PLTR Hits $1B+ Qtr Rev

Ramtin Naimi, OpenAI, Vanta, Anaconda, fal, OffDeal, Motive, Figma, Flexport/Convoy

“I use Brex for EVERYTHING.” - Roy Lee, Cluely

Brex is the modern finance platform, combining the world’s smartest corporate card with integrated expense management, banking, bill pay, and travel.

Over 30,000 companies, including ServiceTitan, Anthropic, Scale AI, Mercor, DoorDash, & Wiz, use Brex.

Hello from Kentucky

I am not sure if I can share why I’m here yet, so you’ll just have to follow along on X..

Musings

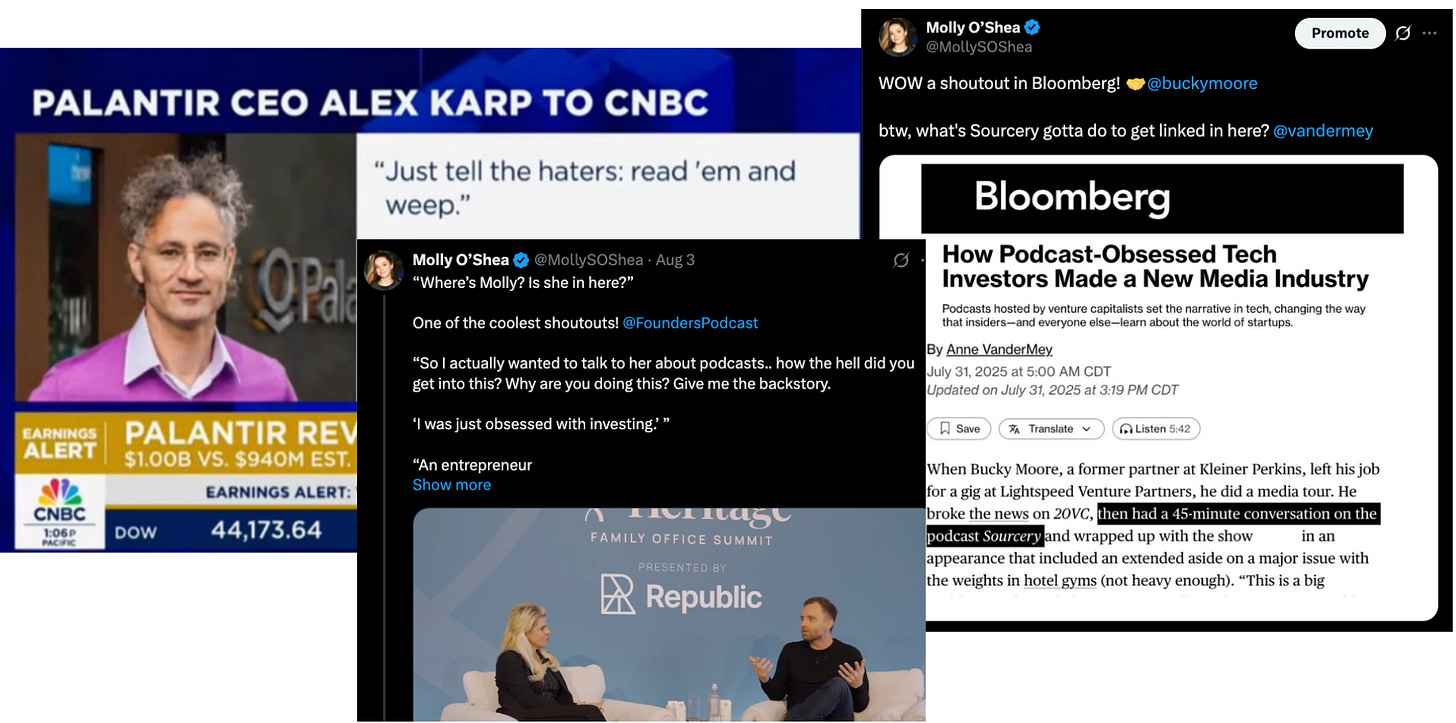

"Just tell the haters: read ''em and weep"

Palantir Q2 2025 Earnings: Revenue tops $1B, Rule of 40 score hits 94% (Presentation included)

AI

Dwarkesh Patel on AI, Learning, & Podcasting | Jack Altman

Sam Altman on This Past Weekend w/ Theo Von

A 16-year-old (!!) published an interview on the future of jobs & AI w/ Jacqui Canney, chief people & AI enablement officer at ServiceNow, a ~$200B public company.. 16!!

What’s actually happening BTS of OpenAI? LLMs? What’s benchmarking?? | This week in startups

OpenAI secures $8.3bn in latest huge fundraising | Dragoneer fund will invest $2.8bn in one of the largest start-up cheques ever written by a company

IPOs

We found the official tech IPO watchlist of the hottest soon-to-be S-1 filings

VC

How This VC Went From Broke to Becoming the Hot Hand in Silicon Valley | Ramtin Naimi, Founder of Abstract Ventures

Recent Sourcery Shoutouts! Thank you!

Check out Kalshi → The largest prediction market & the only legal platform in the US where you can trade directly on the outcomes of future events (sports, IPOs, politics, weather, AI, etc).

Top Interviews

General Matter: Peter Thiel’s $50M Bet on American Nuclear Fuel | Scott Nolan, Founder & CEO (& Partner at Founders Fund)

How Palantir Is Modernizing the Military With AI | Greg Little, Senior Counselor at Palantir

Launching Out of Stealth: Artificial Intelligence Underwriting Company | Rune Kvist, CEO

→ Follow Sourcery on: X, YouTube, Spotify, Apple, Linkedin

Last Week (7/28-8/1):

Relevant deals include the 70+ deals across stages below. I've categorized the deals below into seven categories, Fintech, Care, Enterprise / Consumer, HardTech, Sustainability, Acquisition/PE, and Fund Announcements, and ordered from later-stage rounds to early-stage rounds.

VC Deals

Fintech:

- Ramp, a New York City-based financial operations platform, raised $500 million in Series E-2 funding. ICONIQ led the round and was joined by Sutter Hill Ventures, Lightspeed Ventures, T. Rowe Price Associates, GV, and others.

- QI Tech, a São Paulo-based financial infrastructure company, raised $63 million in a Series B extension. General Atlantic led the round.

- Salient, a San Francisco-based provider of AI-powered financial services technology, raised $60 million in funding. Andreessen Horowitz led the round and was joined by Matrix Partners, Michael Ovitz, and Y Combinator.

- Stable, a New York City-based layer 1 blockchain network powered by USDT and designed to achieve seamless financial transactions through stablecoins, raised $28 million in seed funding. Bitfinex & Hack VC led the round and was joined by Franklin Templeton, Castle Island Ventures, eGirl Capital, Bybit-Mirana, and others.

- Wingspan, a New York City-based payroll platform for managing independent contractors, raised $24 million in Series B funding. Touring Capital led the round and was joined by existing investors Andreessen Horowitz, Long Journey Ventures, Distributed Ventures, Company Ventures, and 186 Ventures.

- Tako, a Brazilian payroll and workforce management platform, raised $18m from Ribbit Capital and a16z

- Flyhomes, an Issaquah, Wash.-based real estate platform, raised $15m in Series D funding from a16z, Norwest Venture Partners, Canvas Ventures, and Camber Creek

- OffDeal, a New York-based investment banking platform, raised $12m in Series A funding. Radical Ventures led, joined by YC, Rebel Fund, and Centre Street Partners

- TakeUp, an SF-based pricing engine for independent hotels, raised $11m in Series A funding led by 1848 Ventures

- Keye, a New York City-based AI tool designed for private equity teams, raised $5 million in seed funding from Sorenson Capital, General Catalyst, Y Combinator, ERA, Tiferes Ventures, Dunamu Ventures, Palm Drive Capital, and angel investors.

- Due, a London-based developer of a stablecoin API, raised $4m in seed extension funding led by Speedinvest

Care:

- Ambience Healthcare, a San Francisco-based AI platform for documentation, coding, and clinical workflow, raised $243 million in Series C funding. Oak HC/FT and Andreessen Horowitz led the round and were joined by existing investors OpenAI Startup Fund, Kleiner Perkins, and Optum Ventures.

- Ultromics, a U.K. developer of cardiology diagnostics solutions, raised $55m in Series C funding. L&G, Allegis Capital, and Lightrock led, joined by Oxford Science Enterprises, GV, Blue Venture Fund, Oxford University, University of Chicago Medicine and UPMC Enterprises.

- Small Door Veterinary, a membership-based veterinary care company, raised $35m in equity funding. Valspring Capital led, joined by Primary Venture Partners, C&S Family Capital, Lerer Hippeau, and Toba Capital. It also secured $20m in debt from Bridge Bank.

- Arbital Health, a San Francisco, Calif.-based health care technology company that provides critical infrastructure for providers and payers to successfully manage risk-based contracts, raised $31 million in Series B funding. Valtruis led the round and was joined by existing investors Transformation Capital, Shaper Capital, and Healthy Ventures.

- Sava, a London, U.K.-based preventative health company, raised $19 million in Series A funding. Balderton Capital and Pentland Ventures led the round and were joined by Norrsken VC and JamJar Investments.

- C8 Health, a New York City-based practices implementation platform for health care, raised $12 million in Series A funding. Team8 led the round and was joined by 10D and Vertex Venture Israel.

- Journey, a New York City-based provider of mental health solutions for companies, raised $8 million in Series A funding. Cambrian Growth Partners led the round and was joined by Manchester Story, Canaan Partners, J-Ventures, J-Impact, Life Science Angels, HealthTech Capital, and others.

- JotPsych, a Pepper Pike, Ohio-based medical AI scribe, raised $5 million in seed funding. Base10 Partners led the round.

Enterprise/Consumer:

- OpenAI raised $8.3b at a $300b valuation. This is part of a previously announced $40b round that's expected to close by year-end, inclusive of the $10 billion that closed in June ($7.5b from SoftBank). Participants in this tranche include Dragoneer, Blackstone, TPG, T. Rowe Price, Fidelity, a16z, Altimeter, Coatue, D1 Capital Partners, Founders Fund, Sequoia Capital, Tiger Global, and Thrive Capital.

- Quince, a DTC online fashion retailer, is raising about $200m at a $4.5b valuation

- Observe, a San Mateo, Calif.-based observability startup, raised $156m in Series C funding. Sutter Hill Ventures led, joined by Madrona Ventures, Alumni Ventures, Snowflake Ventures and Capital One Ventures.

- Vanta, an SF-based enterprise compliance management startup, raised $150m in Series D funding at a $4.15b valuation. Wellington led, joined by Atlassian Ventures, CrowdStrike Ventures, Goldman Sachs, Sequoia Capital, and JPMorgan

- Anaconda, an Austin-based AI operating system, raised $150 million in Series C funding. Insight Partners led the round and was joined by Mubadala Capital.

- fal, a San Francisco-based generative media infrastructure platform, raised $125 million in Series C funding from Salesforce Ventures, Shopify Ventures, Google AI Futures Fund, Bessemer Venture Partners, Kindred Ventures, and others.

- HeroDevs, a Sandy, Utah-based security solutions provider, raised $125 million in funding. PSG led the round and was joined by existing investor Album.

- Reka, a Sunnyvale, Calif.-based multi-modal model builder, raised $110m at over a $1b valuation from such backers as Radical Ventures, Snowflake, and Nvidia

- Oxide Computer Company, an Emeryville, Calif.-based cloud computing company, raised $100 million in Series B funding. US Innovative Technology Fund led the round and was joined by existing investors Eclipse, Intel Capital, Riot Ventures, and others.

- Carbyne, a New York City-based provider of cloud-native emergency communications and response solutions, raised $100 million in funding from AT&T Ventures, Axon Enterprise, Cox Enterprises, Global Medical Response, Hanaco Growth, Hercules Capital, and others.

- SAFE, a Palo Alto, Calif.-based CyberAGI company, raised $70 million in Series C funding. Avataar Ventures led the round and was joined by SIG Venture Capital, NextEquity Partners, Prosperity7 Ventures, and existing investors.

- Good Job Games, an Istanbul, Turkey-based mobile games company, raised $60 million in Series A funding. Menlo Ventures and Anthos Capital led the round and were joined by Bessemer Venture Partners.

- Wallarm, a San Francisco-based API and agentic AI security platform, raised $55 million in Series C funding. Toba Capital led the round.

- Positron AI, a Reno, Nev.-based developer of a transformer inference appliance, raised $51.6m in Series A funding. Valor Equity Partners, Atreides Management, and DFJ Growth led, joined by Flume Ventures, Resilience Reserve, 1517 Fund, and Unless.

- BlinkOps, an Austin, Texas-based developer of cybersecurity micro-agents, raised $50 million in Series B funding. O.G. Venture Partners led the round and was joined by Lightspeed Venture Partners and Vertex Growth.

- Teramount, a Jerusalem, Israel-based high-speed data transfer company, raised $50 million in funding. Koch Disruptive Technologies led the round and was joined by AMD Ventures, Hitachi Ventures, and others.

- Lumana, a Los Gatos, Calif.-based AI video security company, raised $40 million in Series A funding. Wing Venture Capital led the round and was joined by Norwest and S Capital.

- Legion, an AI security operations center startup, raised $38m in seed and Series A funding. Coatue led, joined by Accel and Picture Capital

- Dropzone AI, a Seattle-based developer of cybersecurity agents, raised $37m in Series B funding. Theory Ventures led, joined by Madrona, Decibel Ventures, Pioneer Square Labs, and IQT

- Sparrow, an SF-based employee leave management startup, raised $35m in Series B funding led by Silver Lake Waterman

- Cline, a San Francisco-based developer of an AI coding agent, raised $32 million in seed and Series A funding. Emergence Capital led the Series A round and was joined by Pace Capital, 1984 Ventures, Essence VC, Cox Exponential, and others.

- Fable Security, a San Francisco-based human risk management platform, raised $31 million in funding from Greylock Partners and Redpoint Ventures.

- Multibeam, a Santa Clara, Calif.-based process control startup for semiconductors, raised $31m in Series B funding. Onto Innovation and Lam Capital led, joined by UMC Capital and MediaTek Capital

- Prophet Security, a Palo Alto, Calif.-based security platform, raised $30 million in Series A funding. Accel led the round and was joined by Bain Capital Ventures and others.

- E2B, a San Francisco-based provider of open-source cloud infrastructure designed for AI agents, raised $21 million in Series A funding. Insight Partners led the round and was joined by Decibel, Sunflower Capital, Kaya, and angel investors.

- LakeFS, a version control system for enterprise data, raised $20m led by Maor Investments, with participation from Dell Technologies Capital, Norwest, and Zeev Ventures

- Promptfoo, an AI security and evaluation platform, raised $18.4m in Series A funding. Insight Partners led, joined by insider a16z.

- Knit, an Austin-based AI-powered platform for consumer market research, raised $16.1 million in Series A funding. Sound Ventures and GFT Ventures led the round and were joined by Silicon Road Ventures, Osage Ventures, Rise of the Rest, and others.

- Echo, a software infrastructure security startup, raised $15m in seed funding led by Notable Capital and Hyperwise Ventures

- PlayerZero, an Atlanta-based predictive software company that uses AI agents to fix coding problems before that code is released, raised $15 million in Series A funding and $5 million in seed funding. Foundation Capital led the Series A round and Green Bay Ventures led the seed round.

- Deep Cogito, a San Francisco-based superintelligence company, raised $13 million in Series A funding. Benchmark led the round.

- Seal Security, a provider of application security solutions, raised $13m in Series A funding. Vertex Israel led, joined by More Investments, SBI Group, and CCL

- Root Evidence, a Boise, Idaho-based cybersecurity company, raised $12.5 million in seed funding. Ballistic Ventures led the round and was joined by Grossman Ventures.

- Hightouch, an SF-based data and AI agent platform for marketers, raised $12m in Series C funding from Snowflake and Capital One

- Julius AI, a San Francisco-based AI-powered data analyst for knowledge workers, raised $10 million in seed funding from Bessemer Venture Partners, Y Combinator, Horizon VC, AI Grant, 8VC, and angel investors.

- Reach Security, a San Francisco-based developer of AI-powered assistant technology designed to reduce exposure to security risks, raised $10 million in funding from M12 and existing investors including Artisanal Ventures.

- Tzafon, an SF-based AI infrastructure startup, raised $9.7m in pre-seed funding. HV Capital led, joined by Streamlined VC and Kakao VC

- Metaforms, a San Francisco-based AI platform for market research agencies, raised $9 million in Series A funding. Peak XV Partners led the round and was joined by Nexus Venture Partners and Together Fund.

- TACEO, a Graz, Austria-based developer of infrastructure for secure computation on encrypted data, raised $5.5 million in seed funding. Archetype VC led the round and was joined by a16z CSX, Cyber.Fund, A.Capital Ventures, Polymorphic, and angel investors.

- Caspian, a San Francisco-based AI-powered customs compliance company, raised $5.4 million in seed funding. Primary Venture Partners led the round and was joined by Blank Ventures.

- Pensero, a New York City-based AI-powered developer intelligence platform, raised $5 million in funding. Mighty Capital and ICONIQ Capital led the round.

- Retab, a San Francisco-based AI agent that builds document extraction pipelines, raised $3.5 million in pre-seed funding from VentureFriends, Kima Ventures, K5 Global, and angel investors.

- Caseflood.ai, a San Francisco-based legal AI agent, raised $3.2 million in funding from Acquisition.com, Y Combinator, Rebel Fund, Four Cities Capital, Elevation Capital, Amino Capital, and others.

- Dawnguard, an Amsterdam-based cybersecurity company, raised $3 million in pre-seed funding. 9900 Capital led the round and was joined by angel investors.

HardTech:

- Motive, a San Francisco-based AI-powered Integrated Operations Platform for the physical economy, raised $150 million in funding. Kleiner Perkins led the round and was joined by AllianceBernstein and existing investors.

- Lumotive, a Redmond, Wash.-based programmable optics company, raised $59 million in Series B funding from Amazon’s Industrial Innovation Fund, Oman’s ITHCA, Gates Frontier, and MetaVC.

- Positron AI, a Reno, Nev.-based developer of hardware for multimodal AI, raised $51.6 million in Series A funding. Valor Equity Partners, Atreides Management, and DFJ Growth led the round and were joined by Flume Ventures and others.

- Augmodo, a Seattle-based developer of spatial AI technology for inventory and task tracking, raised $37.5 million in Series A funding. TQ Ventures led the round and was joined by Arena Holdings, the family office of Tony James, and others.

- Reveal Technology, a Bozeman, Mont.-based defense technology company, raised $30 million in Series B funding. Ballistic Ventures led the round and was joined by defy.vc, Booz Allen Ventures, Shield Capital, Next Frontier Capital, and Madison Valley Partners.

- Still Bright, a Newark, N.J.-based developer of copper extraction tech, raised $18.7m in seed funding. Material Impact and Breakthrough Energy Ventures led, joined by Azolla Ventures, Fortescue, Impact Science Ventures, and SOSV

- Planted Solar, an Oakland, Calif.-based solar deployment platform, raised $12 million from Piva Capital, Breakthrough Energy Ventures, Khosla Ventures, and Team Builder Ventures.

- Overwatch Imaging, a Hood River, Ore.-based developer of airborne imaging systems and AI-powered automation software for intelligence and surveillance, raised $6 million in funding. Squadra Ventures led the round and was joined by SEMCAP AI, the Elevate Oregon Venture Direct Fund, and Edo Capital.

- CVector, a Boston-based industrial AI company, raised $1.5 million in funding from Schematic Ventures.

Acquisitions & PE:

- Flexport, valued by VCs at $8b in 2022, sold the Convoy freight tech assets it acquired two years ago to DAT Freight & Analytics.

- Ray Dalio sold his remaining stake in Bridgewater, the hedge fund giant he founded, and left its board of directors

- John Hess plans to buy back the Hess toy truck business from Chevron (NYSE: CVX), which recently completed its $53b acquisition of Hess Corp

- Contentsquare, a digital analytics company whose backers include Sixth Street and SoftBank, agreed to acquire Loris AI, a conversation intelligence platform that had raised nearly $20m from firms like ServiceNow Ventures and Bow Capital.

- Gamefound, a Polish board-game maker, acquired Indiegogo, the crowdfunding platform whose backers include Kleiner Perkins, Insight Venture Partners, Institutional Venture Partners, and Khosla Ventures back Indiegogo. Republic previously was in talks to buy Indiegogo

- Union Pacific (NYSE: UNP) agreed to buy rival railroad operator Norfolk Southern (NYSE: NSC) for $85 billion in cash and stock.

- Palo Alto Networks (Nasdaq: PANW) has agreed to buy Israeli cybersecurity firm CyberArk (Nasdaq: CYBR) for around $25 billion in cash and stock.

- Lyft (Nasdaq: LYFT) completed its €175m purchase of taxi app FreeNow from BMW and Mercedes-Benz

IPOs:

- Firefly Aerospace, a commercial space flight business backed by AE Industrial Partners, set IPO terms to 16.2m shares at $35-$39. It would have a $5.8b market value, were it to price in the middle, and plans to list on the Nasdaq (FLY).

Love merch? Check out our shop: sourcerymerch.com

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.