Sourcery (2/6-2/10)

Aliens or Balloons? ~ Coincover, Canoe, Tazapay, Follow, Cenoa, Mazepay, Kasheesh, Blip Lab, ShiftMed, Faro Health, Reshape Bio, Simple HealthKit, Tuned, Wyndly, Beaming Health, Jobber, Atmosphere

Not much commentary today, but a lot of deals below

What topics are you most interested in reading about? Comment or reply directly, we want to hear from you!

Musings

Venture Capital, Withering & Dying, Tomasz Tunguz

Dreaming Of Dry Powder, The Collective Hallucination of Oncoming Capital, Kyle Harrison

E115: The AI Search Wars: Google vs. Microsoft, Nordstream report, State of the Union, All-In Podcast

Hm, sounds like something someone would say if there were aliens 👀

Anyways, to recap the Super Bowl:

. . .

Last Week (2/6-2/10):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Coincover, Canoe, Tazapay, Follow, Cenoa, Mazepay, Kasheesh, Blip Lab, ShiftMed, NOCD, Faro Health, Reshape Bio, Simple HealthKit, Tuned, Wyndly, Beaming Health, Jobber, Atmosphere, InfluxData, Acceldata, Ushur, Magic.dev, MindsDB, Breef, Moderne, Marker Learning, Riot, Peggy, CarIQ, Samooha, Macro, WARP, Disco, HowNow, Moonhub, Replo, VAULT, Frond, VulnCheck, EarlyBird Education, Snapser, Latent, Zeitview, Therma; CVS/Oak Street Health, Litify, IBM/StepZen

Final numbers on Super Bowl Ads & Viewership and BeReal Peak? at the bottom.

Deals

Fintech:

- Coincover, a Cardiff, Wales-based digital asset protection company, raised $30 million in funding led by Foundation Capital.

- Canoe Intelligence, a New York-based alternative investment data provider, raised $25 million in Series B funding. F-Prime Capital led the round and was joined by Eight Roads Ventures and others.

- Conquest Planning, a Winnipeg, Canada-based financial planning software startup, raised CAD $24 million ($17.87 million) in Series A funding. Fidelity International Strategic Ventures led the round and was joined by Portage Ventures, BNY Mellon, and RBC.

- Tazapay, a Singapore-based cross-border payments startup, raised $16.9m in Series A funding. Sequoia Capital Southeast Asia led, and was joined by EscapeVelocity, PayPal Alumni Fund, Gokul Rajaram, Foundamental, January Capital, RTP Global and Saison Capital. https://axios.link/3JTFRJC

- Elementus, a New York-based blockchain data analytics company, raised $10 million in Series A-2 funding led by ParaFi Capital.

- Fierce, a New York-based financial investment and management app, raised $10 million in seed funding. Pendrell, AP Capital, Wheelhouse Digital Studios, Space Whale Capital, and other angels invested in the round.

- Follow, a San Francisco-based investment platform, raised $9 million in funding. Atomic, Uncork Capital, and Vera Equity invested in the round.

- Cenoa, a blockchain-based wallet, raised $7m in seed funding. Quiet Capital led and was joined by Underscore VC, Human Capital, Ulu Ventures, Acrew and Collective Spark. www.cenoa.com

- Mazepay, an Aarhus, Denmark-based fintech platform, raised €4 million ($4.29 million) in funding. Scale Capital led the round and was joined by Hambro Perks and Outward VC.

- Kasheesh, a New York-based digital payment platform, raised $3.5 million in seed extension funding. Lil Baby, Fanatics CEO Michael Rubin, actor Robin Wright, Odell Beckham Jr, and others invested in the round.

- Blip Labs Technologies, a New York-based bill management platform, raised $2.1 million in seed funding. Susa Ventures, Dash Fund, Shrug Capital, Wischoff Ventures, Picks and Shovels, Browder Capital, Rief Ventures, and other angels invested in the round.

- Vertical Insure, a Minneapolis-based insurance provider, raised an additional $2 million in seed funding. Greenlight led the round and was joined by Groove Capital and others.

- Inkle, an accounting and compliance SaaS for U.S. companies created by overseas founders, raised $1.5m in pre-seed funding from Picus Capital, Saison Capital and Force Ventures. www.inkle.io

. . .

Care:

- ShiftMed, a McLean, Va.-based W-2 health care workforce management marketplace, raised $200 million in funding co-led by Panoramic Ventures led the round and was joined by Blue Heron Capital and Audacious Capital.

- Clearsense, a Jacksonville, Fla.-based health data analytics company, raised $50m in Series D funding. HealthQuest Capital led, and was joined by Health Catalyst Capital and UPMC Enterprises. https://axios.link/3jxCddJ

- NOCD, a Chicago-based telehealth startup focused on obsessive-compulsive disorder, raised $34m. Cigna Ventures and 7wireVentures co-led, and were joined by Kaiser Permanente Ventures, F-Prime Capital, Eight Roads Capital, Health Enterprise Partners and Longitude Capital. www.treatmyocd.com

- Faro Health, a San Diego-based digital infrastructure development company for clinical trials, raised an additional $20 million in funding. General Catalyst led the round and was joined by Section 32, Polaris Partners, Zetta Ventures, and Northpond Ventures.

- Reshape Bio, a Copenhagen-based microbial research and development digitization platform, raised $8.1 million in funding. ACME Capital led the round and was joined by FundersClub, Y Combinator, and other angels.

- Simple HealthKit, a Freemont, Calif.-based diagnostic delivery health care platform, raised $8 million in Series A funding. Initialized Capital led the round and was joined by Kleiner Perkins, Kapor Capital, and Quest Venture Partners.

- Tuned, a New York-based digital hearing health company, raised $3.5 million in funding, Distributed Ventures led the round and was joined by Idealab NY and MTS.

- Uniify, a Danish provider of no-code onboarding software for financial companies, raised €3m from backers like People Ventures and Forward VC. www.uniify.io

- Wyndly, a Lakewood, Colo.-based at-home allergy testing and treatment company, raised $2 million in funding. Y Combinator, Goodwater Capital, Civilization Ventures, Sweater Ventures, and Kevin Mahaffey invested in the round.

- Beaming Health, a San Francisco-based occupational therapy platform for people with autism, raised $1.7 million in seed funding. NextGen Venture Partners led the round and was joined by Tau Ventures, Divergent Investments, Designer Fund, and MedMountain Ventures.

. . .

Enterprise & Consumer:

- Jobber, an Edmonton, Canada-based operations management software provider for home service businesses, raised $100 million in Series D funding. General Atlantic led the round and was joined by Summit Partners, Version One Ventures, and Tech Pioneers Fund.

- Atmosphere, an Austin-based streaming TV entertainment company, raised $65 million in Series D funding co-led by Sageview Capital, Valor Equity Partners, and S3 Ventures.

- InfluxData, a San Francisco-based time series data platform provider, raised $51 million in Series E funding. Princeville Capital and Citi Ventures co-led the round and were joined by Battery Ventures, Mayfield Fund, Sapphire Ventures, and others.

- Acceldata, a Campbell, Calif.-based data observability platform, raised $50 million in Series C funding. March Capital led the round and was joined by Industry Ventures, Sanabil Investments, and Insight Partners.

- Ushur, a Santa Clara, Calif.-based customer experience automation platform, raised $50 million in Series C funding. Third Point Ventures led the round and was joined by Iron Pillar, 8VC, Aflac Ventures, and Pentland Ventures.

- Magic.dev, a San Francisco-based A.I.-assisted software development product company, raised $23 million in Series A funding. Alphabet’s independent growth fund, CapitalG, led the round and was joined by Nat Friedman, Elad Gil, and Amplify Partners.

- flox, a New York-based Nix implementation platform, raised $16.5 million in Series A funding led by New Enterprise Associates.

- MindsDB, a London- and San Jose-based applied machine learning platform, raised $16.5 million in Series A funding from Benchmark.

- Breef, a New York-based marketing outsourcing platform, raised $16m in Series A equity and debt funding. Greycroft led, and was joined by BDMI, UTA.VC, Afterpay and UC Berkeley's The House Fund. https://axios.link/3JKbuFp

- Moderne, a San Francisco-based software modernization company, raised $15 million in Series A funding. Intel Capital led the round and was joined by True Ventures, Mango Capital, and Allstate Strategic Ventures.

- Marker Learning, a New York-based remote learning and attention disability services company, raised $15 million in Series A funding. Andreessen Horowitz led the round and was joined by the venture arm of Richard Branson’s Virgin Group, Primary Ventures, Difference Partners, Operator Partners, Night Ventures, and others.

- Riot, a New York-based cybersecurity platform for employee protection, raised $12 million in funding. Base10 led the round and was joined by Y Combinator, Funders Club, Founders Future, and other angels.

- Peggy, a Toronto-based contemporary art marketplace, raised $10.8 million in seed funding. Real Ventures, ZVC, Garage Capital, Portage, Nomad Capital, and other angels invested in the round.

- Car IQ, a San Francisco-based vehicle payments platform, raised an additional $15 million in Series B funding. Forte Ventures led the round and was joined by State Farm Ventures, TELUS Ventures, Avanta Ventures, Visa, Bridgestone, Navistar, and Circle K.

- Mattiq, a Chicago-based electrochemical solutions provider, raised $15 million in seed funding led by Material Impact.

- Samooha, a San Francisco-based data collaboration application company, raised $12.5 million in Series A funding co-led by led by Altimeter Capital, Snowflake Ventures, and other angels.

- Macro, a New York-based productivity suite using A.I., raised $9.3 million in seed funding. Andreessen Horowitz led the round and was joined by Craft, BoxGroup, and 3kVC.

- The Ugly Company, a Farmersville, Calif.-based dried fruit snacks producer, raised $9 million in Series A funding. Sun Valley Packing and Value Creation Strategies co-led the round and were joined by Justin Timberlake and Valley Ag Capital Holdings.

- GlossAi, a Tel Aviv-based video generator platform, raised $8 million in seed funding. New Era Capital Partners led the round and was joined by Guidestar Ventures, 97212 Ventures, MindCET Ventures, Ginossar Ventures, Maccabee Ventures, and others.

- Rembrand, a Los Altos, Calif.-based product placement platform, raised $8 million in seed funding led by Greycroft and UTA.VC.

- Wisor AI, a Tel Aviv-based freight booking software company, raised $8 million in seed funding led by Team8.

- Lineaje, a Saratoga, Calif.-based software supply chain security management company, raised $7 million in seed funding led by Tenable Ventures.

- FireCompass, a Boston-based ethical hacking startup, raised $7m. Cervin and Athera Venture Partners co-led, and was joined by Bharat Innovation Fund. www.firecompass.com

- Lineaje, a Saratoga, Calif.-based software supply chain security management startup, raised $7m in seed funding led by Tenable Ventures. www.lineaje.dev

- Mawari, a San Jose-based extended reality streaming platform, raised $6.5 million in seed funding. Blockchange Ventures and Decasonic co-led the round and were joined by Abies Ventures, Accord Ventures, Anfield, Outlier Ventures, Primal Capital, and others.

- CUB3, a Los Angeles- and London-based loyalty platform for social media users, raised $6.5 million in Series A funding co-led by BITKRAFT Ventures and Fabric Ventures.

- WARP, an LA-based middle-mile freight network, raised $5.7m from MaC Venture Capital, Bonfire Ventures and Frontier Venture Capital. www.wearewarp.com

- Disclo, an Atlanta-based job accommodations platform, raised $5 million in seed funding led by General Catalyst.

- HowNow, a London-based employee training and onboarding platform, raised $5 million in Series A funding from Mercia Asset Management and Pearson.

- Sesame Labs, a San Francisco-based Web3 marketing startup, raised $4.5 million in seed funding. Wing Venture Capital and Patron co-led the round and were joined by DoubleJump, Forte, MoonFire, Samsung, Twin Ventures, and others.

- Moonhub, a San Francisco-based A.I.-based hiring platform, raised $4.4 million in funding. Khosla Ventures and GV co-led the round and were joined by AIX Ventures, Day One Ventures, and other angels.

- Replo, an SF-based low-code platform for creating Shopify pages, raised $4.2m in seed funding from YC, Infinity Ventures, La Famiglia and Figma Ventures. https://axios.link/3DV0rWg

- VAULT, a New York-based digital music collectible company, raised $4 million in Series A funding. Placeholder VC led the round and was joined by AlleyCorp, Bullpen Capital, and Everblue Management.

- Frond, a San Francisco-based online community builder, raised $3.3 million in pre-seed funding. Cherry Ventures led the round and was joined by Icehouse Ventures, WndrCo, Script Capital, Tiny VC, Remote First Capital, 468 Capital, and others.

- VulnCheck, a Lexington, Mass.-based vulnerability intelligence company, raised $3.2 million in seed funding. Sorenson Ventures led the round and was joined by In-Q-Tel, Lux Capital, and Aviso Ventures.

- EarlyBird Education, a Boston-based gamified early literacy assessment platform, raised $3 million in funding. MassMutual’s MM Catalyst Fund led the round and was joined by Lobby Capital and Amplify Capital.

- Snapser, a Foster City, Calif.-based customizable backend platform for gaming studios, raised $2.6 million in seed funding led by Andreessen Horowitz.

- Latent Technology, a British developer of generative AI for video games, raised $2.1 million in pre-seed funding. Root Ventures and Spark Capital co-led, and were joined by Bitkraft. https://axios.link/3DJ8wgs

. . .

Sustainability:

- Zeitview (fka DroneBase), an LA-based aerial data analytics company, raised $55m. Valor Equity Partners led, and was joined by USV, Upfront Ventures, Euclidean Capital, Energy Transition Ventures and Hearst Ventures. https://axios.link/40yb5Mi

- Therma, a San Francisco-based cooling intelligence platform, raised $19 million in Series A funding. Zero Infinity Partners led the round and was joined by Deciens Capital, CityRock Venture Partners, Homecoming Capital, Ananta Capital, Kindergarten Ventures, Collaborative Fund, and Govtech Fund.

Acquisitions & PE:

- CVS Health agreed to acquire Oak Street Health, a Chicago-based primary care provider, for $10.6 billion.

- Post Holdings agreed to acquire Rachael Ray Nutrish, an Orlando-based dog food brand, and Kibbles ’n Bits, an Orrville, Ohio-based dog food brand, from J.M. Smucker for $1.2 billion.

- Funds managed by Oaktree Capital Management agreed to acquire Enercon Services, a Kennesaw, Ga.-based engineering and environmental services firm, from AE Industrial Partners. Financial terms were not disclosed.

- Bessemer Venture Partners acquired a majority stake in Litify, a Brooklyn-based legal operating platform, previously raised over $50m from firms like Tiger Global and Fortress Investment Group. www.litify.com Financial terms were not disclosed.

- IBM acquired StepZen, a Santa Clara, Calif.-based GraphQL optimization and scaling platform. Financial terms were not disclosed.

- Bed Bath & Beyond (Nasdaq: BBBY) said it will seek to raise around $1b via the sale of new securities, as the retailer fights to stave off bankruptcy. https://axios.link/3HGigJF

- Kargo, a New York-based ad tech company, acquired Denver-based video ad platform VideoByte for upwards of $100m (including earnouts). https://axios.link/3Y6sYjw

- Snow Software, a Swedish asset management software provider, hired JPMorgan to find a buyer for around $1b (including debt), per Reuters. Backers include Sumeru Equity Partners, Adams Street Partners, Ontario Pension Board and Vitruvian Partners. https://axios.link/3RJhmAP

- Robinhood (Nasdaq: HOOD) plans to buy back around 55m shares currently held by disgraced FTX founder Sam Bankman-Fried. https://axios.link/3IcZpYj

- Michael Jackson's estate is nearing a sale of half its interests in the singer's music catalog for between $800m and $900m, per Variety. https://axios.link/3XgKyQT

- Ford Motor Co. (NYSE: F) sold the majority of its remaining stake in EV maker Rivian (Nasdaq: RIVN), one week after disclosing a $7.3b write-down on its investment. https://axios.link/3jPo7V5

. . .

IPOs:

- Cava, a Mediterranean restaurant chain, confidentially filed for an initial public offering.

- Nextracker, a Fremont, Calif.-based solar tracking systems designer and manufacturer, raised $638.4 million in an initial public offering of 26.6 million shares priced at $24. The company originally planned to raise up to $535.9 million through the sale of 23.3 million shares priced between $20-23.

. . .

SPACs:

- Urgent.ly, a Vienna, Va.-based digital roadside assistance platform, agreed to go public via a reverse merger with Otonomo (Nasdaq: OTMO), an Israeli connected auto tech company. Urgent.ly has raised $80m in VC funding, while Otonomo went public via SPAC in 2021 at a $1.4b market cap, but subsequently traded down below $75m. https://axios.link/3IdFecp

Funds:

- Shamrock Capital raised $600m for its third content and media rights fund. www.shamrockcap.com

Final Numbers

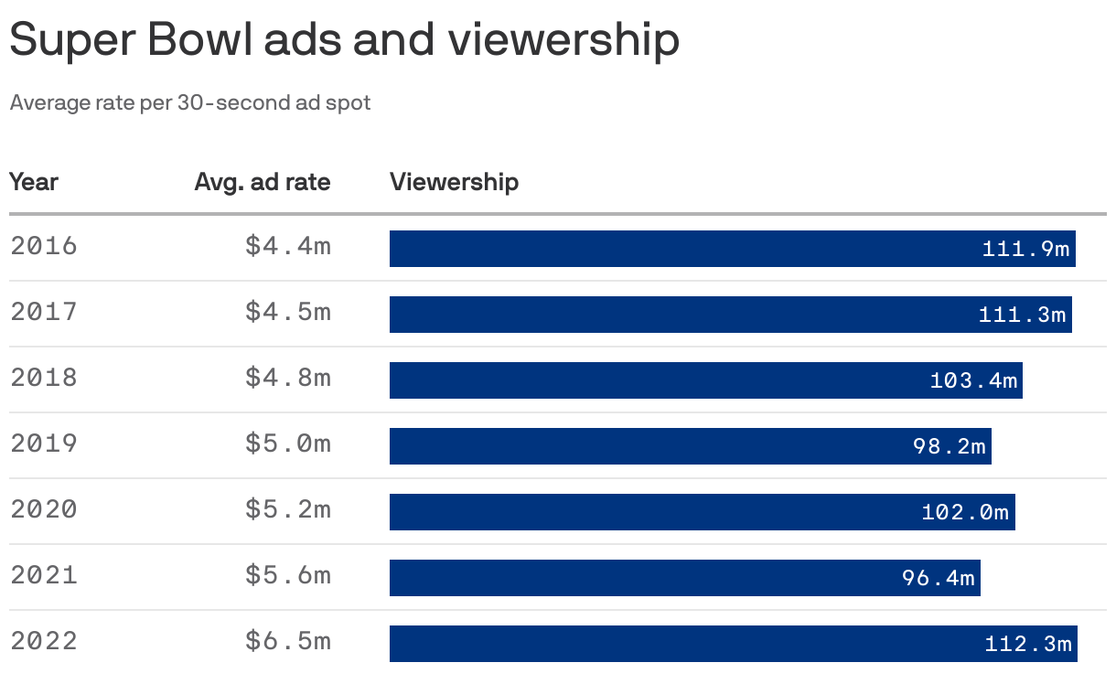

Data: Kantar, Nielsen; Chart: Axios Visuals

Crypto company ads will be missing from this year's Super Bowl broadcast, after dominating in 2022. Perhaps we should have listened to Larry David.

Picking up some of the slack will be ads for electric vehicle makers, including one for GM in which Will Ferrell drives through Netflix shows like "Bridgerton," "Squid Game" and "Stranger Things."

Super Bowl ad sales were been a bit sluggish this year, but some 30-second spots still fetched more than $7 million.

. . .

\!/ Time To BeSafe \!/

Damien Kieran, Twitter's ex-chief privacy officer who left the company when Musk took over, has been recruited by BeReal — last year’s official iPhone app of the year. BeReal has been challenged on privacy issues in the past, particularly over concerns about real-time location sharing, but privacy might be just one of its worries at the moment.

The pic-sharing platform, which gives users the same 2-minute window to capture whatever they are up to when the notification hits, may have already had its 15 minutes of fame, as downloads have quickly dropped off.

Building on the buzz

The Paris-based company seemingly emerged out of nowhere, one app in a buzzy new set of stripped-back social media that threatened to upheave the established powerhouses, as younger generations sought authenticity in the carefully-curated world of Instagram and Facebook.

BeReal, which raised $60m last year, properly took off in the summer of 2022, with global downloads peaking in Q3 when the app welcomed just under 40m simultaneous-snappers. Extrapolating from the figures in January, BeReal's downloads are set to drop to just 16m in Q1 this year, according to data from Apptopia via Sifted. And, despite the aforementioned plaudit from Apple itself, BeReal has dropped out of the top 100 on the App Store in recent weeks, per Sensor Tower data.

Like Clubhouse, Vine, Yik Yak, Periscope and many, many other social media apps that briefly caught lightning in a bottle, BeReal may be finding out just how hard it is to maintain the buzz.

. . .

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.