BREAKING: How Autopilot Hit $500M AUM

Autopilot: $500M invested, $2B in volume, 9M trades, $6B in connected assets

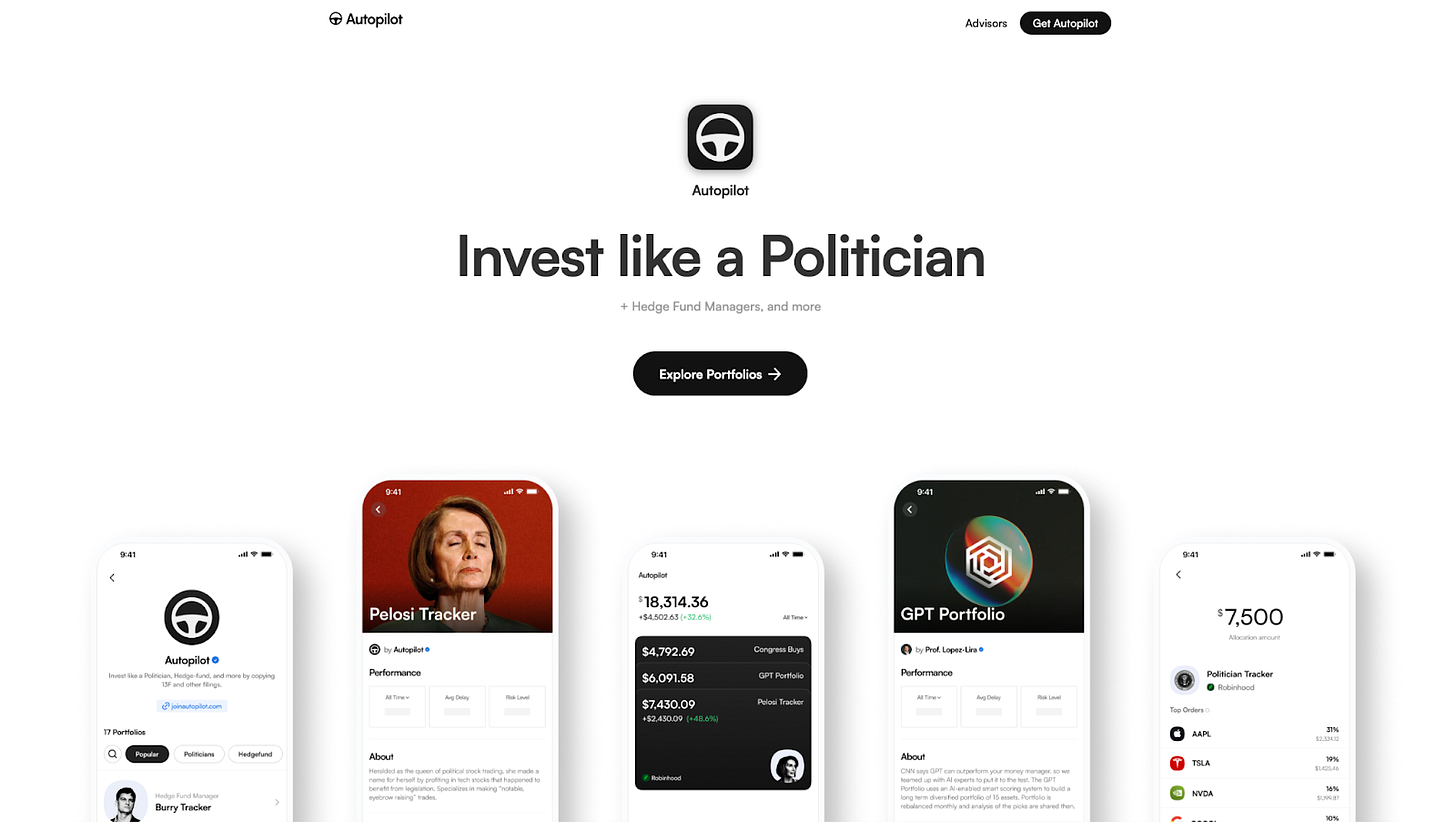

Autopilot: Invest Like a Politician (+ Hedge Fund Managers, & more)

Wow. I am pumped to have Chris Josephs, Co-Founder of Autopilot, on the pod. Autopilot enables users to link brokerage accounts and automate trades based on expert portfolios, including those of politicians, hedge fund managers, and financial creators. We dive into the highly relevant and spicy topic on the intricacies of political insider trading, the venture-backed journey of Autopilot, their innovative viral social media growth strategies (like their infamous 1.1M + follower X account Nancy Pelosi Stock Tracker), and more.

→ Listen on Spotify, YouTube, Apple

Chris shares high-profile issues including Nancy Pelosi's trading patterns, the history and nuances of insider trading laws, Autopilot’s bipartisan approach, and the potential impact of banning politicians from stock trading. In addition, we learn about the secret sauce behind Autopilot's viral growth, their creative marketing tactics, and what lies ahead for the company as they partner with creators to further democratize investment opportunities.

P.S. Chris is a bit of a celebrity himself, having recently been featured on Tucker Carlson’s podcast (reaching ~700K views on YT), Tom Bilyeu, and, yes, even TMZ. Rogan if you’re reading this.. give Chris a call.

“ we are fully building a venture-backed multi-billion dollar outcome company”

Whether you're an investor, entrepreneur, or simply curious about the intersection of technology, politics, and finance, this conversation is packed with insights and actionable takeaways.. I’ve never said “wow” more in an interview.

Below we’ll go even deeper into Autopilot’s viral growth, VC funding, the history of insider trading, legislation & regulations, and how government officials are regulated (or not).

Autopilot Stats:

Over $500 million invested and 9M trades on Autopilot. Built by the team behind the viral Pelosi Tracker account. Over 90,000+ investors, More than $2 billion in trade volume since launching in 2023. Over $6 billion in total connected assets.

Autopilot has raised ~$7M to date from funds such as Craft Ventures, Nomad, Path Ventures, NextFund, Balaji Ventures, and more.

DISCLAIMER: Not Financial Advice. For entertainment purposes only.

Highlights:

00:00 - The Hypocrisy of Politicians Trading Stocks

00:42 - Introducing Chris Josephs of Autopilot & Nancy Pelosi Stock Tracker

02:03 - The Evolution of Insider Trading

05:43 - The Stock Act and Its Loopholes

08:58 - The Richard Burr Scandal

11:45 - AOC's Push for a Trading Ban

21:21 - Autopilot's Mission and Growth

36:15 - Viral Growth Marketing Strategies

45:43 - The Future of Retail Investing

56:45 - Product Design Inspo: Apple, Duolingo, Brex

59:34 - VC Fundraising and Business Growth

01:04:26 - Exciting Plans for the Future

Autopilot's Business and Growth

The Autopilot investment app works by allowing users to mimic the portfolios of politicians, hedge fund managers, and AI-powered strategies, automating the process of buying and selling stocks based on those selected portfolios. Users connect their brokerage accounts to the app, choose a portfolio to follow, select an investment amount, and Autopilot automatically places trades based on the selected portfolio's holdings.

With 2.5 million downloads, six figures of active subscribers, and $6 billion in connected assets (of which $500 million are actively traded), Autopilot has demonstrated remarkable growth. The company boasts an eight-figure ARR (Annual Recurring Revenue) and has paid $500k to creators on its platform. Social media has been a key driver of success, with 3.5 million followers across platforms generating approximately 70 million impressions monthly. Despite its reliance on popular figures like Pelosi, Autopilot is actively diversifying its offerings by partnering with creators and influencers, such as Unusual Whales, and expanding into long-term investment options like retirement accounts.

Insider Trading and Political Controversies

Prior to the STOCK Act of 2009, insider trading among politicians was unregulated, leading to rampant abuse. The STOCK Act introduced a requirement for politicians, their spouses, and dependents to report trades within 45 days, but the delay often allows trades to escape real-time scrutiny. For example, Nancy Pelosi could make a trade on January 1 and report it as late as February 15. Politicians like Richard Burr have been implicated in insider trading scandals, such as during COVID-19, when Burr liquidated $1.4 million in stocks after receiving intelligence briefings, saving himself significant losses. Despite FBI and SEC investigations, no charges were filed.

Similarly, Marjorie Taylor Greene has been criticized for timely trades, including purchases of Nvidia and Apple stocks before tariff announcements. Pelosi herself has been a subject of fascination, with her portfolio consistently outperforming the market, achieving a 54% gain in 2024, compared to SPY’s 30% lower performance. Controversial political figures like Trump and Greene have further fueled debates, with AOC and Bernie Sanders advocating for a complete ban on stock trading by politicians. A 2024 bipartisan bill proposed by Senators Josh Hawley and John Ossoff seeks to ban trading for politicians and their spouses by 2027-2028 and mandate divestment from private investments, though critics argue it could discourage future politicians with private business holdings from running for office.

→ Check out our interview with Kalshi CEO Tarek Mansour on the nuances of insider trading in commodity derivatives & prediction markets

Nancy Pelosi & Autopilot’s Trade Tracker

Nancy Pelosi has become a central figure in Autopilot’s success, with her trades followed by 100K+ users and $350 million in investments reportedly tracking her portfolio (essentially her own hedge fund). Pelosi’s focus on AI and tech stocks, including Nvidia, Google, and smaller AI companies like Tempus AI and Vistra AI, has drawn significant interest. Despite the 45-day reporting delay required by the STOCK Act, Pelosi’s long-term buy-and-hold strategy makes her trades an attractive option for retail investors. However, Autopilot acknowledges that if a ban on politicians trading stocks is enacted, it could slow growth significantly. Pelosi Tracker, one of Autopilot’s most popular pilots, accounts for a large share of its social media following and user engagement. To mitigate risks, the company has diversified its offerings by partnering with other creators and influencers to build a broader marketplace for retail investors.

Retail Investing Trends and the Role of Social Media

Social media has revolutionized retail investing, creating faster news cycles that amplify market volatility and emotional trading behaviors. Platforms like X, Instagram, and TikTok drive retail investor engagement, but they also expose users to scams and misinformation. Autopilot leverages these platforms effectively, achieving viral success with campaigns like its “Pelosi Tracker” and creative memes such as “The Perfect Trade,” which garnered millions of impressions. However, the company is cautious about avoiding "valueless impressions" and emphasizes high-quality, trust-building content to attract serious investors.

Retail investors often struggle with emotional trading; studies show that missing the top 10 trading days in a year can reduce annualized returns from 9.8% to 3.3%. Autopilot aims to address this issue by offering a "set it and forget it" model, allowing users to automate long-term investment strategies rather than reacting to short-term market fluctuations.

Marketing and Content Strategies

Autopilot has excelled in growth marketing by creating engaging, shareable content tailored to specific platforms. For instance, the company capitalized on viral trends, such as AI-generated videos and GPT portfolios, to generate millions of impressions. In one notable campaign, Autopilot gave GPT $50,000 to invest, creating a Twitter account that gained 130,000 followers in a week and attracted $40 million in assets under management following the GPT portfolio.

The company avoids traditional performance marketing, relying instead on organic growth through social media. Its content team, though small, has achieved outsized results by focusing on creativity and storytelling. For example, the team recreated a viral Ghibli-style meme to satirize Pelosi’s trades, earning over 5 million views across platforms. Autopilot’s approach to marketing emphasizes authenticity and trust, avoiding clickbait tactics that could undermine its credibility.

Autopilot's Diversification into Creators

Autopilot has taken significant steps to diversify its business by partnering with creators to build an ecosystem where influencers can monetize their expertise. The platform allows creators, such as Unusual Whales and Quiver Quantitative, to launch their own portfolios that users can follow via Autopilot. This enables creators to build businesses on the platform, with a revenue-sharing model based on subscription fees.

For example, if a creator charges $30 per month for access to their portfolio, they receive a portion of the subscription revenue. As of now, Autopilot has paid out $500,000 to creators, with some earning six-figure incomes annually from their portfolios. The company currently has 9-10 active creators (referred to as "pilots") and 30-40 in the pipeline, further illustrating the scalability of this model.

Diversifying into creators not only reduces Autopilot’s reliance on the popularity of figures like Nancy Pelosi but also broadens its appeal by catering to a wider audience of retail investors who want to follow influencers or niche experts. The platform’s vision is to become a marketplace where both professional investors and influencers can thrive, creating new opportunities for creators to build sustainable businesses.

Product Design and Development

Autopilot’s product philosophy is rooted in simplicity, drawing inspiration from iconic companies like Apple, which emphasizes minimalism in its design. The goal is to make the user experience seamless and intuitive, with fewer buttons and quicker onboarding processes, such as faster Know Your Customer (KYC) verification. The team is also influenced by Duolingo, particularly its approach to A/B testing and gamification, although Autopilot avoids excessive gamification to maintain trust in its financial product.

On the backend, Autopilot has also taken cues from Brex, a fintech company known for its clean and efficient dashboards, to develop its "pilot portal." This portal allows creators to manage their portfolios and trades with ease, providing a simple and data-driven interface. The team also focuses on maintaining compliance, a critical aspect for financial products, while ensuring that the design remains user-friendly and accessible. This balance of simplicity, functionality, and compliance has been key to Autopilot’s success in attracting and retaining users.

Funding and Vision for the Future

Autopilot has raised approximately $7 million, with key investors including Craft Ventures, Nomad Ventures, and Path VC. The company’s lean, capital-efficient model has allowed it to scale rapidly without relying heavily on outside funding. While Autopilot has not yet announced a Series A round, it is considering strategic partnerships to support future growth. The company’s long-term vision includes building a marketplace for retail investors to follow expert portfolios and expanding into underdeveloped areas like retirement accounts. Autopilot also aims to empower creators to build businesses on its platform, with some already earning six-figure incomes. The ultimate goal is to democratize access to institutional-grade investment strategies and restore trust in financial and political systems by promoting transparency.

Broader Impact and Mission

Autopilot’s mission is to bring trust and transparency back to financial and political institutions. The company believes that banning politicians from trading stocks could reduce public cynicism and improve faith in governance. By providing tools for retail investors to follow proven strategies, Autopilot seeks to level the playing field and empower individuals to make informed, emotion-free investment decisions.

The company also highlights the need for stronger protections against scams targeting retail investors, which have risen sharply with the growth of social media. Looking forward, Autopilot is committed to scaling its platform while maintaining its core values of simplicity, trust, and transparency.

Autopilot’s Bipartisan Approach

Autopilot has taken a firmly bipartisan stance, emphasizing its commitment to transparency and accountability regardless of political affiliation. The company is clear about its mission: to restore trust in political and financial institutions by holding politicians accountable for their trading activities. Chris has repeatedly highlighted that 86% of Americans support banning politicians from trading stocks, and this issue resonates across party lines. While the platform gained early traction with its Pelosi Tracker, which follows the trades of Nancy Pelosi, Autopilot has also tracked Republican politicians like Marjorie Taylor Greene and Dan Crenshaw, ensuring that no one is immune to scrutiny.

Autopilot’s bipartisan commitment can be seen in its content strategy and media presence, which aim to expose insider trading and hypocrisy from all sides of the political spectrum. For example, the platform’s social media accounts, such as the Politician Trade Tracker on Instagram (with ~1 million followers), call out questionable trades by both Democrats and Republicans. Whether it’s Nancy Pelosi’s investments in tech stocks like Nvidia or Marjorie Taylor Greene’s timely purchases of Apple, Nvidia, and Qualcomm around tariff announcements, Autopilot ensures that both sides of the aisle are held to the same standard. This even-handed approach helps Autopilot avoid being labeled as partisan, despite the polarizing nature of its content.

Chris has also underscored that Autopilot supports any political figure advocating for greater transparency and stricter regulations on political trading. For instance, the company has expressed support for AOC’s push to ban politicians from trading stocks, as well as bipartisan bills like the Pelosi Act proposed by Senators Josh Hawley and Jon Ossoff. The company’s willingness to work with lawmakers and activists from both sides demonstrates its commitment to the broader goal of restoring trust in institutions, rather than catering to one political ideology.

While Autopilot has faced occasional backlash for appearing on politically charged platforms like Tucker Carlson, Josephs has emphasized that the company is open to engaging with all audiences. Whether it’s Tucker Carlson, Tom Bilyeu, or even hypothetical appearances on platforms like Joe Rogan or Trevor Noah, Autopilot’s focus remains on spreading its message of transparency and accountability to as many people as possible. This bipartisan stance is integral to the company’s identity and mission, as it works to bridge political divides and empower retail investors to make informed decisions in a fairer, more transparent system.

History of Insider Trading

Insider trading involves trading securities based on material, nonpublic information, typically by corporate insiders or those with access to such information. Its history is tied to the development of financial markets and efforts to ensure fairness.