OMG OpenAI..

Human Interest, Bending Spoons, Mercor, Fireworks AI, Whatnot, Harvey, Sublime Security, Fruitist, Legora, EnduroSat, SavvyMoney, Navan, Zerohash, SambaNova, Nexthink, Jamf

Brought to you by Brex:

Brex is the coolest superintelligent finance platform: cards, expenses, travel, bill pay, banking—wrapped into a high-performance stack. Built for scale. Trusted by teams that move fast.

Hello from NYC

Apologies for being incredibly late on the weekly. We’ve been “locked-in” on possibly one of our biggest surprises to date. TBD on if/when it gets released but fingers crossed. I genuinely couldn’t be more excited..

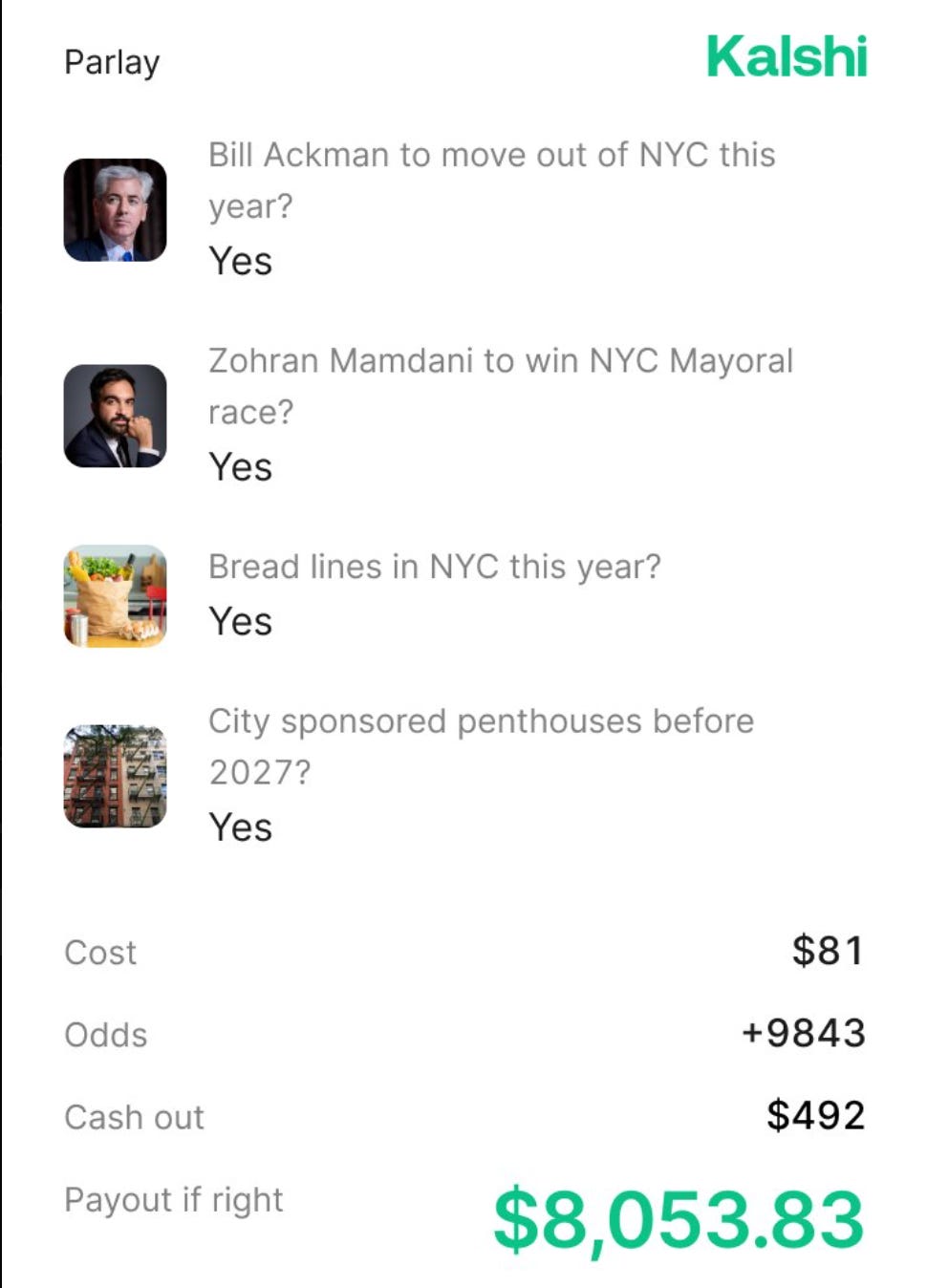

Anyways.. about NYC.. are you worried about the future of city? Wondering what happens once change of power occurs in <2 months? Will the breadlines be gluten free? All caught up on reading the Communist Manifesto yet?

→ Manhattan’s most popular figure answers all your Q’s (no it’s not the ‘new’ guy)

Now, I’m headed to London - byeee - say hi if you’re there! 🇬🇧

Musings

Elon

Capital Markets

Goldman, JPMorgan, BlackRock CEOs Join Saudi Arabia’s Mega Investment Summit

1929 vs 2025: Andrew Ross Sorkin on Crashes, Bubbles & Lessons Learned

AI

OpenAI reorg sets up $500 billion for-profit AI behemoth: OpenAI Group

Microsoft will get a 27% share in OpenAI Group

OpenAI will also purchase an incremental $250 billion of Azure service

Built to benefit everyone by OpenAI

The nonprofit, now called the OpenAI Foundation (The current equity value of the foundation’s 26% stake is around $130 billion)

$50M People-First AI Fund

The Sam Altman interview causing drama.. Brad Gerstner, Satya Nadella (Microsoft) & Sam Altman (OpenAI) unpack the $3T AI buildout – BG2

Underrated Interview: “Is there an AI bubble?” Gavin Baker of Atreides

Palantir

Palantir Technologies | Q3 2025 Earnings Webcast + Performance Deck

Must Watch: What Palantir Sees | Shyam Sankar, Palantir CTO

More

Check out Kalshi → The largest prediction market & the only legal platform in the US where you can trade directly on the outcomes of future events (sports, politics, weather, AI, etc).

Top Interviews

Inside Coatue: How the $70B Asset Manager Trades & Invests in Tech | Gamestop, Applovin, Meta, Google, AI, Meme Stocks → Listen on X, Spotify, YouTube, Apple

Part II: Alfred Lin, Sequoia | OpenAI, Airbnb, Citadel Securities, Profound, Clay, Kalshi → Listen on X, Spotify, YouTube, Apple

Ryan Serhant on the Future of NYC | Over $20B+ in sales. $45M raised for S.MPLE + media empire → Listen on X, Spotify, YouTube, Apple

A Note From the Author:

→ Follow Sourcery on: X, YouTube, Spotify, Apple, Linkedin

Last-Last Week (10/27-10/31):

Relevant deals include the 70+ deals across stages below. I’ve categorized the deals below into seven categories, Fintech, Care, Enterprise / Consumer, HardTech, Sustainability, Acquisition/PE, and Fund Announcements, and ordered from later-stage rounds to early-stage rounds.

VC Deals

Fintech:

- Human Interest, a San Francisco-based 401(k) platform raised over $100 million at a $3 billion post-money valuation. The round included insiders Baillie Gifford, BlackRock, Marshall Wace, Morgan Stanley, and TPG. Human Interest was last valued at $1.3 billion in summer 2024, and says it will end 2025 with around $200 million in ARR.

- Onfire, a Tel Aviv, Israel-based AI-powered revenue intelligence platform for tech sales teams, raised $20 million in funding. Grove Ventures and TLV Partners led the round.

- Grasp, a Stockholm, Sweden-based platform designed to automate investment banking and management consulting work, raised $7 million in Series A funding. Octopus Ventures led the round and was joined by Yanno Capital.

Care:

- Valthos, a San Francisco-based developer of AI-powered systems designed for identifying biological threats, raised $30 million in seed funding from OpenAI Startup Fund, Lux Capital, and Founders Fund.

- Archy, a San Jose, Calif.-based AI-powered platform designed to automate processes for dental practices, raised $20 million in Series B funding. TCV led the round and was joined by Bessemer Venture Partners, CRV, Entrée Capital, and others.

- Indomo, a Boston, Mass.-based developer of an injectable therapy for acne, raised $25 million in funding from Atomic, Foresite Capital, Polaris Partners, and others.

- Arya Health, a New York City-based platform designed to automate scheduling, compliance, and other processes for home health and post-acute care providers, raised $18.2 million in Series A funding. ACME Capital led the round and was joined by Ridge Ventures, Twelve Below, and others.

- Ava, a San Francisco-based credit-building platform, raised $15 million in seed funding from Greylock, Transform VC, Firebolt, Twine Ventures, Sure Ventures, Defy.vc, and others.

- Sweatpals, an Austin, Texas-based in-real-life fitness platform designed to bring people together, raised $12 million in funding. Patron, a16z speedrun, and HartBeat Ventures led the round.

- Bevel, a New York City-based AI health companion, raised $10 million in Series A funding. General Catalyst led the round and was joined by others.

- Honey Health, a Mountain View, Calif.-based provider of AI agents for health-care workflows, raised $7.8m in seed funding. Pelion Venture Partners led, joined by Streamlined, Burst Capital, and 8-Bit Capital

- CustoMED, a Ramat Gan, Israel-based platform using AI and 3D printing to generate surgical tools and implants, raised $6 million in seed funding from Longevity Venture Partners, Varana Capital, Flag Capital, and others.

- Human Health, a London, U.K.-based precision health platform, raised $5.5 million in funding from LocalGlobe, Airtree, Skip Capital, Aliavia, Scale Ventures, and angel investors.

- Cylerity, a Madison, Wis.-based AI-powered platform designed to accelerate health care reimbursements, raised $4 million in seed funding. HealthX Ventures led the round and was joined by C2 Ventures, Upstreams Ventures, Wisconsin Investment Partners, and Tundra Angel.

Enterprise/Consumer:

- Bending Spoons, an Italian holding company that buys and seeks to revitalize legacy tech brands. has raised $710 million led by T. Rowe Price at an $11 billion pre-money valuation. It also added $2.8 billion in new debt.

- Mercor, a San Francisco-based platform that connects AI labs with experts in a variety of topics for AI model training, raised $350 million in Series C funding. Felicis led the round and was joined by Benchmark, General Catalyst, and Robinhood Ventures.

- Fireworks AI, a Redwood City, Calif.-based AI inference cloud platform, raised $250 million in Series C funding. Lightspeed Venture Partners, Index Ventures, and Evantic led the round and were joined by Sequoia Capital.

- Whatnot, a Los Angeles, Calif.-based live shopping platform, raised $225 million in Series F funding. DST Global and CapitalG led the round and were joined by Sequoia Capital, Alkeon Capital, and others.

- Harvey, an SF-based legal AI startup, raised $150m in new funding at a $10b valuation led by a16z

- Sublime Security, a Washington, D.C.-based email security platform, raised $150 million in Series C funding. Georgian led the round and was joined by Avenir, 01A, Index Ventures, Citi Ventures, and Slow Ventures.

- Fruitist, a Century City, Calif. And San Isidro, Argentina-based superfruit snack brand, raised $150 million in funding. J.P. Morgan Asset Management led the round and was joined by others.

- Legora, a Stockholm, Sweden-based developer of a collaborative AI platform for lawyers, raised $150 million in Series C funding. Bessemer Venture Partners led the round and was joined by ICONIQ, General Catalyst, Redpoint Ventures, Benchmark, and Y Combinator.

- ConductorOne, a San Francisco and Portland, Ore.-based AI-powered identity security platform, raised $79 million in Series B funding. Greycroft led the round and was joined by CrowdStrike Falcon Fund and existing investors.

- Syllo, a New York City-based AI-powered litigation platform, raised $30 million in funding from Venrock, Two Seas Capital, and others.

- Recess, a Los Angeles, Calif. and New York City-based developer of non-alcoholic beverages designed for relaxation, raised $30 million in Series B funding. CAVU Consumer Partners led the round and was joined by Rocana, Midnight Ventures, Torch Capital, and others.

- Mem0, an SF-based AI memory infrastructure platform, raised $24m seed and Series A funding from Kindred Ventures, Basis Set Ventures, Peak XV Partners, GitHub Fund, and YC

- Reflectiz, a Boston, Mass.-based AI-powered website security company, raised $22 million in Series B funding. Fulcrum Equity Partners led the round and was joined by Capri Ventures, YYM Ventures, AFG Partners, and others.

- Kaizen, a New York City-based developer of software designed for public services, raised $21 million in Series A funding. NEA led the round and was joined by 776, Accel, Andreessen Horowitz, and Carpenter Capital.

- The Mobile-First Company, a Miami, Fla.-based developer of an AI suite designed to replace legacy business software for small teams, raised $12 million in seed funding. Base10 and Lightspeed Venture Partners led the round and were joined by others.

- CUE Labs, a Zug, Switzerland-based developer of an open source configuration language, raised $10 million in funding. Sequoia Capital and OSS Capital led the round and were joined by Founders Fund, Dell Technologies Capital, and angel investors.

- Polygraf AI, an Austin, Texas-based enterprise AI security platform, raised $9.5 million in seed funding. Allegis Capital led the round and was joined by Alumni Ventures DataPower VC, Domino Ventures, and existing investors.

- Vesence, an SF-based legal tech reviewer and proofreader, raised $9m in seed funding. Emergence Capital led, joined by Creandum, 20VC, and YC

- Lula Commerce, a Philadelphia-based provider of digital commerce tech for convenience retailers, raised $8m in Series A funding. Semcap led, joined by Rich Products Ventures, GO PA Fund, NZVC, UP Partners, Green Circle Foodtech Ventures, and Outlander VC

- Wild Moose, a San Francisco-based AI-powered site reliability engineering platform, raised $7 million in seed funding. iAngels led the round and was joined by Y Combinator, F2 Venture Capital, Maverick Ventures, and others.

- Tempo, a code collaboration platform, raised $5m in seed funding from YC, Golden Ventures, Box Group, Webflow Ventures, iNovia, and General Catalyst

- Socratix AI, a San Francisco-based developer of AI agents for fraud and risk teams, raised $4.1 million in seed funding. Pear VC led the round and was joined by Y Combinator, Twenty Two Ventures, and others.

- Forum AI, a New York City-based platform designed to evaluate how major AI systems handle subjective and high-stakes topics, raised $3 million in seed funding. Lerer Hippeau led the round and was joined by Perplexity AI’s venture fund.

HardTech:

- EnduroSat, a Sofia, Bulgaria-based satellite-as-a-service company, raised $100 million in funding from Riot Ventures, Google Ventures, Lux Capital, and others.

Sustainability:

- Stardust Solutions, an Israeli solar geoengineering startup, raised $60m. Lowercarbon Capital led, joined by Exor, Matt Cohler, Future Ventures, Never Lift Ventures, Starlight Ventures, Nebular, Lauder Partners, Attestor, Kindred Capital, Orion Global Advisors. Future Positive Capital, and Earth.now

- Frontline Wildfire Defense, a San Francisco-based wildfire defense company, raised $48 million in Series A funding. Norwest led the round.

- Emerald AI, a Washington, D.C.-based AI-powered energy consumption platform for data centers, raised $18 million in a seed extension. Lowercarbon Capital led the round and was joined by NVIDIA, Radical Ventures, Salesforce Ventures, National Grid Partners, Amplo Ventures, Earthshot Ventures, and others.

Acquisitions & PE:

- Figma (NYSE: FIG) acquired Weavy, a media generation startup seeded by such firms as Atlassian Ventures, Datapower Ventures, and EdenBase.

- Mastercard (NYSE: MA) is in advanced talks to acquire crypto and stablecoin infrastructure provider Zerohash for around $1.5b. Zerohash has raised $275m, including last month at a $1b valuation, from Interactive Brokers, Morgan Stanley, SoFi, Apollo, Jump Crypto, Northwestern Mutual, FTMO, IMC, Liberty City Ventures, Bain Capital, Point72 Ventures, Nyca, Peak6 and Tastytrade

- Intel (Nasdaq: INTC) is in talks to acquire SambaNova, a Palo Alto, Calif.-based AI chipmaker that’s raised over $1b in VC funding, per Bloomberg. A deal likely would come in below SambaNova’s last valuation of $5b, fetched in 2021. Backers include Intel Capital, SoftBank, BlackRock, GV, Walden International, GIV, Temasek, and WRVI.

- Netflix (Nasdaq: NFLX) hired Moelis & Co. to explore a takeover bid for Warner Bros. Discovery‘s (Nasdaq: WBD) studio and streaming business, which also has been the subject of offers from Paramount Skydance (Nasdaq: PSKY)

- Vista Equity Partners acquired a majority stake in Nexthink, a Lausanne, Switzerland and Boston, Mass.-based digital employee experience platform, that values the company at approximately $3 billion.

- PSG Equity and Canapi Ventures led a $225 million minority investment in SavvyMoney, a Dublin, Calif.-based financial wellness platform.

- Ping Identity, backed by Thoma Bravo, agreed to acquire Keyless, a London, U.K.-based developer of biometric authentication technology. Financial terms were not disclosed.

- Francisco Partners agreed to take Jamf, a Minneapolis, Minn.-based Apple device management and security company for organizations, private for $2.2 billion.

- Forward Consumer Partners agreed to acquire a majority stake in Justin’s, a Boulder, Colo.-based nut butters and confections company, from Hormel Foods. Financial terms were not disclosed.

- Barclays (NYSE: BCS) agreed to buy Best Egg, a Philadelphia-based consumer lender, for around $800m. Best Egg had raised over $300m in VC funding from firms like Healthcare of Ontario Pension Plan and Davidson Kempner Capital Management

- Modern Treasury, a payments platform valued by VCs at over $2.2b, acquired Beam, a stablecoin and fiat payment platform, for $40m. Beam had raised $14m from firms like Archetype and Castle Island Ventures.

- Aramco agreed to buy a “significant minority stake” in Humain, an AI company majority owned by Saudi Arabia’s Public Investment Fund. Humain also signed up to a $3b data center build deal with Airtrunk, owned by Blackstone and CPP Investment Board

IPOs:

- Navan (fka TripActions), a Palo Alto, Calif.-based corporate travel and expense management platform, raised $923m in its IPO at a $6.7b fully-diluted valuation. It will list on the Nasdaq (NAVN) and reports a $100m net loss on $329m in revenue for the first half of 2025. Navan had raised over $2b, including in 2022 at a $9.2b valuation, from firms like Lightspeed, a16z, Zeev Ventures, Coatue, 01 Advisors, and Group 11.

Funds:

- Sequoia Capital raised $750m for a new early-stage fund and $200m for a new seed funding

Love merch? Check out our shop: sourcerymerch.com

DM me if you want something for free. I’m serious — :)

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.

You forgot to mention Beta Technologies in the IPO list. I realize it's a Joby competitor, but it's notable and was bigger than Navan's IPO. Plus it's not everyday we get a company public company out of Vermont.