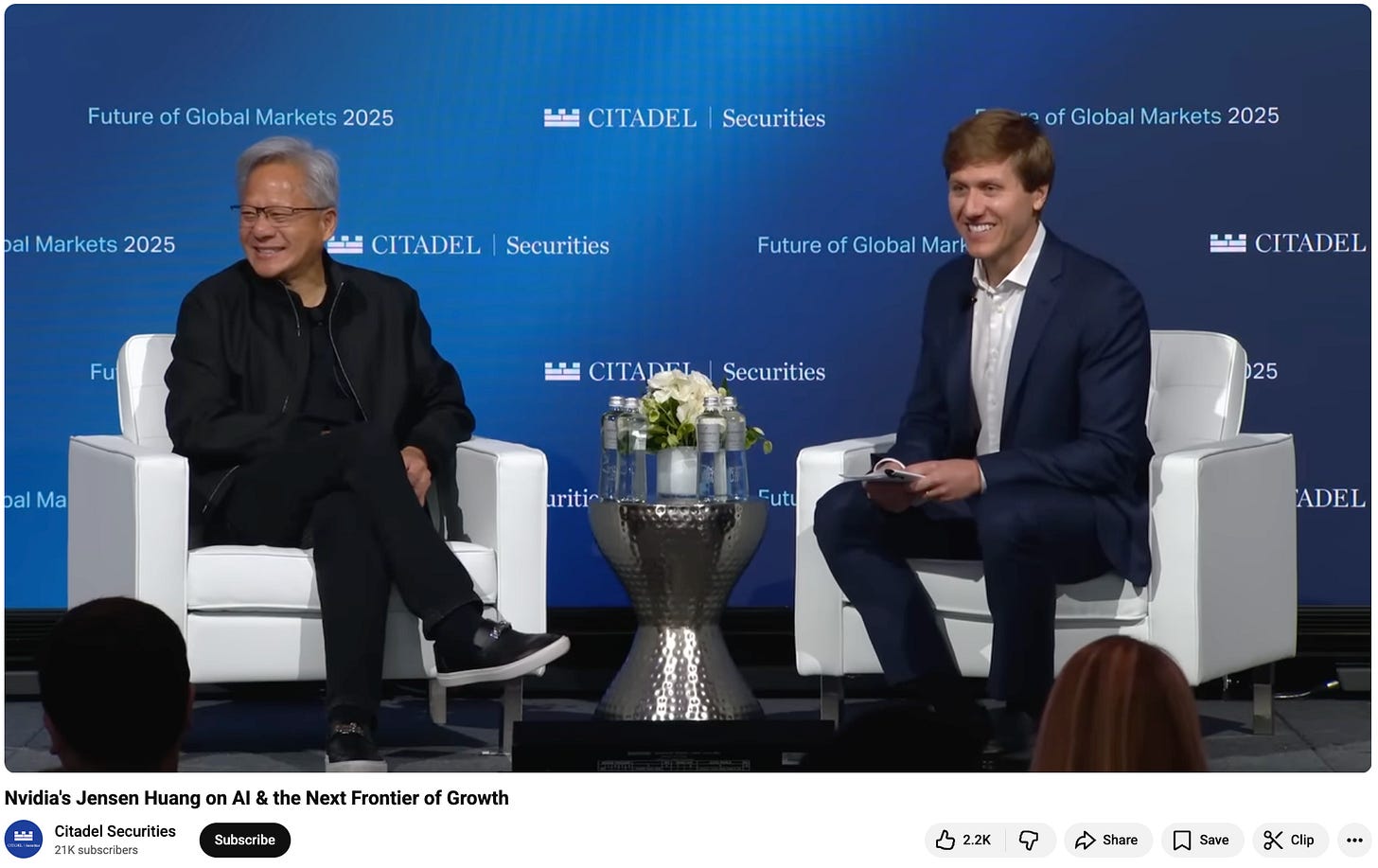

Nvidia’s Jensen Huang on AI & the Next Frontier of Growth

Nvidia founder and CEO Jensen Huang speaks with Sequoia Capital partner Konstantine Buhler about the company’s journey, from its foundational insight into accelerated computing to its role building the infrastructure for the AI revolution. Jensen also details Nvidia’s integrated AI factory platform, the immense future markets in agentic AI and physical AI, and the importance of sovereign AI.

$1 Million Investment, 1993

Konstantine: “They were both (Nvidia & Citadel Securities) powered by the computing revolution, and both are leaders in their respective industries with technology. They also have another, lesser-known fact. In both cases, their first outside investor was Sequoia Capital.”

Jensen: “$1 million. They, they risked $1 million in Nvidia in 1993.”

Konstantine: “You were worth it. One solid million dollars.”

A Conversation With Ken Griffin

Ken Griffin, Founder of Citadel Securities, joined Bloomberg TV’s Francine Lacqua for a one-on-one discussion covering the outlook for the U.S. economy, fiscal policy, global competitiveness and the future growth of Citadel Securities.

Kalshi Founders Tarek Mansour & Luana Lopes Lara On Turning Events Into Assets

Kalshi co-founders Tarek Mansour & Luana Lopes Lara joined Molly O’Shea, host of the Sourcery podcast, for a conversation on how prediction markets are emerging as a new asset class. The discussion covered Kalshi’s rapid growth, its regulatory journey and how event contracts are reshaping finance by turning real-world outcomes like elections, inflation or sports results into tradable assets.

Maybe your best yet. Keep cooking!