$20.7B+ Week

Deals: Prometheus, Lambda, Kalshi, Luma AI, Kraken, Physical Intelligence, CHAOS Industries, Function Health, Genspark, Gopuff, Suno

Brought to you by Brex:

Brex, the ultra-superintelligent finance platform for elite businesses, combining the world’s smartest corporate card with integrated expense management, banking, bill pay, & travel. Trusted by 35,000+ companies, including Anthropic, Arm, Robinhood, ServiceTitan, DoorDash, & Wiz. Built for scale. Spend smarter, move faster.

Hello from CT

Sending this today because I’m just so very thankful for Sourcery (& it was the only time I could get to it). It’s been an incredible year & so much more is about to happen. Thank you all for your support, messages, & continued encouragement.

If there are any topics, guests, or general feedback, reply! I want to hear it.

Enjoy the “day-off,” alongside this ridiculously long list of deals & very large funding announcements. Juicy.

TLDR: $20.7B+ Week

Project Prometheus ($6.2B), Lambda ($1.5B), Kalshi ($1B), Luma AI ($900M), Kraken ($800M), CHAOS Industries ($510M), Physical Intelligence ($600M), Function Health ($298M), Genspark ($275M), Gopuff ($250M), Suno ($250M), Federato ($100M), Faire ($100M), RapidSOS ($100M), Parallel ($100M), Einride ($100M), Ursa Major ($100M equity + $50M debt), Celero ($140M), Alembic ($145M), Sakana AI ($135M), Profluent ($106M), Adobe→Semrush ($1.9B), Topgolf→Leonard Green ($1B), BeatBox→AB InBev ($700M), PANW→Chronosphere ($3.35B).

Musings

AI

A conversation with Sundar Pichai about Gemini 3, Nano Banana Pro

Satya Nadella describes how lessons from Microsoft’s history apply to today’s boom

Capital Markets

Jack Altman w/ Robinhood’s Vlad Tenev on AI, Prediction Markets, & the Future of Trading

Inside General Atlantic: How a $100B Growth Equity Firm Invests on Invest Like The Best

More

Lessons learned from working with Elon Musk, Jeff Bezos, and his brothers | Ari Emanuel’s “Anti-AI” Bet on Live Entertainment

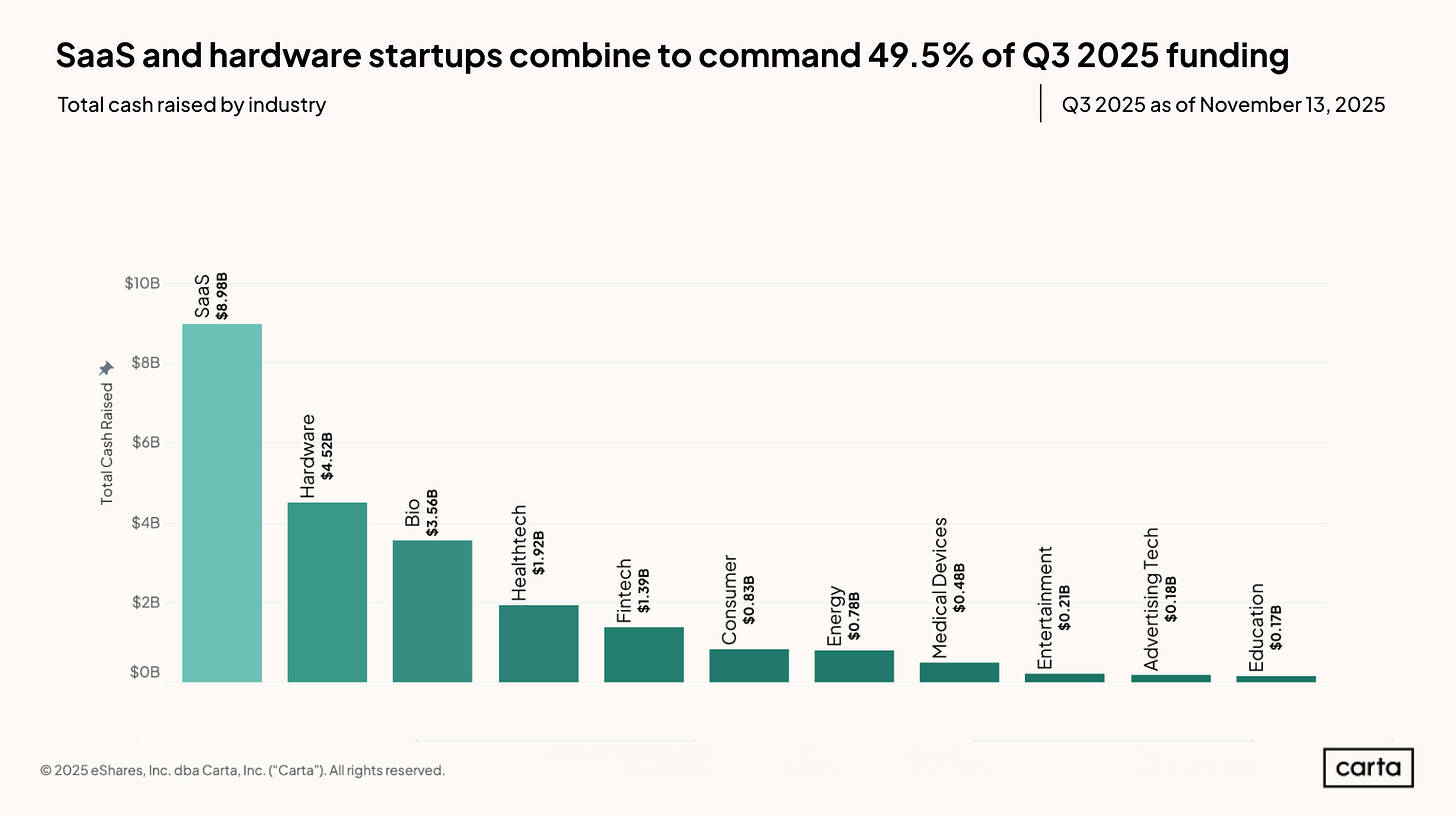

Carta Q3 Funding Data is in.

Top Interviews

$635M Exit → $600M Fund: a16z General Partner, David Ulevitch

How Marc Andreessen, Ben Horowitz, & David Ulevitch Started a16z’s Newest Strategy → Listen on X, Spotify, YouTube, Apple

Quick Hits

→ Follow Sourcery on: X, YouTube, Spotify, Apple, Linkedin

Last Week (11/17-11/21):

Relevant deals include the 70+ deals across stages below. I’ve categorized the deals below into seven categories, Fintech, Care, Enterprise / Consumer, HardTech, Sustainability, Acquisition/PE, and Fund Announcements, and ordered from later-stage rounds to early-stage rounds.

VC Deals

Fintech:

- Kalshi, the largest U.S. predictions market, raised $1b at an $11b valuation led by insiders CapitalG and Sequoia Capital

- Kraken, a Cheyenne, Wyo.-based crypto exchange, raised $800m at a $20b valuation. Citadel Securities led with a $200m investment, joined by Jane Street, HSG, Oppenheimer Alternative Investment Management, and Tribe Capital.

- Federato, an SF-based provider of insurance workflow software, raised $100m in Series D funding. Goldman Sachs Alternatives led, joined by insiders Emergence Capital, Caffeinated Capital, StepStone Group, and Pear VC

- Numeric, an SF-based accounting automation startup, raised $51m in Series B funding. IVP led, joined by Menlo Ventures, Founders Fund, Alkeon, 8VC, Socii Capital, Access Industries, Friends & Family Capital, and Long Journey Ventures.

- Maxima, a San Mateo, Calif.-based agentic AI platform designed for accounting automation, raised $41 million across Seed and Series A rounds from Redpoint Ventures, Kleiner Perkins, Audacious Ventures, and others.

- Baselane, a New York City-based banking and financial platform designed for real estate investors, raised $34.4 million across Series A and B rounds. Thomvest Ventures led the $20 million Series B round and Matrix Partners led the $14.4 million Series A round.

- Kanastra, a São Paulo, Brazil-based fintech company for private credit funds and securitizations, raised $30 million in Series B funding. F-Prime led the round and was joined by the International Finance Corporation and others.

- Stuut, an accounts receivables automation startup, raised $29.5m in Series A funding, per Fortune. A16z led, joined by Activant Capital, Khosla Ventures, 1984 Ventures, Carya Venture Partners, Page One Ventures, Vesey Ventures, and Valley Ventures.

- Tidalwave, an AI platform for mortgage origination, raised $22m in Series A funding led by Permanent Capital, with D.R. Horton and Engineering Capital participating

- Sphere, a tax compliance platform, raised $21m Series A in Series A funding. A16z led, joined by YC and Felicis Ventures

- sunday, an Atlanta, Ga.-based payment platform designed for restaurant hospitality, raised $21 million in Series B funding from DST Global Partners and others.

- Modern Life, a New York City-based AI-powered life insurance brokerage, raised $20 million in Series A funding. Thrive Capital led the round and was joined by New York Life Ventures, Northwestern Mutual Future Ventures, and Allegis.

- Coverbase, an SF-based AI procurement and risk platform, raised $20m in Series A funding led by Canapi Ventures.

- Remitee, a Buenos Aires, Argentina-based remittance infrastructure provider, raised $20 million in funding. Krealo led the round and was joined by Copec Wind Ventures, Soma Capital, Redwood Ventures, Latitud, and Algorand.

- Anzen, a San Francisco-based AI-powered distribution platform for commercial insurance, raised $16 million in Series A funding. Madrona led the round and was joined by Sandbox Industries, SNR, Andreessen Horowitz, and others.

- Condukt, a London, U.K.-based compliance platform for financial services, raised $10 million in funding. Lightspeed Venture Partners and MMC Ventures led the round and were joined by Cocoa Ventures.

- Pibit AI, a San Francisco-based developer of AI for underwriting, raised $7 million in Series A funding. Stellaris Venture Partners led the round and was joined by Y Combinator and Arali Ventures.

- Mesta, a San Francisco-based global fiat and stablecoin payment network, raised $5.5 million in seed funding. Village Global led the round and was joined by Circle Ventures, Paxos, Canonical Crypto, WTI, and existing investors Garuda Ventures, Everywhere Ventures, and Inventum Ventures.

- Asseta AI, a New York City-based accounting platform designed for family offices, raised $4.2 million in seed funding. Nyca Partners and Motive Partners led the round.

- Kaaj, a San Francisco-based AI platform designed to automate small business loan underwriting, raised $3.8 million in seed funding. Kindred Ventures led the round and was joined by Better Tomorrow Ventures and others.

- Orion, a Denver, Colo.-based AI-powered risk intelligence platform, raised $3.5 million in seed funding. Dynamo Ventures led the round and was joined by Techstars, BVVC, and Service Provider Capital.

- Deduction, a New York City-based developer of an AI-powered tax accountant, raised $2.8 million in pre-seed funding. One Way Ventures and Creator Ventures led the round and were joined by Alpine VC, Intuition, Charley Moore, and angel investors.

Care:

- Function Health, an Austin, Texas-based longevity startup, raised $298m in Series B funding at a $2.5 billion post-money valuation. Redpoint Ventures led, joined by a16z, FirstMark, Battery Ventures and Menlo Ventures

- Profluent, an Emeryville, Calif., protein design AI startup, raised $106m. Altimeter and Bezos Expeditions led, joined by insiders Spark Capital, Insight Partners, and Air Street Capital.

- Arbiter, a New York City-based platform designed to connect health care patients, providers, and payers in one place, raised $52 million in funding. TriEdge Investment and MFO Ventures led the round and were joined by WindRose Health Investors and others.

- Voize, a Berlin, Germany-based AI companion designed for nursing care, raised $50 million in Series A funding. Balderton Capital led the round and was joined by existing investors HV Capital, Redalpine, and Y Combinator.

- Predicta Biosciences, a Cambridge, Mass.-based precision oncology company, raised $23.4 million in Series A funding. Engine Ventures led the round and was joined by Illumina Ventures, Lightchain Capital, Mass General Brigham Ventures, and others.

- Nest Health, a value-based care company focused on families, raised $22.5m in Series A funding from 8VC, Blue Venture Fund, Amboy Street Ventures, and Socium Ventures

- Manta Cares, a San Francisco-based platform designed to help cancer patients and caregivers track symptoms, medications, and appointments, raised $5.4 million in seed funding. Pear VC and Sozo Ventures led the round and were joined by angel investors.

- Ember, a San Francisco-based AI-powered revenue cycle management platform for health care, raised $4.3 million in seed funding. Nexus Venture Partners and Y Combinator led the round.

- Cellbyte, a Munich, Germany-based AI-powered platform designed to help pharmaceutical companies accelerate drug launches, raised $2.8 million in seed funding. Frontline Ventures led the round and was joined by Y Combinator, Pace Ventures, Saras Capital, and Springboard Health Angels

- Preveta, a Los Angeles, Calif.-based AI-powered care navigation platform designed for specialty care, raised $2.4 million in a Series A extension. Navigate Ventures and Sovereign Capital led the round and were joined by Bullpen Capital and TMV.

Enterprise/Consumer:

- Project Prometheus, an AI startup focused on real-world applications, has raised $6.2b — much of which comes from co-founder and co-CEO Jeff Bezos

- Lambda, a San Francisco-based superintelligence cloud, raised $1.5 billion in Series E funding. TWG Global led the round and was joined by Thomas Tull’s US Innovative Technology Fund and existing investors.

- Luma AI, a Palo Alto, Calif.-based video generation platform, raised a $900m Series C round at a $4b valuation. Humain led, joined by AMD Ventures, a16z, Amplify Partners, and Matrix Partners

- Genspark, a developer of agentic AI for knowledge workers, raised $275m in Series B funding at a $1.25b post-money valuation. Emergence Capital Partners led, joined by SBI Investment, LG Technology Ventures, Pavilion Capital, and Uphonest Capital.

- Gopuff, a Philadelphia, Penn.-based courier service, raised $250 million in funding. Eldridge Industries and Valor Equity Partners led the round and were joined by Baillie Gifford, Equalis Capital, and others.

- Suno, an AI music platform, raised $250m at a $2.45b valuation. Menlo Ventures led, joined by Hallwood Media, Lightspeed, Matrix and NVentures

- Alembic, a San Francisco-based developer of a casual AI platform designed to provide marketing analytics for C-Suite executives, raised $145 million in Series B funding. Prysm Capital and Accenture led the round and were joined by Silver Lake Waterman, Liquid 2 Ventures, and others.

- Sakana AI, a Japanese AI model developer, raised around $135m in Series B funding at a $2.65b post-money valuation from MUFG, Khosla Ventures, Macquarie Capital, NEA, Lux Capital, and In-Q-Tel

- Faire, an SF-based wholesale marketplace, launched a $100m tender offer at a $5.2b valuation, per Bloomberg. WCM Investment Management is leading, joined by Baillie Gifford and True North Fund

- RapidSOS, an NYC-based emergency response data platform, raised $100m at a valuation north of $1b led by Apax

- Parallel, a Palo Alto, Calif.-based company developing infrastructure designed to enable AI agents to access and think with the web, raised $100 million in Series A funding. Kleiner Perkins and Index Ventures led the round and were joined by Spark Capital and existing investors.

- Doppel raises $70 million Series C at more than $600 million valuation to fight AI-powered social engineering attacks

- Venn, a New York City-based operating system for multifamily housing, raised $52 million in Series B funding. NOA and CIM Group led the round and were joined by Group 11, Oren Zeev, and others.

- Vibe.co, a New York City-based ad platform designed to bring hyper-targeting to connected TV, raised $50 million in Series B funding. Hedosophia led the round and was joined by Elaia, Singular, and others.

- Agentio, a New York City-based AI-powered platform for creator-led advertising, raised $40 million in Series B funding. Forerunner led the round and was joined by Benchmark, Craft Ventures, and others.

- Apono, an NYC-based cloud identity-security startup, raised $34m in Series B funding. U.S. Venture Partners led, joined by Swisscom Ventures, Vertex Ventures, and 33N Ventures.

- CloudX, a San Francisco-based AI-powered advertising platform for mobile publishers, raised $30 million in Series A funding. Addition led the round and was joined by DST Global, Terrain, and others.

- Vyntelligence, a London, U.K.-based agentic video intelligence work platform, raised $30 million in Series B funding. Morgan Stanley Investment Management and Blume Equity led the round.

- Moonlake AI, a San Francisco-based AI research lab, raised $28 million in seed funding from AIX Ventures, Threshold, NVIDIA Ventures, and others.

- GetVocal, a Paris, France-based conversational AI platform designed for customer service, raised $26 million in Series A funding. Creandum led the round and was joined by Elaia and Speedinvest.

- Method Security, a dual-use cybersecurity company, raised $26m in seed and Series A funding, per Axios. Backers include a16z, General Catalyst, Blackstone, Crossbeam Venture Partners, Forward Deployed Venture Capital, and Pax Ventures

- Span, an AI developer intelligence platform, raised $25m in seed and Series A funding from Alt Capital, Craft Ventures, SV Angel, BoxGroup, and Bling Capital

- Wispr, a San Francisco-based voice-to-text AI model designed to produce polished writing from voice entries, raised $25 million in a Series A extension. Notable Capital led the round and was joined by Flight Fund.

- Sphere, a San Francisco-based cross-border compliance platform, raised $21 million in Series A funding. Andreessen Horowitz led the round and was joined by Y Combinator and Felicis Ventures.

- OpenHands, a Boston, Mass.-based open platform for cloud coding agents, raised $18.8 million in Series A funding. Madrona led the round and was joined by Menlo Ventures, Obvious Ventures, Fujitsu Ventures, and Alumni Ventures.

- Automat, a San Francisco-based workflow automation platform for enterprises, raised $15.5 million in Series A funding. Felicis led the round and was joined by Initialized, Khosla Ventures, and Y Combinator.

- Mate, a Tel Aviv, Israel-based cybersecurity platform, raised $15.5 million in seed funding. Team8 and Insight Partners led the round.

- Datum, a New York City-based open network cloud, raised $13.6 million in seed funding from Amplify Partners, CRV, Vervin Ventures, and others.

- onepot AI, a San Francisco-based developer of an AI chemistry platform designed to accelerate the synthesis of small molecules for drug discovery, raised $13 million in seed funding. Khosla Ventures, Fifty Years, and Speedinvest led the round and were joined by others.

- Jiga, a San Francisco-based AI-powered sourcing platform, raised $12 million in Series A funding. Aleph led the round and was joined by Symbol and Y Combinator.

- Xenia, a Chicago, Ill.-based developer of AI-powered operations software for multi-location organizations, raised $12 million in Series A investment from PSG.

- Filament, a New York City-based invite-only connection platform for professionals, raised $10.7 million in seed funding from EQT Ventures, Flybridge Capital, Oceans Ventures, and others.

- Milestone, a Tel Aviv, Israel-based platform for measuring the adoption and impact of AI coding tools, raised $10 million in seed funding. Heavybit and Hanaco Ventures led the round and were joined by Atlassian Ventures and angel investors.

- Obello, a San Francisco-based AI-powered graphic design platform, raised $8.5 million in seed funding. Obvious Ventures led the round and was joined by Baukunst and others.

- DJUST, a Paris, France-based business-to-business operations platform, raised €7 million ($8.2 million) in a Series A extension. NEA led the round and was joined by Elaia and Speedinvest.

- Poly, a San Francisco-based AI-powered cloud file browser company, raised $8 million in seed funding. Felicis led the round and was joined by Bloomberg Beta, NextView, Figma Ventures, AI Grant, Wind Ventures, and MVP Ventures.

- Shipday, a Menlo Park, Calif.-based delivery and logistics technology platform for small and medium-sized businesses, raised $7 million in Series A funding. ECP Growth and Ibex led the round and were joined by B Capital and Supply Chain Ventures.

- alphaXiv, a San Francisco-based platform that curates AI research, benchmarks, and models, raised $7 million in seed funding. Menlo Ventures and Haystack led the round and were joined by Shakti VC, Conviction Embed, Upfront Ventures, and angel investors.

- Cavela, a supplier sourcing automation startup, raised $6.6m in seed funding. XYZ Venture Capital and Susa Ventures led, joined by Crossover Capital

- SubImage, a San Francisco-based cloud security platform designed to map a company’s entire infrastructure, raised $4.2 million in seed funding from FundersClub, Y Combinator, Phosphor Capital, and Transpose Platform.

- AlertD, a San Francisco-based agentic AI site reliability engineering and DevOps platform, raised $3 million in pre-seed funding. True Ventures led the round.

HardTech:

- Physical Intelligence, a San Francisco-based developer of AI models designed for the physical world, raised $600 million in funding. CapitalG led the round and was joined by existing investors Lux Capital, Thrive Capital, Jeff Bezos, and others.

- CHAOS Industries, a Los Angeles, Calif.-based developer of threat-detection and anti-radar software for the defense industry, raised $510 million in Series D funding. Valor Equity Partners led the round and was joined by 8VC and Accel.

- Celero Communications, an Irvine, Calif.-based digital signal processor technology company, raised $140 million across Series B, Series A, and seed rounds. CapitalG led the Series B round and Sutter Hill Ventures led the Series A and seed rounds.

- Einride, a Stockholm, Sweden-based provider of digital, electric, and autonomous solutions for road freight, raised $100 million in funding from EQT Ventures and others.

- Ursa Major Technologies, a Berthound, Colo., rocket engine startup, raised $100m at a $600m valuation. Eclipse led, joined by Woodline Partners, Principia Growth, XN and Alsop Louie Partners. It also secured $50m in debt

- Amperesand, a Singapore-based developer of next-generation power infrastructure for AI data centers and critical power applications, raised $80 million in Series A funding. Walden Catalyst Ventures and Temasek led the round.

- Gridware, a San Francisco-based developer of active grid response technology, raised $55 million in Series B funding. Tiger Global and Generation Investment Management led the round and were joined by existing investors Sequoia Capital, Convective Capital, Fifty Years, True Ventures, Lowercarbon, and Y Combinator.

- Flexion, a Zurich, Switzerland-based developer of an intelligent software layer designed to power humanoid robots, raised $50 million in Series A funding from DST Global Partners, NVentures, Redalpine, Prosus Ventures, and Moonfire Ventures.

- Fabric8Labs, a San Diego, Calif.-based developer of advanced additive manufacturing facilities that can create metal parts that cannot be created with traditional manufacturing, raised $50 million in funding. NEA and Intel Capital led the round and were joined by existing investors Lam Capital, TDK Ventures, SE Ventures, and others.

- Phaidra, a Seattle, Wash.-based developer of AI agents for AI factories, raised $50 million in Series B funding. Collaborative Fund led the round and was joined by Helena, Index Ventures, and NVIDIA.

- Archetype AI, a Palo Alto, Calif.-based physical AI company, raised $35 million in Series A funding. IAG Capital Partners and Hitachi Ventures led the round and were joined by Bezos Expeditions, Venrock, Amazon Industrial Innovation Fund, Samsung Ventures, Systemiq Capital, and others.

- PowerLattice, a Vancouver, Wash.-based developer of a power delivery chiplet designed to reduce compute power needs for AI accelerators, raised $25 million in Series A funding. Playground Global and Celesta Capital led the round.

- Quindar, a Denver, Colo.-based platform designed for monitoring and automating spacecraft operations, raised $18 million in Series A funding. Washington Harbour led the round and was joined by Booz Allen Ventures, FUSE, FCVC, and Y Combinator.

- Endolith, a Denver, Colo.-based developer of technology designed to help miners recover copper from already discarded ore, raised $13.5 million in Series A funding. Squadra Ventures led the round and was joined by Draper Associates, Denver Ventures, Ever Blue, Alumni Ventures, Mana Ventures, and others.

- PicoJool, a Palo Alto, Calif.-based developer of optical chips and modules designed for high-bandwidth, low-cost connectivity in hyperscale AI data centers, raised $12 million in funding. Playground Global led the round.

- Reelables, a London, U.K.-based developer of smart labels for tracking cargo and inventory, raised $10.4 million in Series A funding from Amigos Ventures, Moneta, and others.

- Luminal, a San Francisco-based GPU optimization company, raised $5.3 million in seed funding. Felicis Ventures led the round and was joined by angel investors.

- Sensetics, a Princeton, N.J.-based haptics and touch data company, raised $1.8 million in pre-seed funding. MetaVC Partners and Fitz Gate Ventures led the round and were joined by Blue Sky Capital and AIC Ventures.

Sustainability:

- Bindwell, a San Francisco-based company using AI to develop pesticides designed to be safer, raised $6 million in seed funding. General Catalyst and A Capital led the round and were joined by SV Angel and Paul Graham.

Acquisitions & PE:

- Leonard Green is in talks to buy Topgolf from Topgolf Callaway Brands (NYSE: MODG) for around $1 billion

- Thoma Bravo bought a majority stake in Java development platform Azul from Vitruvian Partners and Lead Edge Capital (both of which will retain minority stakes)

- IonQ (NYSE: IONQ) agreed to acquire Skyloom Global, a Broomfield, Colo.-based network provider that raised nearly $53 million from Castlegate Capital Advisors and IronGate Capital Advisors

- Anheuser-Busch InBev (NYSE: BUD) is in talks to buy alcoholic beverage maker BeatBox for around $700m, per the WSJ. Austin, Texas-based BeatBox has raised around $23m in VC funding from Concentric Equity Partners, Morrison Seger, and ICBM Venture Capital.

- Adobe (Nasdaq: ADBE) agreed to buy Boston-based marketing SaaS Semrush (Nasdaq: SEMR) for $1.9b

- GlobalFoundries (Nasdaq: GFS) acquired Advanced Micro Foundry, a Singaporean silicon photonics foundry

- TSG Consumer acquired a minority stake in Pura Vida Miami, a Miami, Fla.-based all-day cafe and lifestyle brand. Financial terms were not disclosed.

- Cognizant agreed to acquire 3Cloud, a Chicago, Ill.-based Microsoft Azure services provider, from Gryphon Investors. Financial terms were not disclosed.

- General Atlantic acquired a minority stake in SmartHR, a Tokyo, Japan-based HR and labor management software company, from Coral Capital for $96 million.

- Cloudflare agreed to acquire Replicate, a San Francisco-based platform designed to make it easier for developers to deploy and run AI models. Financial terms were not disclosed.

- Blackstone invested $50 million in Norm Ai, a New York City-based AI-powered legal compliance company.

- Palo Alto Networks (Nasdaq: PANW) will pay $3.35b to acquire Chronosphere, an Issaquah, Wash.-based data observability startup most recently valued by VCs at $1.6b in late 2023. Chronosphere raised over $400m from GV, Geodesic Capital, Addition, Founders Fund, General Atlantic, Greylock, Glynn Capital and Lux Capital

- Workday (Nasdaq: WDAY) agreed to acquire Pipedream, an SF-based integration platform for AI agents that raised $22m from 8-Bit Capital, CRV, and WiL

IPOs:

- Gloo, a Boulder, Colo.-based provider of management software for faith-based organizations, raised $73m in its IPO. It priced at $8 per share, below its $10-$12 range, for an initial market cap of $582m. It will list on the Nasdaq (GLOO), while backers include Thrivent. Gloo’s exec chair and tech head is ex-Intel CEO Pat Gelsinger.

- Kraken, a U.S.-based crypto exchange recently valued at $40b, confidentially filed for a U.S. IPO

Funds:

- DigitalBridge Group, a Boca Raton, Fla.-based private equity fund, raised $11.7 billion for its third fund focused on digital infrastructure companies.

Love merch? Check out our shop: sourcerymerch.com

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.