Sourcery 🎉 Rick Rubin, Jeff Bezos, Reid Hoffman, Mistral

(12/18-12/22) Vestwell, Knownwell, Harvey AI, Meltwater, Halcyon, ScaleOps, Distributional, Hydrogrid; Chobani/La Colombe, Coupang/Farfetch

Congratulations! 🥳 🥳

If you’re reading this.. you get 23% off Sourcery merch

Use code: Sourcery23

Finale

You’ve made it to the last week of 2023. And while we expected headlines to slowdown, last week included high-profile fundings like Harvey AI, acquisitions like Chobani & La Colombe, Coupang & Farfetch, IBM StreamSets & webMethods, ServiceNow & UltimateSuite.. as well as a SPAC with Lynk Global (who would’ve thought?).

We’re taking this quiet week to catch up on podcasts (believe it or not), movies, documentaries (Rick Rubin Shangri-LA), family time, hikes, and learning some new things like Python & more LLM/AI Infrastructure research. Might need another week?

In just the last 7 weeks, we went from moving from LA, to _starting something new_, to traveling pretty heavily (maybe spent 10 days total in the new place?), and let’s just say we’re looking forward to finally sharing all of the exciting updates.. as well as settling into the New Year. 😊

As for clues on what’s next, here are some books my brother gifted me.

Musings

The best things we’ve listened to so far this break

AI

The Case for AI Optimism With Reid Hoffman, No Priors: Elad Gil & Sarah Guo

Reid needs no introduction, he’s the co-founder of PayPal, Linkedin, & most recently Inflection AI which is building empathetic AI companions. He is also a board member at Microsoft & former board member at OpenAI. Listen for the historical case for an optimistic outlook on emerging technology like AI, advice for workers who fear AI may replace them, & why it’s impossible to regulate before you innovate. Plus, some predictions.

Fireside Chat with Eiso Kant, CTO of Poolside, and Matt Turck, Partner at FirstMark Capital

Eiso Kant, CTO + Co-Founder of Poolside, the buzzy new AI tool for software development. Eiso and Matt talk about Poolside’s foundational model, the critical role of data quality in AI, the importance of controlling all levels of the stack, and the merits of building a global AI company out of Europe.

Balaji Srinivasan on How AI Will Shape the Future, Moment of Zen

Balaji Srinivasan joins Nathan Labenz to discuss polytheistic AI and AI gods, human-AI symbiosis, and how AI will be controlled.

Rapidly Digesting Documents Using AI with Humata’s Cyrus Khajvandi and Dan Rasmuson, Ark Invest

Mistral’s New Mixture-of-Experts Model, Mixtral 8x7B, Delivers on Both Performance and Efficiency, & More, Ark Invest

Last week, Mistral AI released Mixtral 8x7B, a new open-source Mixture-of-Experts (MoE) large language model (LLM) that includes 8 small neural networks, each of which is finetuned in a specific area of expertise. Also included in GPT-4, the MoE structure enables higher efficiency than in other LLMs, calling on relevant expert models to answer different queries.

The Ultimate AI Roundtable: What Happens Now in AI, Why Google are Vulnerable, @20VC

Des Traynor Co-Founder of Intercom. Yann LeCun VP & Chief AI Scientist at Meta and Silver Professor at NYU affiliated with the Courant Institute of Mathematical Sciences & the Center for Data Science. He was the founding Director of FAIR and of the NYU Center for Data Science. Emad Mostaque Co-Founder and CEO @ StabilityAI, the parent company of Stable Diffusion. Jeff Seibert Founder & CEO @ Digits, building the future of AI-powered accounting. Tomasz Tunguz Founder and General Partner @ Theory Ventures. Douwe Kiela CEO of Contextual AI. Cris Valenzuela is the CEO and co-founder of Runway. Richard Socher is the founder and CEO of You.com.

Hardtech/AI

Jeff Bezos: Amazon and Blue Origin | Lex Fridman Podcast #405

From building Amazon to now focusing on Blue Origin, 1,000 ways to be smart, public personas vs personal relationships (Elon), truth-seeking, disrupting heirarchy to create meritocracy within organizations, reading between the lines of anecdotes vs data, AI, LLMs are ‘discoveries’ not inventions, crisp documents & messy meetings, 10,000 year clock & long-term thinking, wandering & inventing, to retraining our attention spans with long-form content.

Want to read the 2hr interview in 10min? Check out my Summary Xeet ⬇️

New Year Prep

New Year Coming? The One Big Question, Dr. Julie Gurner

. . .

Last Week (12/18-12/22):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into five categories, FinTech, Care, Enterprise & Consumer, HardTech, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Vestwell, Backer, Salt Labs, Knownwell, Harvey AI, Meltwater, Halcyon, ScaleOps, Distributional, Strike Graph, Addressable, Claim, Lightmatter, GreyOrange, Arkon Energy, TuMeke, PaintJet, Base Operations, Vectoflow, UltiHash, Lingrove, Hydrogrid; Chobani/La Colombe, Coupang/Farfetch, IBM/StreamSets & webMethods, ServiceNow/UltimateSuite, DocuSign, mPulse/HealthTrio, Snowflake/Samooha; Link Global

Final numbers on Recession in America? And The Rapid Ascent of AI at the bottom.

Deals

Fintech:

- Vestwell, a New York City-based platform for retirement, health, education, and other savings programs, raised $125 million in Series D funding. Lightspeed Venture Partners led the round and was joined by Fin Capital, Primary Venture Partners, and others.

- Backer, a San Francisco-based platform designed to connect parents with the best 529 savings plan for their children, raised $9.5 million in Series A funding from WndrCo.

- Salt Labs, a New York City-based loyalty rewards platform for hourly workers, raised $8 million in funding from Third Prime.

- Felix Pago, an SF-based money transfer startup focused on LatAm remittances, raised $2.8m led by Switch Ventures, per Axios Pro. https://axios.link/3ttsKcj

. . .

Care:

- Knownwell, a Needham, Mass.-based weight management company, raised $20m in Series A funding. A16z led, and was joined by Flybridge LTV Operator Fund, Oxeon, Larry Summers, Brynn Putnam, Lydia Gilbert, and Varsha Rao. https://axios.link/48gT3RW

- Forte, a Highland, Md.-based workplace well-being startup, raised $3.3m in seed funding, per Axios Pro. Tom Blaisdell led, and was joined by Cubit Capital, Fairbridge Park and Sovereign's Capital. https://axios.link/4aGtawT

. . .

Enterprise & Consumer:

- Harvey, an SF-based legal AI startup, raised $80m in Series B funding. Elad Gil and Kleiner Perkins co-led, and were joined by the OpenAI Startup Fund and Sequoia Capital. https://axios.link/475Pc8X

- Meltwater, an SF-based media monitoring company, raised $65m from Verdane at around a $562m valuation. https://axios.link/4aohKxu

- SimSpace, a Boston, Mass.-based provider of military-grade cybersecurity, raised $45 million in funding from L2 Point Management.

- Halcyon, an Austin, Texas-based provider of anti-ransomware software, raised $40 million in Series B funding from Bain Capital Ventures.

- ScaleOps, a Tel Aviv, Israel-based platform designed to automate the management of cloud environments, raised $21.5 million in funding from Lightspeed Venture Partners and others.

- Distributional, a remote-based platform for testing AI models, raised $11 million in seed funding. Andreessen Horowitz led the round and was joined by Operator Stack, Point72 Ventures, SV Angel, and others.

- Strike Graph, a Seattle, Wash.-based security and compliance platform, raised $8.5 million in funding. BAMCAP led the round and was joined by existing investors Madrona, Information Venture Partners, and Rise of the Rest.

- Delphina, an SF-based copilot for data science, raised $7.5m in seed funding co-led by Costanoa Ventures and Radical Ventures. https://axios.link/3v1qwkX

- Addressable, a Tel Aviv, Israel-based designed to help marketers to target Web3 users, raised $6 million in new funding from BITKRAFT, Karatage, Viola Ventures, Fabric Ventures, Mensch Capital Partners, North Island Ventures.

- Turngate, an Ellicott City, Md.-based IT and cybersecurity platform, raised $5 million in seed funding from Paladin Capital Group.

- Claim, a Boston, Mass.-based social media platform that connects users by their favorite brands, raised $4 million in seed funding. Sequoia Capital led the round and was joined by Susa Ventures, BoxGroup, and others.

. . .

HardTech:

- Lightmatter, a Boston-based photonic computing company, raised $155m in Series C2 funding co-led by GV and Viking Global Investors. https://axios.link/4amq2Gh

- GreyOrange, a Roswell, Ga.-based robotic automation platform for fulfillment and warehouse operations, raised $135 million in Series D funding. Anthelion Capital led the round and was joined by existing investors Mithril, 3State Ventures, and Blume Ventures.

- Arkon Energy, a Sydney, Australia-based owner and operator of data centers, raised $110 million in funding. Bluesky Capital Management led the round and was joined by Kestrel 0x1, Nural Capital, and Florence Capital.

- TuMeke, a San Mateo, Calif.-based platform that can automatically assess workplace safety risks through pictures, raised $10 million in Series A funding. Intel Capital led the round and was joined by others.

- Agtonomy, an SF-based autonomous agriculture software startup, raised $22.5m in Series A funding. Momenta led, and was joined by Doosan Bobcat North America, and Toyota Ventures. https://axios.link/41qrq6F

- PaintJet, a Nashville, Tenn.-based company integrating robotics and AI into the commercial painting process, raised $10 million in Series A funding. Outsiders Fund led the round and was joined by 53 Stations, Dynamo, Pathbreaker Ventures, MetaProp, and VSC Ventures.

- Base Operations, a Washington, D.C.-based provider of threat intelligence for physical security, raised $9.1m in Series A funding. Grotech Ventures and Spero Ventures co-led, and were joined by Vela Partners, Good Growth Capital, Mindset Ventures, Alliance Holdings, and Gaingels. www.baseoperations.com

- Aether Fuels, an SF-based alt fuels maker for the aviation and maritime sectors, raised $8.5m from JetBlue Ventures, TechEnergy Ventures, Doral Energy Tech Ventures, Foothill Ventures, and Xora Innovation. www.aetherfuels.com

- Vectoflow, a German provider of 3D printed flow measurement systems, raised €4m from Bayern Kapital, WN Invest, Asto One Investment, Argo Vantage, Schwarz Holding, AM Ventures, and KfW. https://axios.link/46WJpTe

- UltiHash, a San Francisco-based provider of data storage solutions designed to make data storage more sustainable, raised $2.5 million in pre-seed funding. Inventure led the round and was joined by PreSeedVentures, Tiny VC, Futuristic VC, and others.

. . .

Sustainability:

- Lingrove, a San Rafael, Calif.-based low-carbon building materials supplier, raised $10m in Series B funding. Lewis & Clark Agrifood and Diamond Edge Ventures co-led, and were joined by Bunge Ventures and SOSV. www.lingrove.com

- Hydrogrid, an Austrian provider of hydropower plant software, raised $8.5m in Series A funding. Inven Capital and Karma Ventures co-led, and were joined by insiders CNB Capital and SET Ventures. https://axios.link/3ttvkij

- Friendlier, a Canadian reusable packaging company, raised C$5m in seed funding co-led by Relay Ventures and Garage Capital. https://axios.link/4aopzTV

- Standard Biocarbon, a Portland, Maine-based producer of biochar, a form of charcoal that can capture carbon, raised $5 million in funding from Nexus Development Capital.

Acquisitions & PE:

- Chobani acquired La Colombe, a Philadelphia, Penn.-based coffee roaster and café operator, for $900 million.

- Coupang agreed to acquire Farfetch, a London, U.K.-based luxury fashion retailer, for $500 million.

- IBM agreed to acquire StreamSets, a San Francisco-based data operations and data ingestion platform, and webMethods, a Fairfax, Va.-based B2B integration platform, from Software AG, for €2.1 billion ($2.3 billion).

- ServiceNow agreed to acquire UltimateSuite, a Prague, Czech Republic-based task mining company. Financial terms were not disclosed.

- General Atlantic is in talks to buy Actis, an infrastructure investor with $12.7b in AUM, per the FT. This comes on the heels of General Atlantic filing confidential IPO papers.

- DocuSign (Nasdaq: DOCU), the SF-based e-signature company, is exploring a sale process, per the WSJ. Company shares rose 12.5% on the news, bringing its market cap up to $12.9 billion. https://axios.link/3RJl7YA

- mPulse acquired HealthTrio, a Tucson, Ariz.-based health care portal for health care providers, and Decision Point Healthcare Solutions, a Boston, Mass.-based data analytics and engagement optimization platform for health care providers. Financial terms were not disclosed.

- Carlyle and Insight Partners agreed to buy Exiger, a New York-based provider of supply chain risk management SaaS that had been backed by Carrick Capital Partners (whose stake will be around 2% post close, per a source). https://axios.link/3GOy6Sp

- Clearlake Capital Group and Insight Partners agreed to buy Irvine, Calif.-based data analytics software company Alteryx (NYSE: AYX) for $4.4b, or $48.25 per share (59% premium to Friday's closing price). https://axios.link/48kBMXQ

- Snowflake (NYSE: SNOW) agreed to buy Samooha, a Los Altos-based data-sharing startup that raised $12.5m in VC funding from Snowflake, Altimeter, and Cowboy Ventures. https://axios.link/3RMpstP

- Traliant, backed by PSG, acquired Kantola Training Solutions, a San Francisco, Calif.-based harassment and diversity training platform for employees. Financial terms were not disclosed.

- Monomoy Capital Partners agreed to acquire Waupaca Foundry, a Waupaca, Wis.-based supplier of cast and machined iron castings for the automotive, commercial vehicle, and other industrial markets. Financial terms were not disclosed.

- Nippon Steel (Tokyo: 5401) of Japan agreed to buy U.S. Steel (NYSE: X) for $14.9b, or $55 per share (40% premium to Friday's closing price). It's also a big bump from the earlier Cleveland Cliffs bid that had been favored by the steelworkers union, whose leader this morning slammed the Nippon agreement.

. . .

IPOs:

- Fractyl Health, a Lexington, Mass.-based developer of type 2 diabetes and obesity therapies, filed to go public. Mithril Capital Management, General Catalyst, Bessemer Venture Partners, and One Palmer Square Associates back the company.

- Golden Goose, an Italian luxury fashion group owned by Permira, will seek to raise around €1b in its Milan IPO, per Reuters. https://axios.link/3v1zoHg

. . .

SPACs:

- Lynk Global, a satellite-direct-to-standard-phone company, agreed to go public via Slam Corp. (Nasdaq: SLAM), a SPAC led by Alex Rodriquez. https://axios.link/3Tydu8z

Funds:

- ARTIS Ventures, a San Francisco-based venture capital firm, raised $200 million for its fourth fund focused on data, software, AI, machine learning, and deep learning companies working with human health and well-being.

- Achieve Partners, a New York-based VC firm focused on ed-tech, raised $167m for a new fund. www.achievepartners.com

- Red Cell Partners, a McLean, Va.-based incubation fund raised $91 million for its first fund focused on defense and healthcare companies.

- Climactic, a San Francisco and New York City-based venture capital fund, raised $65 million for its first fund focused on companies looking to make the mobility and enterprise sectors more sustainable.

- Springdale Ventures of Austin, Texas, raised $40m for a fund focused on early-stage consumer brands. https://axios.link/41oZqjL

- Rally Ventures, a Menlo Park, Calif. and Minneapolis, Minn.-based venture capital firm, raised $240 million for its fifth fund focused on AI & machine learning, cybersecurity, fintech, and software as a service companies.

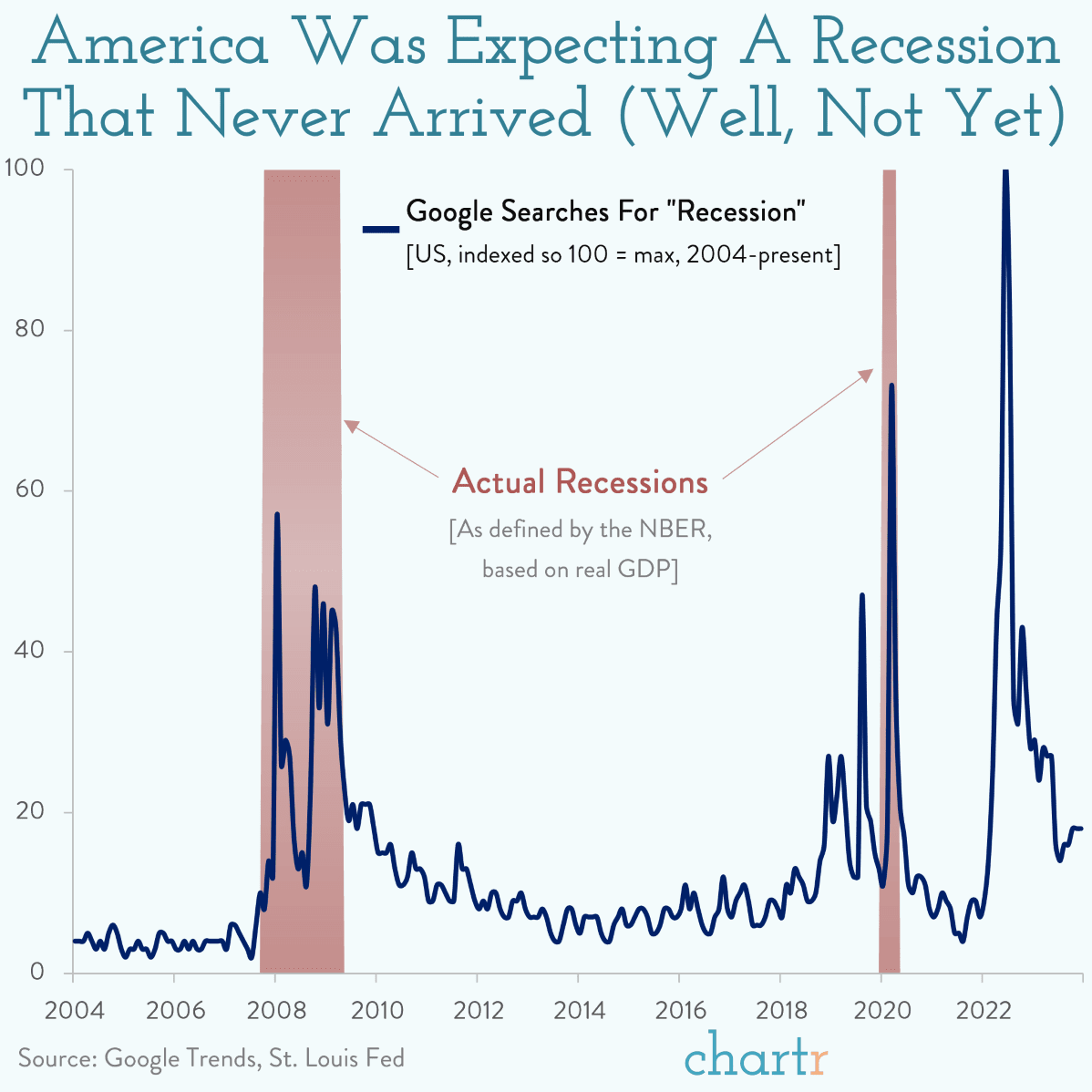

Coming in… softly?

As we entered 2023, there was a lot for markets to be nervous about: inflation was running hot, the corporate world was still adjusting to what post-Covid work looked like, and economists were rolling out their favorite words — “it depends” — when asked whether the Federal Reserve’s interest rate hikes would send the economy into a recession.

But the latest data seems to suggest that Jay Powell and co. might have pulled it off — indicating at the Fed’s final monetary policy meeting that they are more likely to be cutting interest rates than hiking them next year. Indeed, the recession that so many expected to come… hasn’t shown up.

Say no more

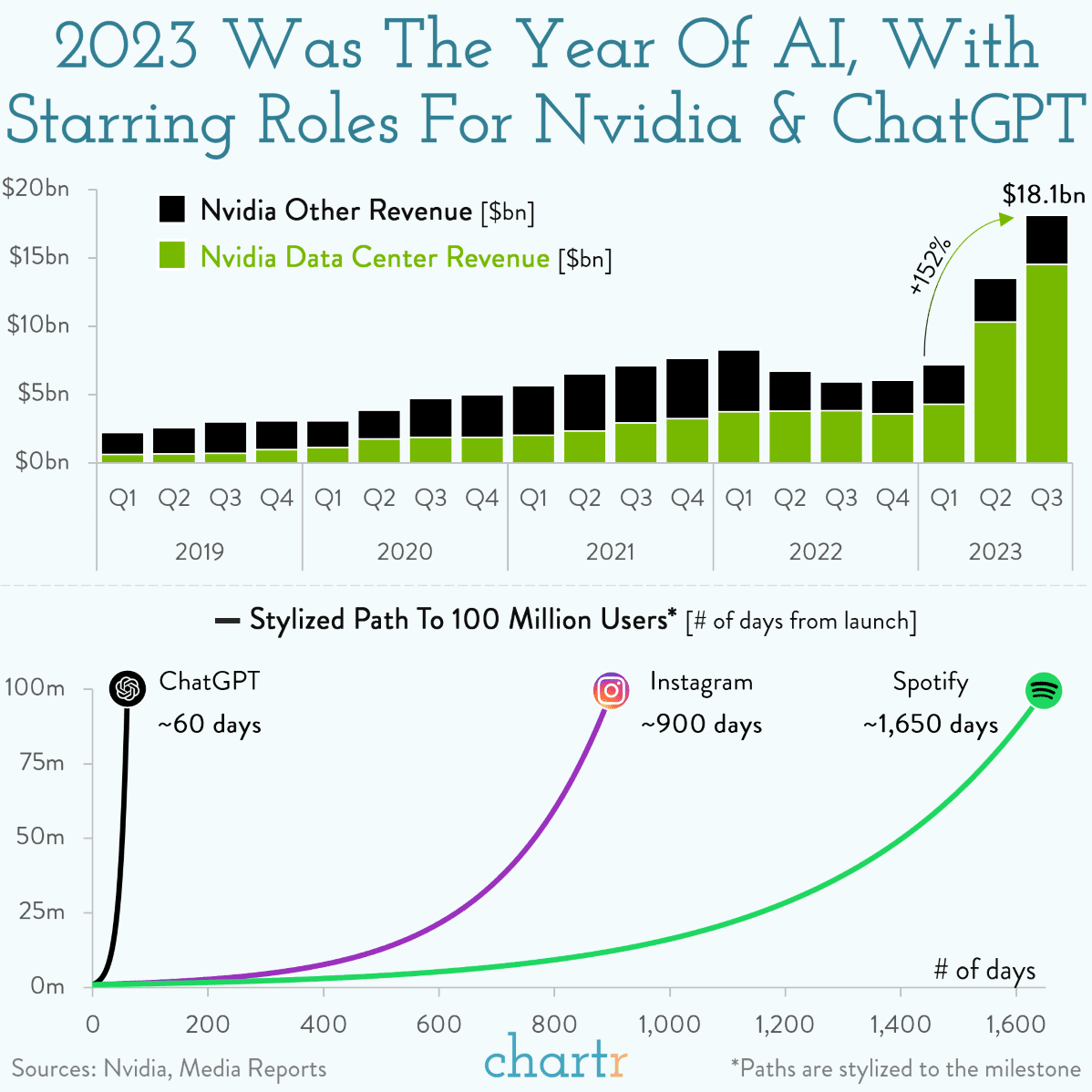

The slightest mention of rate cuts has been enough to send traders into a buying frenzy, with US stocks up 14% since the end of October, taking the total gains for the S&P 500 Index to a whopping +25% on the year. A substantial portion of that rally was because big tech was feeling much more like the 2020/21 version of itself, as some of the biggest tech stocks posted massive year-to-date gains (Alphabet+53%, Apple+57%, Amazon+79%, Tesla+138%) — but none more so than Nvidia, which had one of the best years in corporate history.

AI’s arrival

Nvidia CEO Jensen Huang this year revealed that back in 2018 the tech giant had a watershed moment, deciding — in his words — to “bet the company”, doubling down on building innovative graphics processing units (GPUs) that would become the building blocks for some of the most disruptive software ever built: generative artificial intelligence. The reward for that bold vision? Soaring GPU sales and a stock price that’s up 247% this year — taking Nvidia into the rarefied air of the $1 trillion market cap club.

Although ChatGPT was launched at the end of 2022, 2023 was undoubtedly the year that AI tools burst into the real mainstream, with students, creative artists, accountants, lawyers, coders, major enterprises, and even criminals finding ways to use the burgeoning set of tools.

The chatbot soared to a million users in just 5 days, hitting the 100 million user milestone a mere 2 months after its launch. For perspective, Instagram took 15x as long to reach that benchmark, and Spotify took around 4-and-a-half years. Ignoring Meta's Threads, which leveraged its Instagram user base, no product has ever grown at such a rapid pace. Throw in a little boardroom drama, plus a few doomsday “end of the world” quotes about AI, and you’ve had quite the year.

. . .

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.

Merry Christmas.