FOMO: All the deals you missed

$1B+ | Discord, Jensen, xAI, Claude, a16z, Vlad Tenev, Snowflake/Observe, Lux, Booz Allen, ElevenLabs, deel, Apple/Gemini

Brought to you by Brex:

Brex, the ultra-superintelligent AF finance platform for elite businesses, combining the world’s smartest corporate card with integrated expense management, banking, bill pay, & travel. Trusted by 35,000+ companies, including Anthropic, Arm, Robinhood, ServiceTitan, DoorDash, & Wiz. Built for scale. Spend smarter, move faster.

Hello from SF

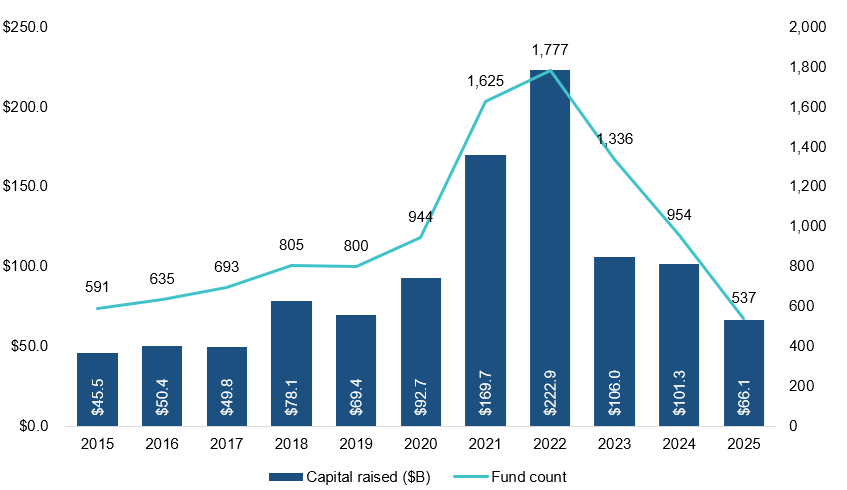

Light on VC deals coming into the new year (light 2025 as well, see Pitchbook chart) - not short on headlines, content, or M&A tho. whew.

Musings

Big Dollars

Andreessen Horowitz, just raised over $15B. With these new funds including American Dynamism ($1.176B), Apps ($1.7B), Bio + Health ($700M), Infrastructure ($1.7B), Growth ($6.75B), and other venture strategies ($3B)

FACT: a16z has raised over 18% of all venture capital dollars allocated in the United States in 2025.

a16z: The Power Brokers by Packy McCormick (a16k word essay on a16z on the day of a15b fundraise)

Booz Allen partners with a16z for Advanced Technology for Governments

Marc Andreessen’s 2026 Outlook: AI Timelines, US vs. China, & Price of AI

Jensen

Elad Gil & Sarah Guo w/ NVIDIA President, Founder & CEO Jensen Huang

Nvidia’s Jensen Huang on AI & the Next Frontier of Growth, Konstantine Buhler of Sequoia

AI

AI Competition Stays Hot

More

Top Interviews

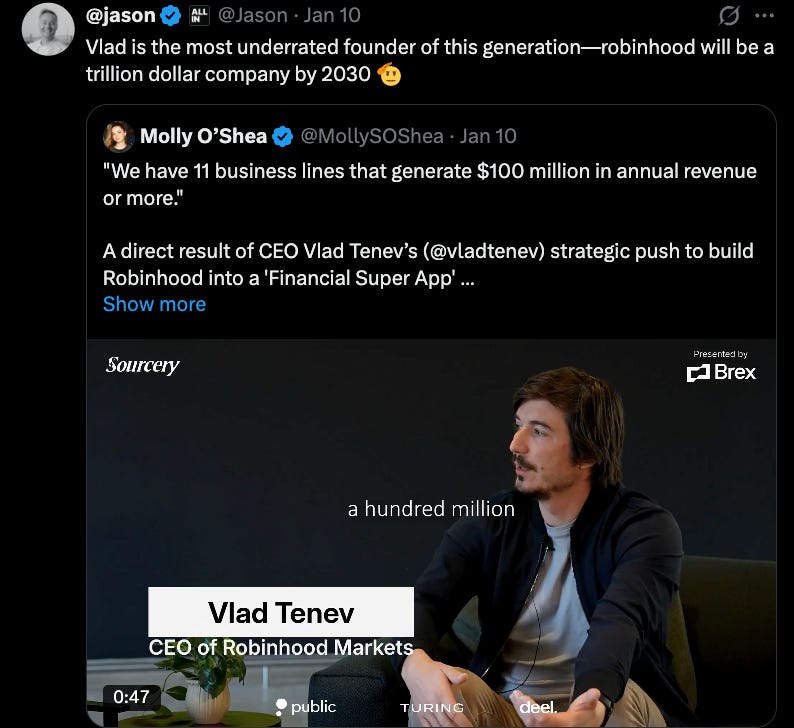

Vlad Tenev, CEO of Robinhood on their Record Year → Listen on X, Spotify, YouTube, Apple

Jeffrey Katzenberg’s $2.8B AUM investment firm → Listen on X, Spotify, YouTube, Apple

Palmer Luckey, Anduril → Listen on X, YouTube, Spotify & Apple

→ Follow Sourcery on: X, YouTube, Spotify, Apple, Linkedin

Last Week (1/5-1/9):

Relevant deals include the 70+ deals across stages below. I’ve categorized the deals below into seven categories, Fintech, Care, Enterprise / Consumer, HardTech, Sustainability, Acquisition/PE, and Fund Announcements, and ordered from later-stage rounds to early-stage rounds.

VC Deeeeeeeels

Fintech:

- Corgi, a San Francisco-based AI insurance platform designed for startups, raised $108 million in funding from Y Combinator, Kindred Ventures, Contrary, and others.

- Autonomous Technologies Group, a New York City-based developer of AI agents designed to serve as financial advisors, raised $15 million in pre-seed funding from Y Combinator, Collaborative Group, Fusion Fund, and others.

- Babylon, an infrastructure layer for Bitcoin to serve as collateral across DeFi, raised $15m from a16z

- Pluto, an NYC-based private markets lending platform, raised $8.6m in seed funding from Motive Ventures, Portage, Apollo Global Management, Hamilton Lane, Tectonic Ventures, and Broadhaven Ventures.

Care:

- Canopy, a Palo Alto, Calif.-based developer of safety technology for health care environments, raised $22 million in Series B funding. 111° West Capital and ACME Capital led the round and were joined by existing investors.

- Tucuvi, a New York City-based developer of an AI voice agent designed for care teams, raised $20 million in Series A funding. Cathay Innovation and Kfund led the round and was joined by existing investors Frontline Ventures, Seaya Ventures, and Shilling.

- Luminate, a Galway, Ireland-based at-home cancer treatment company, raised $21 million in Series A funding. ARTIS Ventures and Lachy Groom led the round and were joined by Western Alliance Life Sciences and existing investors 8VC, Y Combinator, Atlantic Bridge, and others.

- Oasys, a New York City-based developer of an AI-powered operating system for behavioral health, raised $4.6 million in funding from Pathlight Ventures, Twine Ventures, Better Ventures, and 1984 Ventures.

Enterprise/Consumer:

- xAI, the Palo Alto, Calif.-based developer of the Grok AI model, raised $20 billion in Series E funding from Valor Equity Partners, Stepstone Group, Fidelity Management & Research Company, Qatar Investment Authority, and others.

- Anthropic is raising $10b at a $350b valuation led by GIC and Coatue, as first reported by the WSJ and confirmed by Axios

- LMArena, a San Francisco-based developer of an open platform designed for comparing and testing new AI models, raised $150 million in funding. Felicis and UC Investments led the round and were joined by Andreessen Horowitz, The House Fund, LDVP, Kleiner Perkins, and others.

- Swap, a London-based e-commerce logistics platform, raised $100m in Series C funding led by DST Global and Iconiq

- Valinor Enterprises, a Washington, D.C.-based defense and government tech company, raised $54 million in Series A funding. Friends & Family Capital led the round and was joined by existing investors General Catalyst, Founders Fund, Red Cell Partners, and others.

- Protege, a New York City-based AI data platform, raised $30 million in Series A funding. a16z led the round and was joined by Footwork, CRV, and others.

- Semafor, a news media startup, raised $30m at a $330m post-money valuation.

- Blackbird.AI, a New York City-based developer of an AI model designed to identify narrative threats to companies, raised $28 million in funding from Ten Eleven Ventures, Dorilton Ventures, and others.

- interos.ai, an Arlington, Va.-based developer of supply chain risk management software, raised $20 million in funding from Blue Owl Capital and Structural Capital.

- Known, a dating app, raised $9.7m led by Forerunner Ventures and NFX

- AgileRL, a London, U.K.-based developer of AI training, tuning, and deployment company, raised $7.5 million in funding. Fusion Fund led the round and was joined by Flying Fish, Octopus Ventures, Entrepreneur First, and Counterview Capital.

- Unusual, a San Francisco-based platform designed to change how AI talks about brands and products, raised $3.6 million in funding from BoxGroup, Long Journey Ventures, Y Combinator, and others.

HardTech:

- DayOne Data Centers, a Singapore-based data center platform, entered into definitive agreements for $2 billion in Series C funding, led by Coatue and joined by others.

- Kraken, a London-based utility software startup developed within Octopus Energy, raised $1b at an $8.65b post-money valuation to split from Octopus and prep for an IPO. D1 Capital Partners led, joined by includes Ontario Teachers’ Pension Plan, Fidelity, and Durable Capital Partners

- Lyte, a Mountain View, Calif.-based developer of “visual brains” for robots, raised $107m from Avigdor Willenz, Fidelity, Atreides Management, Exor Ventures, Key1 Capital, and Venture Tech Alliance.

- Cambium, an El Segundo, Calif.-based maker of advanced materials for defense and aerospace, raised $100m in Series B funding. 8VC led, joined by MVP Ventures, Lockheed Martin Ventures, GSBackers, Veteran Ventures Capital, J17 Ventures, Vanderbilt University, Alumni Ventures, Gaingels, Inevitable Ventures, JACS Capital, and Jackson Moses.

- Array Labs, a maker of small satellites for Earth observation, raised $20m in Series A funding. Catapult Ventures led, joined by Washington Harbour Partners, Kompas VC, YC, Maiora Capital, Animal Capital, Aera VC, Cultivation Capital, and Clearance Ventures.

Public–Investing platform Public just launched Generated Assets, which lets you turn any idea into an investable index with AI. Seriously, you can type in anything, from “AI-powered supply-chain companies with positive FCF” to “defense tech companies growing revenue over 25% YoY.” With Generated Assets, you can build, backtest, refine, & invest in any thesis with AI. Gone are the days of one-size-fits-all ETFs. public.com/sourcery

Acquisitions & PE:

- Meta (Nasdaq: META) agreed to acquire Manus AI, a Singapore-based developer of general AI agents, for upwards of $2.5b. Manus AI was valued at only $500 million when it raised $75 million in Series B funding last May, led by Benchmark

- Nvidia (Nasdaq: NVDA) signed a $20b non-exclusive licensing deal with AI chipmaker Groq, which results in most Groq employees moving to Nvidia and major returns for shareholders Social Capital, Disruptive, BlackRock, Neuberger Berman, Deutsche Telekom Capital Partners, Samsung, 1789 Capital, Cisco, D1, Cleo Capital, Altimeter, Firestreak Ventures, Conversion Capital, and Modi Venture

- TransDigm (NYSE: TDG) agreed to buy Stellant Systems, a Torrance, Calif., maker of electronic components and subsystems serving aerospace and defense customers, for $960m from Arlington Capital Partners.

- Apollo Global Management agreed to invest $1.2b into building products group QXO (NYSE: QXO)

- Coinbase agreed to acquire The Clearing Company, a San Francisco-based prediction markets company. Financial terms were not disclosed.

- Hg agreed to acquire OneStream, a Birmingham, Mich.-based enterprise finance management platform, for approximately $6.4 billion. General Atlantic and Tidemark are taking minority stakes.

- Artis BioSolutions, backed by Oak HC/FT, agreed to acquire Syngoi Technologies, a Zamudio, Spain-based biotech company looking to manufacture synthetic DNA technologies. Financial terms were not disclosed.

- Stord, an Atlanta-based ecommerce fulfillment company valued by VCs at $1.5b, acquired smaller rival Shipwire from France’s Ceva Logistics

- Snowflake (NYSE: SNOW) agreed to acquire Observe, a San Mateo, Calif., observability platform that’s raised nearly $500m from firms like Snowflake Ventures, Sutter Hill Ventures, Madrona, Alumni Ventures, and Capital One Ventures.

- OpenAI is acqui-hiring the team behind Convogo, a leadership coaching software startup that had been seeded by South Park Commons.

- Flexera, backed by Thoma Bravo, acquired ProsperOps, an Austin, Texas-based cost optimization platform designed for Amazon Web Service, Azure, & Google Cloud, from H.I.G. Capital. Flexera also acquired Chaos Genius, a Palo Alto, Calif.-based developer of AI agents designed for data & cost optimization on Snowflake and Databricks. Financial terms were not disclosed.

- Fireblocks, a crypto custody and infrastructure firm, agreed to acquire fintech accounting startup Tres Finance for about $130m, per Fortune. Tres had raised around $19m from Lightspeed, Cyberfund, MoonPay Ventures, New Form Capital, Boldstart Ventures, Cyber.Fund, Faction Ventures, and Ambush Capital.

- DigitalBridge and Credstview Partners completed their $1.5b take-private buyout of broadband provider WideOpenWest.

- Flutterwave, an Africa-focused fintech valued by VCs at over $3b, acquired Mono, a Nigerian open-banking startup that had raised $17.5m from firms like Tiger Global, General Catalyst and Target Global.

- Accenture (NYSE: ACN) agreed to acquire Faculty, a London-based company that helps corporate clients adopt AI. Faculty had raised around $50m from Apax Digital, LocalGlobe, Mercuri, Phoenix Court, and Metaplanet

- D-Wave Quantum (NYSE: QBTS) agreed to acquire Quantum Circuits, which had raised around $125m from firms like Sequoia Capital, Arch Venture Partners, F-Prime Capital, Fitz Gate Ventures, Canaan Partners, Tribeca Venture Partners, Osage University Partners, In-Q-Tel, Connecticut Innovations, and Tao Capital Partners. axios.link/3N76IWh

- Mobileye (Nasdaq: MBLV) agreed to acquire Israeli humanoid robotics startup Mentee Robotics for $900m in cash and stock. Mentee raised around $38m from firms like Cisco Investments, Ahren Innovation Capital, 10D, Ahren Innovation Capital and Samsung Next Ventures.

IPOs:

- Discord, an SF-based encrypted chat app popular with gamers, filed confidentially for an IPO, per Bloomberg. It’s raised over $1b in VC funding, from firms like Dragoneer, Sony Interactive Entertainment, Coatue, Edelweiss Capital, Acrew Capital, Fidelity, Mindrock Capital, Summit Peak Investments, 1Confirmation, Bitkraft, Tencent, Accel, and General Catalyst.

- PicPay, a Brazilian digital bank, filed for an IPO that Renaissance Capital estimates could raise up to $500m. It plans to list on the Nasdaq (PICS).

Funds:

- Andreessen Horowitz, just raised over $15B. With these new funds including American Dynamism ($1.176B), Apps ($1.7B), Bio + Health ($700M), Infrastructure ($1.7B), Growth ($6.75B), and other venture strategies ($3B), a16z has raised over 18% of all venture capital dollars allocated in the United States in 2025.

- Warburg Pincus, a New York City-based private equity firm, raised $3 billion for its third fund focused on financial services companies.

- Lux Capital, a New York City and Menlo Park, Calif.-based venture capital firm, raised $1.5 billion for its ninth fund focused on emerging science and technology companies.

Love merch? Check out our shop: sourcerymerch.com

PS if you DM what you want we’ll send you a free gift link. (it’s a secret tho)

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.

Paid Endorsement. Brokerage services by Open to the Public Investing Inc, member FINRA & SIPC. Advisory services by Public Advisors LLC, SEC-registered adviser. Crypto trading provided by Zero Hash LLC, licensed by the NYSDFS. Generated Assets is an interactive analysis tool by Public Advisors. Output is for informational purposes only and is not an investment recommendation or advice. See disclosures at public.com/disclosures/ga. Matched funds must remain in your account for at least 5 years. Match rate and other terms are subject to change at any time.

She’s the best!!!!!!!

ElevenLabs is crushing it.

Just tested it out this weekend - so good.