Vulcan Elements' $1.4 Billion Partnership: U.S. Govt & ReElement Technologies

Rarest Company on Earth

Brought to you by Brex:

Brex is the intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast.

$1.4 Billion Partnership

Vulcan Elements announces a $1.4 billion public-private partnership with the U.S. Government and ReElement Technologies to build America’s first 100% vertically integrated rare earth magnet supply chain, ensuring all production—from recycling to finished magnets—occurs on U.S. soil.

The collaboration represents a major step toward re-industrializing American manufacturing & strengthening national security.

Secretary of Commerce Howard Lutnick

“Our investment in Vulcan Elements will accelerate U.S. production of rare earth magnets for American manufacturers. We are laser-focused on bringing critical mineral and rare earth manufacturing back home, ensuring America’s supply chain is strong, secure and perfectly reliable.”

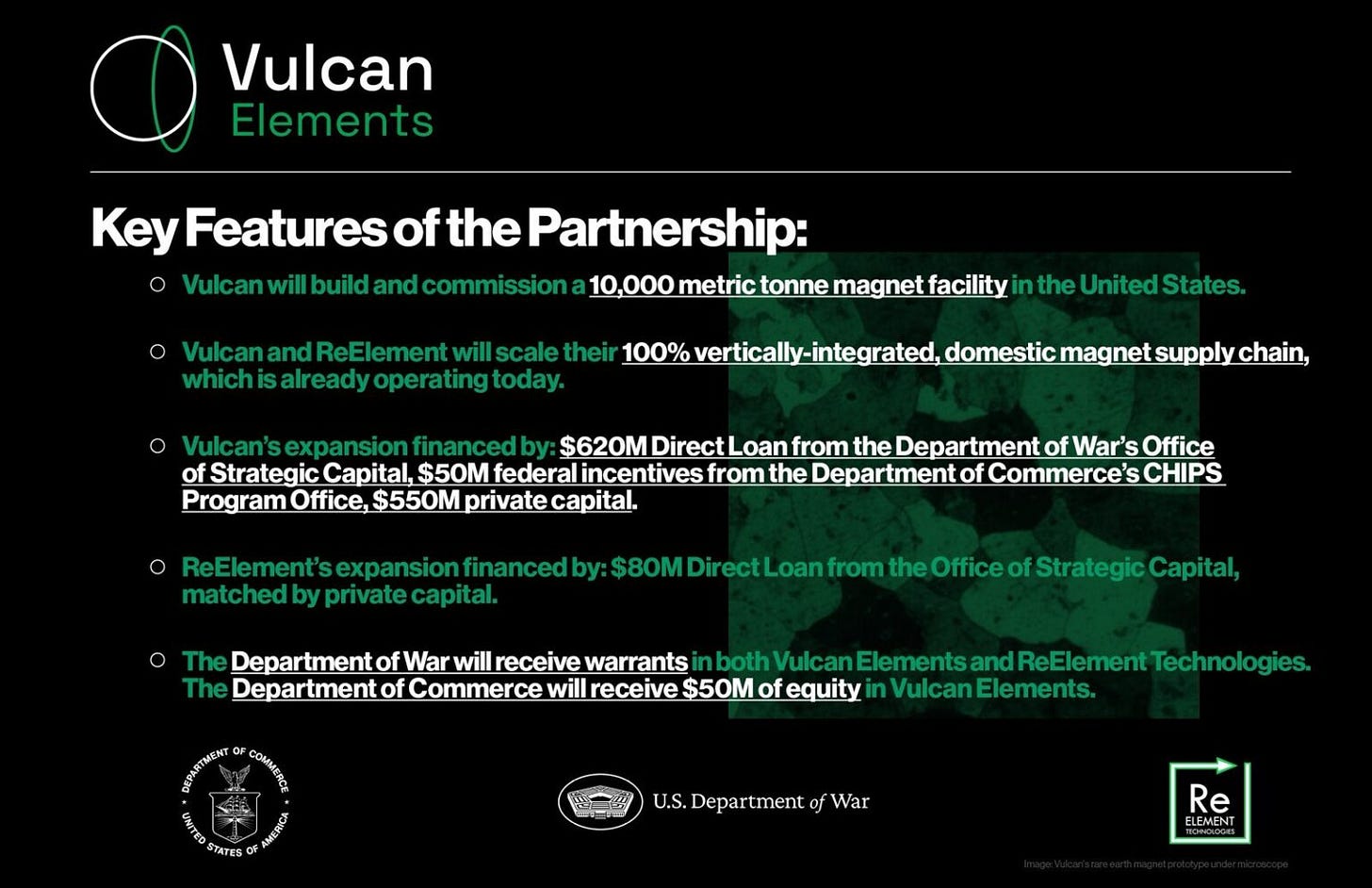

Deal Structure & Financing:

Total package: $1.4 billion

Vulcan Elements: $620M direct loan from the Department of War’s Office of Strategic Capital, $50M in federal incentives from the Department of Commerce (CHIPS Act), and $550M in private capital.

ReElement Technologies: $80M direct loan from the Office of Strategic Capital, matched by private capital.

The Department of War will receive warrants in both companies, and the Department of Commerce will hold $50M in Vulcan equity.

Project Scope:

Construction & operation of a 10,000-metric-tonne NdFeB U.S. magnet facility

Expansion of a closed-loop, recycling-based supply chain capable of producing 10,000 tonnes of magnets annually.

Integration of ReElement’s rare earth oxide refining (from e-waste and end-of-life magnets) with Vulcan’s reduction, metal production, and magnet manufacturing capabilities.

Leadership Commentary:

John Maslin, CEO of Vulcan Elements, called the partnership “a milestone in America’s ability to deliver an urgently needed capability,” underscoring the company’s military-grade execution focus.

Mark Jensen, CEO of ReElement Technologies, highlighted that the partnership “secures America’s fundamental supply chains” through proven innovation and collaboration.

Strategic Impact:

The partnership cements the U.S.’s ability to independently produce high-performance rare earth magnets, which are vital to AI data centers, semiconductors, satellites, electric vehicles, drones, robotics, and defense platforms. It advances supply chain sovereignty, reduces reliance on foreign sources, and delivers a resilient, end-to-end domestic ecosystem.

Full Press Release → Vulcan Elements

REVISIT: The Rarest Company on Earth

Vulcan Elements CEO John Maslin joins Sourcery to announce their $65M Series A led by Altimeter (Brad Gerstner, Erik Kriessmann) with participation from One Investment Management (Rajeev Misra) to build the most advanced rare earth magnet factory in America, fully decoupled from China.

Brining their total funding to $75M.

→ Listen on X, Spotify, YouTube, Apple

A Familiar Story

The rare earth magnet market, estimated at $29B globally in 2025, is in a position strikingly similar to uranium enrichment (<.1% global nuclear fuel enrichment): a critical, high-barrier technology the U.S. once dominated, only to abandon under the assumption global supply chains would always be stable, & diversification is good. After the Cold War, America convinced itself it could outsource almost everything, trading industrial self-reliance for short-term cost savings. In magnets, as with enrichment, that thinking created a single-point-of-failure dependency on geopolitical rivals.

China now produces roughly 94% of the world’s high-performance magnets, leaving the U.S. with less than 1% of capacity. This is more than a trade imbalance, it’s a structural vulnerability that could freeze production lines for everything from missiles to MRI machines overnight if supply is cut off. Rebuilding this capability isn’t just about catching up; it’s about ensuring America can compete, defend itself, and innovate without asking for permission.

More specifically: By the early 2000s, the United States had essentially exited the rare earth magnet market. In 2000, Magnequench moved its NdFeB magnet production facilities from Indiana to Tianjin, China, marking the end of large-scale U.S. manufacturing in this critical sector. Supporting this shift, a 2019 analysis notes that the U.S. “finally stopped its rare earth production in 2002” due to price pressures and enviqonmental disadvantages compared to China.

Once trusted to be part of America’s industrial backbone, rare earth magnet production was quietly outsourced, an emblem of misplaced post–Cold War confidence. Today, this decision now leaves the U.S. highly vulnerable to supply disruptions in everything from consumer electronics to national defense.

. . .

Read more: Altimeter Leads $65M Series A in the Rarest Company On Earth

More in Not Boring

Weekly Dose of Optimism, Packy McCormick

“The rare earth magnets are coming home.

In The Electric Slide, Sam D’Amico and I went deep on the importance of rare earth magnets to everything electric, their history (“So on the same day that Sagawa presented Sumitomo’s Nd₂Fe₁₄B compound, Croat presented GM’s exact same Nd₂Fe₁₄B compound!”), and America’s epic fumble of rare earth magnets leadership (GM sold Magnequench to Deng Xiaoping’s sons-in-law). We pointed out that China now controls 90% of rare earth magnets production, a capability that has proven useful in trade negotiations with the US. And we mentioned one company that was working to fix the problem: Vulcan Elements.”

Brought to you by:

Brex—The intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast.

As a Sourcery subscriber you get: 75,000 points after spending $3,000 on Brex card(s), white-glove onboarding, $5,000 in AWS credits, $2,500 in OpenAI credits, & access to $180k+ in SaaS discounts. On top of $500 toward Brex travel, $300 in cashback, plus exclusive perks (like billboards..) visit → brex.com/sourcery

Turing—Turing delivers top-tier talent, data, and tools to help AI labs improve model performance, and enable enterprises to turn those models into powerful, production-ready systems. Visit: turing.com/sourcery

Carta—Carta connects founders, investors, and limited partners through software purpose-built for private capital. Trusted by 2.5M+ equity holders, 65,000+ companies in 160+ countries, Carta’s platform of software & services lays the groundwork so you can build, invest, and scale with confidence. Visit: Sourcery/carta

Kalshi—The largest prediction market & the only legal platform in the US where people can trade directly on the outcomes of future events (sports, politics, weather, AI, etc).