Sourcery → BSOD + Wiz

(7/15-7/19) USA Math Olympiad W ➕ Aven, Saronic, Halo Industries, Standard Bots, Kandjii, Arcee AI, Adaptive, Nearfield Instruments, Thyme Care

Today’s Sourcery is brought to you by Archer Aviation..

Archer’s goal is to transform urban travel, replacing 60–90-minute commutes by car with estimated 10–20-minute electric air taxi flights that are safe, sustainable, low noise, and cost-competitive with ground transportation. Archer’s Midnight is a piloted, four-passenger aircraft designed to perform rapid back-to-back flights with minimal charge time between flights.

Learn more about how Archer is set to open a new world of opportunity for passengers by providing safe and efficient access to people, places, and events across the communities they live at archer.com

Musings

Macro

Big Tech Rotation [Jamin Ball of Altimeter]

Skilled immigration is a national security priority [Noah Smith & Minn Kim]

Check out Silicon Valley's Best Kept Secret for Skilled Immigration [Sourcery]

David Senra - Passion & Pain [Invest Like the Best]

Google parent and Wiz end talks on $23bn deal [FT]

Wiz will now target an IPO.. 🙏

AI

Here’s the full list of 28 US AI startups that have raised $100M or more in 2024 [TechCrunch]

OpenAI's 5-Step Journey to AGI: Roadmap Unveiled [Bloomberg]

[Zero paywall recap at Peter Diamandis]

The lagging outcomes of the AI boom, plus new memos on Hinge Health, Navier, and more [Contrary Research]

NVIDIA and Mistral AI have launched Mistral NeMo 12B [NVIDIA]

Google is integrating AI technology into the U.S. broadcast of the Paris Olympics [Economic Times]

HardTech

Inside California’s Freedom-Loving, Bible-Thumping Hub of Hard Tech [Vanity Fair] (..yes, it’s El Segundo)

Graeme Forster - Rolls-Royce: Turbines and Tribulations [Business Breakdowns]

Flying Cars Set 523-mile Distance Record (100x Energy Density) [Joby]

TSMC forecasts record growth for 2024 due to high demand for AI chips, plans $30-32 billion in capital expenditures. [AI News]

The University of Texas' Texas Institute for Electronics has been awarded $840M to build a Department of Defense microelectronics manufacturing center. [UT News]

SpaceX has developed an enhanced version of its Dragon spacecraft, dubbed "Dragon XL," designed to safely deorbit the International Space Station. [Techcrunch]

More

New Drug CURES Diabetes, Boosting Insulin Cells 700% (in Mice) [Interesting Engineering]

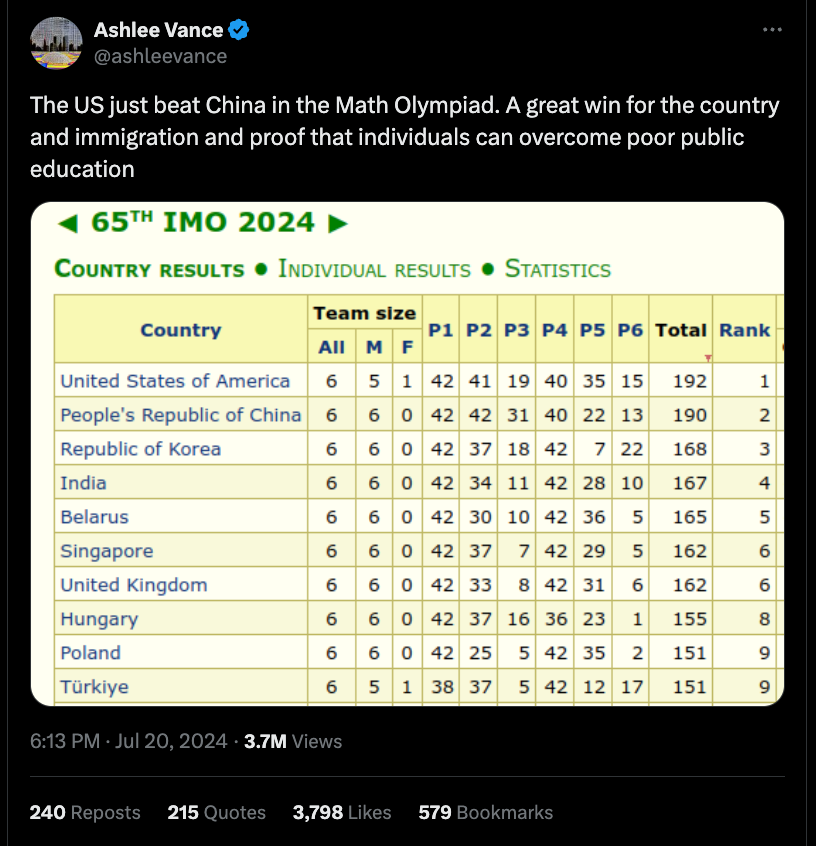

US beat China in the Math Olympiad [Ashlee Vance on X]

The “Blue Screen of Death” (aka BSOD) - Major IT issues caused by CrowdStrike’s failed cybersecurity software update led to severe flight disruptions, with 78% of Atlanta, 71% of Houston, and 67% of Detroit departures delayed or canceled, totaling 2,430 flights affected by midday Friday. [Axios]

CrowdStrike's shares dropped 11% following a global IT outage that impacted several companies and services. [CNBC]

Lulu Meservey & John Coogan dive into their crisis comms strategy on X

Top Interviews

Last Week (7/15-7/19):

Relevant deals include the 90+ deals across stages below.

I've categorized the deals below into eight categories, Fintech, Care, Enterprise / Consumer, HardTech, Sustainability, Acquisition/PE, IPO, and Fund Announcements, and ordered from later-stage rounds to early-stage rounds.

Highlighted VC Deals include:

Aven, Saronic, Halo Industries, Standard Bots, Kandjii, Arcee AI, Adaptive, Nearfield Instruments, Thyme Care

Acquisitions & PE

Tekion, Matera, Aurora Solar

Funds

Kingswood Capital Management, CCMP Growth Advisors

Final Numbers

Uber Economics

VC Deals

This roundup was customized & powered by Wonder. Start your free trial here.

Fintech:

- Aven, a San Francisco-based home equity-backed consumer credit cards provider, secured $142M in Series D funding, led by Khosla Ventures and General Catalyst, with participation from Caffeinated Capital, Electric Capital, Founders Fund, and The General Partnership.

- OCN, a Mexico City, Mexico-based fintech company, closed $86M in funding, led by Caravela Capital, Collide Capital, and Great North Ventures, with support from i80 Group.

- Slope, a San Francisco, CA-based B2B payments platform, secured $65M in funding, led by J.P. Morgan Payments and joined by Y Combinator, Jack Altman, and Saga.

- Partior, a Singapore-based unified ledger fintech platform for instant settlement of cross-border payments and tokenized assets, raised over $60M in Series B funding, led by Peak XV Partners, with support from Valor Capital Group, Jump Trading Group, J.P. Morgan, Standard Chartered, and Temasek.

- Coast, a New York-based enterprise smart fuel and fleet spending management provider, raised $40M in Series B financing, led by ICONIQ Growth, with support Accel, Insight Partners, Vesey Ventures, Avid Ventures, and Thomvest.

- Allium, an NYC-based enterprise blockchain data platform, raised $16.5M in Series A funding, led by Theory Ventures, with support from Kleiner Perkins and Amplify Partners.

- Monetary Metals, a Scottsdale, AZ-based gold financial institution operating in the gold yield marketplace, raised over $5M in funding, led by a private placement offering.

- Arvo Tech, a Columbus, OH-based tax strategy solution for small businesses, closed $2.5M in Series A funding, led by Bandon Partners and joined by existing investors.

- Arvo Tech, a Columbus, Ohio-based employee tax credit provider, raised $2.5M in Series A funding, led by Bandon Partners and joined by existing investors.

- Bima Labs, a San Mateo, CA-based Bitcoin-backed stablecoins creator, secured $2.25M in Seed funding, led by Portal Ventures, with support from Draper Goren Blockchain, Sats Ventures, Luxor Technology, Delta Blockchain Fund, Halo Capital, CoreDAO, and other angel investors.

Care:

- Thyme Care, a Nashville, TN-based value-based cancer care provider, completed a $95M Series C funding round, led by Concord Health Partners and supported by CVS Health Ventures, Town Hall Ventures, a16z Bio + Health, AlleyCorp, Echo Health Ventures, Frist Cressey Ventures, and Foresite Capital.

- Huma, a London, U.K. and New York City-based patient engagement, monitoring, and clinical trial platform, closed $80M in Series D funding, backed by AstraZeneca, Hat Technology Fund 4 by HAT SGR, HV Fund by Hitachi Ventures, and others.

- Freshpaint, a San Francisco, CA-based healthcare privacy platform, secured $30M in Series B funding, led by Threshold and joined by SignalFire, Intel Capital, Y Combinator, and Zero Prime.

- Seven Starling, a Washington, DC-based virtual provider of women’s behavioral health services, completed a $10.9M Series A funding round, led by RH Capital, with participation from Pear VC, Expa, Magnify Ventures, Emerson Collective, and Inflect Health.

- After.com, a US online platform providing end-of-life services for families, closed $10M in Series A funding, led by HIPstr.

- Juno, a San Diego, CA-based child disability insurance provider, secured $8.5M in Series A funding, led by Spero Ventures and joined by Floating Point, Newark Ventures, and WVV Capital.

- Kins, a Boston, MA-based digital-first hybrid care physical therapy practice provider, completed a $7M Series A funding round, led by Healthworx alongside Redesign Health, W Health Ventures, and Asahi Kasei Ventures.

Enterprise/Consumer:

- Kandji, a San Francisco, CA-based Apple endpoint management and security platform, secured $100M in funding, at $850M valuation, led by General Catalyst.

- DataCore Software, a Fort Lauderdale, FL-based data infrastructure and management company, closed $60M in funding, led by Vistara Growth.

- Amity Solutions (ASOL), a Bankok, Thailand-based software and AI business, completed a $60M in Series C funding round, co-led by Insight Capital and SMDV, with support from Gobi Partners and other existing investors.

- Vectara, a Palo Alto, CA-based generative AI product platform, secured $25M in Series A funding, led by FPV Ventures and Race Capital, with participation from Alumni Ventures, WVV Capital, Samsung Next, Fusion Fund, Green Sands Equity, and Mack Ventures.

- Arcee AI, a Miami, FL-based small language model building and deployment platform, closed $24M in Series A funding, led by Emergence Capital, with support from Arcadia Capital, Long Journey Ventures, Scott Banister, Flybridge, and Centre Street Partners.

- Exa, a San Francisco, CA-based AI research lab, received $22M in Seed and Series A funding, led by Lightspeed Venture Partners, with support from NVentures, and Y Combinator.

- Alvys, a Solana Beach, CA-based logistics and supply chain management operating platform, raised $20.5M in Series A funding, led by Titanium Ventures, with support from RTP, Bonfire and Picus Capital.

- Thoughtful AI, an Austin, TX-based AI-powered revenue cycle automation company, secured $20M in Series A funding, led by Nick Solaro of Drive Capital alongside the support from TriplePoint Capital.

- Adaptive, an NYC-based financial automation platform provider for the construction industry, closed $19M in Series A funding, led by Emergence Capital, with support from Andreessen Horowitz, Definition, Exponent, 3kvc, Box Group, and Gokul Rajaram.

- Momento, a Seattle, WA-based real-time data platform, completed a $15M Series A funding round, led by Bain Capital Ventures and joined by The General Partnership, Marianna Tessel Neha Narkhede, Tom Killalea, Don MacAskill, and John Lilly.

- OnRamp, a Boston, MA-based customer onboarding software provider, raised $14.2M in seed and Series A funding, led by Javelin Venture Partners and joined by Contour Venture Partners, Pear VC, Quiet Capital, Correlation Ventures, Frontier Ventures, J Ventures and other strategic individual investors.

- Escala, a Miami Beach, FL-based CRM platform for companies in the Hispanic market, closed $12M in funding, led by IGNIA and Alaya Capital, with support from High Alpha and other investors.

- Notable Systems, a Denver-based automated document processing startup, secured

$8.8M in Series A funding, led by Grotech Ventures.

- Shaped.ai, an NYC-based AI recommendation and search platform companies, raised $8M in Series A funding, led by Madrona Ventures and joined by Y-Combinator and other individuals.

- Dusk, a San Francisco, CA-based platform for building and playing social multiplayer games, secured $8M in funding, led by Founders and Makers Fund and supported by Ben Liu, Thomas Hartwig, and Adi Rathnam.

- Didero, a New York City-based AI agent for automating supply chain workflows, closed $7M in Seed funding, led by First Round Capital, with participation from Construct Capital, AI Grant, Box Group, Company Ventures, and Conviction.

- EverFence, a Newport Beach, CA-based technology startup providing fence solutions, raised $7M in Series A funding, led by HIPstr.

- aiXplain, a San Jose, CA-based accelerated AI development platform, closed $6.5M in Series A funding, led by Wa’ed Ventures, with participation from Osama Elkady and Kane Minkus.

- EdgeRunner AI, a Seattle, WA-based Generative AI provider for edge applications, raised $5.5M in seed funding, led by Four Rivers Group and joined by Madrona Ventures and other strategic angels.

- Modicus Prime, an Austin, TX-based computer vision software provider,, closed $3.5M in Seed funding, led by Silverton Partners, alongside Alumni Ventures and others.

- Tribe AI, a Brooklyn, NY-based AI services company, secured $3.3M in Seed funding, led by Bryce Roberts from Indie and joined by other investors.

- Kudos, a Los Angeles, CA-based disposable diaper company, closed $3M in a Seed extension funding round, backed by Precursor Ventures, Xfund, and Oversubscribed Ventures.

- Pelotero, a Boston, MA-based player intelligence platform, raised $3M in seed funding, led by Greg Ciongoli and Bennett Fisher, alongside support from Frederick Kerrest and Ryan Moore.

- GovPort, a Fairfax, VA-based SaaS subcontractor management platform, secured $2.8M in funding, led by PruVen Capital and Fin Capital, with support from QED Investors, Humba Ventures, Cambrian Ventures, and NextGen Venture Partners.

- PairUp, a Chicago, Ill.-based workplace knowledge sharing platform, raised $2.8M in funding, led by HearstLab and Hillsven with participation from Graham & Walker, Looking Glass Capital, Honeystone Ventures, MSIV, and Lofty Ventures.

- Making Space, a Los Angeles, CA-based B2B SaaS talent acquisition and learning platform, raised $2M in Pre-Seed funding, led by Beta Boom and joined by JFFVentures, FullCircle, American Student Assistance (ASA), ECMC Foundation, SmartJob, Mindshift Capital, Techstars, and other investors.

- Lumos Technologies, a Wilmington, NC-based data analytics startup, closed an undisclosed multimillion-dollar investment in Seed funding from undisclosed investors.

- Botrista, a San Francisco, CA-based data-driven, automated beverage platform, raised an undisclosed amount in Series C funding from undisclosed investors.

HardTech:

- Saronic, an Austin, TX-based defense technology company, secured $175M in Series B funding, at a $1B valuation, led by Andreessen Horowitz (a16z) and joined by 8VC, Caffeinated Capital, Elad Gil, and NightDragon, among others.

- Nearfield Instruments, a Dutch maker of metrology and inspection solutions for

chipmakers, completed a €135M or ($147M) Series C funding round, co-led by Walden Catalyst and Temasek, with participation from Innovation Industries, Invest-NL, and ING M&G Investments.

- Halo Industries, a Santa Clara, CA-based creator of a laser manufacturing technology platform for the semiconductor industry, closed $80M in Series B funding, led by Thomas Tull’s U.S. Innovative Technology Fund (USIT), alongside 8VC and SAIC.

- DreamBig Semiconductor Inc., a San Jose, CA-based emerging semiconductor startup providing high-performance solutions for AI, datacenters, 5G and automotive markets, raised $75M in Series B funding, led by Samsung Catalyst Fund and the Sutardja Family, with participation from Samsung, Hanwha, Event Horizon, Raptor, the Sutardja Family, UMC Capital, BRV, Ignite Innovation Fund, Grandfull Fund, and others.

- Standard Bots, an NYC-based robotics automation company, secured $63M in funding, led by General Catalyst, with support from Amazon Industrial Innovation Fund and Samsung Next.

- Arrcus, a San Jose, CA-based hyperscale networking software company, completed a $30M funding round, led by Prosperity7 Ventures, NVIDIA, Lightspeed, Hitachi Ventures, Liberty Global, Clear Ventures, and General Catalyst.

- Heimdall Power, a Houston, TX- and Oslo, Norway-based power grid optimization technological company for utility companies, closed $25M in Series B funding, led by Orlen, Nordic cleantech fund NRP Zero, and the Steinsvik Family Office, with participation from Investinor, Eviny, Hafslund, Lyse, and Sarsia Seed.

- itselectric, a Brooklyn-based electric vehicle curbside charging company, completed a $6.5M seed funding round, led by Failup Ventures and Uber Technologies, with support from Halogen Ventures, The Partnership Fund for NYC, Pulse Fund, Newlab, Gratitude Railroad, Tale VP, Equity Alliance Fund, LACI Impact Fund, and The Helm.

- Coldcart, a Chicago, IL-based orchestration and optimization platform provider for frozen and refrigerated parcel logistics, secured $6.5M in Seed funding, led by Collide Capital, Material. Great North Ventures, Behind Genius Ventures, Feld Ventures, Alumni Ventures, and Service Provider Capital also participated. Collide

- Marathon Fusion, a San Francisco, CA-based startup developing fuel processing technology for the fusion industry, secured $5.9M in seed funding, led by 1517 Fund and Anglo American, with support from Übermorgen Ventures, Shared Future Fund, Malcolm Handley, and other investors.

- Jacobi Robotics, a Berkeley, CA-based AI-powered motion planning technology, closed $5M in Seed funding, led by Moxxie Ventures and joined by Foothill Ventures, Humba Ventures, The House Fund, Swift Ventures, Berkeley SkyDeck Fund, LDV Partners, and Courtyard Ventures.

- Ionna, a Torrance, CA-based EV charging network provider, secured an undisclosed amount of funding from Toyota Motor North America.

Sustainability:

- LevelTen Energy, a Seattle, WA-based transaction infrastructure provider for energy transition, secured $65M in Series D funding, led by B Capital, with support from Aster, Constellation, Google, Intercontinental Exchange, Inc. (NYSE:ICE), Microsoft’s Climate Innovation Fund, NGP, Prelude Ventures, and ZOMA Capital, among others.

- Peak Energy, a Denver, CO-based low-cost, giga-scale energy storage technology developer, closed $55M in Series A funding, led by Xora Innovation and joined by Eclipse, TDK Ventures, Lachy Groom, Tishman Speyer, TechEnergy Ventures, Doral Energy-Tech Ventures, and DETV-Scania Invest.

- Stax Engineering, a Long Beach, CA-based maritime emissions capture and control company, secured $40M in funding, led by Upper90.

- Infinitum, an Austin, TX-based creator of the sustainable air-core motor, completed a $35M Series E Extension funding round, bringing the total raised in Series E funding to $220M, led by Marunouchi Innovation Partners and Rice Investment Group.

- Earthshot Labs, a Mill Valley, CA-based carbon development platform, closed $5.5M in Series A funding, led by Acorn Pacific Ventures, and joined by Earth Foundry, Future Ventures, Resilient Earth Capital, One Small Planet, Parameter Ventures, Sand Hill Angels, and Orca Capital.

Acquisitions & PE:

- Tekion, a Pleasanton, CA-based end-to-end cloud-native automotive platform, closed $200M in Growth capital backed by Dragoneer Investment Group.

- Matera, a Philadelphia, PA-based sotware provider for real-time payments in Brazil, closed a $100M investment from Warburg Pincus.

- Rhizome, a Washington, DC-based climate resilience planning AI-enabled platform for power grids, secured a $1M investment from Convective Capital.