Technology Brothers

xAI +$6B, OpenAI 12 Days, Jared Kushner, Peter Thiel, M&A, Databricks, OURA, Parafin, SandboxAQ

Today’s Sourcery is brought to you by Archer..

Learn more about how Archer is set to open a new world of opportunity for passengers by providing safe and efficient access to people, places, and events across the communities they live at archer.com

Happy Holidays from the Technology Brothers

The most profitable podcast in the world just dropped.

If you haven’t seen the Technology Brothers on X yet, then I don’t know what rock you’re living under. They’re taking over the internet, corporate sponsorships, and AUMs by storm. No VC or Founder is safe. General Partners John Coogan and Jordi Hays are breaking down all of the hottest headlines and viral Xeets in rapid fire on X and on their podcast (which you can listen to wherever you stream). This is not something you want to miss out on. You’re welcome.

P.S. This is the last newsletter of the year, no pod, no deals, nothing, until Jan 3rd. Enjoy your holidays with family and friends!

Musings

Macro

Just how frothy is America’s stockmarket? [Economist]

Palantir, Anduril join forces with tech groups to bid for Pentagon contracts, FT reports [Reuters]

2025 Predictions [Tomasz Tunguz]

AI

Elon Musk’s xAI lands $6B in new cash to fuel AI ambitions [TechCrunch]

AI Semiconductor Landscape feat. Dylan Patel | [BG2 w/ Bill Gurley & Brad Gerstner]

Semianalysis is the #1 resource I go to for anything semi or AI, great research, very thorough

OpenAI announces new o3 models [TechCrunch]

Sora is here [OpenAI]

State-of-the-art video and image generation with Veo 2 and Imagen 3 [Google]

Google Debuts AI Video Tool As OpenAI Resumes Sign-Ups For Rival Sora [Forbes]

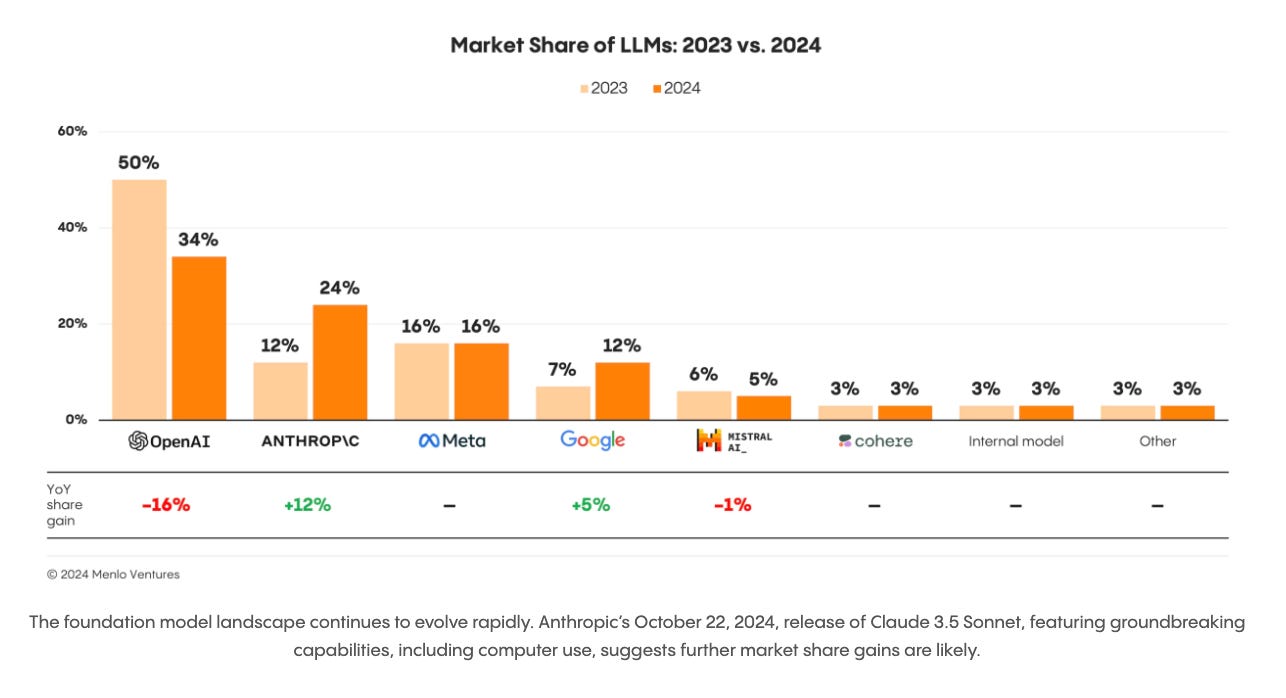

All-In (57:36) Zuck joins Team Elon against OpenAI, AI's competitive landscape, downstream impact on business software [Chart: Menlo Ventures AI Report]

More

Peter Thiel [Rick Rubin’s Tetragrammaton]

Jared Kushner “The Mechanic” [Invest Like The Best]

The Case for Greenland [Pirate Wires]

With rare earth elements, new arctic trade routes, and strategic military advantages, the united states has a mandate to acquire greenland

Why Databricks chose a $10 billion Series J over a 2024 IPO, plus new memos on Boston Metal and Lookout [Contrary Research]

Top angel investors in the U.S. [Lenny’s Newsletter]

Shoutout to Ed & Nadav for #1 and #2

Top Interviews

Cyan Banister & Lee Jacobs Investing in the Magically Weird | SpaceX, Uber, Anduril, Crusoe

How Lucy Guo Is Building A Creator Empire with Shaq, Kygo, & Olivia Dunne | Raising $50M in 2 years

Dan Wright, CEO Armada | Trae Stephens Next Big Bet | $100M For The New Edge

Last Week (12/16-12/20):

Relevant deals include the 70+ deals across stages below. I've categorized the deals below into seven categories, Fintech, Care, Enterprise / Consumer, HardTech, Sustainability, Acquisition/PE, and Fund Announcements, and ordered from later-stage rounds to early-stage rounds.

Highlighted VC Deals include:

Databricks, SandboxAQ, One, Avalanche, Parafin, OURA, Precision Neuroscience, Decart, Haber, Backflip

Acquisitions & PE

Brigit, Together AI/CodeSandbox, Nvidia/Run.ai, Soho House, Deel/Assemble, Buildforce/Ladder, Perplexity/Carbon, SwagUp

Funds

Accel

Final Numbers

2024 IPOs, BATMMAAN Stocks AI: In Everything Everywhere All At Once

VC Deals

Fintech:

- One, a fintech launched by Walmart, raised more than $300m at a $2.5b valuation led by Walmart and Ribbit Capital, per Bloomberg

- Avalanche, a Layer-1 blockchain project, raised $250m in a token sale co-led by Galaxy Digital, Dragonfly, and ParaFi Capital.

- Tyme Group, a Singapore-based digital banking group, raised $250 million in Series D funding. Nubank led the round and was joined by M&G Catalyst Fund and others.

- Parafin, an SF-based embedded fintech platform, raised $100m in Series C funding at a $750m valuation. Notable Capital led, and was joined by Redpoint Ventures, Thrive Capital, Ribbit Capital and GIC.

- Stand, a San Francisco-based insurance provider for climate-impacted properties, raised $30 million in funding from Inspired Capital, Lowercarbon, Equal Ventures, and Convective Capital.

- Plume, a New York City-based blockchain, raised $20 million in Series A funding from Brevan Howard Digital, Haun Ventures, Galaxy Ventures, and others.

- Anatomy Financial, a San Francisco-based financial operations automation platform for healthcare organizations, raised $19 million in Series A funding. Canapi Ventures led the round and was joined by existing investor Lightspeed Venture Partners.

- Jome, an Austin-based AI-powered real estate marketplace, raised $9.8 million in Series A funding. Geek Ventures led the round and was joined by U.Ventures, Toloka VC, and Forefront VP.

- Yei Finance, a New York City-based decentralized lender, raised $2 million in seed funding. Manifold led the round and was joined by DWF Labs, Kronos Research, Outlier Ventures, and others.

Care:

- OURA, an Oulu, Finland-based smart ring developer, raised $200 million in Series D funding from Fidelity Management & Research Company and Dexcom.

- Precision Neuroscience, a New York City-based brain-computer interface technology developer, raised $102 million in Series C funding. General Equity Holdings led the round and was joined by B Capital, Duquesne Family Office, the investment firm of Stanley F. Druckenmiller, and Steadview Capital.

- Remodel Health, an Indianapolis-base provider of ICHRA plans for insurance brokers, raised more than $100m in equity and debt funding led by Oak HC/FT

- SiteOne Therapeutics, a South San Francisco, Calif.-based pain treatment developer, raised $100 million in Series C funding. Novo Holdings led the round and was joined by OrbiMed, Wellington Management, Mission BioCapital, and others.

- Lens, a London-based blockchain L2 network, raised $31 million in funding. Lightspeed Faction led the round and was joined by Alchemy, Avail, Circle, angel investors, and others.

- Justt, a Tel Aviv-based AI-powered chargeback solution, raised $30 million in Series C funding. Zeev Ventures led the round and was joined by existing investors Oak HC/FT and F2 Venture Capital.

- Scripta Insights, a Wellesley, Mass.-based pharmacy navigation platform, raised $17 million in Series B funding. Aquiline led the round and was joined by Contour Venture Partners, Eastside Partners, and ReMY Investors.

- Bluenote, a San Francisco-based regulatory workflow AI platform for life sciences companies, raised $10 million in funding. Lux Capital led the round and was joined by Elad Gil, Anthropic & Menlo Ventures Anthology Fund, McKesson Ventures, and others.

- Arya, a San Francisco-based couples wellness and intimacy platform, raised $8.5 million in Series A funding. Ibex Investors led the round and was joined by existing investors Play Ventures, Patron Fund, and BigBets.vc.

- Confido Health, a Jersey City, N.J.-based AI-powered digital workers developer for healthcare providers, raised $3 million in seed funding. Together Fund led the round and was joined by MedMountain Ventures, Rebellion VC, DeVC, Operators Studio, and others.

Enterprise/Consumer:

- Databricks, a San Francisco-based data AI intelligence platform, is raising $10 billion in Series J funding. Thrive Capital, Andreessen Horowitz, DST Global, GIC, Insight Partners, and WCM Investment Management led the round and were joined by ICONIQ Growth, MGX, Sands Capital, Wellington Management, and existing investor Ontario Teachers’ Pension Plan.

- Hostaway, a Helsinki-based vacation rental platform, raised $365 million in funding. General Atlantic led the round and was joined by existing investor PSG Equity.

- SandboxAQ, a Palo Alto-based AI and quantum techniques solutions provider, raised $300 million in funding from Fred Alger Management, T. Rowe Price Associates, Mumtalakat, and others.

- Decart, a San Francisco-based AI efficiency research lab, raised $32 million in Series A funding. Benchmark led the round and was joined by existing investors Sequoia Capital and Zeev Ventures.

- Bureau, a San Francisco-based risk intelligence platform, raised $30 million in Series B funding. Sorenson Capital led the round and was joined by PayPal Ventures, existing investors Commerce Ventures, GMO Venture Partners, Village Global, and others.

- Cimulate, a digital commerce search startup, raised $28.5m in Series A funding. Spark Capital led, and was joined by Sierra Ventures, Pillar VC, LFX Venture Partners, and Commerce Ventures.

- Unrivaled, a professional women’s basketball league, raised $28 million in Series A funding. The Berman family led the round and was joined by Build Your Legacy Ventures, Linda Henry, Avenue Sports Fund, and others.

- Baller League, a London-based 6x6 football league, raised $25 million in Series A funding. EQT Ventures led the round and was joined by existing investor Dreamcraft VC and others.

- Cartesia, a San Francisco-based multimodal intelligence company, raised $22 million in funding. Index Ventures led the round and was joined by A* Capital, Conviction, General Catalyst, angel investors, and others.

- Boon, a developer of agentic AI tools for fleets, raised $20.5m in seed and Series A funding from Marathon and Redpoint Ventures.

- Bureau, an SF-based fraud risk and intelligence startup, raised $20m in Series B funding. Sorenson Capital led, and was joined by PayPal Ventures, Commerce Ventures, GMO Venture Partners, Village Global, Quona Capital, and XYZ Ventures.

- Ask Sage, an Arlington, Va.-based generative AI solutions provider for the public, defense, and commercial sectors, raised $17 million in Series A funding. Sapphire Ventures led the round and was joined by Mucker Capital.

- Nuon, a San Francisco-based software deployment technology developer, raised $16.5 million in funding. Uncork Capital and M12 led the round and were joined by Alumni Ventures, Deep Acre, Essence Venture Capital, angel investors, and others.

- BlueQuibit, an SF-based quantum SaaS startup, raised $10m in seed funding led by Nyca Partners

- Fraction AI, a New York City-based AI-assisted data labeling platform, raised $6 million in pre-seed funding. Spartan and Symbolic led the round and were joined by Borderless, Anagram, Foresight, and Karatage.

- Starboard, a Toronto-based AI-powered global trade logistics solutions provider, raised $5.5 million in seed funding. Eclipse led the round and was joined by Garuda Ventures and Everywhere Ventures.

- Tenor, a San Francisco-based leadership development AI platform, raised $5.4 million in seed funding. Base10 Partners led the round and was joined by Reach Capital and angel investors.

- Maisa, a San Francisco and Valencia, Spain-based agentic AI chain-of-work technology developer, raised $5 million in pre-seed funding. NFX and Village Global led the round and were joined by angel investors.

- Hamming.ai, a San Francisco-based AI voice agent reliability testing platform, raised $3.8 million in seed funding. Mischief led the round and was joined by YCombinator, AI Grant, Pioneer, angel investors, and others.

- Refute, a London-based disinformation detection and response company, raised £2.3 million ($2.9 million) in pre-seed funding. Playfair and Episode 1 led the round and were joined by Notion Capital and Amadeus Capital Partners.

HardTech:

- Haber, an industrial AI startup, raised $38m in Series C equity funding (plus $6m in debt) from Creaegis, Beenext, and Accel.

- Backflip, a San Francisco-based AI-powered 3D design software developer, raised $30 million in funding. NEA and Andreessen Horowitz led the round and were joined by angel investors.

- Slip Robotics, an Atlanta-based automated truck-loading robots-as-a-service provider, raised $28 million in Series B funding. DCVC led the round and was joined by existing investors EVE Atlas, Tech Square Ventures, Hyde Park Venture Partners, and others.

- BILT, a Dallas-based 3D instructions-as-a-service provider, raised $21 million in Series B funding. Silverton Partners led the round and was joined by Amex Ventures, Fifth Growth Fund, and Silicon Valley Bank.

- Electrified Thermal Solutions, a Medford, Mass.-based electrified heating and thermal energy technology developer, raised $19 million in funding from Holcim MAQER Ventures, Vale Ventures, TechEnergy Ventures, existing investors Clean Energy Ventures and Starlight Ventures, and others.

- Hauler Hero, a San Diego-based waste management operations optimization software, raised $10 million in seed funding. I2BF Global Ventures led the round and was joined by K5 Global, Somersault Ventures, Recall Capital, and others.

- Engineered Arts, a Falmouth, England-based humanoid robotics developer, raised $10 million in Series A funding. Helium-3 Ventures led the round and was joined by Nicolas Desmarais, Belvoir Investments, ThirtySeven Holdings, Figueira Capita, and others.

- Mojave Energy Systems, a Sunnyvale, Calif.-based energy-efficient HVAC system manufacturer, raised $9.5 million in Series A funding. Existing investors Fifth Wall and At One Ventures led the round and were joined by Earth Venture Capital and existing investors Myriad Venture Partners, Starshot Capital, and Alumni Ventures Group.

- SmartAC.com, a Houston-based HVAC and plumbing contractors customer loyalty platform, raised $8 million in an extension round. Mercury Fund led the round and was joined by existing investors.

- Cadstrom, a Montreal, Canada-based AI-assisted electronic devices design system, raised $6.8 million in seed funding. Bison Ventures led the round and was joined by Innovation Endeavors and AI2 Incubator.

- Orqa, a Osijek, Croatia-based drone systems developer, raised €5.8 million ($6.1 million) in seed funding. Lightspeed Venture Partners led the round and was joined by Radius Capital, Decisive Point, and existing investor Day One Capital.

- T-robotics, a San Francisco-based robotic programming developer, raised $5.4 million in seed funding. Engine Ventures and Emergent Ventures led the round and were joined by Berkeley Skydeck and Raisewell.

- Mantis Robotics, a Pleasanton, Calif.-based human-robot collaboration technology developer, raised $5 million in funding. Emerald Technology Ventures led the round and was joined by the Amazon Industrial Innovation Fund.

- Loadar, a Belfast, Ireland-based freight procurement and management service, raised $4 million in seed funding. Frontline Ventures led the round and was joined by existing investor Techstart Ventures.

- Buildpeer, a San Pedro Garza García, Mexico-based construction management platform, raised $2.5 million in seed funding from Brick & Mortar Ventures.

Sustainability:

- CleanCapital, a New York City-based clean energy company, raised $145 million in funding from Manulife Investment Management and others.

Acquisitions & PE:

- Upbound Group agreed to acquire Brigit, a New York City-based financial health technology developer, for up to $460 million in cash and stock.

- Commure, a health-care AI company that's raised $700m from VCs, acquired care automation startup Memora Health in an all-stock deal. Memora had raised $30m from firms like a16z, General Catalyst, Frist Cressey Ventures, and Transformation Capital.

- Together AI acquired CodeSandbox, an Amsterdam-based cloud development environment. Financial terms were not disclosed.