Sourcery → DOGE

John Doerr, Milei, Milton Friedman, Oura

Today’s Sourcery is brought to you by Archer..

Learn more about how Archer is set to open a new world of opportunity for passengers by providing safe and efficient access to people, places, and events across the communities they live at archer.com

Happy Thanksgiving!

Hopefully you all are already checked out and taking some time for yourselves to be with your families. We’ll tryyy to keep things short this week on the musings front, however, as for deals.. this is the first time in a very long time the Care section had a significant volume in funding announcements.

To highlight a few of the largest deals across the board, Oura raised $75m at a $5B valuation, Lighthouse raised $370M at a $1B valuation, Cyera raised a $300M Series D, Skydio added $170m to the $230m Series E, and The Exploration Company raised $160 million in Series B.

Lastly, shoutout to Newcomer’s Cerebral Valley AI Summit for hosting another incredible event. Link to some of the interviews below.

I was lucky enough to meet John Doerr of Kleiner Perkins, early investor in Alphabet, Amazon, Uber, Twitter, Intuit, Slack, Sun Micro, +more. And Author of the original OKR handbook, Measure What Matters, & Speed and Scale: An Action Plan for Solving Our Climate Crisis Now.

Musings

Macro

Javier Milei: President of Argentina - Freedom, Economics, and Corruption [Lex Fridman Podcast]

AI

Report | 2024: The State of Generative AI in the Enterprise [Menlo Ventures]

Databricks CEO Breaks Down the AI Hype-Cycle [Logan Bartlett]

Cerebral Valley Interviews

DOGE

AI Scaling Laws, DOGE, FSD 13, Trump Markets [BG2 w/ Bill Gurley & Brad Gerstner]

Milton Friedman proposes removing U.S. gov’t depts [Elon on X]

Milei's impact, DOGE's tight timeline, impact on GDP growth, "default sustainable," how to communicate DOGE [All-in]

Elon Musk and Vivek Ramaswamy: The DOGE Plan to Reform Government [WSJ]

Density CEO Andrew Farah breaks down gov’t office space inefficiency by the numbers [Andrew on X]

Startups

The Levers of Innovation | A Shortage of Founders, Funding, Foundations, or Guts? [Kyle Harrison]

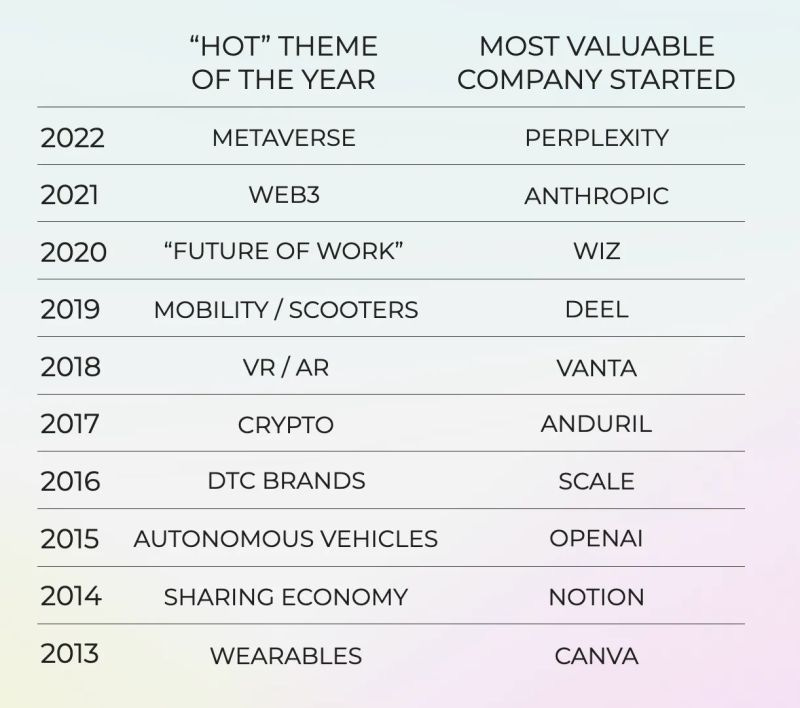

Play It Cool: Chasing Heat vs. Being Contrarian in Venture Capital [Rex Woodbury]

Top Interviews

Dan Wright, CEO Armada | Trae Stephens Next Big Bet, $100M for The New Edge

Joshua Browder, DoNotPay | Saving Consumers $100M+ & Investing in Thiel Fellows

Last Week (11/18-11/22):

Relevant deals include the 70+ deals across stages below. I've categorized the deals below into seven categories, Fintech, Care, Enterprise / Consumer, HardTech, Sustainability, Acquisition/PE, and Fund Announcements, and ordered from later-stage rounds to early-stage rounds.

Acquisitions & PE

Stripe, Wiz/Dazz, Jersey Mike’s Subs, Centerfield/Brainjolt, Bronze/Chroma

Funds

Bling Capital

Final Numbers

Amazon’s Billions in AI Investment

VC Deals

Fintech:

- Federato, an SF-based insurance underwriting platform, raised $40m in Series C funding. StepStone Group led, and was joined by Emergence Capital, Caffeinated Capital, and Pear VC

- Goodstack, a London-based corporate giving platform, raised $28m in Series A funding. General Catalyst led, and was joined by Morpheus Ventures and Repeat.

- Noble, an asset issuance platform for stablecoins, raised $15m in Series A funding led by Paradigm

- Rise, a startup allowing companies to pay contractors using stablecoins, raised $6.3m in Series A funding co-led by Draper and Polymorphic

- GetMyHome, a Redondo Beach, Calif., homebuying tech startup, raised $1.5m in pre-seed funding from Wischoff Ventures and Progression Fund

Care:

- Ōura, a Finnish maker of sleep rings and other wearables, raised $75m from Dexcom (Nasdaq: DXCM) at a $5b valuation.

- Zarminali Health, a Chicago-based pediatric care provider, raised $40 million in seed funding from General Catalyst.

- minu, a Mexico City-based employee wellness platform, raised $30 million in Series B funding. QED Investors led the round and was joined by Next Billion Capital Partners, Flourish Ventures, Promotora Impact Ventures, existing investors FinTech Collective, Redwood Ventures, Salkantay, Nazca, and others.

- TailorMed, a New York City-based end-to-end healthcare platform, raised $30 million in funding. Windham Capital Partners led the round and was joined by Citi Impact Fund, Samsung Next, BrightEdge, and others.

- Synapticure, a Chicago-based neurodegenerative diseases virtual care provider, raised $25 million in Series A funding. B Capital led the round and was joined by CommonSpirit Health, CVS Health Ventures, RA Capital Management, Nexus NeuroTech Ventures, and existing investors Google Ventures, Optum Ventures, and Rock Health Capital.

- Seen Health, an Alhambra, Calif.-based senior care provider, raised $22 million in Series A funding. 8VC led the round and was joined by Basis Set, Primetime Partners, Virtue, and Astrana Health.

- Citizen Health, a San Mateo, Calif.-based consumer health AI platform, raised $15.5 million in seed funding. Transformation Capital led the round and was joined by Wavemaker 360 and angel investors.

- Ladder, an Austin-based strength training app, raised $15 million in Series B funding. Point72 and ADvantage VC led the round and were joined by PagsGroup and existing investors Tapestry VC and LivWell Ventures. Also, General Catalyst invested $90 million in the company.

- World Class Health, a New York City-based healthcare solutions provider for self-funded employers and their employees, raised $8 million in seed funding. AlleyCorp led the round and was joined by LifeX, Joyance, Cooley & Co, and others.

- Jimini Health, a New York City-based AI-supported mental healthcare platform, raised $8 million in pre-seed funding from Zetta Venture Partners, LionBird, PsyMed, and others.

- Kalder, a New York City-based rewards program for brands, raised $7 million in seed funding. Javelin Venture Partners led the round and was joined by 8VC, Human Capital, Gingerbread Capital, angel investors, and others.

- CalmWave, a Seattle-based alarm fatigue solution provider for ICUs, raised $5.3 million in funding. Third Prime led the round and was joined by Catalyst by Wellstar, Silver Circle, Rebellion, Impulsum, and existing investors Bonfire Ventures, Tau Ventures, and Hike Ventures.

- FertilAI, a Giv'atayim, Israel-based AI-driven patient insights provider for fertility treatment, raised $4.5 million in funding. Longevity Venture Partners and Redseed led the round and were joined by angel investors.

- Revisto, a San Antonio-based medical, legal, and regulatory AI review solution for pharmaceutical marketing materials, raised $4 million in seed funding. LiveOak Ventures led the round and was joined by Eli Lilly, Tau Ventures, and Arkin Digital Health.

- Heim Health, a London-based at-home healthcare software platform, raised £2.2 million ($2.8 million) in seed funding. Heal Capital led the round and was joined by Form Ventures, Portfolio Ventures, and Houghton Street Ventures.

- DANNCE.AI, a Boston-based AI biomarkers platform for neurological care, raised $2.6 million in pre-seed funding. LDV Capital led the round and was joined by Glasswing Ventures, The Leo Lion Company, Duke Capital Partners, and Merck Digital Sciences Studio.

Enterprise/Consumer:

- Odoo, a Belgian provider of SME productivity software, secured a €500m secondary investment at a €5b valuation from firms like CapitalG and Sequoia Capital.

- Lighthouse, a London-based travel and hospitality insights platform, raised $370 million at a $1 billion valuation in Series C funding from KKR.

- Cyera, a New York City-based AI-powered data security platform, raised $300 million in Series D funding. Accel and Sapphire Ventures led the round and were joined by Sequoia, Redpoint, Coatue, and Georgian.

- Kong, a San Francisco-based cloud API technologies developer, raised $125 million in Series E funding. Tiger Global and Balderton led the round and were joined by Ontario Teachers’ Pension Plan, 137 Ventures, existing investors Andreessen Horowitz, Index Ventures, CRV, and others.

- League One Volleyball, a Los Angeles-based youth volleyball clubs community, raised $100 million in funding. Atwater Capital led the round and was joined by existing investors Ares Management and Left Lane Capital.

- Spectro Cloud, a San Jose-based Kubernetes management platform, raised $75 million in Series C funding. Growth Equity at Goldman Sachs Alternatives led the round and was joined by existing investors.

- Rox, a San Francisco-based AI agent developer for salespeople, raised $50 million in funding from Sequoia Capital, GV, and General Catalyst.

- Lightning AI, a New York City-based deep learning framework developer, raised $50 million in funding from Cisco Investments, J.P. Morgan, K5 Global, and NVIDIA.

- OneRail, an Orlando-based omnichannel fulfillment solution provider, raised $42 million in Series C funding. Aliment Capital led the round and was joined by eGateway Capital, Florida Opportunity Fund, existing investors Arsenal Growth Equity, Piva Capital, Bullpen Capital, and others.

- Roboflow, a Des Moines, Iowa,-based computer vision startup, raised $40m in Series B funding, per Fortune. GV led, and was joined by Craft Ventures and YC.

- SuperAnnotate, a San Francisco-based AI datasets creation and management software provider, raised $36 million in Series B funding. Socium Ventures led the round and was joined by NVIDIA, Databricks Ventures, Play Time Ventures, and existing investors.

- Lightyear, a New York City-based enterprise telecom management software provider, raised $31 million in Series B funding. Altos Ventures led the round and was joined by existing investors Ridge Ventures, Amplo, Zigg Capital, and Susa Ventures.

- Monkey Tilt, a Las Vegas-based online gaming platform, raised $30m in Series A funding. Pantera Capital led, and was joined by Polychain Capital, PokerGo, Hack VC, Dream Ventures, Accomplice, Mirana, and Josh Hannah

- Wordware, a San Francisco-based AI development full-stack operating system, raised $30 million in seed funding. Spark Capital led the round and was joined by Felicis, Y-Combinator, Day One Ventures, and angel investors.

- Distyl, a New York City-based AI solutions provider for businesses, raised $20 million in Series A funding. Lightspeed Venture Partners led the round and was joined by Khosla Ventures, existing investors Coatue, Dell Technologies Capital, Nat Friedman, and angel investors.

- Prompt Security, a New York City-based generative AI security platform, raised $18 million in Series A funding. Jump Capital led the round and was joined by Ridge Ventures, Okta, F5, and existing investor Hetz Ventures.

- Aviz Networks, a San Jose-based AI-driven networking solutions provider, raised $17 million in Series A funding. Alter Venture Partners led the round and was joined by Celestica, Qualcomm Ventures, and existing investors Cisco Investments, Moment Ventures, Wistron, and Accton.

- Spines, a Boynton Beach, Fla.-based AI-powered publishing platform, raised $16 million in Series A funding. Zeev Ventures led the round and was joined by existing investors Aleph, M-Fund, and LionTree.

- Aira Technologies, a San Francisco-based AI cellular network infrastructure technology developer, raised $14.5 million in Series B funding from AT&T Ventures, Intel Capital, IQT, existing investors NeoTribe and Acrew, and others.

- Keychain, a New York City-based packaged goods manufacturing platform, raised $15 million in Series A funding. BoxGroup led the round and was joined by General Mills, Schreiber, and existing investors Lightspeed Venture Partners and SV Angel.

- Arcade, a visual storytelling platform, raised $14m. Kleiner Perkins led, and was joined by insiders Upfront Ventures and Foundation Capital.

- Twine, a Tel Aviv-based digital cybersecurity employees developer, raised $12 million in seed funding. Ten Eleven Ventures and Dell Technologies Capital led the round and were joined by angel investors.

- Agentio, a New York City-based sponsored creator content ad platform, raised $12 million in Series A funding. Benchmark led the round and was joined by existing investors Craft Ventures and AlleyCorp and others.

- Locad, a Singapore-based e-commerce logistics engine developer, raised $9 million in pre-Series B funding. Global Ventures and existing investor Reefknot Investments led the round and were joined by Sumitomo Equity Ventures and existing investors Antler Elevate, Febe Ventures, and JG Summit.

- Apideck, a San Francisco-based real-time unified APIs provider, raised $7.5 million in Series A funding. Airbridge Equity Partners led the round and was joined by PMV, angel investors, and others.

- Flywheel Dynamix, a San Francisco-based software acquisition marketplace, raised $7 million in seed funding from Storm Ventures, Foster Ventures, BeeNex, FeBe, and Teknos Ventures.

- Hopae, a San Francisco-based digital identity solution provider, raised $6.5 million in funding. SV Investment led the round and was joined by Z Venture Capital and Bon Angels Venture Partners.

- Amigo, a New York City-based digital cloning platform for service providers, raised $6.3 million in funding. General Catalyst and GSV Ventures led the round and were joined by Comma Capital, CohoVC, and angel investors.

- Distru, an Oakland, Calif.-based ERP platform for the cannabis industry, raised $6 million in Series A funding from Poseidon Investment Management and Global Founders Capital.

- Workbrew, a remote software delivery platform for workplaces, raised $5 million in funding. Heavybit led the round and was joined by Essence VC and Operator Collective.

- Fanstake, an NIL platform for college sports fans, raised $3m co-led by Susa Ventures and Will Ventures

- Taito.ai, a Finnish performance enablement platform, raised $2.7m in seed funding led by Accel

- Novus, a Boston-based AI orchestration platform, raised $2.5 million in seed funding from Venture Lane, MIT Sandbox, Vestel Ventures, and others.

- Theo Ai, San Francisco-based predictive legal AI platform, raised $2.2 million in pre-seed funding. NextView and nvp capital led the round and were joined by Ripple Ventures, Beat Ventures, and SCVC Fund.

HardTech:

- Skydio, the San Mateo, Calif., dronemaker, added $170m to the $230m Series E it closed last year from KDDI, Axon and insider Linse Capital.

- The Exploration Company, a Munich-based cargo delivery space capsule developer, raised $160 million in Series B funding. Balderton Capital and Plural led the round and were joined by Bessemer Venture Partners, NGP Capital, French Tech Souveraineté, and DeepTech & Climate Fonds.

- Pickle Robot, a Cambridge, Mass.-based physical AI robotic automation systems developer, raised $50 million in Series B funding from Teradyne Robotics Ventures, Toyota Ventures, Ranpak, and others.

- Inversion, a Los Angeles-based space-to-Earth cargo delivery service provider, raised $44 million in Series A funding. Spark Capital and Adjacent led the round and were joined by Lockheed Martin Ventures, Kindred Ventures, and Y Combinator.

- Class8, a Toronto-based data provider for the trucking business formerly named FleetOps, raised $22 million in Series A funding. Xplorer Capital led the round and was joined by Commerce Ventures and existing investors Inspired Capital and Resolute Ventures.

- Revv, a New York City-based AI solutions provider for the auto repair industry, raised $20 million in funding. Left Lane Capital led the round and was joined by existing investors Soma Capital, 1984, and Agalé Ventures.

- Lightsynq, a Boston-based quantum interconnect technology solutions developer, raised $18 million in Series A funding. Cerberus Ventures led the round and was joined by Murata Electronics North America, IAG Capital Partners, Safar Partners, and others.

- Teleo, a Palo Alto-based heavy equipment autonomous technology developer, raised $16.2 million in Series A extensions. UP.Partners led the $9.2 million first extension round and was joined by Trousdale Ventures, existing investor F-Prime Capital, and others. UP.Partners led the second extension round and was joined by Triatomic Capital, existing investors F-Prime Capital and Trucks Venture Capital, and others.

- BrightAI, a provider of physical infrastructure monitoring solutions, raised $15m in seed funding from Upfront Ventures.

- Flipturn, a New York City-based EV charger and fleet management platform, raised $11 million in Series A funding. CRV led the round and was joined by Accel.

- REBA, a Denver-based data analytics and intelligence platform for the property management industry, raised $10 million in Series B funding from Blueprint Equity.

- Four Growers, a Pittsburgh-based harvesting robots developer, raised $9 million in Series A funding. Basset Capital led the round and was joined by existing investors Ospraie Ag Science, Y Combinator, and others.

Sustainability:

- Vaulted Deep, a Houston-based biomass carbon removal and storage company, raised $32.3 million in Series A funding. Prelude Ventures led the round and was joined by Fall Line Capital, Rethink Impact, and existing investors Lowercarbon Capital, Earthshot Ventures, and WovenEarth Ventures.