Michael Dell's $6.25B Gift to American Children

Thrive Holdings x OpenAI | Deals: Pershing Square, Revolut, Pennylane, SoftBank’s Ampere Computing, Fuse Energy, X-energy, Kioxia

Brought to you by Brex:

Brex, the ultra-superintelligent finance platform for elite businesses, combining the world’s smartest corporate card with integrated expense management, banking, bill pay, & travel. Trusted by 35,000+ companies, including Anthropic, Arm, Robinhood, ServiceTitan, DoorDash, & Wiz. Built for scale. Spend smarter, move faster.

Hello from LA

It’s December.

(that’s it. that’s the intro.)

Anyways, deals are quite sparse today since last week didn’t exist, if you’re yearning for more, check back on the very large $20.7B+ week here.

Musings

Big News

A $6.25 Billion Gift: Michael & Susan Dell will give 25M American children $250 each to jumpstart an investment account for their futures.

More from Michael Dell, OneDell. +Bloomberg

The Invest America Act, founded by Brad Gerstner and signed into law by President Trump, is a new national program that gives every eligible U.S. child a savings and investment account they can grow over time. Backed by federal legislation, businesses, and charitable organizations, it helps families and employers put children on a stronger financial path into adulthood.

Building on the foundation of substantial research and similar local programs across the country, a large and diverse coalition united in support of this idea. Business leaders like Michael Dell, Brad Gerstner, Dara Khosrowshahi, and Jensen Huang—who recognize the power of compounding—stepped up to voice their support. The policy was included in the 2025 tax legislation & was signed into law on July 4, 2025.

How it works:

An American child born after December 31, 2024 and before January 1, 2029 for whom a Trump Account is established will receive an initial $1,000 deposit from the government, with the potential for parents to contribute up to an additional $5,000 per year initially.

Employers may make an annual contribution of up to $2,500 to a Trump Account and that contribution will not impact the employee’s taxable income.

CEA estimates that, under a scenario of average returns on the U.S. stock market, Trump Account balance for a baby born in 2026 will be:

$303,800 by age 18 and $1,091,900 by age 28 if maximum contributions are made.

$5,800 by age 18 and $18,100 by age 28 if no contributions are made.

ICYMI

Joshua Kushner: Thrive Holdings x OpenAI

OpenAI Statement: OpenAI takes an ownership stake in Thrive Holdings to accelerate enterprise AI adoption

Bill Ackman plots IPO of hedge fund Pershing Square in early 2026

AI

Leave David Sacks alone

Ilya Sutskever – “You know what’s crazy? That all of this is real.”

Why is SaaS Dead in a World of AI? Turing CEO on 20VC

More

Molly’s Game Uncensored: Mob Threats, FBI Raid & $100M Pots... & Still Won

Watching: Stripe’s Final BFCM numbers

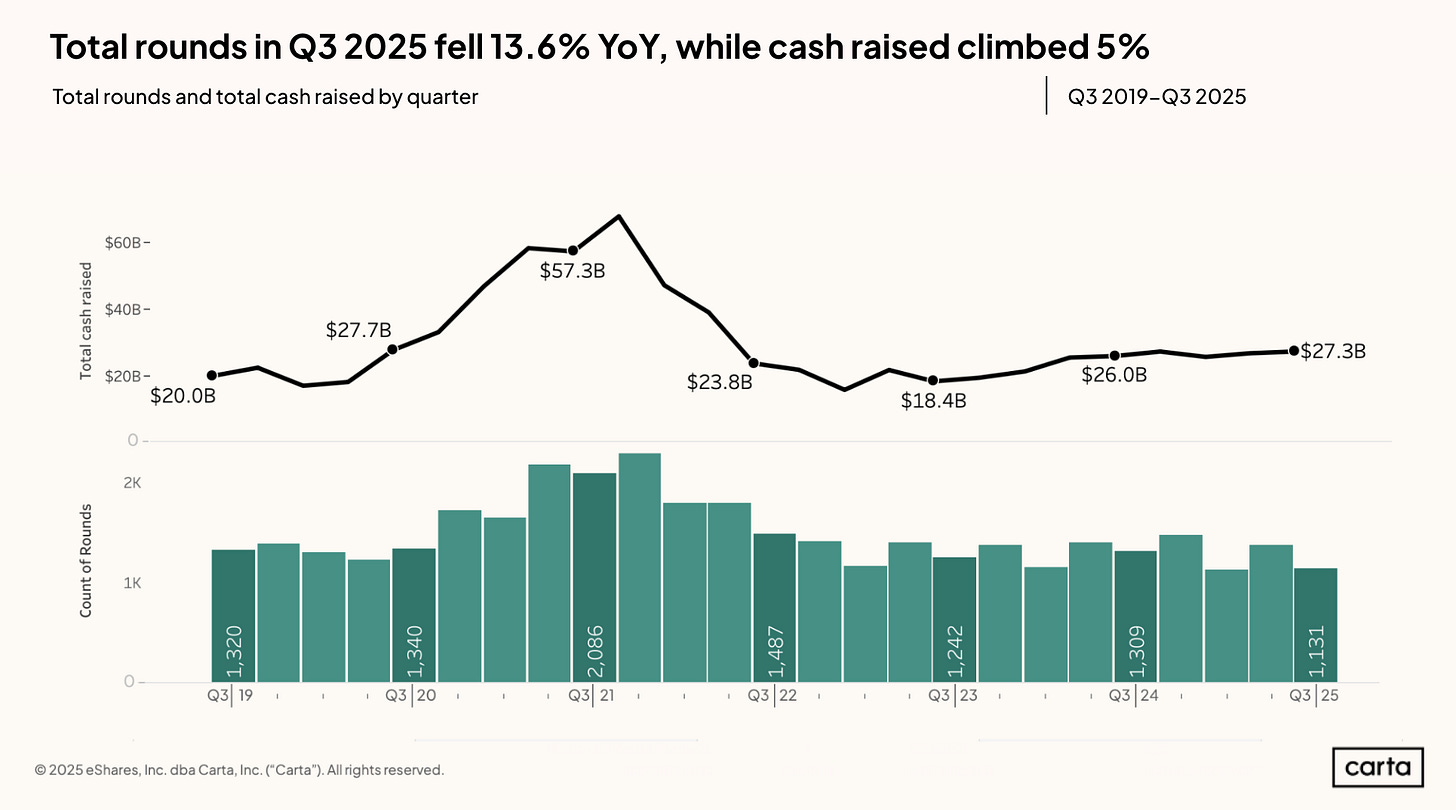

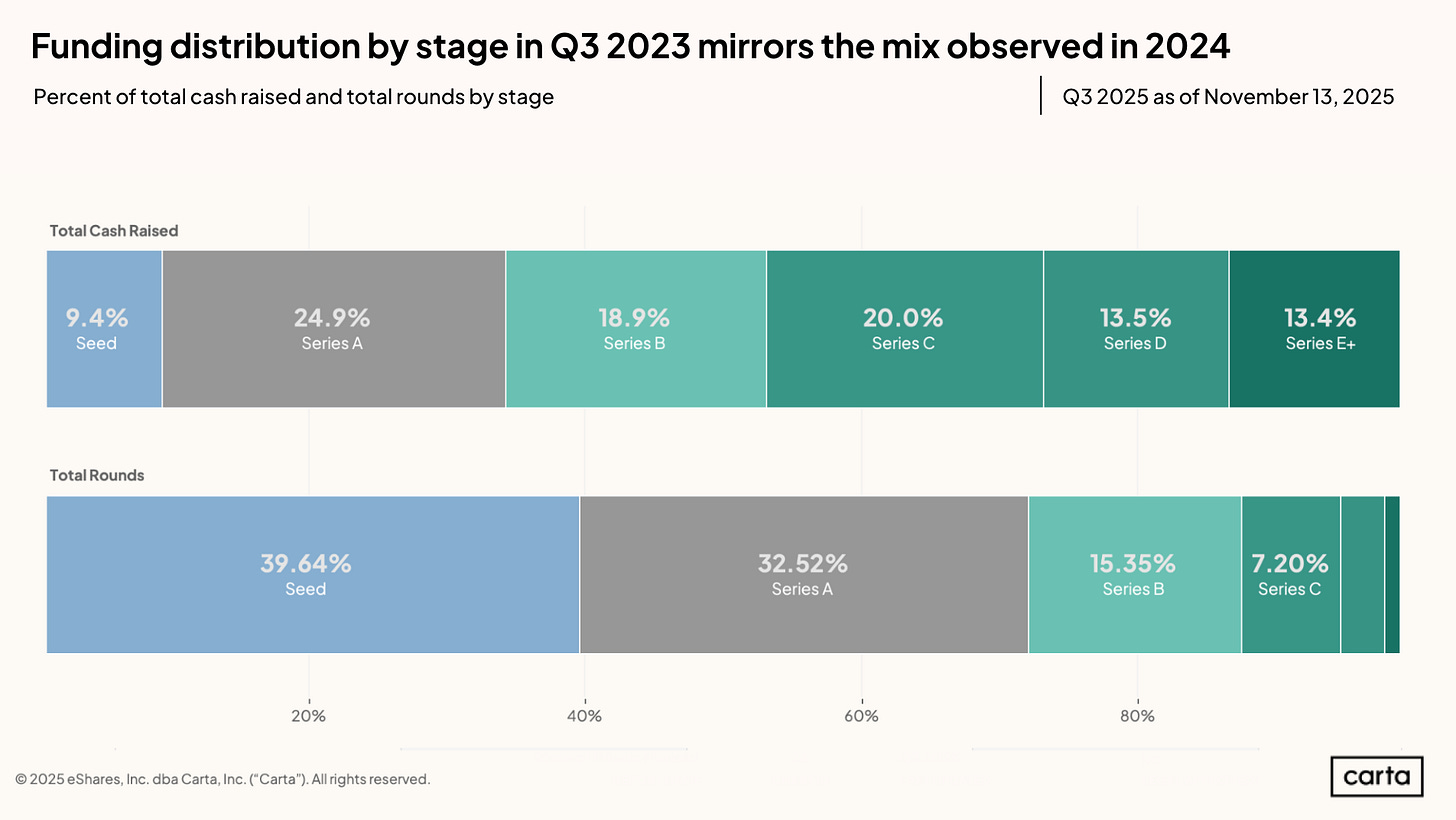

Carta Q3 Data

Top Interviews

What Travis Kalanick Taught Bradley Tusk, & Why He Closed His VC Fund

Inside Thrive Capital with Partner, Philip Clark | OpenAI, Cursor, Wiz, Nudge, Physical Intelligence → Listen on X, Spotify, YouTube, Apple

Ryan Serhant on the Future of NYC Over $20B+ in sales. $45M raised for S.MPLE + media empire → Listen on X, Spotify, YouTube, Apple

Quick hits

→ Follow Sourcery on: X, YouTube, Spotify, Apple, Linkedin

Last Week (11/24-11/28):

Relevant deals include the 70+ deals across stages below. I’ve categorized the deals below into seven categories, Fintech, Care, Enterprise / Consumer, HardTech, Sustainability, Acquisition/PE, and Fund Announcements, and ordered from later-stage rounds to early-stage rounds.

VC Deals

Fintech:

- Revolut, the London-based neobank, was valued at $75b in a secondary share sale led by Coatue, Greenoaks, Dragoneer, and Fidelity. Other participants included a16z, NVentures, Franklin Templeton, and T. Rowe Price. Sellers included both employees and early investors.

- Pennylane, a French accounting software startup, is in talks to raise $200m led by TCV at a $4.25b valuation, per Bloomberg. Existing backers include CapitalG and Sequoia Capital.

- Model ML, a New York City-based AI workflow automation platform for financial services, raised $75 million in Series A funding. FT Partners led the round and was joined by Y Combinator, QED, 13Books, and others.

- Range, a provider of flat-fee financial planning services to mass affluent households, raised $60m in Series C funding. Scale Venture Partners led, joined by Gradient Ventures, Cathay Innovation, and 53 Stations

- CoPlane, an SF-based platform for streamlining back-office work, raised $14m in seed funding from Stripe, Optum Ventures, and Terrain.

Care:

- Quarry Thera, a New Haven, Conn.-based cancer and immunology biotech, raised a $32m Series A from Yosemite, Canaan Partners, F-Prime Capital, and Lilly Ventures

- Nest Health, a New Orleans, La.-based health care platform designed for families, raised $22.5 million in Series A funding from Socium Ventures, Amboy Street Ventures, Impact America Fund, and others.

- Cordance Medical, a Mountain View, Calif.-based maker of brain ultrasound technology, raised $8m in seed funding. Sonder Capital led, joined by Shanda Grab Ventures, Angel Physician’s Fund, SmartGateVC, and R42

- Annie, a Lehi, Utah-based developer of an AI model for dental practices, raised $4 million in seed funding. Las Olas Venture Capital and Chicago Ventures led the round and were joined by Gamba Ventures and others.

Enterprise/Consumer:

- Sorcero, a Washington, D.C.-based AI-powered intelligence platform for life sciences, raised $42.5 million in Series B funding. NewSpring Growth led the round and was joined by Leawood Venture Capital and Blu Ventures.

- Opti, an enterprise identity security platform, raised $20m in seed funding from YL Ventures, Mayfield, Hetz Ventures, Squared Circle Ventures, and Maple Capital,

- Momentic, a San Francisco-based AI-powered testing platform for dev teams, raised $15 million in Series A funding. Standard Capital led the round and was joined by Dropbox Ventures and existing investors.

- Procure AI, a London-based procurement automation startup, raised $13m in seed funding. Headline led, joined by C4 Ventures and Futury Capital.

- Augmentt, an Ottawa, Canada-based Microsoft 365 security management platform developer, raised C$12m Series A led by Camber Partners

- AIOne, a New York City-based enterprise context management platform, raised $11 million in funding from Vestigo Ventures and Nadia Partners.

- Onton, an ecommerce discovery startup, raised $7.5m in seed funding. Footwork led, joined by Liquid 2 and Parable Ventures.

- Mira, a developer of smart eyeglasses, raised $6.6m in seed funding. General Catalyst led, joined by Pillar VC and Naval Ravikant.

HardTech:

- X-energy, a Rockville, Maryland-based developer of small modular reactors, has raised $700 million in Series D funding led by insider Jane Street. Participants include Ark Invest, Corner Capital, Galvanize, Hood River Capital Management, Reaves Asset Management, XTX Ventures and insiders Ares Management, Emerson Collective, NGP, and Segra Capital Management. Last year the company raised $500 million led by Amazon, which also is an X-energy customer.

- Cerrion, a Zurich-based manufacturing intelligence startup, raised $18m in Series A funding. Creandum led, joined by insiders YC, Goat Capital, 10x Founders ,and Session VC.

- Momentic, an SF-based AI testing startup, raised $15m in Series A funding. Standard Capital led, joined by Dropbox Ventures, YC, FCVC, Transpose Platform, and Karman Ventures

- Maritime Fusion, an SF-basded developer of nuclear fusion reactors on boats, raised $4.5m in seed funding. Trucks VC led, joined by Aera VC, Alumni Ventures, Paul Graham, and YC.

- Interface, a San Francisco-based AI-powered industrial safety platform, raised $3.5 million in seed funding from defy.vc, Precursor Ventures, and Rock Yard Ventures.

- Fuse Energy, a London-based electricity startup, is in advanced talks to raise new funding led by Lowercarbon at a $5b valuation, per the FT. Existing backers include Balderton

Sustainability:

- Overstory, a Dutch provider of vegetation intelligence for the utility industry to prevent wildfires, raised $43m in Series B funding. Blume Equity led, joined by Energy Impact Partners, B Capital, Semapa Next, Pale Blue Dot, CapitalT, Convective Capital, Bentley Systems, MCJ, and Moxxie Ventures

Public–Investing platform Public just launched Generated Assets, which lets you turn any idea into an investable index with AI. Seriously, you can type in anything, from “AI-powered supply-chain companies with positive FCF” to “defense tech companies growing revenue over 25% YoY.” With Generated Assets, you can build, backtest, refine, & invest in any thesis with AI. Gone are the days of one-size-fits-all ETFs. public.com/sourcery

Acquisitions & PE:

- SoftBank completed its $6.5b acquisition of Santa Clara, Calif., chipmaker Ampere Computing from Carlyle and Oracle.

- Majesco, a portfolio company of Thoma Bravo, agreed to acquire Vitech, a New York City-based provider of cloud-native benefits administration software.

- Guardian Capital Partners acquired a majority stake in Raptor Power Systems, an Eatontown, N.J.-based maker of power products serving data centers.

- Cohen & Gresser, a New York law firm whose clients included Sam Bankman-Fried and Ghislaine Maxwell, is in talks to sell a $40m stake to private equity, per the FT.

- Bain Capital plans to sell a $2.3b stake in chipmaker Kioxia (Tokyo: 285A) via a block trade.

- Estée Lauder (NYSE: EL) is weighing a sale of K-beauty brand Dr.Jart+

- Aramco hired Citigroup to sell a multibillion dollar stake in its oil export and storage terminals unit,

IPOs:

- Pershing Square, the investment firm led by Bill Ackman, is preparing for a 2026 IPO and also the launch of a new closed-end fund, per the FT and WSJ.

- Enhanced, a sports competition and performance company whose backers include Peter Thiel and George Church, agreed to go public at an implied $1.2b valuation via A Paradise Acquisition Corp. (Nasdaq: APAD), an entertainment SPAC

Love merch? Check out our shop: sourcerymerch.com

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.

Disclosure:

Paid Endorsement. Brokerage services by Open to the Public Investing Inc, member FINRA & SIPC. Advisory services by Public Advisors LLC, SEC-registered adviser. Crypto trading provided by Zero Hash LLC, licensed by the NYSDFS. Generated Assets is an interactive analysis tool by Public Advisors. Output is for informational purposes only and is not an investment recommendation or advice. See disclosures at public.com/disclosures/ga. Matched funds must remain in your account for at least 5 years. Match rate and other terms are subject to change at any time.