$1B+ Deal: Crusoe

Chainguard, Tempo, Anduril & OpenAI Acquisitions, Sourcery 100 Ultimate List

Brought to you by Brex:

Brex is the intelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by 35,000+ companies, including ServiceTitan, Anthropic, Scale AI, Mercor, DoorDash, & Wiz. Spend smarter, move faster.

Hello from SF

Last week I was “off-grid” & “offline” at a lovely retreat on an island in the middle of the pacific ocean with a weirdly magical team. It was really special - you don’t really know until day 3-4 how much you need to “reprogram” or as we coined.. “recombinate” your brain.

Certainly, good company, sunshine, lots of competitive outdoor activities and some spa time will help (*mostly, it was the company*). Really incredible group of intensely successful, but very, very thoughtful people.

That being said - there was no “deal” newsletter last week.

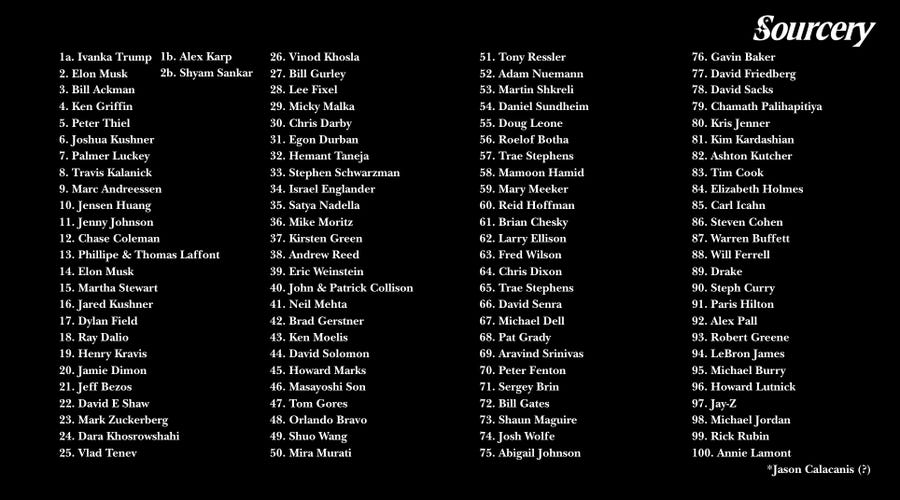

Sourcery 100 - Ultimate Guest List

This list unexpectedly kind of went viral over the weekend. I am still quite surprised from all of the help & offers to intros - I really can’t thank you all enough! Things are happening A LOT faster than expected. I am so excited.

Note: This list doesn’t include already recorded guests, and I’m sure I missed some people! More to come :)

Musings

Deal of the Week

Hedge Fund Week??

Dan Sundheim of D1 Capital on the art of public market investing

$70B in AUM Former CAA Agent Turned Investor on AI & Venture

Check out Kalshi → The largest prediction market & the only legal platform in the US where you can trade directly on the outcomes of future events (sports, politics, weather, AI, etc).

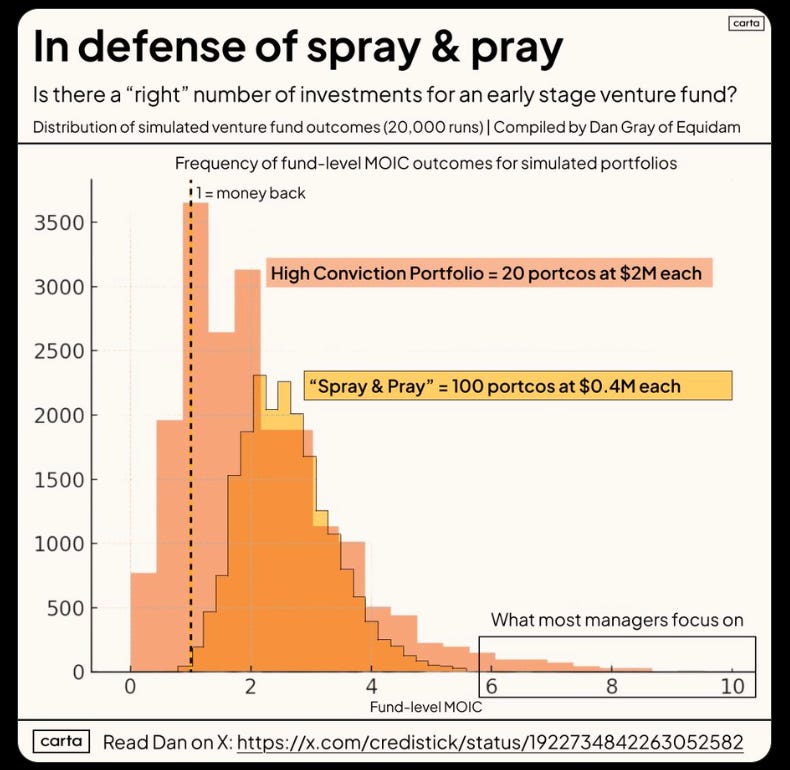

Carta—Carta connects founders, investors, & limited partners through software purpose-built for private capital. Trusted by 2.5M+ equity holders, 65,000+ companies in 160+ countries.

Top Interviews

Sequoia Launches 2 New Early Stage Funds: $200M Seed Fund VI & $750M Venture Fund XIX: Interview with Alfred Lin, No 1 Midas List Investor (2 yrs in a row) → Listen on X, Spotify, YouTube, Apple

Coatue on Meme Stocks, AI & Strategy, Sector Head, Michael Barton → Listen on X, Spotify, YouTube, Apple

Elad Gil, Jared Kushner & Eric Wu on AI in the Enterprise with Brain Co → Listen on X, Spotify, YouTube, Apple

→ Follow Sourcery on: X, YouTube, Spotify, Apple, Linkedin

Last Week (10/20-10/24):

Relevant deals include the 70+ deals across stages below. I’ve categorized the deals below into seven categories, Fintech, Care, Enterprise / Consumer, HardTech, Sustainability, Acquisition/PE, and Fund Announcements, and ordered from later-stage rounds to early-stage rounds.

VC Deals

Fintech:

- Tempo, a blockchain-based payments startup created by Stripe and Paradigm, raised $500m in Series A funding at a $5b valuation, per Fortune. Greenoaks and Thrive Capital led, joined by Sequoia, Ribbit Capital, and SV Angel

- Anrok, a sales tax compliance automation startup, raised $55m in Series C funding at a $525m valuation. Spark Capital led, joined by Sapphire Ventures, Khosla Ventures, Sequoia Capital and Index Ventures.

- Starbridge, a govtech startup for business sales teams, raised $42m in Series A funding led by Craft Ventures

- Streetbeat, a Palo Alto, Calif.-based AI-powered intelligence platform designed for financial professionals and retail investors, raised $15 million in Series A funding. CDP Venture Capital led the round and was joined by TTV Capital, P101, Monte Carlo Capital, 3Lines, and others.

- Finster AI, a provider of AI tools to investment banks and asset managers, raised $15m in seed and Series A funding from FinTech Collective, Peak XV, and Hoxton Ventures

- Brico, a San Francisco-based AI-powered platform designed to automate state and federal licensing for financial institutions, raised $13.5 million in Series A funding. Flourish Ventures led the round and was joined by existing investors Restive Ventures and Pear VC.

- Clerq, a New York City-based payments platform for high-ticket transactions, raised $12 million in Series A funding. 645 Ventures led the round and was joined by existing investors FirstMark Capital, Fika Ventures, Commerce Ventures, and Dash Fund.

- Karta, a Miami-based provider of premium credit cards for non-residents with U.S. bank accounts. raised $5.4m in seed funding. Canary led, joined by Clocktower Ventures and FJ Labs

- Piere, a New York City-based AI-powered financial automation platform, raised $2.1 million in pre-seed funding. Grand Ventures led the round and was joined by Selah Ventures, Trustage Ventures, Samvid Ventures, and Fabric VC.

Care:

- OpenEvidence, a Cambridge, Mass.-based AI medical assistant for doctors, raised $200m in Series C funding at a $6b valuation led by insider GV, per the NY Times. Other backers include Coatue, Conviction Capital, and Thrive Capital.

- Hyro, a New York City-based developer of conversational AI for health care, raised $45 million in funding. Healthier Capital led the round and was joined by Norwest, Define Ventures, and existing investors.

- knownwell, a Boston, Mass.-based provider of primary and specialized obesity and overweight care, raised $25 million in funding. CVS Ventures led the round and was joined by MassMutual Catalyst Fund, Intermountain Ventures, and others.

- Sage Care, a Palo Alto, Calif.-based AI platform designed for health care navigation, raised $20 million in funding. Yosemite led the round and was joined by General Catalyst, Metrodora, SV Angel, and others.

- Brook.ai, a Seattle, Wash.-based remote health care platform, raised $28 million in Series B funding. UMass Memorial Health and Morningside led the round.

- Faeth Therapeutics, a San Francisco-based biotechnology company developing therapies designed to target tumor metabolism, raised $25 million in funding. S2G Ventures led the round and was joined by Khosla Ventures, Future Ventures, Digitalis Ventures, and others.

- Andel, a Las Vegas, Calif.-based pharmacy benefits cooperative platform, raised $4.5 million in funding from Lightbank, Seedcamp, Bertelsmann Investments, Houghton Street Ventures, and Springboard.

- Triplemoon, a Dallas, Texas-based mental health services platform for pediatric patients and their families, raised $3.5 million in seed funding. Activate Venture Partners and LiveOak Ventures led the round.

Enterprise/Consumer:

- Chainguard, a Kirkland, Wash.-based open source security startup,, raised $280m from General Catalyst‘s Customer Value Fund.

- Uniphore, a Palo Alto, Calif.-based business AI platform, raised $260 million in Series F funding from NVIDIA, AMD, Snowflake, Databricks, and others.

- Fal.ai, an SF-based provider of media AI models for developers, raised around $250m at a valuation north of $4b from backers like Sequoia Capital and Kleiner Perkins

- Suno, a Cambridge, Mass.-based AI music generator, raised $125m. is in talks to raise over $100m at a $2b+ valuation, per Bloomberg. It previously raised $125m from Lightspeed, Matrix Partners, Founder Collective, and Nat Friedman

- LangChain, a San Francisco-based agent engineering platform, raised $125 million in funding. IVP led the round and was joined by CapitalG, Sapphire Ventures, and existing investors.

- Shop My Shelf (dba ShopMy), an NYC-based curated commerce infrastructure company, raised $70m at a $1.5b valuation. Avenir led, joined by Bain Capital Ventures, Bessemer Venture Partners, and Menlo Ventures

- Findem, a Redwood City, Calif.-based AI-powered hiring platform, raised $51 million in funding. SLW led the round and was joined by Wing Ventures and others.

- ROLLER, an Austin, Texas-based venue management platform, raised $50 million in funding. Insight Partners led the round and was joined by J.P. Morgan.

- UnifyApps, a New York City-based developer of enterprise AI operating systems, raised $50 million in Series B funding. WestBridge Capital led the round and was joined by ICONIQ and others.

- Serval, a San Francisco-based AI-powered IT service management platform, raised $47 million in Series A funding. Repoint Ventures led the round and was joined by First Round Capital, General Catalyst, Box Group, and others.

- Starbridge.ai, a New York City-based AI-powered sales platform designed for the public sector, raised $42 million in Series A funding. Craft Ventures led the round and was joined by others.

- Sumble, a San Francisco-based sales intelligence platform, raised $38.5 million across seed and Series A rounds led by Canaan Partners and Coatue, joined by Square Peg Capital, Zetta Venture Partners, Bloomberg Beta, and others.

- Keycard, a San Francisco-based platform for building and deploying AI agents, raised $38 million across seed and Series A rounds. Andreessen Horowitz and boldstart ventures led the $8 million seed round and Acrew Capital led the $30 million Series A round.

- Defakto, a Palo Alto, Calif.-based non-human identity security platform, raised $30.8 million in Series B funding. XYZ Venture Capital led the round and was joined by The General Partnership, Bloomberg Beta, and WndrCo.

- CurbWaste, a New York City-based operating system for waste hauling, raised $28 million in Series B funding. Socium Ventures led the round and was joined by Flourish Ventures, TTV Capital, B Capital Group, and SquarePoint Capital.

- ChipAgents, a Goleta, Calif.-based agentic AI chip design platform, raised $21 million in Series A funding. Bessemer Venture Partners led the round and was joined by others.

- Estuary, a New York City-based data movement and streaming platform, raised $17 million in Series A funding. M13 led the round and was joined by Firstmark and Operator Partners.

- Riff, an Oslo, Norway-based vibe coding platform designed for enterprise-grade applications, raised $16 million in Series A funding. Northzone led the round and was joined by Skyfall Ventures, Maki.vc, Sondo Capital, and others.

- Darwin AI, a New York City-based company designed to help public sector agencies integrate AI safely, raised $15 million in Series A funding. Insight Partners led the round and was joined by UpWest and Resolute Ventures.

- Finster AI, a London, U.K.-based developer of AI-powered research and task automation platform for investment banks and asset managers, raised $15 million across Series A and seed rounds. FinTech Collective led the Series A round and Peak XV led the seed round.

- AdsGency, a San Francisco-based developer of a platform designed to be an AI ad agency, raised $12 million in seed funding. XYZ Venture Capital led the round and was joined by Streamlined Ventures, HF0, Hat-Trick Capital, and others.

- Moonshot AI, a New York City-based developer of an AI-powered platform designed to autonomously optimize online stores, raised $10 million in seed funding. Mighty Capital led the round and was joined by Oceans Ventures, Uncorrelated, Garuda Ventures, and Almaz Capital.

- Fourier Health, a Miami, Fla.-based data processing and data exchange platform, raised $8.4 million in funding. Yosemite led the round and was joined by NextGen Venture Partners, Innospark Ventures, and others.

- Anchor Browser, a Tel Aviv, Israel and New York City-based developer of a cloud browser for AI agents, raised $6 million in seed funding. Blumberg Capital led the round and was joined by Gradient.

- Dialogue AI, a Los Angeles, Calif.-based market research platform with live conversational AI technology, raised $6 million in seed funding. Lightspeed Venture Partners led the round and was joined by Seven Stars, Uncommon Projects, and others.

- Tempo, a Toronto, Canada-based AI-powered platform designed for engineers to collaborate on code, raised $5 million in seed funding from YCombinator, Golden Ventures, Box Group, Webflow Ventures, and others.

- Luster, an Indianapolis, Ind.-based AI-powered platform designed to help customer-facing teams prevent mistakes, raised $3 million in seed funding. High Alpha and Ivy Ventures led the round and were joined by others.

HardTech:

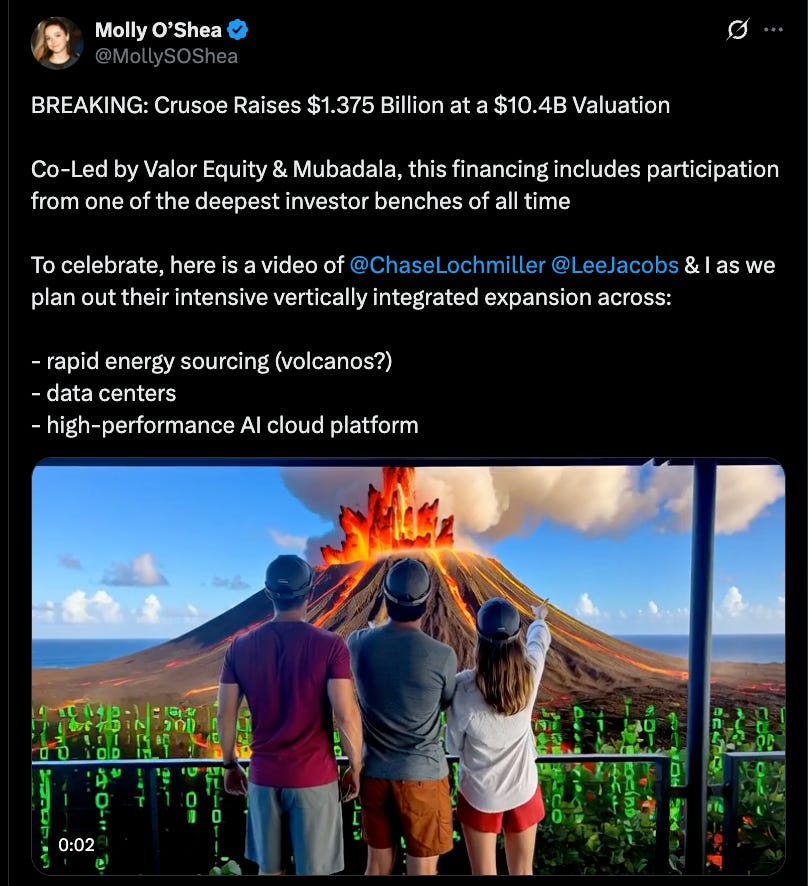

- Crusoe Energy, a Denver-based modular data center company, held a first close on what it says will be nearly a $1.4b Series E round at a valuation north of $10b. Valor Equity Partners and Mubadala Capital are leading, with participation from Altimeter Capital, BAM Elevate, Fidelity, Founders Fund, and Blue Owl Capital.

- Redwood Materials, a Sparks, Nev.-based battery recycling and energy storage company, raised $350 million in Series E funding. Eclipse led the round and was joined by NVentures and others.

- Sesame, a smart glasses and conversational AI startup led by Oculus co-founder Brendan Iribie, raised $250m in Series B funding from backers like Sequoia Capital and Spark Capital

- Seneca, a San Francisco-based firefighting technology company, raised $60 million in funding. Caffeinated Capital and Convective Capital led the round and were joined by First Round Capital, Transition VC, Advance Venture Partners, and others.

- Arbor Energy, an El Segundo, Calif.-based power and carbon removal startup, raised $55m in Series A funding. Lowercarbon Capital and Voyager Ventures led, joined by Gigascale Capital, and Marathon Petroleum

- HiveWatch, an El Segundo, Calif.-based provider of physical security software, raised $33m in Series B funding. Anthos Capital led, joined by Harmonic Growth Partners and Across Capital.

- Acelab, a Brooklyn, N.Y.-based AI-powered platform designed to help architects choose building materials, raised $13.5 million in Series A funding. Navitas Capital led the round and was joined by JLL Spark, Divco West, and others.

- Sizable Energy, a Milan, Italy-based ocean energy storage company, raised $8 million. Playground Global led the round.

- Planera, a Pleasanton, Calif.-based construction project management company, raised $8 million in funding. Sierra Ventures, Prudence, Brick & Mortar Ventures, and Sorenson Capital led the round and were joined by others.

- Milvus Advanced, an Oxford, U.K.-based developer of rare metal alternatives, raised $6.9 million in seed funding. Hoxton Ventures led the round and was joined by LQD Ventures, Übermongen, Tuesday Capital, and others.

- Coolant, a San Francisco-based company using 3D vision and AI for environmental intelligence, raised $4.3 million across seed and pre-seed rounds. General Catalyst led the seed round and Floodgate led the pre-seed round.

- Chipmind, a Zurich, Switzerland-based platform building AI agents designed to accelerate chip manufacturing, raised $2.5 million in funding. Founderful led the round and was joined by angel investors.

Acquisitions & PE:

- Anduril, the defense-tech company valued by VCs at over $30b, acquired American Infrared Solutions, a Hudson, N.H.-based maker of cooled infrared cameras and components.

- OpenAI acquired Software Applications, maker of AI user interfaces for Mac desktops that had raised $6.5m from backers like Dylan Field and OpenAI CEO Sam Altman

- Mammoth Brands agreed to acquire Coterie, a New York City-based baby care brand, from American Pacific Group. Financial terms were not disclosed.

- Veeam, a Seattle-based data resiliency firm owned by Insight Partners, agreed to buy Securiti AI, a San Jose, Calif.-based provider of cybersecurity and compliance automation tools, for around $1.73b in cash and stock. Securiti AI had raised over $230m from General Catalyst, Mayfield, Capital One Ventures, Blue Owl, Cisco Investments, Workday Ventures, and Citi Ventures

- CoreWeave (Nasdaq: CRWV) said it will not increase its $9b all-stock takeover bid for Core Scientific (Nasdaq: CORZ), despite opposition from some large shareholders and proxy firm ISS.

- Coinbase (Nasdaq: COIN) paid $375m to acquire Echo, an onchain capital raising platform

- Blue Owl Capital launched a joint venture with Meta (Nasdaq: META) that will own and operate a $27b data center project in Louisiana.

- DraftKings (Nasdaq: DKNG) agreed to buy Railbird Technologies, holder of a CFTC license that could let DraftKings participate in the predictions markets.

- LVMH (Paris: MC) is seeking to sell its 50% stake in Fenty Beauty, the cosmetics company it co-owned by Rihanna

Funds:

- BoxGroup raises $550 million across two new funds as venture firm crosses 16 years

Love merch? Check out our shop: sourcerymerch.com

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.

First comment - that's ok